|

National Tax Association

The National Tax Association - Tax Institute of America (NTA) is a US non-profit, non-partisan organization committed to the study and discussion of public taxation, spending, and borrowing decisions by governments around the world. Since its founding in 1907, the NTA has remained the leading association of tax professionals and public finance scholars devoted to advancing the theory and practice of public finance. Its focus remains on education rather than political debate. The organization educates government officials, tax professionals, and the general public. The National Tax Association was founded in Ohio in 1907 by a group of "nearly 100 lawyers, university professors, business leaders, and government administrators". The organization's initial goal was to advocate for tax reform with the goal of creating alternate taxation models which could then be adopted by municipalities. However, due to a long-term lack of consensus on how to replace the property tax A property ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-profit Organization

A nonprofit organization (NPO) or non-profit organisation, also known as a non-business entity, not-for-profit organization, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in contrast with an entity that operates as a business aiming to generate a profit for its owners. A nonprofit is subject to the non-distribution constraint: any revenues that exceed expenses must be committed to the organization's purpose, not taken by private parties. An array of organizations are nonprofit, including some political organizations, schools, business associations, churches, social clubs, and consumer cooperatives. Nonprofit entities may seek approval from governments to be tax-exempt, and some may also qualify to receive tax-deductible contributions, but an entity may incorporate as a nonprofit entity without securing tax-exempt status. Key aspects of nonprofits are accountability, trustworthiness, honesty, and openness to eve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nonpartisanism

Nonpartisanism is a lack of affiliation with, and a lack of bias towards, a political party. While an Oxford English Dictionary definition of ''partisan'' includes adherents of a party, cause, person, etc., in most cases, nonpartisan refers specifically to political party connections rather than being the strict antonym of "partisan". Canada In Canada, the Legislative Assembly of the Northwest Territories and the Legislative Assembly of Nunavut are the only bodies at the provincial/territorial level that are currently nonpartisan; they operate on a consensus government system. The autonomous Nunatsiavut Assembly operates similarly on a sub-provincial level. India In India, the Jaago Re! One Billion Votes campaign was a non-partisan campaign initiated by Tata Tea, and Janaagraha to encourage citizens to vote in the 2009 Indian general election. The campaign was a non-partisan campaign initiated by Anal Saha. Philippines In the Philippines, barangay elections (election ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal person, legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (Tax noncompliance, non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat tax, flat percentag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Spending

