|

Neo-Keynesean

The neoclassical synthesis (NCS), neoclassical–Keynesian synthesis, or just neo-Keynesianism was a neoclassical economics academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book ''The General Theory of Employment, Interest and Money'' (1936). It was formulated most notably by John Hicks (1937), Franco Modigliani (1944), and Paul Samuelson (1948), who dominated economics in the post-war period and formed the mainstream of macroeconomic thought in the 1950s, 60s, and 70s. A series of developments occurred that shook the neoclassical synthesis in the 1970s as the advent of stagflation and the work of monetarists like Milton Friedman cast doubt on neo-Keynesian conceptions of monetary theory. The conditions of the period proved the impossibility of maintaining sustainable growth and low level of inflation via the measures suggested by the school. The result would be a series of new ideas to bring ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microeconomic

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as whole, which is studied in macroeconomics. One goal of microeconomics is to analyze the market mechanisms that establish relative prices among goods and services and allocate limited resources among alternative uses. Microeconomics shows conditions under which free markets lead to desirable allocations. It also analyzes market failure, where markets fail to produce efficient results. While microeconomics focuses on firms and individuals, macroeconomics focuses on the sum total of economic activity, dealing with the issues of growth, inflation, and unemployment and with national policies relating to these issues. Microeconomics also deal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supply And Demand

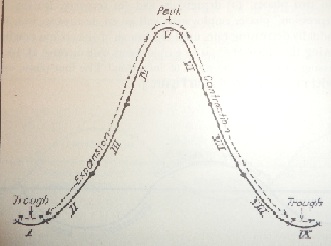

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris paribus, holding all else equal, in a perfect competition, competitive market, the unit price for a particular Good (economics), good, or other traded item such as Labour supply, labor or Market liquidity, liquid financial assets, will vary until it settles at a point where the quantity demanded (at the current price) will equal the quantity supplied (at the current price), resulting in an economic equilibrium for price and quantity transacted. The concept of supply and demand forms the theoretical basis of modern economics. In macroeconomics, as well, the AD–AS model, aggregate demand-aggregate supply model has been used to depict how the quantity of real GDP, total output and the aggregate price level may be determined in equilibrium. Graphical representations Supply schedule A supply schedule, depicted graphically as a supply cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

JSTOR

JSTOR (; short for ''Journal Storage'') is a digital library founded in 1995 in New York City. Originally containing digitized back issues of academic journals, it now encompasses books and other primary sources as well as current issues of journals in the humanities and social sciences. It provides full-text searches of almost 2,000 journals. , more than 8,000 institutions in more than 160 countries had access to JSTOR. Most access is by subscription but some of the site is public domain, and open access content is available free of charge. JSTOR's revenue was $86 million in 2015. History William G. Bowen, president of Princeton University from 1972 to 1988, founded JSTOR in 1994. JSTOR was originally conceived as a solution to one of the problems faced by libraries, especially research and university libraries, due to the increasing number of academic journals in existence. Most libraries found it prohibitively expensive in terms of cost and space to maintain a comprehen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The General Theory Of Employment, Interest, And Money

''The General Theory of Employment, Interest and Money'' is a book by English economist John Maynard Keynes published in February 1936. It caused a profound shift in economic thought, giving macroeconomics a central place in economic theory and contributing much of its terminology – the " Keynesian Revolution". It had equally powerful consequences in economic policy, being interpreted as providing theoretical support for government spending in general, and for budgetary deficits, monetary intervention and counter-cyclical policies in particular. It is pervaded with an air of mistrust for the rationality of free-market decision making. Keynes denied that an economy would automatically adapt to provide full employment even in equilibrium, and believed that the volatile and ungovernable psychology of markets would lead to periodic booms and crises. The ''General Theory'' is a sustained attack on the classical economics orthodoxy of its time. It introduced the concepts of the cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Don Patinkin

Don Patinkin (Hebrew: דן פטינקין) (January 8, 1922 – August 7, 1995) was an American-born Israeli monetary economist, and the President of the Hebrew University of Jerusalem.Nissan Liviatan, 2008. "Patinkin, Don (1922–1995)," ''The New Palgrave Dictionary of Economics'', 2nd EditionAbstract./ref> Biography Don Patinkin was born January 8, 1922, in Chicago, to a family of Jewish emigrants from Poland. While doing his undergraduate studies at the University of Chicago, he also studied the Talmud at the Hebrew Theological College in Chicago. He continued at Chicago for his graduate studies, earning a Ph.D. in 1947 under the supervision of Oskar R. Lange. Patinkin was a strong Zionist and, while doing his graduate studies, planned to immigrate to Palestine; in his graduate research he studied Palestinian economics, although he did not complete his thesis in this subject. After graduating he held lecturer positions at the University of Chicago and the University of Illi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

James Tobin

James Tobin (March 5, 1918 – March 11, 2002) was an American economist who served on the Council of Economic Advisers and consulted with the Board of Governors of the Federal Reserve System, and taught at Harvard and Yale Universities. He developed the ideas of Keynesian economics, and advocated government intervention to stabilize output and avoid recessions. His academic work included pioneering contributions to the study of investment, monetary and fiscal policy and financial markets. He also proposed an econometric model for censored dependent variables, the well-known tobit model. Along with fellow neo-Keynesian economist James Meade in 1977, Tobin proposed nominal GDP targeting as a monetary policy rule in 1980. Tobin received the Nobel Memorial Prize in Economic Sciences in 1981 for "creative and extensive work on the analysis of financial markets and their relations to expenditure decisions, employment, production and prices." Outside academia, Tobin was widely known ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lawrence Klein

Lawrence Robert Klein (September 14, 1920 – October 20, 2013) was an American economist. For his work in creating computer models to forecast economic trends in the field of econometrics in the Department of Economics at the University of Pennsylvania, he was awarded the Nobel Memorial Prize in Economic Sciences in 1980 specifically "for the creation of econometric models and their application to the analysis of economic fluctuations and economic policies." Due to his efforts, such models have become widespread among economists. Harvard University professor Martin Feldstein told the Wall Street Journal that Klein "was the first to create the statistical models that embodied Keynesian economics," tools still used by the Federal Reserve Bank and other central banks. Life and career Klein was born in Omaha, Nebraska, the son of Blanche (née Monheit) and Leo Byron Klein. He went on to graduate from Los Angeles City College, where he learned calculus; the University of California ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alvin Hansen

Alvin Harvey Hansen (August 23, 1887 – June 6, 1975) was an American economist who taught at the University of Minnesota and was later a chair professor of economics at Harvard University. Often referred to as "the American John Maynard Keynes, Keynes", he was a widely read popular author on economic issues, and an influential advisor to the government on economic policy. Hansen helped create the Council of Economic Advisors and the Social Security (United States), Social Security system. He is best remembered today for introducing Keynesian economics in the United States in the 1930s and 40s. More effectively than anyone else, he explicated, extended, domesticated, and popularized the ideas embodied in Keynes's ''The General Theory of Employment, Interest and Money, The General Theory.'' He helped develop with John Hicks the IS–LM model (or Hicks–Hansen model), a mathematical representation of Keynesian economics, Keynesian macroeconomic theory. In 1967, Paul McCracken (ec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maurice Allais

Maurice Félix Charles Allais (31 May 19119 October 2010) was a French physicist and economist, the 1988 winner of the Nobel Memorial Prize in Economic Sciences "for his pioneering contributions to the theory of markets and efficient utilization of resources", along with John Hicks (Value and Capital, 1939) and Paul Samuelson (The Foundations of Economic Analysis, 1947), to neoclassical synthesis. They formalize the self-regulation of markets, that Keynes refuted, while reiterating some of his ideas. Born in Paris, France, Allais attended the Lycée Lakanal, graduated from the École Polytechnique in Paris and studied at the École nationale supérieure des mines de Paris. His academic and other posts have included being Professor of Economics at the École Nationale Supérieure des Mines de Paris (since 1944) and Director of its Economic Analysis Centre (since 1946). In 1949, he received the title of doctor-engineer from the University of Paris, Faculty of Science. He also held t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alfred Marshall

Alfred Marshall (26 July 1842 – 13 July 1924) was an English economist, and was one of the most influential economists of his time. His book '' Principles of Economics'' (1890) was the dominant economic textbook in England for many years. It brought the ideas of supply and demand, marginal utility, and costs of production into a coherent whole. He is known as one of the founders of neoclassical economics. Life and career Marshall was born at Bermondsey in London, second son of William Marshall (1812–1901), clerk and cashier at the Bank of England, and Rebecca (1817–1878), daughter of butcher Thomas Oliver, from whom, on her mother's death, she inherited property. William Marshall was a devout strict Evangelical, "author of an Evangelical epic in a sort of Anglo-Saxon language of his own invention which found some favour in its appropriate circles" and of a tract titled ''Men's Rights and Women's Duties''. Marshall had two brothers and two sisters; a cousin was the econ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |