|

Partnership Taxation

Partnership taxation is the concept of taxing a partnership business entity. Many jurisdictions regulate partnerships and the taxation thereof differently. Common law Many common law jurisdictions apply a concept called "flow through taxation" to partnerships. Partnerships are a flow-through entity where the taxes are assessed at the entity level but which are applied to the partners of the partnership. United States Partnership taxation is codified as Subchapter K of Chapter 1 of the U.S. Internal Revenue Code (Title 26 of the United States Code). Partnerships are "flow-through" entities for United States federal income taxation purposes. Flow-through taxation means that the entity does not pay taxes on its income. Instead, the owners of the entity pay tax on their "distributive share" of the entity's taxable income, even if no funds are distributed by the partnership to the owners. Federal tax law permits the owners of the entity to agree how the income of the entity will ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Partnership

A partnership is an arrangement where parties, known as business partners, agree to cooperate to advance their mutual interests. The partners in a partnership may be individuals, businesses, interest-based organizations, schools, governments or combinations. Organizations may partner to increase the likelihood of each achieving their mission and to amplify their reach. A partnership may result in issuing and holding equity or may be only governed by a contract. History Partnerships have a long history; they were already in use in medieval times in Europe and in the Middle East. According to a 2006 article, the first partnership was implemented in 1383 by Francesco di Marco Datini, a merchant of Prato and Florence. The Covoni company (1336-40) and the Del Buono-Bencivenni company (1336-40) have also been referred to as early partnerships, but they were not formal partnerships. In Europe, the partnerships contributed to the Commercial Revolution which started in the 13th centur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flow-through Entity

A flow-through entity (FTE) is a legal entity where income "flows through" to investors or owners; that is, the income of the entity is treated as the income of the investors or owners. Flow-through entities are also known as pass-through entities or fiscally-transparent entities. Common types of FTEs are general partnerships, limited partnerships and limited liability partnerships. In the United States, additional types of FTE include S corporations, income trusts and limited liability companies. Most countries require an FTE (or its owners) to file an annual return reporting the shares of income allocated to owners, and to provide each owner with a statement of allocated income to enable owners to report their shares of income on their own tax returns. In the United States, the statement of allocated income is known as a K-1 (or Schedule K-1). Depending on the local tax regulations, this structure can avoid dividend tax and double taxation because only owners or investors are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, eff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

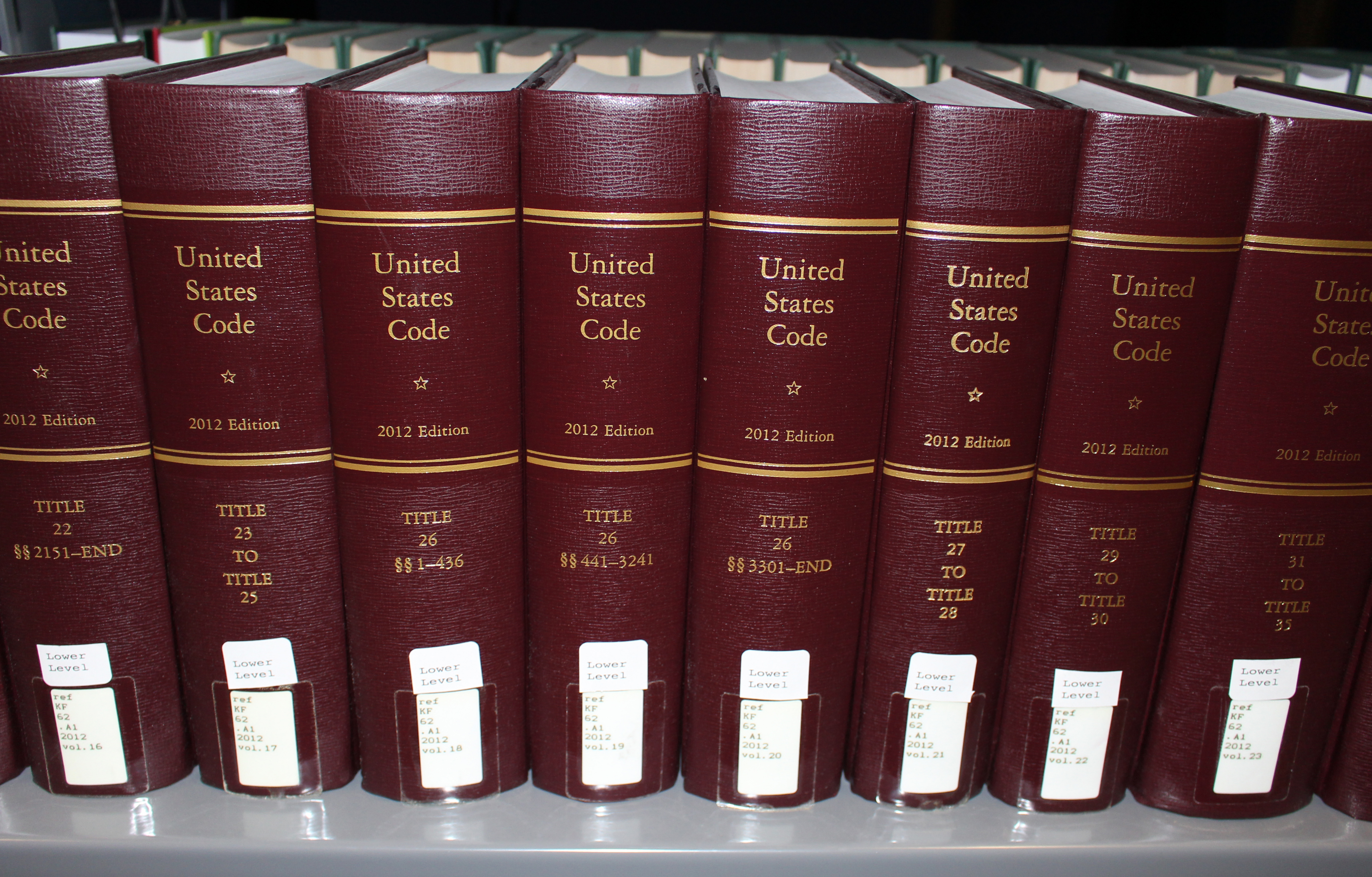

United States Code

In the law of the United States, the Code of Laws of the United States of America (variously abbreviated to Code of Laws of the United States, United States Code, U.S. Code, U.S.C., or USC) is the official compilation and codification of the general and permanent federal statutes. It contains 53 titles (Titles 1–54, excepting Title 53, which is reserved for a proposed title on small business). The main edition is published every six years by the Office of the Law Revision Counsel of the House of Representatives, and cumulative supplements are published annually.About United States Code Gpo.gov. Retrieved on 2013-07-19. The official version of these laws appears in the '' |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income And Corporation Taxes Act 1988

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. For example, a person's income in an economic sense may be different from their income as defined by law. An extremely important definition of income is Haig–Simons income, which defines income as ''Consumption + Change in net worth'' and is widely used in economics. For households and individuals in the United States, income is defined by tax law as a sum that includes any wage, salary, profit, interest payment, rent, or other form of earnings received in a calendar year.Case, K. & Fair, R. (2007). ''Principles of Economics''. Upper Saddle River, NJ: Pearson Education. p. 54. Discretionary income is often defined as gross income minus taxes and other deductions (e.g., mandatory pension contributions), and is widely used as a basis to com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax (Trading And Other Income) Act 2005

The Income Tax (Trading and Other Income) Act 2005 (c 5) is an Act of the Parliament of the United Kingdom. It restated certain legislation relating to income tax, with minor changes that were mainly intended "to clarify existing provisions, make them consistent or bring the law into line with well established practice." The Bill was the work of the Tax Law Rewrite Project team at the Inland Revenue.Explanatory notesparagraph 10 (and see paragraph 1 for their name)/ref> Part 1 Section 1 Section 1(2) was repealed by Part 1 of Schedule 3 to the Income Tax Act 2007. Part 2 Chapter 4 Section 51 This section was repealed by Part 1 of Schedule 3 to the Income Tax Act 2007. Section 75 Section 75(5) was repealed by paragraph 42 of the Schedule to the Finance Act 2009, Schedule 47 (Consequential Amendments) Order 2009 (SI 2009/2035). Section 79 Section 79(2) was repealed by Part 1 of Schedule 3 to the Corporation Tax Act 2009. Chapter 5 Section 88 Section 88(4)(a) was repealed by se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Corporation Tax

: ''Throughout this article, the term "pound" and the £ symbol refer to the Pound sterling.'' Corporation tax in the United Kingdom is a corporate tax levied in on the profits made by UK-resident companies and on the profits of entities registered overseas with permanent establishments in the UK. Until 1 April 1965, companies were taxed at the same income tax rates as individual taxpayers, with an additional profits tax levied on companies. Finance Act 1965 replaced this structure for companies and associations with a single corporate tax, which took its basic structure and rules from the income tax system. Since 1997, the UK's Tax Law Rewrite ProjectTax Law Rewrite , |

UK Income Tax

Taxation in the United Kingdom may involve payments to at least three different levels of government: central government ( HM Revenue & Customs), devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion. History A uniform Land tax, originally was introduced in England during the late 17th century, formed the main source of government revenue throughout the 18th century and the early 19th century. Stephen Dowell, ''History of Taxation and Taxes in England'' (Ro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HM Revenue And Customs

HM Revenue and Customs (His Majesty's Revenue and Customs, or HMRC) is a non-ministerial government department, non-ministerial Departments of the United Kingdom Government, department of the His Majesty's Government, UK Government responsible for the tax collection, collection of Taxation in the United Kingdom, taxes, the payment of some forms of Welfare state in the United Kingdom, state support, the administration of other regulatory Regime#Politics, regimes including the national minimum wage and the issuance of national insurance numbers. HMRC was formed by the merger of the Inland Revenue and HM Customs and Excise, which took effect on 18 April 2005. The department's logo is the St Edward's Crown enclosed within a circle. Prior to the Elizabeth II, Queen's death on 8 September 2022, the department was known as ''Her'' Majesty's Revenue and Customs and has since been amended to reflect the change of monarch. Departmental responsibilities The department is responsible for the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hong Kong

Hong Kong ( (US) or (UK); , ), officially the Hong Kong Special Administrative Region of the People's Republic of China ( abbr. Hong Kong SAR or HKSAR), is a city and special administrative region of China on the eastern Pearl River Delta in South China. With 7.5 million residents of various nationalities in a territory, Hong Kong is one of the most densely populated places in the world. Hong Kong is also a major global financial centre and one of the most developed cities in the world. Hong Kong was established as a colony of the British Empire after the Qing Empire ceded Hong Kong Island from Xin'an County at the end of the First Opium War in 1841 then again in 1842.. The colony expanded to the Kowloon Peninsula in 1860 after the Second Opium War and was further extended when Britain obtained a 99-year lease of the New Territories in 1898... British Hong Kong was occupied by Imperial Japan from 1941 to 1945 during World War II; British administration resume ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)