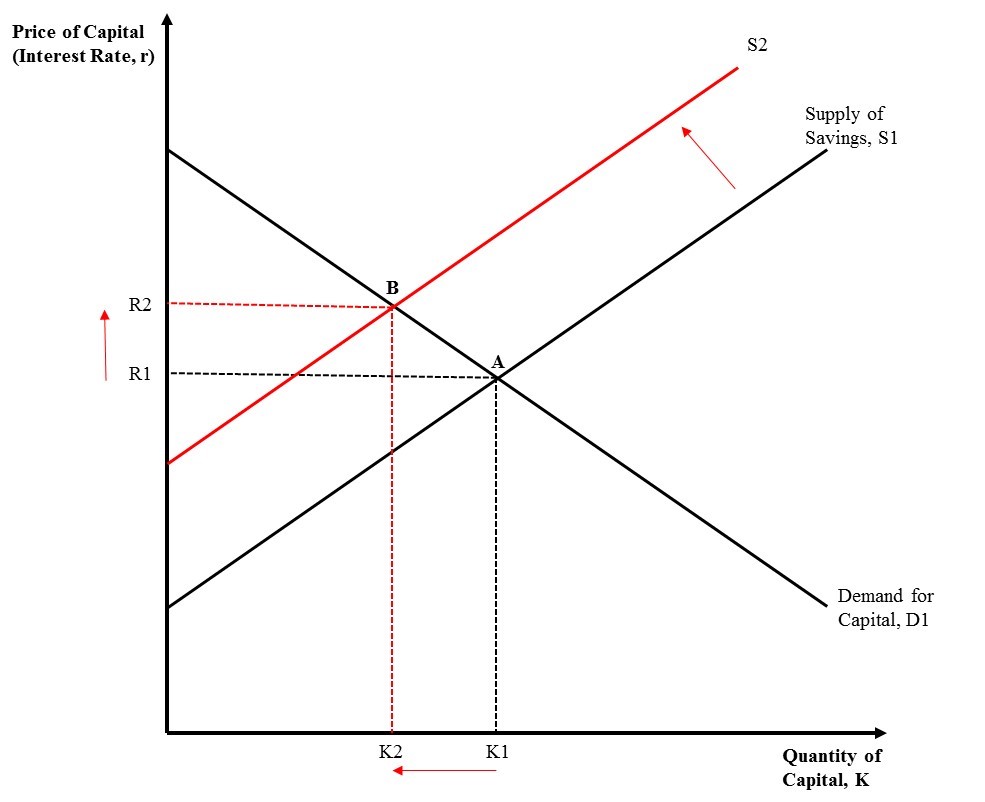

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government Gross fixed capital formation, gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product. Government spending can be financed by government borrowing, taxes, custom duties, the sale or lease of natural resources, and various fees like national park entry fees or licensing fees. When Governments choose to borrow money, they have to gov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Borrowing

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt. In 2020, the value of government debt worldwide was $87.4 US trillion, or 99% measured as a share of gross domestic product (GDP). Government debt accounted for almost 40% of all debt (which includes corporate and household debt), the highest share since the 1960s. The rise in government debt since 2007 is largely attributable to the global financial crisis of 2007–2008, and the COVID-19 pandemic. The ability of government to issue debt has been central to state formation and to state building. Public debt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ohio History Central

Ohio History Connection, formerly The Ohio State Archaeological and Historical Society and Ohio Historical Society, is a nonprofit organization incorporated in 1885. Headquartered at the Ohio History Center in Columbus, Ohio, Ohio History Connection provides services to both preserve and share Ohio's history, including its prehistory, and manages over 50 museums and sites across the state. An early iteration of the organization was founded by Brigadier General Roeliff Brinkerhoff in 1875. Over its history, the organization changed its name twice, with the first occurring in 1954 when the name was shortened to Ohio Historical Society. In 2014, it was changed again to Ohio History Connection, in what members believed was a more modern and welcoming representation of the organization's image. History In its early history, Ohioans made several attempts to establish a formal historical society. On February 1, 1822, the Ohio General Assembly passed legislation creating the Historical ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indiana University

Indiana University (IU) is a system of public universities in the U.S. state of Indiana. Campuses Indiana University has two core campuses, five regional campuses, and two regional centers under the administration of IUPUI. *Indiana University Bloomington (IU Bloomington) is the flagship campus of Indiana University. The Bloomington campus is home to numerous premier Indiana University schools, including the College of Arts and Sciences, the Jacobs School of Music, an extension of the Indiana University School of Medicine, the School of Informatics, Computing, and Engineering, which includes the former School of Library and Information Science (now Department of Library and Information Science), School of Optometry, the O'Neil School of Public and Environmental Affairs, the Maurer School of Law, the School of Education, and the Kelley School of Business. *Indiana University–Purdue University Indianapolis (IUPUI), a partnership between Indiana University and Purdue Universi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Tax In The United States

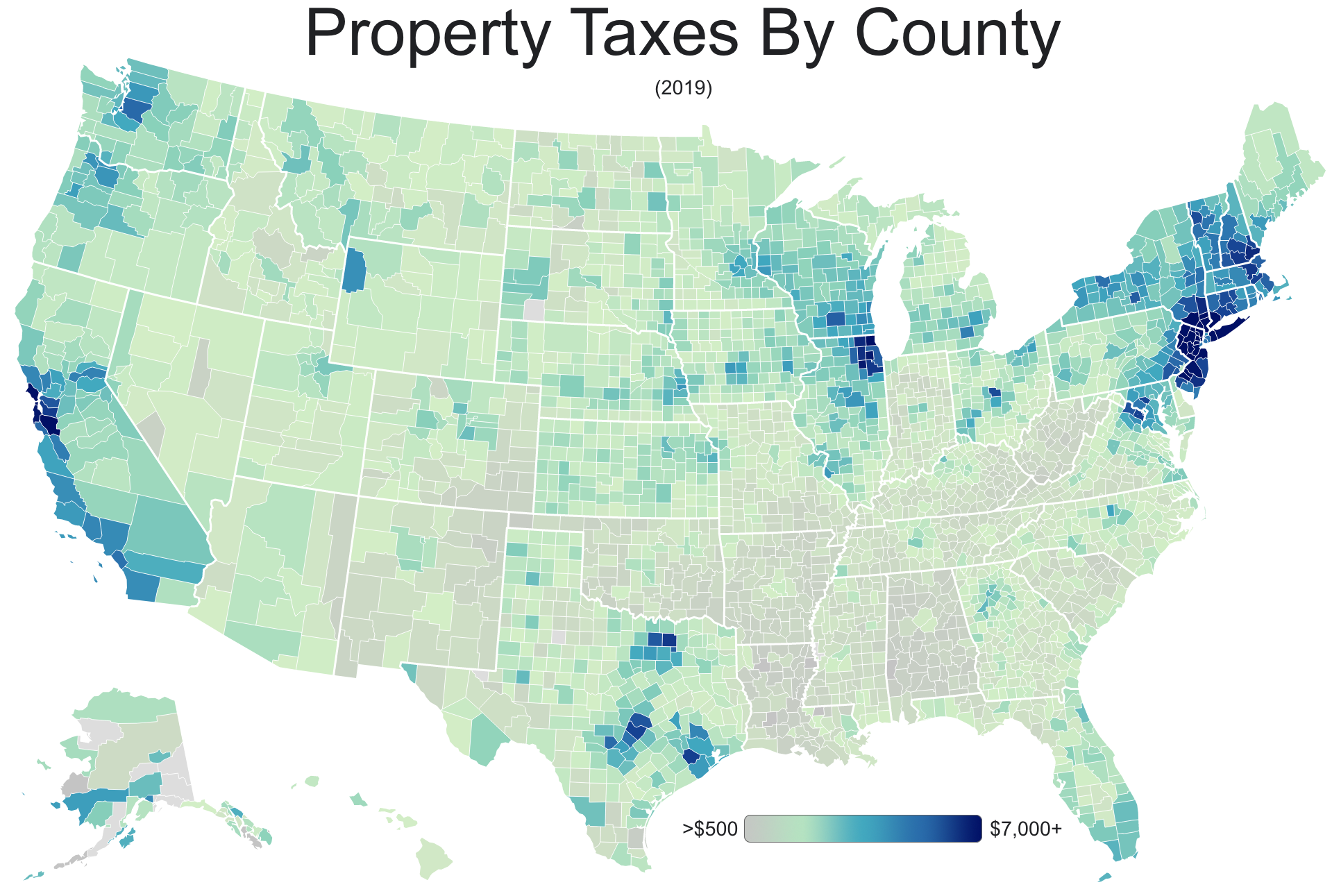

Most local governments in the United States impose a property tax, also known as a millage rate, as a principal source of revenue. This tax may be imposed on real estate or personal property. The tax is nearly always computed as the fair market value of the property times an assessment ratio times a tax rate, and is generally an obligation of the owner of the property. Values are determined by local officials, and may be disputed by property owners. For the taxing authority, one advantage of the property tax over the sales tax or income tax is that the revenue always equals the tax levy, unlike the other taxes. The property tax typically produces the required revenue for municipalities' tax levies. A disadvantage to the taxpayer is that the tax liability is fixed, while the taxpayer's income is not. The tax is administered at the local government level. Many states impose limits on how local jurisdictions may tax property. Because many properties are subject to tax by more than ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

JSTOR

JSTOR (; short for ''Journal Storage'') is a digital library founded in 1995 in New York City. Originally containing digitized back issues of academic journals, it now encompasses books and other primary sources as well as current issues of journals in the humanities and social sciences. It provides full-text searches of almost 2,000 journals. , more than 8,000 institutions in more than 160 countries had access to JSTOR. Most access is by subscription but some of the site is public domain, and open access content is available free of charge. JSTOR's revenue was $86 million in 2015. History William G. Bowen, president of Princeton University from 1972 to 1988, founded JSTOR in 1994. JSTOR was originally conceived as a solution to one of the problems faced by libraries, especially research and university libraries, due to the increasing number of academic journals in existence. Most libraries found it prohibitively expensive in terms of cost and space to maintain a comprehen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |