|

Mark H. A. Davis

Mark Herbert Ainsworth Davis (25 April 1945 – 18 March 2020) was Professor of Mathematics at Imperial College London. He made fundamental contributions to the theory of stochastic processes, stochastic control and mathematical finance. Education and career After completing his BA degree in Electrical Engineering at the University of Cambridge, Davis pursued his PhD degree at UC Berkeley under the supervision of Pravin Varaiya. His PhD thesis, obtained in 1971, initiated the martingale theory of stochastic control. Returning to the UK in 1972, Davis joined the Control Group at Imperial College London. From 1995 to 1999 he was Head of Research and Product Development at Tokyo-Mitsubishi International, leading a quantitative research team providing pricing models and risk analysis for fixed income, equity and credit-related products. He returned to Imperial College London in August 2000 to build Imperial’s Mathematical Finance group within the Department of Mathematics. Res ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematics

Mathematics is an area of knowledge that includes the topics of numbers, formulas and related structures, shapes and the spaces in which they are contained, and quantities and their changes. These topics are represented in modern mathematics with the major subdisciplines of number theory, algebra, geometry, and analysis, respectively. There is no general consensus among mathematicians about a common definition for their academic discipline. Most mathematical activity involves the discovery of properties of abstract objects and the use of pure reason to prove them. These objects consist of either abstractions from nature orin modern mathematicsentities that are stipulated to have certain properties, called axioms. A ''proof'' consists of a succession of applications of deductive rules to already established results. These results include previously proved theorems, axioms, andin case of abstraction from naturesome basic properties that are considered true starting points of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stochastic Control

Stochastic control or stochastic optimal control is a sub field of control theory that deals with the existence of uncertainty either in observations or in the noise that drives the evolution of the system. The system designer assumes, in a Bayesian probability-driven fashion, that random noise with known probability distribution affects the evolution and observation of the state variables. Stochastic control aims to design the time path of the controlled variables that performs the desired control task with minimum cost, somehow defined, despite the presence of this noise. The context may be either discrete time or continuous time. Certainty equivalence An extremely well-studied formulation in stochastic control is that of linear quadratic Gaussian control. Here the model is linear, the objective function is the expected value of a quadratic form, and the disturbances are purely additive. A basic result for discrete-time centralized systems with only additive uncertainty is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2020 Deaths

This is a list of deaths of notable people, organised by year. New deaths articles are added to their respective month (e.g., Deaths in ) and then linked here. 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 See also * Lists of deaths by day The following pages, corresponding to the Gregorian calendar, list the historical events, births, deaths, and holidays and observances of the specified day of the year: Footnotes See also * Leap year * List of calendars * List of non-standard ... * Deaths by year {{DEFAULTSORT:deaths by year ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1945 Births

1945 marked the end of World War II and the fall of Nazi Germany and the Empire of Japan. It is also the only year in which Nuclear weapon, nuclear weapons Atomic bombings of Hiroshima and Nagasaki, have been used in combat. Events Below, the events of World War II have the "WWII" prefix. January * January 1 – WWII: ** Nazi Germany, Germany begins Operation Bodenplatte, an attempt by the ''Luftwaffe'' to cripple Allies of World War II, Allied air forces in the Low Countries. ** Chenogne massacre: German prisoners are allegedly killed by American forces near the village of Chenogne, Belgium. * January 6 – WWII: A German offensive recaptures Esztergom, Kingdom of Hungary (1920–1946), Hungary from the Russians. * January 12 – WWII: The Soviet Union begins the Vistula–Oder Offensive in Eastern Europe, against the German Army (Wehrmacht), German Army. * January 13 – WWII: The Soviet Union begins the East Prussian Offensive, to eliminate German forces in East Pruss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Mathematical Society

The London Mathematical Society (LMS) is one of the United Kingdom's learned societies for mathematics (the others being the Royal Statistical Society (RSS), the Institute of Mathematics and its Applications (IMA), the Edinburgh Mathematical Society and the Operational Research Society (ORS). History The Society was established on 16 January 1865, the first president being Augustus De Morgan. The earliest meetings were held in University College, but the Society soon moved into Burlington House, Piccadilly. The initial activities of the Society included talks and publication of a journal. The LMS was used as a model for the establishment of the American Mathematical Society in 1888. Mary Cartwright was the first woman to be President of the LMS (in 1961–62). The Society was granted a royal charter in 1965, a century after its foundation. In 1998 the Society moved from rooms in Burlington House into De Morgan House (named after the society's first president), at 57–5 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Naylor Prize

Naylor may refer to: People * Bernie Naylor (1923–1993), Australian rules footballer * Bo Naylor (born 2000), Canadian baseball player * Brian Naylor (racing driver) (1923–1989), British racing driver * Brian Naylor (broadcaster) (1931–2009), Australian broadcaster * Brittany Naylor (born 1993) Social Media Personality * Charles Naylor (1806–1872), American politician * Charles Naylor, poet, author, frequent collaborator with Thomas M. Disch * Christopher Naylor (other) * David Naylor (born 1954), Canadian medical researcher * Dillon Naylor (born 1968), Australian cartoonist * Dominic Naylor (born 1970), English footballer * Don Naylor (1910–1991), American radio personality * Doug Naylor (born 1955), British writer * Drew Naylor (born 1986), Australian baseball player * Earl Naylor (1919–1990), American baseball player * Edward Naylor (1867–1934), English organist and composer * Emily Gaddum (née Emily Naylor, born 1985), England born New Zealand ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Income

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Fixed-income securities — more commonly known as bonds — can be contrasted with equity securities – often referred to as stocks and shares – that create no obligation to pay dividends or any other form of income. Bonds carry a level of legal protections for investors that equity securities do not — in the event of a bankruptcy, bond holders would be repaid after liquidation of assets, whereas shareholders with stock often receive nothing. For a company to grow its business, it often must raise money – for example, to finance an acquisition; buy equipment or land, or invest in new product development. The terms on which investors will finance the company will depend on the risk profile of the company ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UC Berkeley

The University of California, Berkeley (UC Berkeley, Berkeley, Cal, or California) is a public university, public land-grant university, land-grant research university in Berkeley, California. Established in 1868 as the University of California, it is the state's first land-grant university and the founding campus of the University of California system. Its fourteen colleges and schools offer over 350 degree programs and enroll some 31,800 undergraduate and 13,200 graduate students. Berkeley ranks among the world's top universities. A founding member of the Association of American Universities, Berkeley hosts many leading research institutes dedicated to science, engineering, and mathematics. The university founded and maintains close relationships with three United States Department of Energy National Laboratories, national laboratories at Lawrence Berkeley National Laboratory, Berkeley, Lawrence Livermore National Laboratory, Livermore and Los Alamos National Laboratory, Los ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stochastic Processes

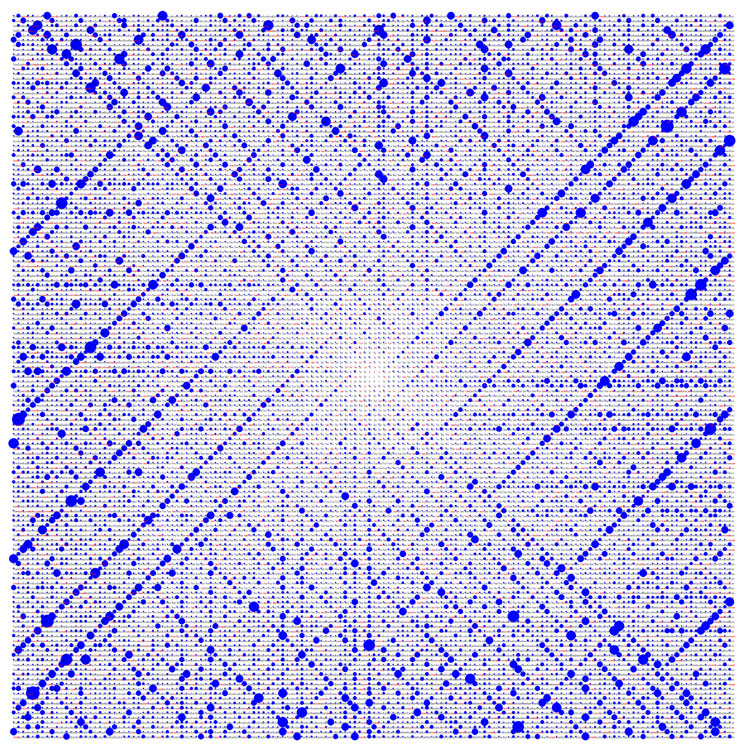

In probability theory and related fields, a stochastic () or random process is a mathematical object usually defined as a family of random variables. Stochastic processes are widely used as mathematical models of systems and phenomena that appear to vary in a random manner. Examples include the growth of a bacterial population, an electrical current fluctuating due to thermal noise, or the movement of a gas molecule. Stochastic processes have applications in many disciplines such as biology, chemistry, ecology, neuroscience, physics, image processing, signal processing, control theory, information theory, computer science, cryptography and telecommunications. Furthermore, seemingly random changes in financial markets have motivated the extensive use of stochastic processes in finance. Applications and the study of phenomena have in turn inspired the proposal of new stochastic processes. Examples of such stochastic processes include the Wiener process or Brownian motion pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Piecewise Deterministic Markov Process

In probability theory, a piecewise-deterministic Markov process (PDMP) is a process whose behaviour is governed by random jumps at points in time, but whose evolution is deterministically governed by an ordinary differential equation between those times. The class of models is "wide enough to include as special cases virtually all the non-diffusion models of applied probability." The process is defined by three quantities: the flow, the jump rate, and the transition measure. The model was first introduced in a paper by Mark H. A. Davis in 1984. Examples Piecewise linear models such as Markov chains, continuous-time Markov chains, the M/G/1 queue, the GI/G/1 queue and the fluid queue can be encapsulated as PDMPs with simple differential equations. Applications PDMPs have been shown useful in ruin theory, queueing theory, for modelling biochemical processes such as DNA replication in eukaryotes and subtilin production by the organism B. subtilis, and for modelling earthquak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |