|

New Jobs Tax Credit

The New Jobs tax credit was a tax credit policy created as part of the 1977 stimulus package enacted by the Carter administration and was in effect through 1978. The tax credit acted as a form of wage subsidy by granting employers a tax credit for making new hires. In 1979, the credit was not renewed and it was ultimately perceived as a failure due to poor execution and lack of exposure. As written in the Tax Reduction and Simplification Act of 1977, the tax credit offered fifty percent of the first $4,200 in wages per employee for increases in employment of at least two percent over the previous year. In early 2010, there was renewed interest in duplicating the original 1977 tax credit in legislation proposed by Barack Obama. The proposed tax credit was renamed and included in the Hiring Incentives to Restore Employment Act The Hiring Incentives to Restore Employment (HIRE) Act of 2010 (, ) is a law in the 111th United States Congress to provide payroll tax breaks and incenti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

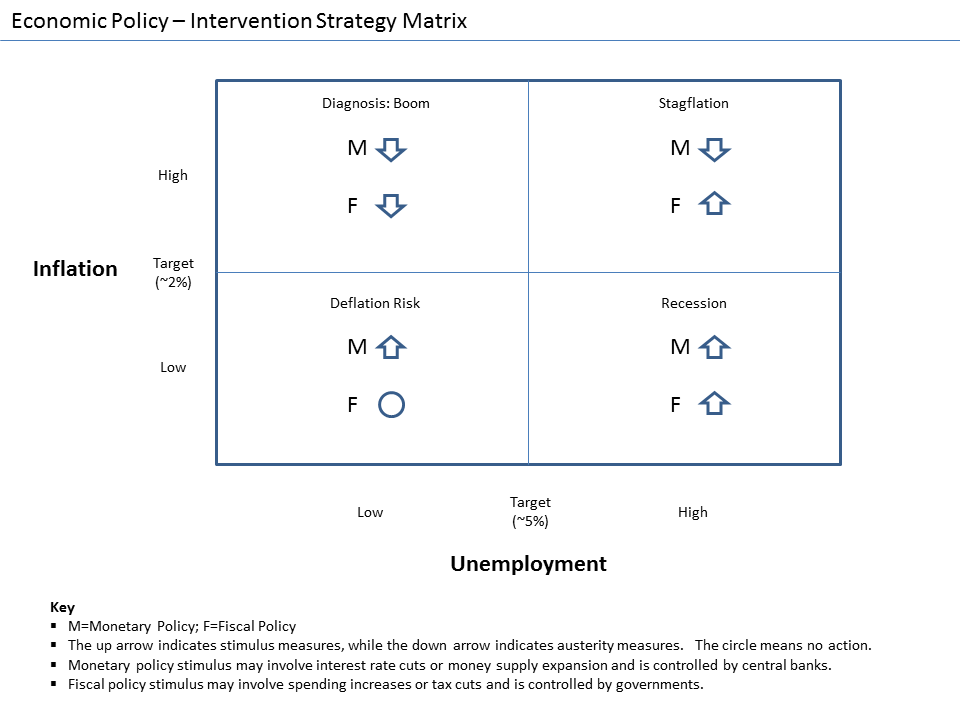

Stimulus (economics)

In economics, stimulus refers to attempts to use monetary policy or fiscal policy (or stabilization policy in general) to stimulate the economy. Stimulus can also refer to monetary policies such as lowering interest rates and quantitative easing. A stimulus is sometimes colloquially referred to as "priming the pump" or "pump priming". Concept During a recession, production and employment are far below their sustainable potential due to lack of demand. It is hoped that increasing demand will stimulate growth and that any adverse side effects from stimulus will be mild. Fiscal stimulus refers to increasing government consumption or transfers or lowering taxes, increasing the rate of growth of public debt. Supporters of Keynesian economics assume the stimulus will cause sufficient economic growth to fill that gap partially or completely via the multiplier effect. Monetary stimulus refers to lowering interest rates, quantitative easing, or other ways of increasing the amount of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Presidency Of Jimmy Carter

Jimmy Carter's tenure as the 39th president of the United States began with his inauguration on January 20, 1977, and ended on January 20, 1981. A Democrat from Georgia, Carter took office after defeating incumbent Republican President Gerald Ford in the 1976 election. His presidency ended following his defeat in the 1980 election by Republican Ronald Reagan. Carter took office during a period of "stagflation," as the economy experienced a combination of high inflation and slow economic growth. His budgetary policies centered on taming inflation by reducing deficits and government spending. Responding to energy concerns that had persisted through much of the 1970s, his administration enacted a national energy policy designed for long-term energy conservation and the development of alternative resources. In the short term the country was beset by an energy crisis in 1979 which was overlapped by a recession in 1980. Carter sought reforms to the country's welfare, health car ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidy

A subsidy or government incentive is a form of financial aid or support extended to an economic sector (business, or individual) generally with the aim of promoting economic and social policy. Although commonly extended from the government, the term subsidy can relate to any type of support – for example from NGOs or as implicit subsidies. Subsidies come in various forms including: direct (cash grants, interest-free loans) and indirect (tax breaks, insurance, low-interest loans, accelerated depreciation, rent rebates). Furthermore, they can be broad or narrow, legal or illegal, ethical or unethical. The most common forms of subsidies are those to the producer or the consumer. Producer/production subsidies ensure producers are better off by either supplying market price support, direct support, or payments to factors of production. Consumer/consumption subsidies commonly reduce the price of goods and services to the consumer. For example, in the US at one time it was cheaper to buy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Reduction And Simplification Act Of 1977

The Tax Reduction and Simplification Act of 1977 was passed by the 95th United States Congress and signed into law by President Jimmy Carter on May 23, 1977. It replaced the percentage standard deduction and minimum standard deduction with a single standard deduction of $3,200 (joint returns) and temporarily extended the general tax credit (maximum of $35/capita or 2% of $9,000 income) through 1978. See also * Congressional Budget and Impoundment Control Act of 1974 The Congressional Budget and Impoundment Control Act of 1974 (, , ) is a United States federal law that governs the role of the Congress in the United States budget process. The Congressional budget process Titles I through IX of the law are also ... References External links * United States federal taxation legislation 1977 in American law {{tax-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

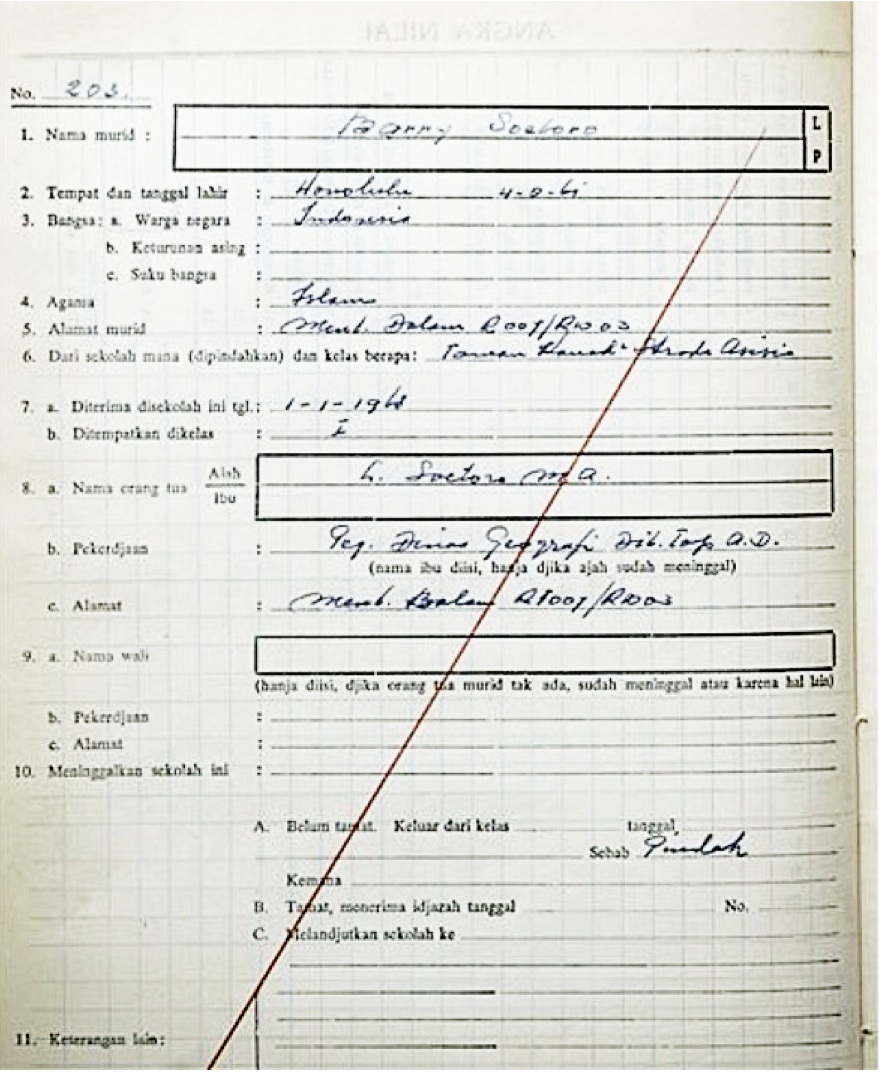

Barack Obama

Barack Hussein Obama II ( ; born August 4, 1961) is an American politician who served as the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, Obama was the first African-American president of the United States. He previously served as a U.S. senator from Illinois from 2005 to 2008 and as an Illinois state senator from 1997 to 2004, and previously worked as a civil rights lawyer before entering politics. Obama was born in Honolulu, Hawaii. After graduating from Columbia University in 1983, he worked as a community organizer in Chicago. In 1988, he enrolled in Harvard Law School, where he was the first black president of the '' Harvard Law Review''. After graduating, he became a civil rights attorney and an academic, teaching constitutional law at the University of Chicago Law School from 1992 to 2004. Turning to elective politics, he represented the 13th district in the Illinois Senate from 1997 until 2004, when he ran for the U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hiring Incentives To Restore Employment Act

The Hiring Incentives to Restore Employment (HIRE) Act of 2010 (, ) is a law in the 111th United States Congress to provide payroll tax breaks and incentives for businesses to hire unemployed workers. Often characterized as a "jobs bill", certain Democrats in Congress state that it is only one piece of a broader job creation legislative agenda, along with the Travel Promotion Act and other bills. Legislative history *The House of Representatives passed the original version on June 18, 2009 by a vote of 259–157. *The Senate passed an amended bill on November 5, 2009 by a vote of 71–28. *The House agreed to the amendments, with amendments, on December 16, 2009 by a vote of 217–212. *The Senate agreed to the amendments, with amendments, on February 24, 2010 by a vote of 70–28. *The House followed on March 4, 2010, passing an amended version (in compliance with new pay-as-you-go rules) by a vote of 217–201. *On March 17,2010 the Senate agreed to the House's amendment b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The American Economic Review

The ''American Economic Review'' is a monthly peer-reviewed academic journal published by the American Economic Association. First published in 1911, it is considered one of the most prestigious and highly distinguished journals in the field of economics. The current editor-in-chief is Esther Duflo, an economic professor at the Massachusetts Institute of Technology. The journal is based in Pittsburgh. In 2004, the ''American Economic Review'' began requiring "data and code sufficient to permit replication" of a paper's results, which is then posted on the journal's website. Exceptions are made for proprietary data. Until 2017, the May issue of the ''American Economic Review'', titled the ''Papers and Proceedings'' issue, featured the papers presented at the American Economic Association's annual meeting that January. After being selected for presentation, the papers in the ''Papers and Proceedings'' issue did not undergo a formal process of peer review. Starting in 2018, papers pre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Economic Association

The American Economic Association (AEA) is a learned society in the field of economics. It publishes several peer-reviewed journals acknowledged in business and academia. There are some 23,000 members. History and Constitution The AEA was established in 1885 in Saratoga Springs, New York by younger progressive economists trained in the German historical school, including Richard T. Ely, Edwin Robert Anderson Seligman and Katharine Coman, the only woman co-founder; since 1900 it has been under the control of academics. The purposes of the Association are: 1) The encouragement of economic research, especially the historical and statistical study of the actual conditions of industrial life; 2) The issue of publications on economic subjects; 3) The encouragement of perfect freedom of economic discussion. The Association as such will take no partisan attitude, nor will it commit its members to any position on practical economic questions. The Association publishes one of the most pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United States

The United States, United States of America has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey. Taxes fall much more heavily on labor income than on capital income. Divergent taxes and subsidies for different forms of income and spending can also constitute a form of indirect taxation of some activities over others. For example, individual spending on higher education can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |