|

Murabahah

''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' ( ar, مرابحة, derived from ''ribh'' ar, ربح, meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the markup (profit) or "cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic (i.e., "shariah compliant") financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments (a contract with deferred payment being known as ''bai-muajjal''). ''Murabaha'' financing is similar to a rent-to-own arrangement in the non-Muslim world, with the intermediary (e.g., the lending bank) retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and ''sukuk'' (Islamic bonds) that use ''murabahah'' contracts. Jamaldeen, ''Islamic Finance For Dummies'', 2012:188-9, 220-1 The purpose o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Murabaha

''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' ( ar, مرابحة, derived from ''ribh'' ar, ربح, meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the markup (profit) or "cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic (i.e., "shariah compliant") financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments (a contract with deferred payment being known as ''bai-muajjal''). ''Murabaha'' financing is similar to a rent-to-own arrangement in the non-Muslim world, with the intermediary (e.g., the lending bank) retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and ''sukuk'' (Islamic bonds) that use ''murabahah'' contracts. Jamaldeen, ''Islamic Finance For Dummies'', 2012:188-9, 220-1 The purpose o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking And Finance

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include ''Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), ''Musharaka'' (joint venture), ''Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include ''Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), ''Musharaka'' (joint venture), ''Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

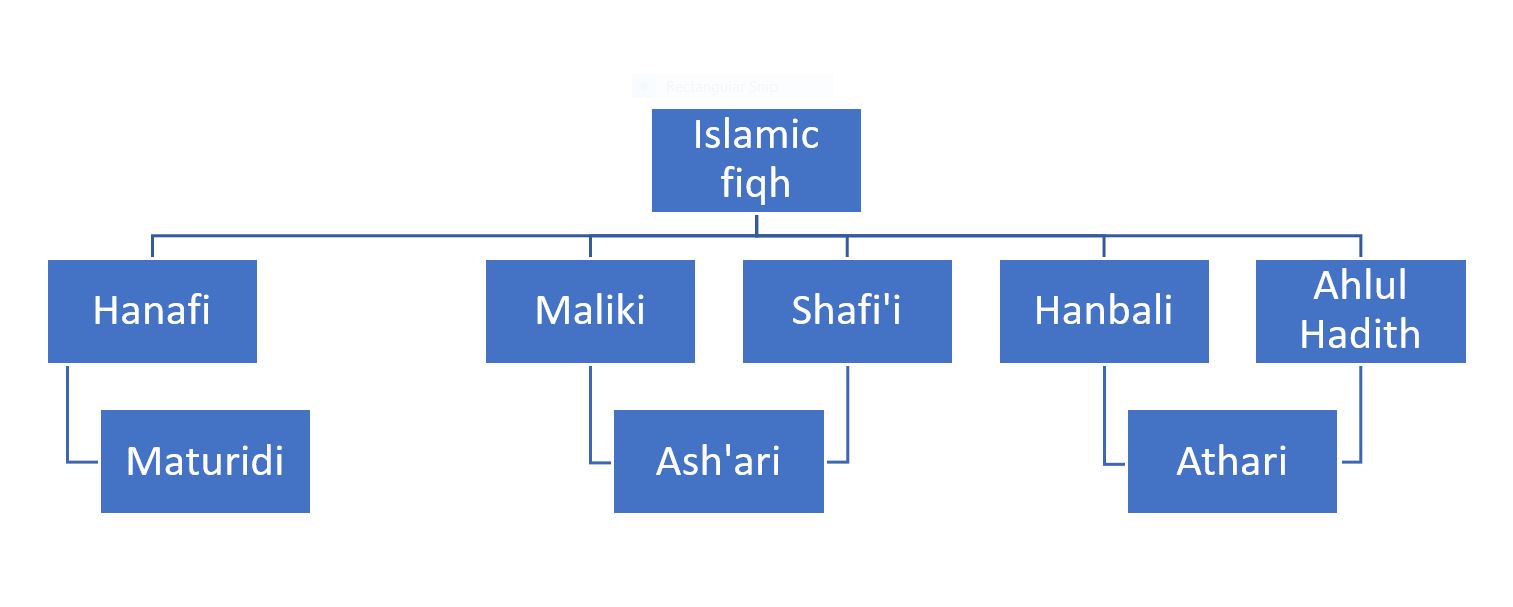

Fiqh

''Fiqh'' (; ar, فقه ) is Islamic jurisprudence. Muhammad-> Companions-> Followers-> Fiqh. The commands and prohibitions chosen by God were revealed through the agency of the Prophet in both the Quran and the Sunnah (words, deeds, and examples of the Prophet passed down as hadith). The first Muslims (the Sahabah or Companions) heard and obeyed, and passed this essence of Islam to succeeding generations (''Tabi'un'' and ''Tabi' al-Tabi'in'' or successors/followers and successors of successors), as Muslims and Islam spread from West Arabia to the conquered lands north, east, and west, Hoyland, ''In God's Path'', 2015: p.223 where it was systematized and elaborated Hawting, "John Wansbrough, Islam, and Monotheism", 2000: p.513 The history of Islamic jurisprudence is "customarily divided into eight periods": El-Gamal, ''Islamic Finance'', 2006: pp. 30–31 *the first period ending with the death of Muhammad in 11 AH. *second period "characterized by personal interp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quran

The Quran (, ; Standard Arabic: , Classical Arabic, Quranic Arabic: , , 'the recitation'), also romanized Qur'an or Koran, is the central religious text of Islam, believed by Muslims to be a revelation in Islam, revelation from God in Islam, God. It is organized in 114 surah, chapters (pl.: , sing.: ), which consist of āyah, verses (pl.: , sing.: , construct case, cons.: ). In addition to its religious significance, it is widely regarded as the finest work in Arabic literature, and has significantly influenced the Arabic language. Muslims believe that the Quran was orally revealed by God to the Khatam an-Nabiyyin, final prophet, Muhammad in Islam, Muhammad, through the archangel Gabriel incrementally over a period of some 23 years, beginning in the month of Ramadan, when Muhammad was 40; and concluding in 632, the year of his death. Muslims regard the Quran as Muhammad's most important miracle; a proof of his prophethood; and the culmination of a series of divine message ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reverse Murabaha Or Tawarruq And Conventional Loan In Landscape

Reverse or reversing may refer to: Arts and media * ''Reverse'' (Eldritch album), 2001 * ''Reverse'' (2009 film), a Polish comedy-drama film * ''Reverse'' (2019 film), an Iranian crime-drama film * ''Reverse'' (Morandi album), 2005 * ''Reverse'' (TV series), a 2017–2018 South Korean television series *"Reverse", a 2014 song by SomeKindaWonderful *REVERSE art gallery, in Brooklyn, NY, US *Reverse tape effects including backmasking, the recording of sound in reverse * '' Reversing: Secrets of Reverse Engineering'', a book by Eldad Eilam *''Tegami Bachi: REVERSE'', the second season of the ''Tegami Bachi'' anime series, 2010 Driving * Reverse gear, in a motor or mechanical transmission * Reversing (vehicle maneuver), reversing the direction of a vehicle * Turning a vehicle through 180 degrees Sports and games *Reverse (American football), a trick play in American football *Reverse swing, a cricket delivery *Reverse (bridge), a type of bid in contract bridge Technology *Reverse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world." Formed in 1944, started on 27 December 1945, at the Bretton Woods Conference primarily by the ideas of Harry Dexter White and John Maynard Keynes, it came into formal existence in 1945 with 29 member countries and the goal of reconstructing the international monetary system. It now plays a central role in the management of balance of payments difficulties and international financial crises. Countries contribute funds to a pool through a quota system from which countries experiencing balance of payments problems can borrow money. , the fund had XDR 477 billion (a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microfinance

Microfinance is a category of financial services targeting individuals and small businesses who lack access to conventional banking and related services. Microfinance includes microcredit, the provision of small loans to poor clients; savings and checking accounts; microinsurance; and payment systems, among other services. Microfinance services are designed to reach excluded customers, usually poorer population segments, possibly socially marginalized, or geographically more isolated, and to help them become self-sufficient.Christen, Robert Peck Christen; Rosenberg, Richard; Jayadeva, Veena. ''Financial institutions with a double-bottom line: Implications for the future of microfinance''. CGAP, Occasional Papers series, July 2004, pp. 2–3. ID Ghana is an example of a microfinance institution. Microfinance initially had a limited definition: the provision of microloans to poor entrepreneurs and small businesses lacking access to credit. The two main mechanisms for the delive ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

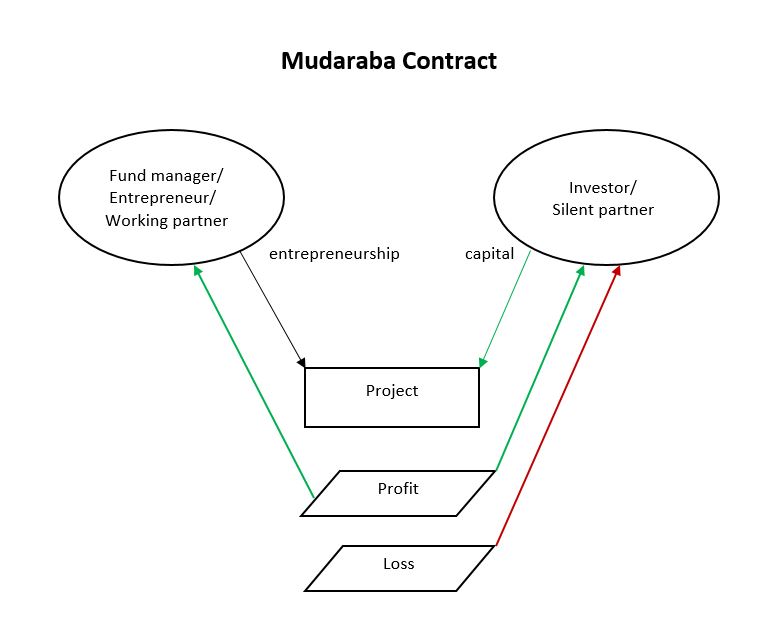

Profit And Loss Sharing

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslims subscribe to. ''Mudarabah'' (مضاربة) refers to "trustee finance" or passive partnership contract, while ''Musharakah'' (مشاركة or مشركة) refers to equity participation contract. Other sources include sukuk (also called "Islamic bonds") and direct equity investment (such as purchase of common shares of stock) as types of PLS. Khan, ''Islamic Banking in Pakistan'', 2015: p.91 The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used). As financing is repaid, the provider of capital collects some agreed upon percentage of the profits (or deducts if there are losses) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sunni

Sunni Islam () is the largest branch of Islam, followed by 85–90% of the world's Muslims. Its name comes from the word '' Sunnah'', referring to the tradition of Muhammad. The differences between Sunni and Shia Muslims arose from a disagreement over the succession to Muhammad and subsequently acquired broader political significance, as well as theological and juridical dimensions. According to Sunni traditions, Muhammad left no successor and the participants of the Saqifah event appointed Abu Bakr as the next-in-line (the first caliph). This contrasts with the Shia view, which holds that Muhammad appointed his son-in-law and cousin Ali ibn Abi Talib as his successor. The adherents of Sunni Islam are referred to in Arabic as ("the people of the Sunnah and the community") or for short. In English, its doctrines and practices are sometimes called ''Sunnism'', while adherents are known as Sunni Muslims, Sunnis, Sunnites and Ahlus Sunnah. Sunni Islam is sometimes referre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)