|

Mandatory Offer

In mergers and acquisitions, a mandatory offer, also called a mandatory bid in some jurisdictions, is an offer made by one company (the "acquiring company" or "bidder") to purchase some or all outstanding shares of another company (the "target"), as required by securities laws and regulations or stock exchange rules governing corporate takeovers. Most countries, with the notable exception of the United States, have provisions requiring mandatory offers. Overview Typically, a mandatory offer must be made when the acquiring company exceeds a certain shareholding threshold in the target, or gains actual control of the target. Most countries, with the notable exception of the United States, have such a requirement. The purpose of mandatory offer regulations is to protect minority shareholders in situations where control of the target is being transferred, and in particular to discourage acquisitions driven by private benefits of control by requiring that a premium be paid for such con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers And Acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is a legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. A deal may be euphemistically called a ''merger of equals'' if both CEOs agree that joining together is in the best interest of both of their companies. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. In most countries, mergers and acquisitions must co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tender Offers

In corporate finance, a tender offer is a type of public takeover bid. The tender offer is a public, open offer or invitation (usually announced in a newspaper advertisement) by a prospective acquirer to all stockholders of a publicly traded corporation (the target corporation) to tender their stock for sale at a specified price during a specified time, subject to the tendering of a minimum and maximum number of shares. In a tender offer, the bidder contacts shareholders directly; the directors of the company may or may not have endorsed the tender offer proposal. To induce the shareholders of the target company to sell, the acquirer's offer price is usually at a premium over the current market price of the target company's shares. For example, if a target corporation's stock were trading at $10 per share, an acquirer might offer $11.50 per share to shareholders on the condition that 51% of shareholders agree. Cash or securities may be offered to the target company's shareholders, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

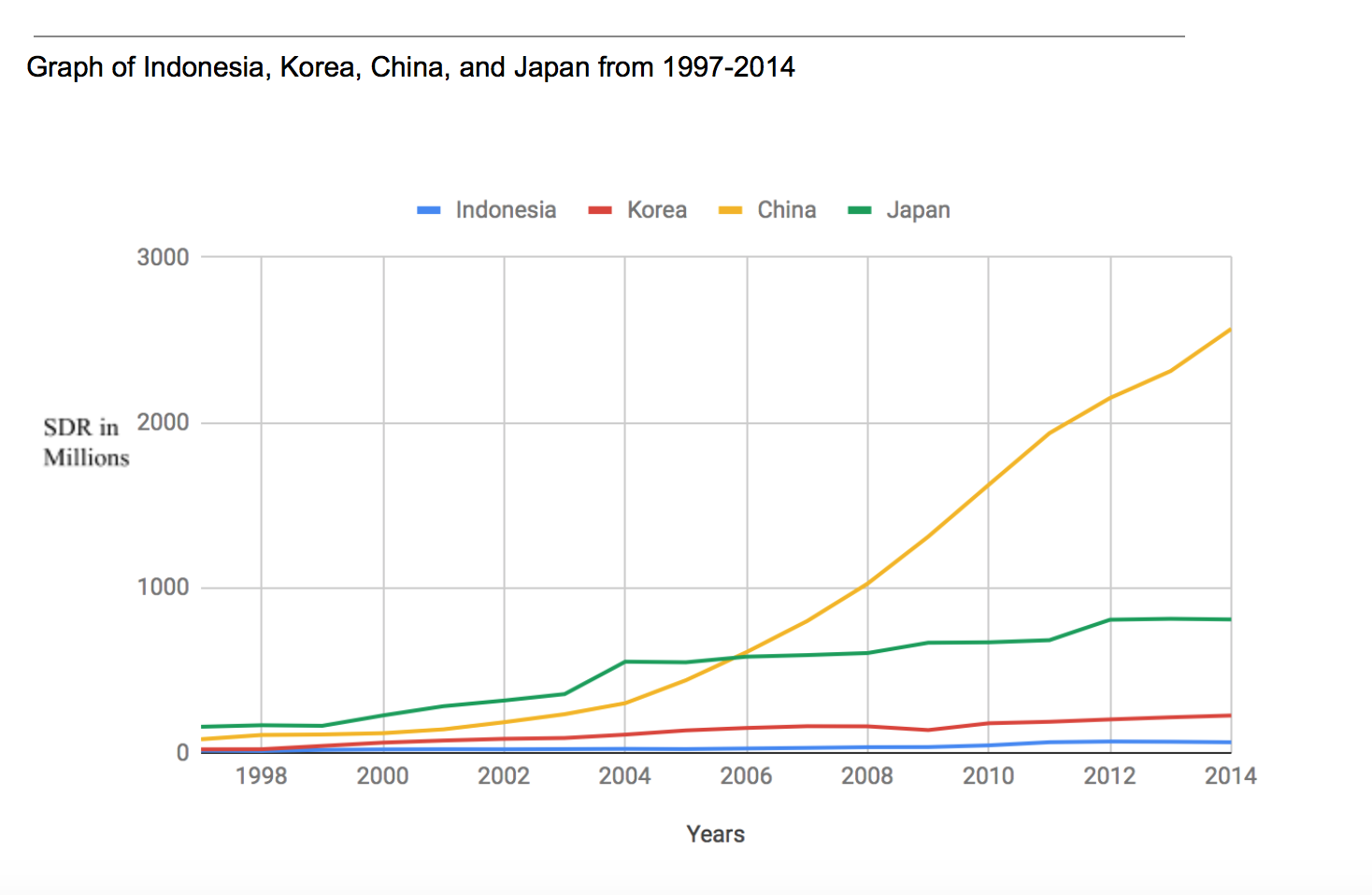

South Korea And The International Monetary Fund

South Korea and the International Monetary Fund (IMF) partner to assist the country in managing its financial system. Korea's economy is considered fundamentally sound because of the balance of their banking sector and their aim toward a zero structural balance without compromising their ability to sustain debt. The IMF Board in 2019 assessed that the policy framework and financial system in place are sturdy and firmly set. History IMF membership South Korea joined the IMF on August 13, 1955. The relationship between the state and the institution have been steady for the most part. The country contributed $8.582 billion SDR (Special Drawing Rights) to the IMF quota, which comprises 1.81% of the IMF's funds. South Korea has 87,292 votes in the IMF, which is 1.73% of the total. South Korea's member of the IMF Board of Governor is Dong Yeon Kim and the alternate Board of Governor is Juyeol Lee. In 2019, the IMF and South Korea continued their partnership in support of capacity ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1997 Asian Financial Crisis

The Asian financial crisis was a period of financial crisis that gripped much of East Asia and Southeast Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid and worries of a meltdown subsided. The crisis started in Thailand (known in Thailand as the ''Tom Yam Kung crisis''; th, วิกฤตต้มยำกุ้ง) on 2 July, with the financial collapse of the Thai baht after the Thai government was forced to float the baht due to lack of foreign currency to support its currency peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, most of Southeast Asia and later South Korea and Japan saw slumping currencies, devalued stock markets and other asset prices, and a precipitous rise in private debt. South Korea, Indonesia and Thailand were ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

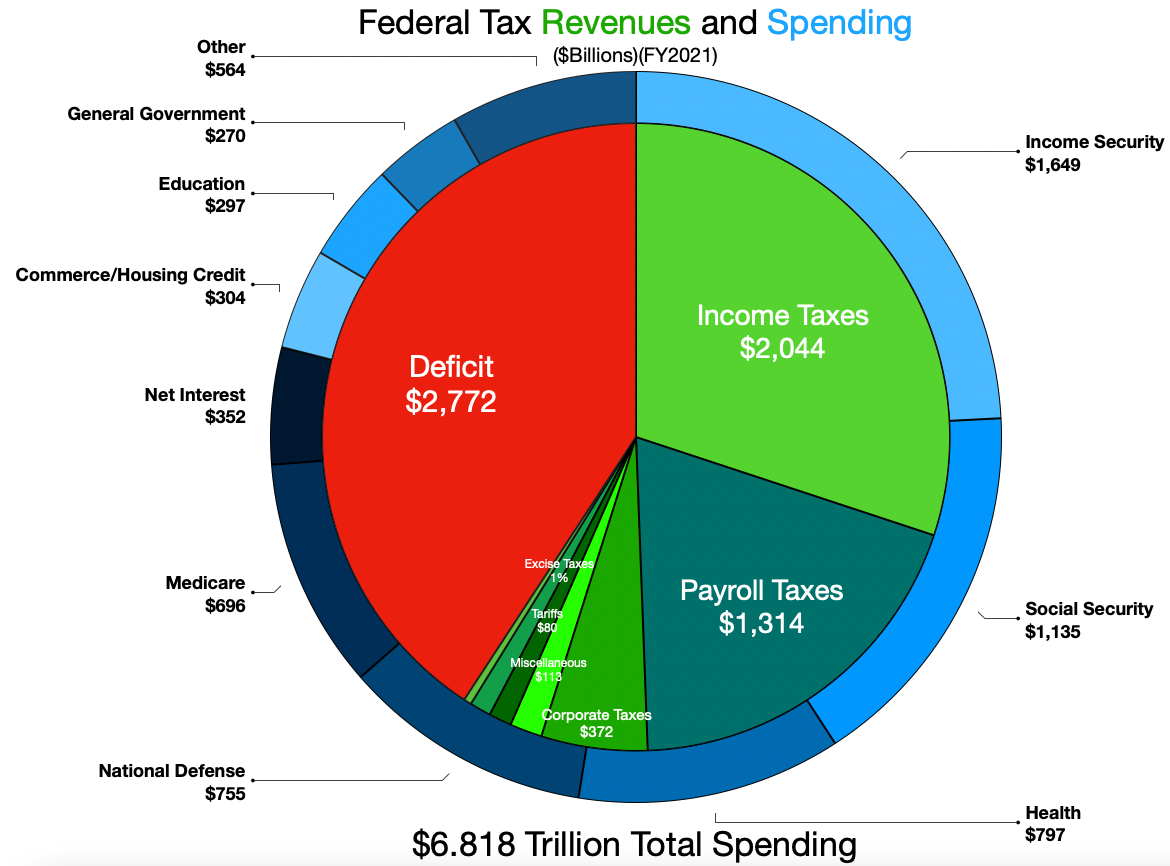

Financial Year

A fiscal year (or financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Laws in many jurisdictions require company financial reports to be prepared and published on an annual basis but generally not the reporting period to align with the calendar year (1 January to 31 December). Taxation laws generally require accounting records to be maintained and taxes calculated on an annual basis, which usually corresponds to the fiscal year used for government purposes. The calculation of tax on an annual basis is especially relevant for direct taxes, such as income tax. Many annual government fees—such as council tax and license fees, are also levied on a fiscal year basis, but others are charged on an anniversary basis. Some companies, such as Cisco Systems, end their fiscal year on the same day of the week each year: the day tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidiary Legislation

Primary legislation and secondary legislation (the latter also called delegated legislation or subordinate legislation) are two forms of law, created respectively by the legislative and executive branches of governments in representative democracies. Primary legislation generally consists of statutes, also known as 'acts', that set out broad outlines and principles, but delegate specific authority to an executive branch to make more specific laws under the aegis of the principal act. The executive branch can then issue secondary legislation (often by order-in-council in parliamentary systems, or by regulatory agencies in presidential systems), creating legally enforceable regulations and the procedures for implementing them. Australia In Australian law, primary legislation includes acts of the Commonwealth Parliament and state or territory parliaments. Secondary legislation, formally called legislative instruments, are regulations made according to law by the executive or judi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities And Exchange Board Of India

The Securities and Exchange Board of India (SEBI) is the regulatory body for securities and commodity market in India under the ownership of Ministry of Finance within the Government of India. It was established on 12 April 1988 as an executive body and was given statutory powers on 30 January 1992 through the SEBI Act, 1992. History Securities and Exchange Board of India (SEBI) was first established in 1988 as a non-statutory body for regulating the securities market. It became an autonomous body on 30 January 1992 and was accorded statutory powers with the passing of the SEBI Act 1992 by the Indian Parliament. SEBI has its headquarters at the business district of Bandra Kurla Complex in Mumbai and has Northern, Eastern, Southern and Western Regional Offices in New Delhi, Kolkata, Chennai, and Ahmedabad respectively. It has opened local offices at Jaipur and Bangalore and has also opened offices at Guwahati, Bhubaneshwar, Patna, Kochi and Chandigarh in Financial Year 2013 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hong Kong Stock Exchange

The Stock Exchange of Hong Kong (SEHK, also known as Hong Kong Stock Exchange) is a stock exchange based in Hong Kong. As of the end of 2020, it has 2,538 listed companies with a combined market capitalization of HK$47 trillion. It is reported as the fastest growing stock exchange in Asia. The stock exchange is owned (through its subsidiary Stock Exchange of Hong Kong Limited) by Hong Kong Exchanges and Clearing Limited (HKEX), a holding company that it also lists () and that in 2021 became world's largest bourse operator in terms of market capitalization, surpassing Chicago-based CME. The physical trading floor at Exchange Square was closed in October 2017. History The Hong Kong securities market can be traced back to 1866, but the stock market was formally set up in 1891, when the Association of Stockbrokers in Hong Kong was established. It was renamed as The Hong Kong Stock Exchange in 1914. By 1972, Hong Kong had four stock exchanges in operation. There were subsequen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities And Futures Commission

The Securities and Futures Commission (SFC) of Hong Kong is the independent statutory body charged with regulating the securities and futures markets in Hong Kong. The SFC is responsible for fostering an orderly securities and futures markets, to protect investors and to help promote Hong Kong as an international financial centre and a key financial market in China. Even though it is considered to be a branch of the government, it is run independently under the authorisation of the laws relating to Securities and Futures. The head office is in One Island East in Quarry Bay. History The SFC was created in 1989 in response to the stock market crash of 1987. In 1997 following the Asian financial crisis, the regulatory framework was further improved. A comprehensive Securities and Futures Ordinance (SFO) was implemented in 2003, which expanded the SFC's regulatory functions and powers. Andrew Sheng served as chairman of the SFC from 1998 until 2005, when he was succeeded by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Common Stock

Common stock is a form of corporate equity ownership, a type of security. The terms voting share and ordinary share are also used frequently outside of the United States. They are known as equity shares or ordinary shares in the UK and other Commonwealth realms. This type of share gives the stockholder the right to share in the profits of the company, and to vote on matters of corporate policy and the composition of the members of the board of directors. The owners of common stock do not own any particular assets of the company, which belong to all the shareholders in common. A corporation may issue both ordinary and preference shares, in which case the preference shareholders have priority to receive dividends. In the event of liquidation, ordinary shareholders receive any remaining funds after bondholders, creditors (including employees), and preference shareholders are paid. When the liquidation happens through bankruptcy, the ordinary shareholders typically receive nothing. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State-owned Enterprises Of China

This is a list of state-owned enterprises of China. A state-owned enterprise is a legal entity that undertakes commercial activities on behalf of an owner government. Their legal status varies from being a part of government to stock companies with a state as a regular or dominant stockholder. There is no standard definition of a government-owned corporation (GOC) or state-owned enterprise (SOE), although the two terms are often used interchangeably. The defining characteristics are that they have a distinct legal shape and they are established to operate in commercial affairs. While they may also have public policy objectives, SOEs should be differentiated from other forms of government agencies or state entities that are established to pursue purely non-financial objectives. The role of the Chinese Communist Party (CCP) in SOEs has varied at different periods but has increased during the rule of CCP General Secretary Xi Jinping, with the Party formally taking a commanding role i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

China Securities Regulatory Commission

The China Securities Regulatory Commission (CSRC) is a government ministry of the State Council of the People's Republic of China (PRC). It is the main regulator of the securities industry in China. History China's first Securities Law was passed December 1998, and became effective July 1, 1999. It is the nation's first comprehensive securities legislation, and grants CSRC "authority to implement a centralized and unified regulation of the nationwide securities market in order to ensure their lawful operation". The CSRC oversees China's nationwide centralized securities supervisory system, with the power to regulate and supervise securities issuers, as well as to investigate, and impose penalties for "illegal activities related to securities and futures"., note 1. The CSRC is empowered to issue opinions or "Guideline Opinions", which are not legally binding, as guidelines for publicly-traded corporations. Indicative of the role of the CSRC, China's highest court, the Suprem ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |