|

PGIM

PGIM, Inc. (PGIM), formerly Prudential Investment Management, is the asset management arm of American life insurance company Prudential Financial. Headquartered in Newark, New Jersey, United States, PGIM manages more than $1 trillion in assets across its fixed income, equity, real estate, alternatives, and multi-asset channels, including $283 billion for retail investors, and $553 billion for institutional clients, as of December 2019. David Hunt has been the CEO since 2011. History PGIM traces its history to the founding of its parent company, Prudential Financial, in 1875. PGIM is currently one of the 10 largest asset managers in the world, with more than 1,100 investment professionals working for the company across 31 offices. The firm is headquartered in the Prudential Tower in Newark, New Jersey, which currently houses approximately 3,000 employees from a variety of PGIM's investment management divisions. Structure PGIM follows a multi-manager model divided into seve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prudential Financial

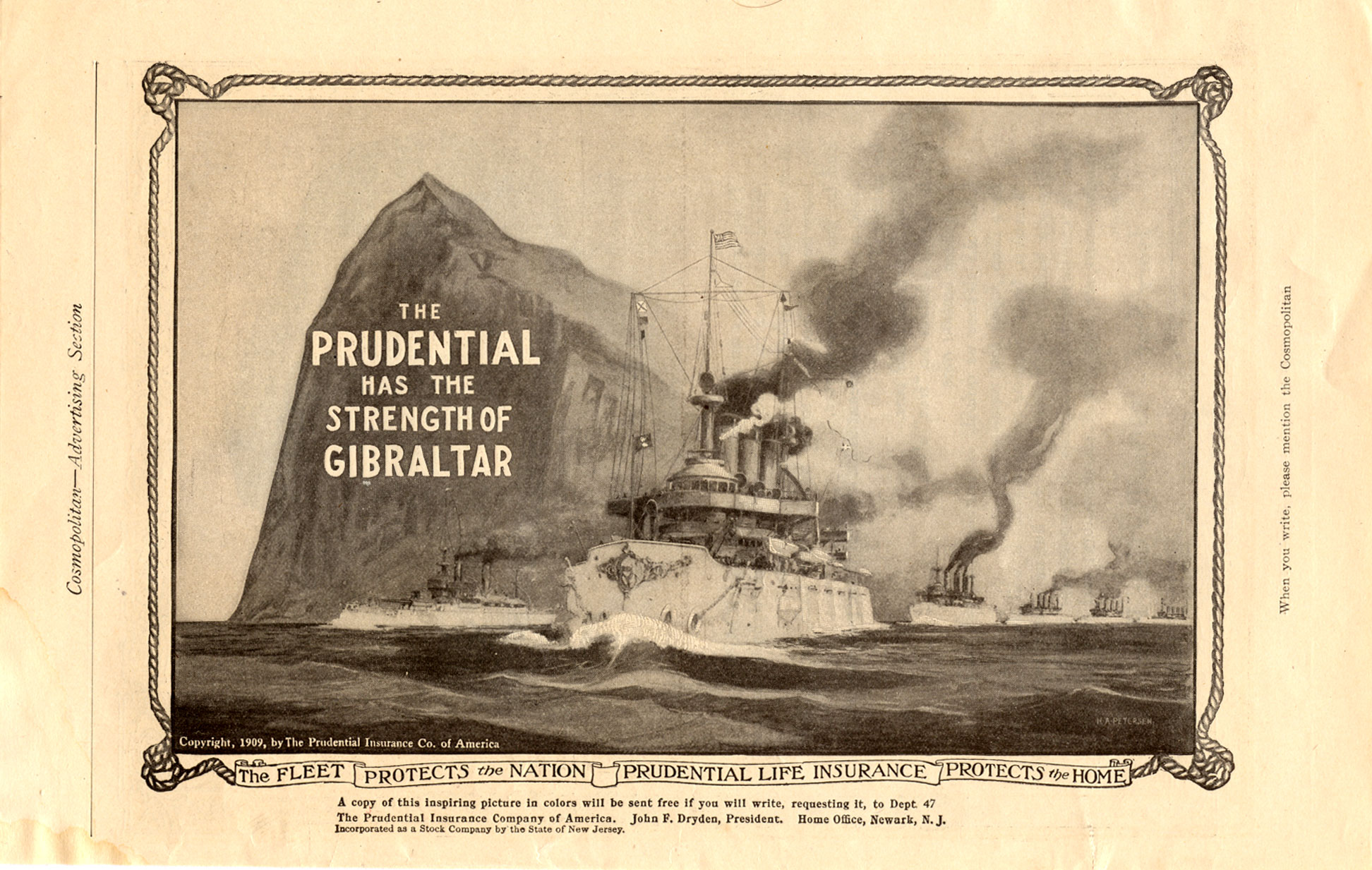

Prudential Financial, Inc. is an American Fortune Global 500 and Fortune 500 company whose subsidiaries provide insurance, retirement planning, investment management, and other products and services to both retail and institutional customers throughout the United States and in over 40 other countries. In 2019, Prudential was the largest insurance provider in the United States with $815.1 billion in total assets. The company uses the Rock of Gibraltar as its logo. Logo The use of Prudential's symbol, the Rock of Gibraltar, began after an advertising agent passed Laurel Hill, a volcanic neck, in Secaucus, New Jersey, on a train in the 1890s. The related slogans "Get a Piece of the Rock" and "Strength of Gibraltar" are also still quite widely associated with Prudential, though current advertising uses neither of these. Through the years, the symbol went through various versions, but in 1989, a simplified pictogram symbol of the Rock of Gibraltar was adopted. It has been used ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Environmental, Social And Corporate Governance

ESG (environmental, social, and corporate governance) data reflect the negative externalities (costs to others) caused by an organization with respect to the environment, to society and to corporate governance. ESG data can be used by investors to assess the material risk the organization is taking and by the organization itself as metrics for strategic and managerial purposes. Investors may also use ESG data beyond assessing material risks to the organization in their evaluation of enterprise value, specifically by designing models based on assumptions that the identification, assessment and management of sustainability-related risks and opportunities in respect to all organizational stakeholders leads to higher long-term risk-adjusted return. Organizational stakeholders include but not limited to customers, suppliers, employees, leadership, and the environment. Since 2020, there has been accelerating interest in overlaying ESG data with the Sustainable Development Goals (SDG ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Management Companies Of The United States

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical effect o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 1875

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability assessmen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Greenhouse Gas Emissions

Greenhouse gas emissions from human activities strengthen the greenhouse effect, contributing to climate change. Most is carbon dioxide from burning fossil fuels: coal, oil, and natural gas. The largest emitters include coal in China and large oil and gas companies, many state-owned by OPEC and Russia. Human-caused emissions have increased atmospheric carbon dioxide by about 50% over pre-industrial levels. The growing levels of emissions have varied, but it was consistent among all greenhouse gases (GHG). Emissions in the 2010s averaged 56 billion tons a year, higher than ever before. Electricity generation and transport are major emitters; the largest single source, according to the United States Environmental Protection Agency, is transportation, accounting for 27% of all USA greenhouse gas emissions. Deforestation and other changes in land use also emit carbon dioxide and methane. The largest source of anthropogenic methane emissions is agriculture, closely followed by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leadership In Energy And Environmental Design

Leadership in Energy and Environmental Design (LEED) is a green building certification program used worldwide. Developed by the non-profit U.S. Green Building Council (USGBC), it includes a set of rating systems for the design, construction, operation, and maintenance of green buildings, homes, and neighborhoods, which aims to help building owners and operators be environmentally responsible and use resources efficiently. By 2015, there were over 80,000 LEED-certified buildings and over 100,000 LEED-accredited professionals. Most LEED-certified buildings are located in major U.S. metropolises. LEED Canada has developed a separate rating system adapted to the Canadian climate and regulations. Some U.S. federal agencies, state and local governments require or reward LEED certification. This can include tax credits, zoning allowances, reduced fees, and expedited permitting. Studies have found that for-rent LEED office spaces generally have higher rents and occupancy rates and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Principles For Responsible Investment

Principles for Responsible Investment (UNPRI or PRI) is a United Nations-supported international network of financial institutions working together to implement its six aspirational principles, often referenced as "the Principles". Its goal is to understand the implications of sustainability for investors and support signatories to facilitate incorporating these issues into their investment decision-making and ownership practices. In implementing these principles, signatories contribute to the development of a more sustainable global financial system. The Principles offer a framework of possible actions for incorporating environmental, social and corporate governance factors into investment practices across asset classes. Responsible investment is a process that must be tailored to fit each organisation's investment strategy, approach and resources. The Principles are designed to be compatible with the investment styles of large, diversified, institutional investors that operate wit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prudential Plc

Prudential plc is a British Multinational corporation, multinational insurance company headquartered in London, England. It was founded in London in May 1848 to provide loans to professional and working people. Prudential has dual primary listings on the London Stock Exchange and Hong Kong Stock Exchange, and is a constituent of the FTSE 100 Index. It also has secondary listings on the New York Stock Exchange and Singapore Exchange. History Early history The company was founded in Hatton Garden in London in May 1848 as The Prudential, Investment, Loan, and Assurance Association and in September 1848 changed its name to The Prudential Mutual Assurance, Investment, and Loan Association, to provide loans to professional and working people. In 1854, the company began selling the relatively new concept of Industrial Branch insurance policies to the working class population for premiums as low as one penny a week through agents acting as door to door salesman, door to door salesmen. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Target Date Fund

A target date fund (TDF), also known as a lifecycle fund, dynamic-risk fund, or age-based fund, is a collective investment scheme, often a mutual fund or a collective trust fund, designed to provide a simple investment solution through a portfolio whose asset allocation mix becomes more conservative as the target date (usually retirement) approaches. History Target-date funds were invented by Donald Luskin and Larry Tint of Wells Fargo Investment Advisors (later Barclays Global Investors), and first introduced in the early 1990s by BGI. Their popularity in the US increased significantly in recent years due in part to the auto-enrollment legislation Pension Protection Act of 2006 that created the need for safe-harbor type Qualifying Default Investment Alternatives, such as target-date funds, for 401(k) savings plans. With the UK enacting auto-enrollment legislation in 2012, target-date funds are used by the National Employment Savings Trust (NEST), and are expected to become in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Momentum Investing

Momentum investing is a system of buying stocks or other securities that have had high returns over the past three to twelve months, and selling those that have had poor returns over the same period. While momentum investing is well-established as a phenomenon no consensus exists about the explanation for this strategy, and economists have trouble reconciling momentum with the efficient market hypothesis and random walk hypothesis. Two main hypotheses have been submitted to explain the momentum effect in terms of an efficient market. In the first, it is assumed that momentum investors bear significant risk for assuming this strategy, and, therefore, the high returns are a compensation for the risk. Momentum strategies often involve disproportionately trading in stocks with high bid-ask spreads and so it is important to take transactions costs into account when evaluating momentum profitability. The second theory assumes that momentum investors are exploiting behavioral shortcomings ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Newark, New Jersey

Newark ( , ) is the most populous city in the U.S. state of New Jersey and the seat of Essex County and the second largest city within the New York metropolitan area.New Jersey County Map New Jersey Department of State. Accessed July 10, 2017. The city had a population of 311,549 as of the , and was calculated at 307,220 by the Population Estimates Program for 2021, making it [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Factor Investing

Factor investing is an investment approach that involves targeting quantifiable firm characteristics or “factors” that can explain differences in stock returns. Security characteristics that may be included in a factor-based approach include size, low-volatility, value, momentum, asset growth, profitability, leverage, term and cost of carry. A factor-based investment strategy involves tilting investment portfolios towards and away from specific factors in an attempt to generate long-term investment returns in excess of benchmarks. The approach is quantitative and based on observable data, such as stock prices and financial information, rather than on opinion or speculation. Factor premiums are also documented in corporate bond markets and also across markets. History The earliest theory of factor investing originated with a research paper by Stephen A. Ross in 1976 on arbitrage pricing theory, which argued that security returns are best explained by multiple factors. Prior to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)