|

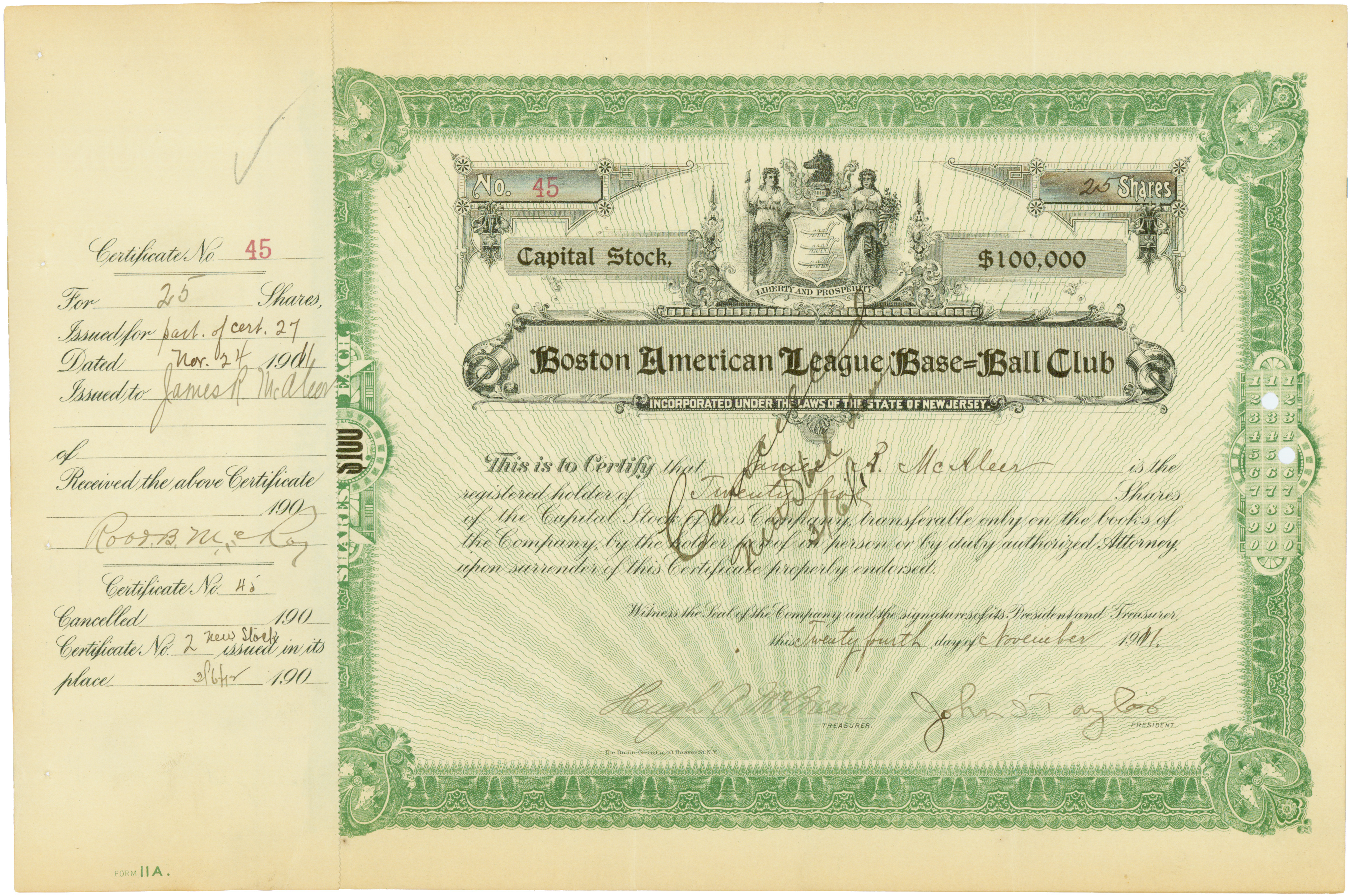

Common Stock

Common stock is a form of corporate equity ownership, a type of security. The terms voting share and ordinary share are also used frequently outside of the United States. They are known as equity shares or ordinary shares in the UK and other Commonwealth realms. This type of share gives the stockholder the right to share in the profits of the company, and to vote on matters of corporate policy and the composition of the members of the board of directors. The owners of common stock do not directly own any assets of the company; instead each stockholder owns a fractional interest in the company, which in turn owns the assets. As owners of a company, common stockholders are eligible to receive dividends from its recent or past earnings, proceeds from a sale of the company, and distributions of residual (left-over) money if it is liquidated. In general, common stockholders have lowest priority to receive payouts from the company. They may not receive dividends until the company ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity (finance)

In finance, equity is an ownership interest in property that may be subject to debts or other liabilities. Equity is measured for accounting purposes by subtracting liabilities from the value of the assets owned. For example, if someone owns a car worth $24,000 and owes $10,000 on the loan used to buy the car, the difference of $14,000 is equity. Equity can apply to a single asset, such as a car or house, or to an entire business. A business that needs to start up or expand its operations can sell its equity in order to raise cash that does not have to be repaid on a set schedule. When liabilities attached to an asset exceed its value, the difference is called a deficit and the asset is informally said to be "underwater" or "upside-down". In government finance or other non-profit settings, equity is known as "net position" or "net assets". Origins The term "equity" describes this type of ownership in English because it was regulated through the system of equity law that devel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Companies

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange ( listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states and so have associations and formal designations, which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation, though a corporation need not be a public company. In the United Kingdom, it is usually a public limited company (PLC). In Fran ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Terminology

Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the Share (finance), shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all Seniority (financial), senior claims such as secured and unsecured debt), or Voting interest, voting power, often dividing these up in proportion to the number of like shares each stockholder owns. Not all stock is necessarily equal, as certain classes of stock may be issued, for example, without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of Shareholder, shareholders. Stock can be bought and sold over-the-counter (finance), privately or on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasury Stock

A treasury stock or reacquired stock is stock which is bought back by the issuing company, reducing the amount of outstanding stock on the open market ("open market" including insiders' holdings). Stock repurchases are used as a tax efficient method to put cash into shareholders' hands, rather than paying dividends, in jurisdictions that treat capital gains more favorably. Sometimes, companies repurchase their stock when they feel that it is undervalued on the open market. Other times, companies repurchase their stock to reduce dilution from incentive compensation plans for employees. Another reason for stock repurchase is to protect the company against a takeover threat.Robert T. Sprouse, "Accounting for treasury stock transactions: Prevailing practices and new statutory provisions." ''Columbia Law Review'' 59.6 (1959): 882-900online/ref> The United Kingdom equivalent of treasury stock as used in the United States is treasury share. Treasury stocks in the UK refers to gover ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shares Issued

In economics and law, issued shares are the shares of a corporation which have been allocated (allotted) and are subsequently held by shareholders. The act of creating new issued shares is called ''issuance''. Allotment is simply the transfer of shares to a subscriber. After allotment, a subscriber becomes a shareholder, though usually that also requires formal entry in a share registry. Overview The number of shares that can be issued is limited to the total authorized shares. Issued shares are those shares which the board of directors and/or shareholders have agreed to issue, and which have been issued. Issued shares are the sum of outstanding shares held by shareholders; and treasury shares are shares which had been issued but have been repurchased by the corporation. The latter generally have no voting rights or rights to dividends. The issued shares of a corporation form the equity capital of the corporation, and some corporations are required by law to have a minimum va ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shares Authorized

The authorised capital of a company sometimes referred to as the authorised share capital, registered capital or nominal capital, (particularly in the United States) is the maximum amount of share capital that the company is authorised by its constitutional documents to issue (allocate) to shareholders. Part of the authorised capital can (and frequently does) remain unissued. The authorised capital can be changed with shareholders' approval. The part of the authorised capital which has been issued to shareholders is referred to as the issued share capital of the company. The device of the authorised capital is used to limit or control the ability of the directors to issue or allot new shares, which may have consequences in the control of a company or otherwise alter the balance of control between shareholders. Such an issue of shares to new shareholders may also shift the profit distribution balance, for example, if new shares are issued at face value and not at market value. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share Capital

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. ''Share capital'' may also denote the number and types of shares that compose a corporation's share structure. Definition In accounting, the share capital of a corporation is the nominal value of issued shares (that is, the sum of their par values, sometimes indicated on share certificates). If the allocation price of shares is greater than the par value, as in a rights issue, the shares are said to be sold at a premium (variously called share premium, additional paid-in capital or paid-in capital in excess of par). This equation shows the constituents that make up a company's real share capital: : \sum\text \times \text This is differentiated from share capital in the accounting sense, as it presents nominal share capital and does not take t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity (finance)

In finance, equity is an ownership interest in property that may be subject to debts or other liabilities. Equity is measured for accounting purposes by subtracting liabilities from the value of the assets owned. For example, if someone owns a car worth $24,000 and owes $10,000 on the loan used to buy the car, the difference of $14,000 is equity. Equity can apply to a single asset, such as a car or house, or to an entire business. A business that needs to start up or expand its operations can sell its equity in order to raise cash that does not have to be repaid on a set schedule. When liabilities attached to an asset exceed its value, the difference is called a deficit and the asset is informally said to be "underwater" or "upside-down". In government finance or other non-profit settings, equity is known as "net position" or "net assets". Origins The term "equity" describes this type of ownership in English because it was regulated through the system of equity law that devel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Common Stock Dividend

A common stock dividend is the dividend paid to common stock owners from the profits of the company. Like other dividends, the payout is in the form of either cash or stock. The law may regulate the size of the common stock dividend particularly when the payout is a cash distribution tantamount to a liquidation. Such cash dividends may serve the intent of defrauding creditors. Cash dividend A cash dividend is the distribution of profits to the common stock shareholders, the owners of the corporation. Such distributions are in equal amounts to the shareholders depending on the portion of the company they own. Stock dividend A stock dividend to common stock dividend owners distributes additional stock in the company to the common stock shareholders. Such dividends are evenly distributed to the shareholders depending on their portion of ownership in the corporation. Such distributions maintain their proportional ownership in the corporation. See also *Common stock * Common stock ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Surplus

Capital surplus, also called share premium, is an account which may appear on a corporation's balance sheet, as a component of shareholders' equity, which represents the amount the corporation raises on the issue of shares in excess of their par value (nominal value) of the shares (common stock). This is called Additional paid in capital in US GAAP terminology but, additional paid in capital is not limited to share premium. It is a very broad concept and includes tax related and conversion related adjustments. Taken together, common stock (and sometimes preferred stock) issued and paid (plus capital surplus) represent the total amount actually paid by investors for shares when issued (assuming no subsequent adjustments or changes). Shares for which there is no par value will generally not have any form of capital surplus on the balance sheet; all funds from issuing shares will be credited to common stock issued. Some other scenarios for triggering a capital surplus include when ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shares Outstanding

Shares outstanding are all the shares of a corporation that have been authorized, issued and purchased by investors and are held by them. They are distinguished from treasury shares, which are shares held by the corporation itself, thus representing no exercisable rights. Shares outstanding and treasury shares together amount to the number of issued shares. Shares outstanding can be calculated as either basic or fully diluted. The basic count is the current number of shares. Dividend distributions and voting in the general meeting of shareholders are calculated according to this number. The fully diluted shares outstanding count, on the other hand, includes diluting securities, such as warrants, capital notes or convertibles. If the company has any diluting securities, this indicates the potential future increased number of shares outstanding. Finding the number of shares outstanding The number of outstanding shares may change due to changes in the number of issued shares, as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-voting Stock

Non-voting stock is the stock that provides the shareholder very little or no vote on corporate matters, such as election of the board of directors or mergers. This type of share is usually implemented for individuals who want to invest in the company's profitability and success at the expense of voting rights in the direction of the company. The investors still get dividends and can participate in capital gains as the shares can be bought and sold in the same way as normal shares. Preferred stock typically has non-voting qualities. Many countries such as Germany, Russia, the United Kingdom and other commonwealth realms have laws or policies against multiple/non-voting stock. In the US, not all corporations offer voting stock and non-voting stock, nor do all stocks usually have equal voting power. Warren Buffett's Berkshire Hathaway corporation has two classes of stocks, Class A voting stock () and Class B non-voting stock (). The Class B stock carries 1/10,000th of the voting righ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |