|

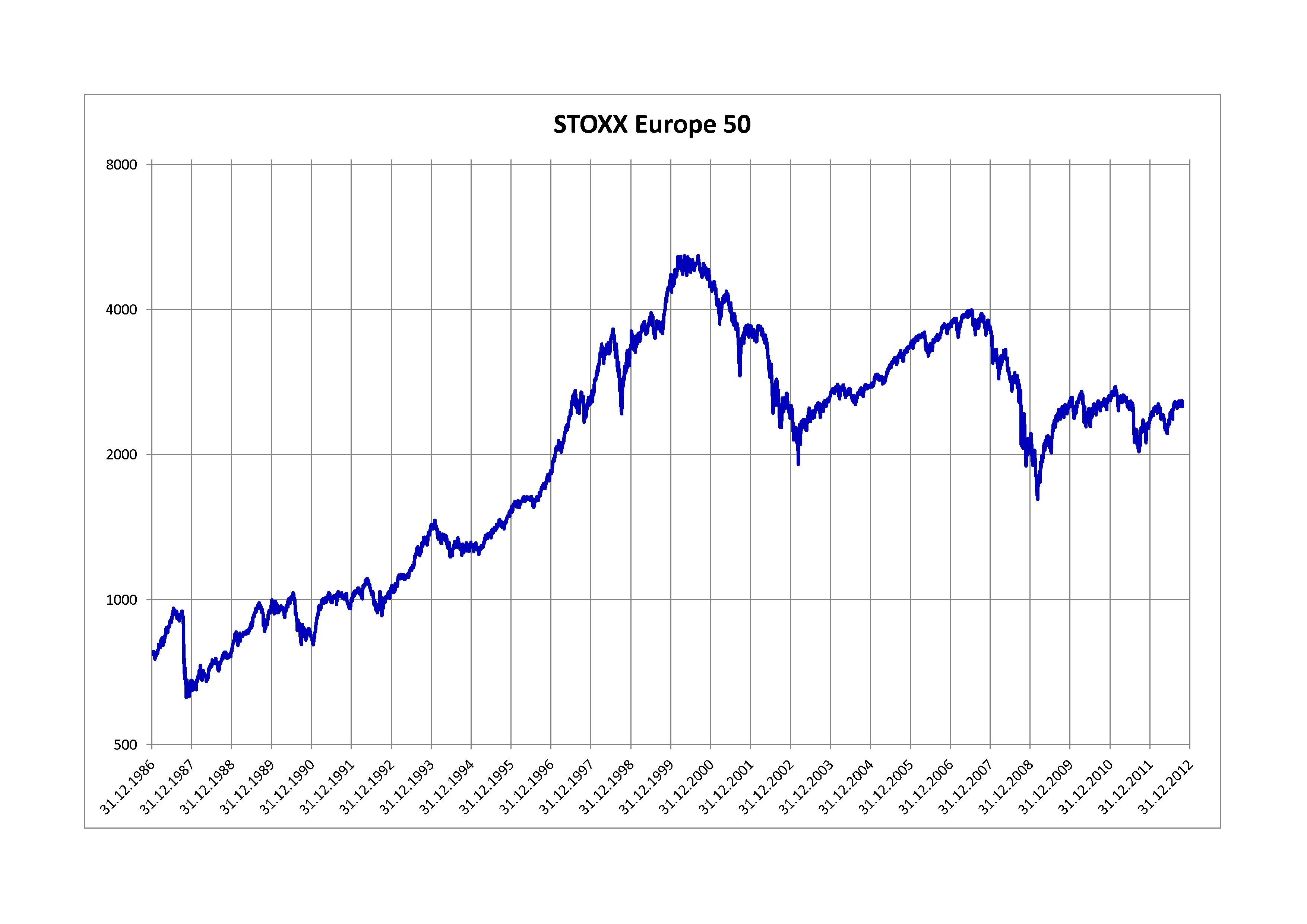

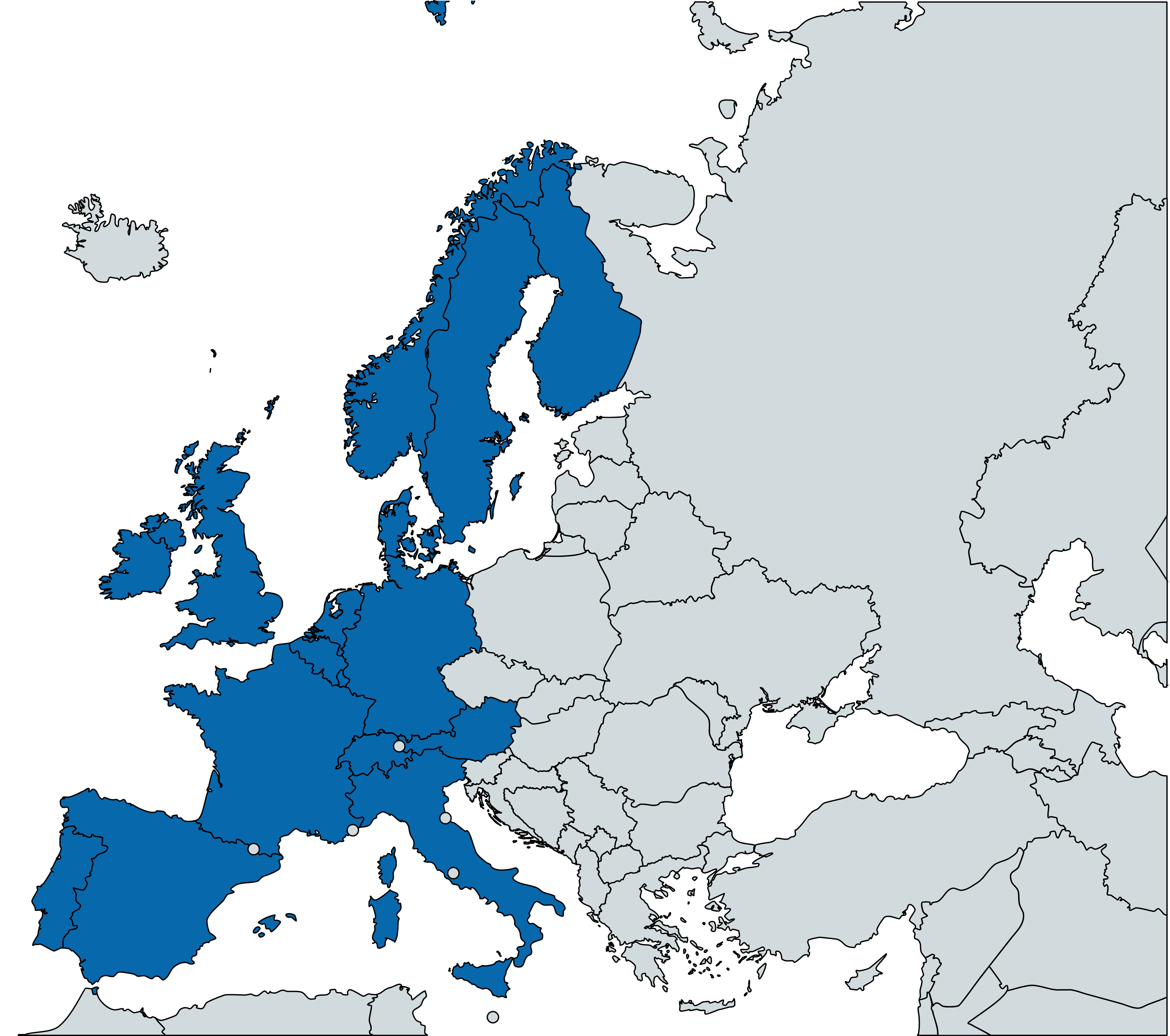

STOXX Europe 50

The STOXX Europe 50 is a stock index of European stocks designed by STOXX Ltd., an index provider owned by Deutsche Börse Group and SIX Group. The index was introduced in February 1998. The STOXX Europe 50 index provides a blue-chip representation of supersector leaders in Europe covering almost 50% of the free-float market capitalization of the European stock market. The index covers 50 stocks from 18 European countries: Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. The index is weighted quarterly according to free-float market capitalization with components capped at a maximum of 10% and is reviewed annually in September. It is licensed to financial institutions to serve as underlying for a wide range of investment products such as exchange-traded funds (ETFs), futures, options, and structured products worldwide. Versions excludi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

STOXX Europe 50

The STOXX Europe 50 is a stock index of European stocks designed by STOXX Ltd., an index provider owned by Deutsche Börse Group and SIX Group. The index was introduced in February 1998. The STOXX Europe 50 index provides a blue-chip representation of supersector leaders in Europe covering almost 50% of the free-float market capitalization of the European stock market. The index covers 50 stocks from 18 European countries: Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. The index is weighted quarterly according to free-float market capitalization with components capped at a maximum of 10% and is reviewed annually in September. It is licensed to financial institutions to serve as underlying for a wide range of investment products such as exchange-traded funds (ETFs), futures, options, and structured products worldwide. Versions excludi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified strike ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

S&P Europe 350

The S&P Europe 350 Index is a stock index of European stocks. It is a part of the S&P Global 1200. The constituent shares are selected for relevance to the broad market, including industry sector balance, longevity (to minimize index turnover) and liquidity of the shares. Investment This index is tracked by an exchange-traded fund, IShares Europe (). Other funds track the FTSE Developed Europe or euro-based indices such as MSCI EMU. In Europe more funds are based on Stoxx Europe 50. See also *STOXX Europe 50 * S&P Europe 350 Dividend Aristocrats *S&P 500 The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of D ... * STOXX Europe 600 References External linksS&P page on S&P Europe 350 Pan-European stock market indices Europe 350 {{stockexchange-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

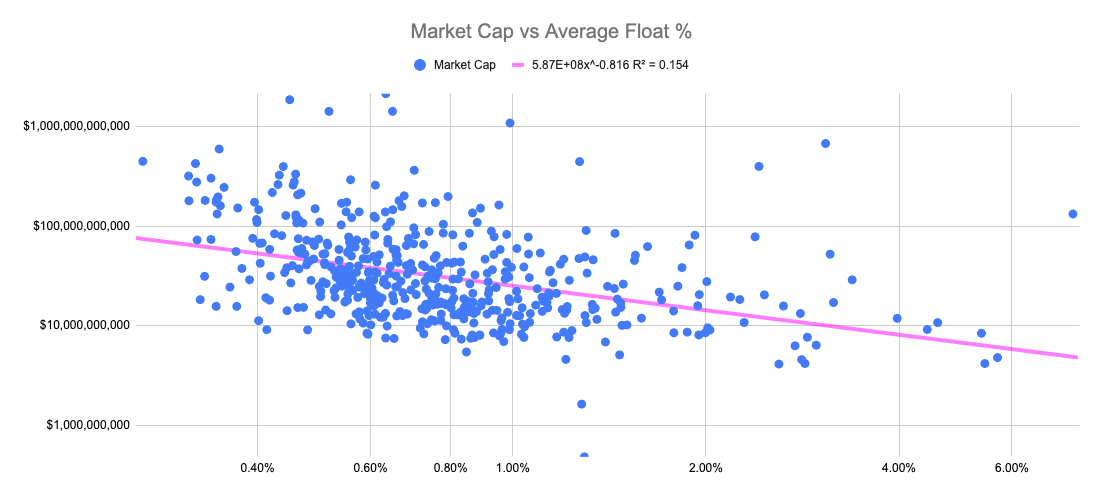

Free-float

In the context of stock markets, the public float or free float represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection (than entire market capitalization) of what public investors consider the company to be worth. In this context, the ''float'' may refer to all the shares outstanding that can be publicly traded. Calculating public float The float is calculated by subtracting the locked-in shares from outstanding shares. For example, a company may have 10 million outstanding shares, with 3 million of them in a locked-in position; this company's float would be 7 million (multiplied by the share price). Stocks with smaller floats tend to be more volatile than those with larger floats. In general, the la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

STOXX Europe 600

The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone). The countries that make up the index are the United Kingdom (composing around 22.3% of the index), France (composing around 16.6% of the index), Switzerland (composing around 14.9% of the index) and Germany (composing around 14.1% of the index), as well as Austria, Belgium, Denmark, Finland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Poland, Portugal, Spain, and Sweden. The STOXX Europe 600 was introduced in 1998. Its composition is reviewed four times a year, in March, June, September, December. The index is available in several currency (AUD, CAD, CHF, EUR, GBP, JPY, USD) and return (Price, Net Return ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eurozone

The euro area, commonly called eurozone (EZ), is a currency union of 19 member states of the European Union (EU) that have adopted the euro (€) as their primary currency and sole legal tender, and have thus fully implemented EMU policies. The 19 eurozone members are Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. The eight non-eurozone members of the EU are Bulgaria, Czech Republic, Croatia, Denmark, Hungary, Poland, Romania, and Sweden. They continue to use their own national currencies, albeit all but Denmark are obliged to join once they meet the euro convergence criteria. Croatia will become the 20th member on 1 January 2023. Among non-EU member states, Andorra, Monaco, San Marino, and Vatican City have formal agreements with the EU to use the euro as their official currency and issue their own coins. In addition, Kosovo and Montenegro h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Structured Product

A structured product, also known as a market-linked investment, is a pre-packaged structured finance investment strategy based on a single Security (finance), security, a basket of securities, Option (finance), options, Index (economics), indices, commodities, debt issuance or foreign Currency, currencies, and to a lesser extent, Derivative (finance), derivatives. Structured products are not homogeneous — there are numerous varieties of derivatives and underlying assets — but they can be classified under the aside categories. Typically, a trading desk, desk will employ a specialized "structurer" to design and manage its structured-product offering. Formal definitions U.S. Securities and Exchange Commission (SEC) Rule 434 (regarding certain prospectus deliveries) defines structured securities as "securities whose cash flow characteristics depend upon one or more indices or that have Embedded option, embedded forwards or options or securities where an investor's investment return ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contract

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of the contract with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Index

In finance, a stock index, or stock market index, is an index that measures a stock market, or a subset of the stock market, that helps investors compare current stock price levels with past prices to calculate market performance. Two of the primary criteria of an index are that it is ''investable'' and ''transparent'': The methods of its construction are specified. Investors can invest in a stock market index by buying an index fund, which are structured as either a mutual fund or an exchange-traded fund, and "track" an index. The difference between an index fund's performance and the index, if any, is called ''tracking error''. For a list of major stock market indices, see List of stock market indices. Types of indices by weighting method Stock market indices could be segmented by their index weight methodology, or the rules on how stocks are allocated in the index, independent of its stock coverage. For example, the S&P 500 and the S&P 500 Equal Weight both covers the same gro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Fund

An exchange-traded fund (ETF) is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold from other owners throughout the day on stock exchanges whereas mutual funds are bought and sold from the issuer based on their price at day's end. An ETF holds assets such as stocks, bonds, currencies, futures contracts, and/or commodities such as gold bars, and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occasionally occur. Most ETFs are index funds: that is, they hold the same securities in the same proportions as a certain stock market index or bond market index. The most popular ETFs in the U.S. replicate the S&P 500, the total market index, the NASDAQ-100 index, the price of gold, the "growth" stocks in the Russell 1000 Index, or the index of the largest technology companies. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free Float

In the context of stock markets, the public float or free float represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection (than entire market capitalization) of what public investors consider the company to be worth. In this context, the ''float'' may refer to all the shares outstanding that can be publicly traded. Calculating public float The float is calculated by subtracting the locked-in shares from outstanding shares. For example, a company may have 10 million outstanding shares, with 3 million of them in a locked-in position; this company's float would be 7 million (multiplied by the share price). Stocks with smaller floats tend to be more volatile than those with larger floats. In general, the la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |