|

Marche A Terme International De France

MATIF SA (French: ''Marché à Terme International de France'') is a private corporation which is both a futures exchange and a clearing house in France. It was absorbed in the merger of the Paris Bourse with Euronext NV to form Euronext Paris. Derivatives formerly traded on the Matif and other members of Euronext are traded on LIFFE Connect, the electronic trading platform of the London International Financial Futures Exchange. LIFFE is an affiliate of Euronext. Products include interest rate futures and options on the Euro notional bond, five year Euro, and three month PIBOR (Paris Interbank Offered Rate), and futures on the 30-year Eurobond and two-year E-note; futures on the CAC 40 Index, STOXX Europe 50, EURO STOXX 50; and futures and options on European rapeseed and futures on rapeseed meal, European rapeseed oil, milling wheat, corn and sunflower seeds. MATIF is also the name by which the French regulators name any market where futures contracts are traded unde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

French Language

French ( or ) is a Romance language of the Indo-European family. It descended from the Vulgar Latin of the Roman Empire, as did all Romance languages. French evolved from Gallo-Romance, the Latin spoken in Gaul, and more specifically in Northern Gaul. Its closest relatives are the other langues d'oïl—languages historically spoken in northern France and in southern Belgium, which French ( Francien) largely supplanted. French was also influenced by native Celtic languages of Northern Roman Gaul like Gallia Belgica and by the ( Germanic) Frankish language of the post-Roman Frankish invaders. Today, owing to France's past overseas expansion, there are numerous French-based creole languages, most notably Haitian Creole. A French-speaking person or nation may be referred to as Francophone in both English and French. French is an official language in 29 countries across multiple continents, most of which are members of the ''Organisation internationale de la Francophonie'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euro

The euro ( symbol: €; code: EUR) is the official currency of 19 out of the member states of the European Union (EU). This group of states is known as the eurozone or, officially, the euro area, and includes about 340 million citizens . The euro is divided into 100 cents. The currency is also used officially by the institutions of the European Union, by four European microstates that are not EU members, the British Overseas Territory of Akrotiri and Dhekelia, as well as unilaterally by Montenegro and Kosovo. Outside Europe, a number of special territories of EU members also use the euro as their currency. Additionally, over 200 million people worldwide use currencies pegged to the euro. As of 2013, the euro is the second-largest reserve currency as well as the second-most traded currency in the world after the United States dollar. , with more than €1.3 trillion in circulation, the euro has one of the highest combined values of banknotes and coins in c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contracts

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of the contract with a m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rapeseed

Rapeseed (''Brassica napus ''subsp.'' napus''), also known as rape, or oilseed rape, is a bright-yellow flowering member of the family Brassicaceae (mustard or cabbage family), cultivated mainly for its oil-rich seed, which naturally contains appreciable amounts of erucic acid. The term ''canola'' denotes a group of rapeseed cultivars which were bred to have very low levels of erucic acid and are especially prized for use as human and animal food. Rapeseed is the third-largest source of vegetable oil and the second-largest source of protein meal in the world. Description ''Brassica napus'' grows to in height with hairless, fleshy, pinnatifid and glaucous lower leaves which are stalked whereas the upper leaves have no petioles. ''Brassica napus'' can be distinguished from ''Brassica nigra'' by the upper leaves which do not clasp the stem, and from ''Brassica rapa'' by its smaller petals which are less than across. Rapeseed flowers are bright yellow and about across. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Europe

Europe is a large peninsula conventionally considered a continent in its own right because of its great physical size and the weight of its history and traditions. Europe is also considered a Continent#Subcontinents, subcontinent of Eurasia and it is located entirely in the Northern Hemisphere and mostly in the Eastern Hemisphere. Comprising the westernmost peninsulas of Eurasia, it shares the continental landmass of Afro-Eurasia with both Africa and Asia. It is bordered by the Arctic Ocean to the north, the Atlantic Ocean to the west, the Mediterranean Sea to the south and Asia to the east. Europe is commonly considered to be Boundaries between the continents of Earth#Asia and Europe, separated from Asia by the drainage divide, watershed of the Ural Mountains, the Ural (river), Ural River, the Caspian Sea, the Greater Caucasus, the Black Sea and the waterways of the Turkish Straits. "Europe" (pp. 68–69); "Asia" (pp. 90–91): "A commonly accepted division between Asia and E ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

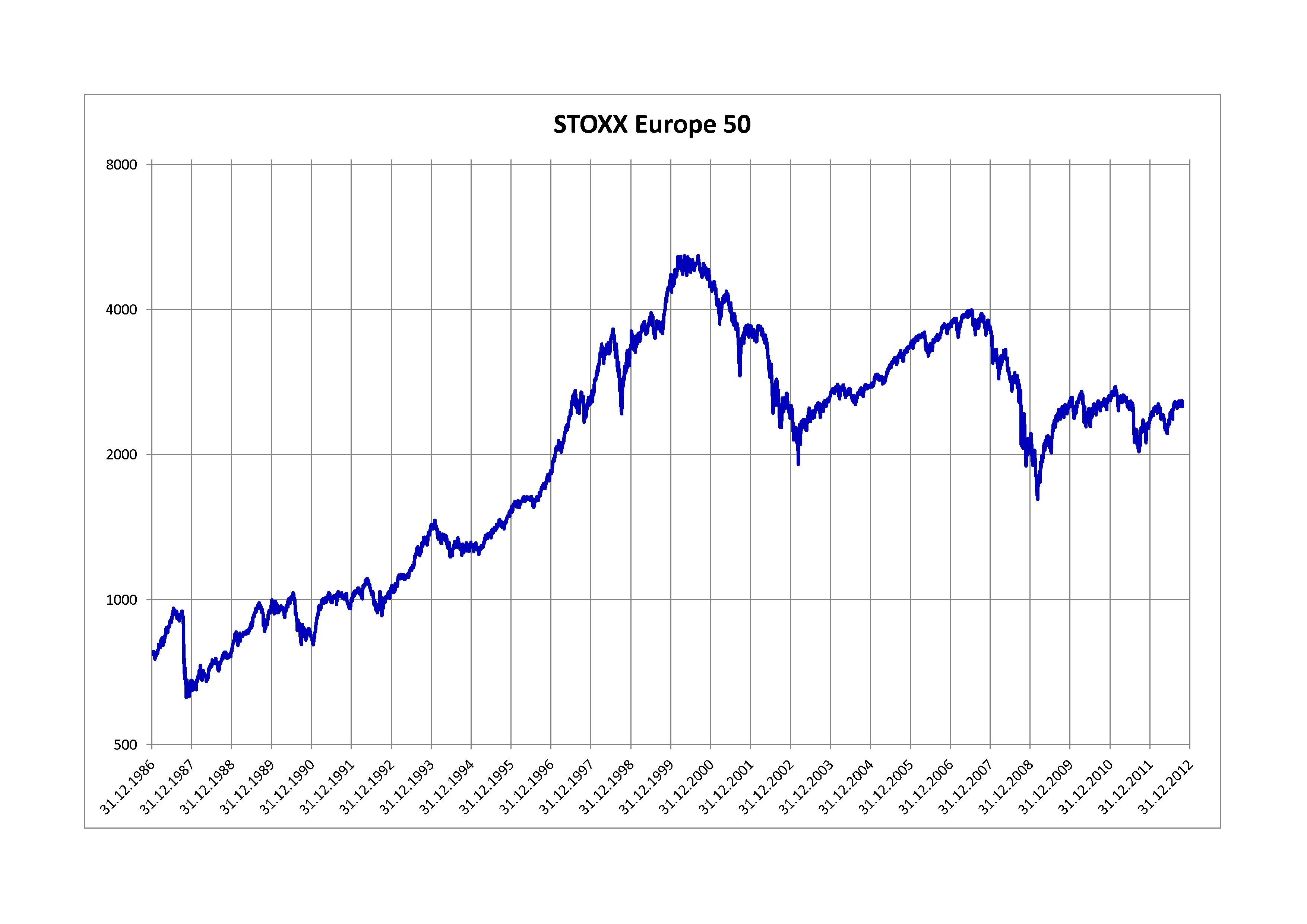

STOXX Europe 50

The STOXX Europe 50 is a stock index of European stocks designed by STOXX Ltd., an index provider owned by Deutsche Börse Group and SIX Group. The index was introduced in February 1998. The STOXX Europe 50 index provides a blue-chip representation of supersector leaders in Europe covering almost 50% of the free-float market capitalization of the European stock market. The index covers 50 stocks from 18 European countries: Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. The index is weighted quarterly according to free-float market capitalization with components capped at a maximum of 10% and is reviewed annually in September. It is licensed to financial institutions to serve as underlying for a wide range of investment products such as exchange-traded funds (ETFs), futures, options, and structured products worldwide. Versions excludi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

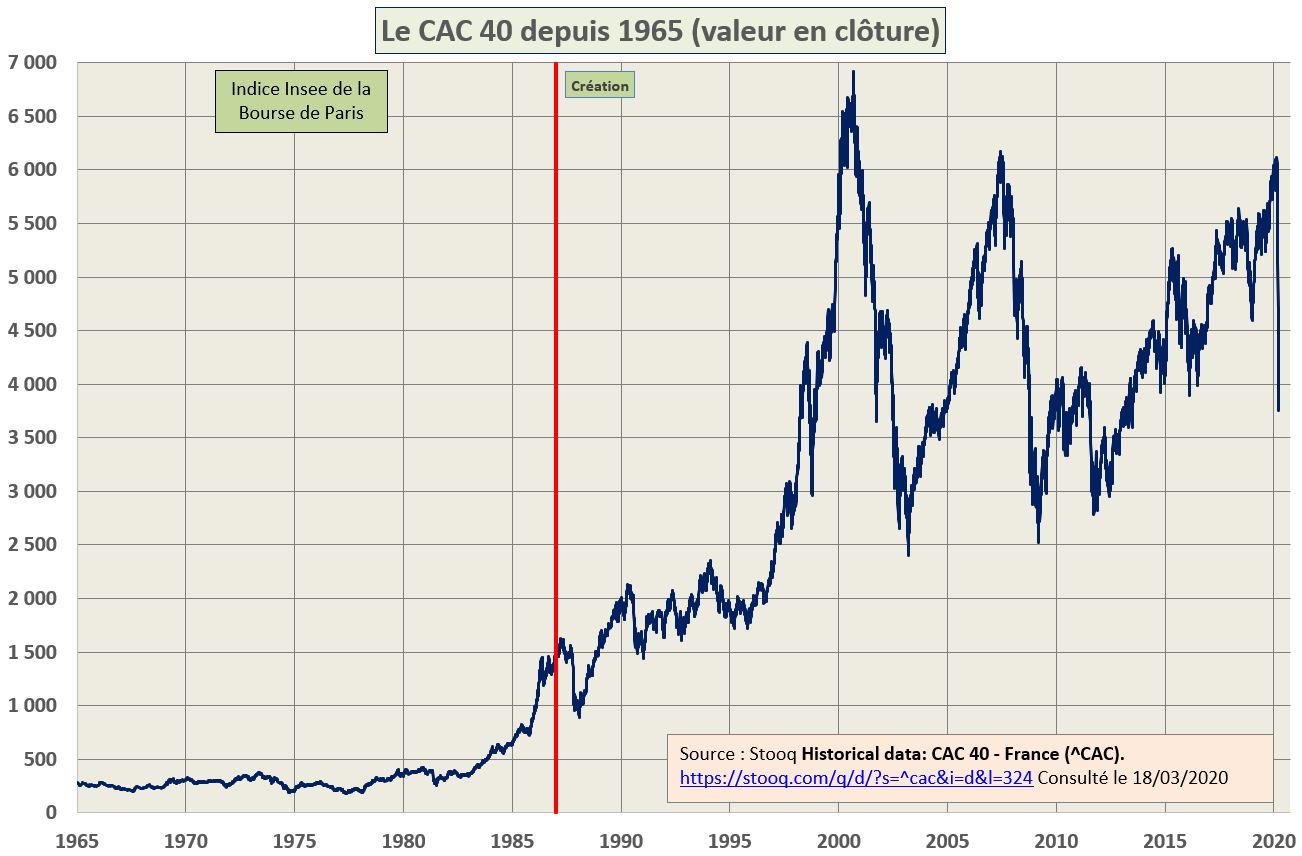

CAC 40

The CAC 40 (french: CAC quarante ) (''Cotation Assistée en Continu'') is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse). It is a price return index. It is one of the main national indices of the pan-European stock exchange group Euronext alongside Euronext Amsterdam's AEX, Euronext Brussels' BEL20, Euronext Dublin's ISEQ 20, Euronext Lisbon's PSI-20 and the Oslo Bors OBX Index. History The CAC 40 takes its name from the Paris Bourse's early automation system Cotation Assistée en Continu (''Continuous Assisted Quotation''). Its base value of 1,000 was set on 31 December 1987, equivalent to a market capitalisation of 370,437,433,957.70 French francs. On 1 December 2003, the index's weighting system switched from being dependent on total market capitalisation to free float market cap only, in line with other leading ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eurobond (international)

A eurobond is an international bond that is denominated in a currency not native to the country where it is issued. They are also called external bonds. They are usually categorised according to the currency in which they are issued: eurodollar, euroyen, and so on. The name became somewhat misleading with the advent of the euro currency in 1999; eurobonds were created in the 1960s, before the euro existed, and thus the etymology is to "European bonds" rather than "bonds denominated in the Euro currency". The eurobond market was traditionally centered in the City of London, with Luxembourg also being a primary listing center for these instruments. Eurobonds have since expanded and are traded throughout the world, with Singapore and Tokyo being notable markets as well. These bonds were originally created to escape regulation: by trading in US dollars in London, certain financial requirements of the US government unpopular with bankers could be evaded, and London was happy to wel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Exchange

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London International Financial Futures Exchange

The London International Financial Futures and Options Exchange (LIFFE, pronounced 'life') was a futures exchange based in London. In 2014, following a series of takeovers, LIFFE became part of Intercontinental Exchange, and was renamed ICE Futures Europe. Euronext acquired LIFFE in 2002, and were then in turn taken over by NYSE in 2007, to form NYSE Euronext. The main rationale for this transaction was to gain ownership of LIFFE. In the same manner, Intercontinental Exchange then purchased NYSE Euronext in 2013, principally to acquire LIFFE. History The London International Financial Futures Exchange (LIFFE), established by Sir Brian Williamson started life on 30 September 1982, to take advantage of the removal of currency controls in the UK in 1979. The exchange modelled itself after the Chicago Board of Trade and the Chicago Mercantile Exchange. It initially offered futures contracts and options linked to short-term interest rates. In 1993 LIFFE merged with the ''London ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |