|

L-QIAIF

Qualifying Investor Alternative Investment Fund or QIAIF is a Central Bank of Ireland regulatory classification established in 2013 for Ireland's five tax-free legal structures for holding assets. The Irish Collective Asset-management Vehicle or ICAV is the most popular of the five Irish QIAIF structures, it is the main tax-free structure for foreign investors holding Irish assets. In 2018, the Central Bank of Ireland expanded the Loan Originating QIAIF or L–QIAIF regime which enables the five tax-free structures to be used for closed-end debt instruments. The L–QIAIF is Ireland's main debt–based BEPS tool as it overcomes the lack of confidentiality and tax secrecy of the Section 110 SPV. It is asserted that many assets in QIAIFs and LQIAIFs are Irish assets being shielded from Irish taxation. Irish QIAIFs and LQIAIFs can be integrated with Irish corporate base erosion and profit shifting ("BEPS") tax tools to create confidential routes out of the Irish tax system to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irish Section 110 Special Purpose Vehicle (SPV)

An Irish Section 110 special purpose vehicle (SPV) or section 110 company, is an Irish tax resident company, which qualifies under ''Section 110'' of the '' Irish Taxes Consolidation Act 1997'' (TCA) for a special tax regime that enables the SPV to attain "tax neutrality": i.e. the SPV pays no Irish taxes, VAT, or duties. Section 110 was created in 1997 to help International Financial Services Centre (IFSC) legal and accounting firms compete for the administration of global securitisation deals, and by 2017 was the largest structured finance vehicle in EU securitisation. Section 110 SPVs have made the IFSC the third largest global Shadow Banking OFC. While they pay no Irish tax, they contribute €100 million annually to the Irish economy in fees paid to IFSC legal and accounting firms. In June 2016, it was discovered that US distressed debt funds used Section 110 SPVs, structured by IFSC service firms, to avoid Irish taxes on €80 billion of Irish domestic investments. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation Tax In The Republic Of Ireland

Ireland's Corporate Tax System is a central component of Ireland's economy. In 2016–17, foreign firms paid 80% of Irish corporate tax, employed 25% of the Irish labour force (paid 50% of Irish salary tax), and created 57% of Irish OECD non-farm value-add. As of 2017, 25 of the top 50 Irish firms were U.S.–controlled businesses, representing 70% of the revenue of the top 50 Irish firms. By 2018, Ireland had received the most U.S. in history, and Apple was over one–fifth of Irish GDP. Academics rank Ireland as the largest tax haven; larger than the Caribbean tax haven system. Ireland's "headline" corporation tax rate is 12.5%, however, foreign multinationals pay an aggregate of 2.2–4.5% on global profits "shifted" to Ireland, via Ireland's global network of bilateral tax treaties. These lower effective tax rates are achieved by a complex set of Irish base erosion and profit shifting ("BEPS") tools which handle the largest BEPS flows in the world (e.g. the Double Ir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank Of Ireland

The Central Bank of Ireland ( ga, Banc Ceannais na hÉireann) is Ireland's central bank, and as such part of the European System of Central Banks (ESCB). It is the country's financial services regulator for most categories of financial firms. It was the issuer of Irish pound banknotes and coinage until the introduction of the Euro currency, and now provides this service for the European Central Bank. The Central Bank of Ireland was founded on 1 February 1943, and since 1 January 1972 has been the banker of the Government of Ireland in accordance with the Central Bank Act 1971, which can be seen in legislative terms as completing the long transition from a currency board to a fully functional central bank. Its head office, the Central Bank of Ireland building, was located on Dame Street, Dublin from 1979 until 2017. Its offices at Iveagh Court and College Green also closed down at the same time. Since March 2017, its headquarters are located on North Wall Quay, where the pu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Haven

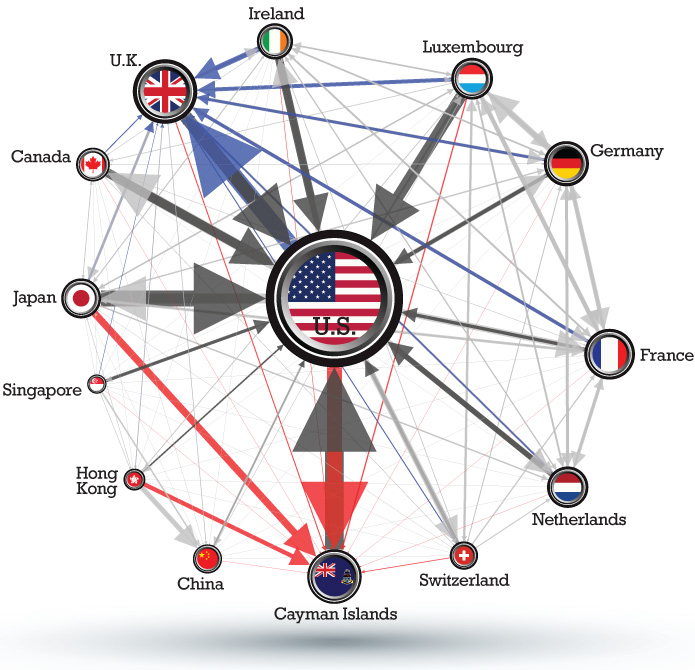

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Havens

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but mos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BEPS

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic activity, thus "eroding" the "tax-base" of the higher-tax jurisdictions using deductible payments such as interest or royalties. For the government, the tax base is a company's income or profit. Tax is levied as a percentage on this income/profit. When that income / profit is transferred to another country or tax haven, the tax base is eroded and the company does not pay taxes to the country that is generating the income. As a result, tax revenues are reduced and the government is detained. The Organization for Economic Co-operation and Development (OECD) define BEPS strategies as "exploiting gaps and mismatches in tax rules". While some of the tactics are illegal, the majority are not. Corporate tax havens offer BEPS tools to "shift" pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dublin Office Sales Price Versus EU-28 (2016)

Dublin (; , or ) is the capital and largest city of Ireland. On a bay at the mouth of the River Liffey, it is in the province of Leinster, bordered on the south by the Dublin Mountains, a part of the Wicklow Mountains range. At the 2016 census it had a population of 1,173,179, while the preliminary results of the 2022 census recorded that County Dublin as a whole had a population of 1,450,701, and that the population of the Greater Dublin Area was over 2 million, or roughly 40% of the Republic of Ireland's total population. A settlement was established in the area by the Gaels during or before the 7th century, followed by the Vikings. As the Kingdom of Dublin grew, it became Ireland's principal settlement by the 12th century Anglo-Norman invasion of Ireland. The city expanded rapidly from the 17th century and was briefly the second largest in the British Empire and sixth largest in Western Europe after the Acts of Union in 1800. Following independence in 1922, Dublin becam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stephen Donnelly 2016

Stephen or Steven is a common English first name. It is particularly significant to Christians, as it belonged to Saint Stephen ( grc-gre, Στέφανος ), an early disciple and deacon who, according to the Book of Acts, was stoned to death; he is widely regarded as the first martyr (or "protomartyr") of the Christian Church. In English, Stephen is most commonly pronounced as ' (). The name, in both the forms Stephen and Steven, is often shortened to Steve or Stevie. The spelling as Stephen can also be pronounced which is from the Greek original version, Stephanos. In English, the female version of the name is Stephanie. Many surnames are derived from the first name, including Stephens, Stevens, Stephenson, and Stevenson, all of which mean "Stephen's (son)". In modern times the name has sometimes been given with intentionally non-standard spelling, such as Stevan or Stevon. A common variant of the name used in English is Stephan ; related names that have found some curre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Financial Services Centre

The International Financial Services Centre (IFSC) is an area of central Dublin and part of the CBD established in the 1980s as an urban regeneration area and special economic zone (SEZ) on the derelict state-owned former port authority lands of the reclaimed North Wall and George's Dock areas of the Dublin Docklands. The term has become a metonym for the Irish financial services industry as well as being used as an address and still being classified as an SEZ. It officially began in 1987 as an SEZ on an docklands site in central Dublin, with EU approval to apply a 10% corporate tax rate for "designated financial services activities". Before the expiry of this EU approval in 2005, the Irish Government legislated to effectively have a national flat rate by reducing the overall Irish corporate tax rate from 32% to 12.5% which was finally introduced in 2003. An additional primary goal of the IFSC was to assist the urban renewal and development programme of the North Wall ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dublin Office Sales Price, As A Multiple Of Cost Of Build, Versus EU-28 (2016)

Dublin (; , or ) is the capital and largest city of Ireland. On a bay at the mouth of the River Liffey, it is in the province of Leinster, bordered on the south by the Dublin Mountains, a part of the Wicklow Mountains range. At the 2016 census it had a population of 1,173,179, while the preliminary results of the 2022 census recorded that County Dublin as a whole had a population of 1,450,701, and that the population of the Greater Dublin Area was over 2 million, or roughly 40% of the Republic of Ireland's total population. A settlement was established in the area by the Gaels during or before the 7th century, followed by the Vikings. As the Kingdom of Dublin grew, it became Ireland's principal settlement by the 12th century Anglo-Norman invasion of Ireland. The city expanded rapidly from the 17th century and was briefly the second largest in the British Empire and sixth largest in Western Europe after the Acts of Union in 1800. Following independence in 1922, Dublin becam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sunday Business Post

The ''Business Post'' (formerly ''The Sunday Business Post'') is a Sunday newspaper distributed nationally in Ireland and an online publication. It is focused mainly on business and financial issues in Ireland. Founding to Irish financial crisis ''The Sunday Business Post'' was co-founded by four people: the economist and editor Damien Kiberd, Aileen O'Toole (former editor of '' Business & Finance''), Frank Fitzgibbon (editor of ''The Sunday Times'' Ireland) and James Morrissey (spokesperson for Denis O'Brien). The ''SBP'' was previously owned by Thomas Crosbie Holdings (TCH). It was then owned by Key Capital, Paul Cooke and staff members (6% equity for staff). It was then owned by Sunrise Media, the shareholders of which include Key Capital. It is now owned by Kilcullen Capital Partners. The paper's first edition appeared on 26 November 1989. While TCH's other major newspaper titles, the ''Irish Examiner'' and ''Evening Echo'', are based in Cork, the ''Post'' is published ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |