|

Pairs Trading

A pairs trade or pair trading is a market neutral trading strategy enabling traders to profit from virtually any market conditions: uptrend, downtrend, or sideways movement. This strategy is categorized as a statistical arbitrage and convergence trading strategy. Pair trading was pioneered by Gerry Bamberger and later led by Nunzio Tartaglia's quantitative group at Morgan Stanley in the 1980s. The strategy monitors performance of two historically correlated securities. When the correlation between the two securities temporarily weakens, i.e. one stock moves up while the other moves down, the pairs trade would be to short the outperforming stock and to long the underperforming one, betting that the "spread" between the two would eventually converge. The divergence within a pair can be caused by temporary supply/demand changes, large buy/sell orders for one security, reaction for important news about one of the companies, and so on. Pairs trading strategy demands good position si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pair Tool

Pair or PAIR or Pairing may refer to: Government and politics * Pair (parliamentary convention), matching of members unable to attend, so as not to change the voting margin * ''Pair'', a member of the Prussian House of Lords * ''Pair'', the French equivalent of peer, holder of a French Pairie, a French high title roughly equivalent to a member of the British peerage Mathematics * 2 (number), two of something, a pair * 2-tuple, in mathematics and set theory * Ordered pair, in mathematics and set theory * Pairing, in mathematics, an R-bilinear map of modules, where R is the underlying ring * Pair type, in programming languages and type theory, a product type with two component types * Topological pair, an inclusion of topological spaces Science and technology * Couple (app), formerly Pair, a mobile application for two people * PAIR (puncture-aspiration-injection-reaspiration), in medicine * Pairing, a handshaking process in Bluetooth communications * Pair programming, an agile ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Autoregressive Moving Average

In statistics, econometrics and signal processing, an autoregressive (AR) model is a representation of a type of random process; as such, it is used to describe certain time-varying processes in nature, economics, etc. The autoregressive model specifies that the output variable depends linearly on its own previous values and on a stochastic term (an imperfectly predictable term); thus the model is in the form of a stochastic difference equation (or recurrence relation which should not be confused with differential equation). Together with the moving-average (MA) model, it is a special case and key component of the more general autoregressive–moving-average (ARMA) and autoregressive integrated moving average (ARIMA) models of time series, which have a more complicated stochastic structure; it is also a special case of the vector autoregressive model (VAR), which consists of a system of more than one interlocking stochastic difference equation in more than one evolving random vari ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Papa John's Pizza

Papa John's International, Inc., d/b/a Papa Johns, is an American pizza restaurant chain. It is the fourth largest pizza delivery restaurant chain in the United States, with headquarters in Louisville, Kentucky and Atlanta, Georgia metropolitan areas. Papa John’s global presence has reached over 5,500 locations in 49 countries and territories; and is currently the world’s third-largest pizza delivery company. History 1984–2009 The Papa John's restaurant was founded in 1984 when "Papa" John Schnatter installed an oven inside a broom closet in the back of his father's tavern, Mick's Lounge, in Jeffersonville, Indiana. He then sold his 1971 Camaro Z28 to purchase US$1,600 worth of used pizza equipment and began selling pizzas to the tavern's customers out of the converted closet. His pizzas proved sufficiently popular that a year later he moved into an adjoining space. Dipping sauce specifically for pizza was invented by Papa John's Pizza that same year, and has sinc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Domino's Pizza

Domino's Pizza, Inc., trading as Domino's, is an American multinational pizza restaurant chain founded in 1960 and led by CEO Russell Weiner. The corporation is Delaware General Corporation Law, Delaware domiciled and headquartered at the Domino's Farms Office Park in Ann Arbor Township, near Ann Arbor, Michigan. As of 2018, Domino's had approximately 15,000 stores, with 5,649 in the United States, 1,500 in India, and 1,249 in the United Kingdom. Domino's has stores in over 83 countries and 5,701 cities worldwide. In 2018 Domino's Pizza was inducted into the Queensland Business Leaders Hall of Fame. History 1960s–2010s In 1960, Tom Monaghan and his brother, James, took over the operation of DomiNick's, an existing location of a small pizza restaurant chain that had been owned by Dominick DeVarti, at 507 Cross Street (now 301 West Cross Street)James Leonard, ''Living the Faith: A Life of Tom Monaghan'' (University of Michigan Press, 2012) pp41-55 in Ypsilanti, Michigan, near ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pepsi

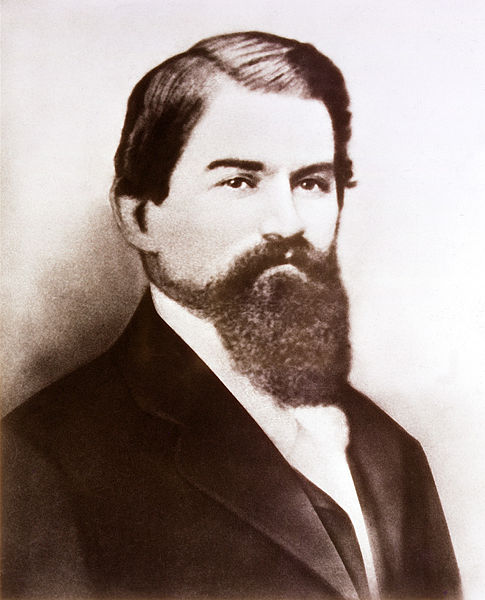

Pepsi is a carbonated soft drink manufactured by PepsiCo. Originally created and developed in 1893 by Caleb Bradham and introduced as Brad's Drink, it was renamed as Pepsi-Cola in 1898, and then shortened to Pepsi in 1961. History Pepsi was first invented in 1893 as "Brad's Drink" by Caleb Bradham, who sold the drink at his drugstore in New Bern, North Carolina. It was renamed Pepsi-Cola in 1898, "Pepsi" because it was advertised to relieve dyspepsia (indigestion) and "Cola" referring to the cola flavor. Some have also suggested that "Pepsi" may have been a reference to the drink aiding digestion like the digestive enzyme pepsin, but pepsin itself was never used as an ingredient to Pepsi-Cola. The original recipe also included sugar and vanilla. Bradham sought to create a fountain drink that was appealing and would aid in digestion and boost energy. In 1903, Bradham moved the bottling of Pepsi from his drugstore to a rented warehouse. That year, Bradham sold 7,968 gall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coca-Cola

Coca-Cola, or Coke, is a carbonated soft drink manufactured by the Coca-Cola Company. Originally marketed as a temperance drink and intended as a patent medicine, it was invented in the late 19th century by John Stith Pemberton in Atlanta, Georgia. In 1888, Pemberton sold Coca-Cola's ownership rights to Asa Griggs Candler, a businessman, whose marketing tactics led Coca-Cola to its dominance of the global soft-drink market throughout the 20th and 21st century. The drink's name refers to two of its original ingredients: coca leaves and kola nuts (a source of caffeine). The current formula of Coca-Cola remains a closely guarded trade secret; however, a variety of reported recipes and experimental recreations have been published. The secrecy around the formula has been used by Coca-Cola in its marketing as only a handful of anonymous employees know the formula. The drink has inspired imitators and created a whole classification of soft drink: colas. The Coca-Cola C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beta Coefficient

In finance, the beta (β or market beta or beta coefficient) is a measure of how an individual asset moves (on average) when the overall stock market increases or decreases. Thus, beta is a useful measure of the contribution of an individual asset to the risk of the market portfolio when it is added in small quantity. Thus, beta is referred to as an asset's non-diversifiable risk, its systematic risk, market risk, or hedge ratio. Beta is ''not'' a measure of idiosyncratic risk. Interpretation of values By definition, the value-weighted average of all market-betas of all investable assets with respect to the value-weighted market index is 1. If an asset has a beta above (below) 1, it indicates that its return moves more (less) than 1-to-1 with the return of the market-portfolio, on average. In practice, few stocks have negative betas (tending to go up when the market goes down). Most stocks have betas between 0 and 3. Treasury bills (like most fixed income instruments ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Systematic Risk

In finance and economics, systematic risk (in economics often called aggregate risk or undiversifiable risk) is vulnerability to events which affect aggregate outcomes such as broad market returns, total economy-wide resource holdings, or aggregate income. In many contexts, events like earthquakes, epidemics and major weather catastrophes pose aggregate risks that affect not only the distribution but also the total amount of resources. That is why it is also known as contingent risk, unplanned risk or risk events. If every possible outcome of a stochastic economic process is characterized by the same aggregate result (but potentially different distributional outcomes), the process then has no aggregate risk. Properties Systematic or aggregate risk arises from market structure or dynamics which produce shocks or uncertainty faced by all agents in the market; such shocks could arise from government policy, international economic forces, or acts of nature. In contrast, specific ri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Asset Pricing Model

In finance, the capital asset pricing model (CAPM) is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions about adding assets to a well-diversified portfolio. The model takes into account the asset's sensitivity to non-diversifiable risk (also known as systematic risk or market risk), often represented by the quantity beta (β) in the financial industry, as well as the expected return of the market and the expected return of a theoretical risk-free asset. CAPM assumes a particular form of utility functions (in which only first and second moments matter, that is risk is measured by variance, for example a quadratic utility) or alternatively asset returns whose probability distributions are completely described by the first two moments (for example, the normal distribution) and zero transaction costs (necessary for diversification to get rid of all idiosyncratic risk). Under these conditions, CAPM shows that the cost ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mean Reversion (finance)

Mean reversion is a financial term for the assumption that an asset's price will tend to converge to the average price over time. Using mean reversion as a timing strategy involves both the identification of the trading range for a security and the computation of the average price using quantitative methods. Mean reversion is a phenomenon that can be exhibited in a host of financial time-series data, from price data, earnings data, and book value. When the current market price is less than the average past price, the security is considered attractive for purchase, with the expectation that the price will rise. When the current market price is above the average past price, the market price is expected to fall. In other words, deviations from the average price are expected to revert to the average. This knowledge serves as the cornerstone of multiple trading strategies. Stock reporting services commonly offer moving averages for periods such as 50 and 100 days. While reporting ser ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long (finance)

In finance, a long position in a financial instrument means the holder of the position owns a positive amount of the instrument. The holder of the position has the expectation that the financial instrument will increase in value. This is known as a bullish position. Security In terms of a security, such as a stock or a bond, or equivalently ''to be long'' in a security, means the holder of the position owns the security, on the expectation that the security will increase in value, and will profit if the price of the security goes up. ''Going long'' a security is the more conventional practice of investing. Future Going long in a future means the holder of the position is obliged to buy the underlying instrument at the contract price at expiry. The holder of the position will profit if the price of the underlying instrument goes up, as the price he will pay will be less than the market price. Option An options Option or Options may refer to: Computing *Option key, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short (finance)

In finance, being short in an asset means investing in such a way that the investor will profit if the value of the asset falls. This is the opposite of a more conventional " long" position, where the investor will profit if the value of the asset rises. There are a number of ways of achieving a short position. The most fundamental method is "physical" selling short or short-selling, which involves borrowing assets (often securities such as shares or bonds) and selling them. The investor will later purchase the same number of the same type of securities in order to return them to the lender. If the price has fallen in the meantime, the investor will have made a profit equal to the difference. Conversely, if the price has risen then the investor will bear a loss. The short seller must usually pay a fee to borrow the securities (charged at a particular rate over time, similar to an interest payment), and reimburse the lender for any cash returns such as dividends that were ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)