|

Kicker (Oregon Tax Rebate)

The Oregon tax rebate, commonly referred to as the kicker, is a rebate calculated for both individual and corporate taxpayers in the U.S. state of Oregon when a revenue surplus exists. The Oregon Constitution mandates that the rebate be issued when the calculated revenue for a given biennium exceeds the forecast revenue by at least two percent. The law was first enacted by ballot measure in 1980, and was entered into the Oregon Constitution with the enactment of Ballot Measure 86 in 2000. The Oregon Department of Revenue distributes the rebate to individuals in what is known to Oregonians as a kicker check. The kicker, which prevents ''surpluses'' above a certain size, is a complement to the balanced budget amendment, which prevents ''deficits.'' If the corporate kicker is triggered, the excess is returned to the state general fund to provide additional funding to K–12 schools. This is the result of the passage of 2012's Ballot Measure 85. Prior to that time, the rebate was d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Rebate

A tax refund or tax rebate is a payment to the taxpayer due to the taxpayer having paid more tax than they owed. By country United States According to the Internal Revenue Service, 77% of tax returns filed in 2004 resulted in a refund check, with the average refund check being $2,100. In 2011, the average tax refund was $2,913. For the 2017 tax year the average refund was $2,035 and for 2018 it was 8% less at $1,865, reflecting the changes brought by the most sweeping changes to the tax code in 30 years. Taxpayers may choose to have their refund directly deposited into their bank account, have a check mailed to them, or have their refund applied to the following year's income tax. As of 2006, tax filers may split their tax refund with direct deposit in up to three separate accounts with three different financial institutions. This has given taxpayers an opportunity to save and spend some of their refund (rather than only spend their refund). Every year, a number of U.S. taxpay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oregon Ballot Measure 5 (1990)

Ballot Measure 5 was a landmark piece of direct legislation in the U.S. state of Oregon in 1990. Measure 5, an amendment to the Oregon Constitution (Article XI, Section 11), established limits on Oregon's property taxes on real estate. Its primary champion and spokesman was Don McIntire, a politically-active Gresham health club owner who would go on to lead the Taxpayers Association of Oregon. Property taxes dedicated for school funding were capped at $15 per $1,000 of real market value per year and gradually lowered to $5 per $1,000 per year. Property taxes for other purposes were capped at $10 per $1,000 per year. Thus, the total property tax rate would be 1.5% at the end of the five-year phase in period. The measure transferred the responsibility for school funding from local government to the state, to equalize funding. The measure was passed in the November 6, 1990 general election with 574,833 votes in favor, 522,022 votes against. It was one of the most contentious measure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Oregon Ballot Measures

The list of Oregon ballot measures lists all statewide ballot measures to the present. In Oregon, the initiative and referendum process dates back to 1902, when the efforts of the Direct Legislation League prompted amending the Oregon Constitution for the first time since 1859. The process of initiative and referendum became nationally known as the ''Oregon System''. Types There are three types of ballot measures: initiatives, referendums, and referrals. Initiatives and referendums may be placed on the ballot if their supporters gather enough signatures from Oregon voters; the number of signatures is a percentage based on the number of voters casting ballots in the most recent election for the Governor of Oregon. ; Initiative: Any issue may be placed before the voters, either amending the Constitution or revising or adding to the Oregon Revised Statutes. Constitutional initiatives require the signature of eight percent of recent voters to qualify for the ballot; statutory ref ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oregon Tax Court

The Oregon Tax Court is a state court in the U.S. state of Oregon, which has jurisdiction in questions of law that regard state tax laws. Examples of matters that would come before this court include income taxes, corporate excise taxes, property taxes, timber taxes, cigarette taxes, local budget law, and property tax limitations. The purpose of the court is parallel to that of the United States Tax Court. Taxpayers and tax authorities can take advantage of a court that is familiar with taxation issues. Oregon Tax Court cases are usually filed by taxpayers who are unhappy with the decisions of the Oregon Department of Revenue or a county tax assessor. The Oregon Tax Court has a single judge who is elected in a statewide election to a 6-year term. The position has been held since January, 2018 by Judge Robert T. Manicke, who was appointed by Governor Kate Brown. He was elected to a full six-year term in November 2018. The court is divided into two divisions: the Magistra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oregon Tax Revolt

The Oregon tax revolt is a political movement in Oregon which advocates for lower taxes. This movement is part of a larger anti-tax movement in the western United States which began with the enactment of Proposition 13 in California. The tax revolt, carried out in large part by a series of citizens' initiatives and referendums, has reshaped the debate about taxes and public services in Oregon. Major figures The leaders of the tax revolt include Don McIntire, president of the Taxpayer Association of Oregon, and Bill Sizemore, leader of Oregon Taxpayers United. Much of the money spent to promote these anti-tax measures were provided by out-of-state backers including Americans for Tax Reform headed by Grover Norquist. National context and the passage of Measure 5 Oregon voters placed limits to property tax in the Oregon Constitution in 1990 with the passage of Measure 5. A majority of voters were frustrated by the increase in property taxes attributed to rapidly rising propert ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ted Kulongoski

Theodore Ralph Kulongoski ( ; born November 5, 1940) is an American politician, judge, and lawyer who served as the 36th Governor of Oregon from 2003 to 2011. A member of the Democratic Party, he served in both houses of the Oregon Legislative Assembly and also served as the state Insurance Commissioner. He was the Attorney General of Oregon from 1993 to 1997 and an associate justice of the Oregon Supreme Court from 1997 to 2001. Kulongoski has served in all three branches of the Oregon state government. Early life and education Kulongoski was born in St. Louis, Missouri, in 1940 to Theodore Kulongoski (1905-1941), the son of Polish immigrants, and his wife Helen, née Newcomer (1915-1997).Governor Ted Kulongoski About Governor Kulongoski He was one year old when his father died of cancer, and spent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Governor Of Oregon

The governor of Oregon is the head of government of Oregon and serves as the commander-in-chief of the state's military forces. The title of governor was also applied to the office of Oregon's chief executive during the provisional and U.S. territorial governments. The current 38th governor of Oregon is Kate Brown, who took office following the resignation of Governor John Kitzhaber amid an ethics scandal. The governor's current salary was set by the 2001 Oregon Legislature at $93,600 annually. Constitutional descriptions Article V of the Oregon State Constitution sets up the legal framework of the Oregon Executive Branch. Eligibility Article V, Section 1 states that the governor must be a U.S. citizen, at least 30 years of age, and a resident of Oregon for at least three years before the candidate's election. Section 2 extends ineligibility as follows: Section 1 further sets the maximum number of consecutive years a governor may serve, specifying that There is no spe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

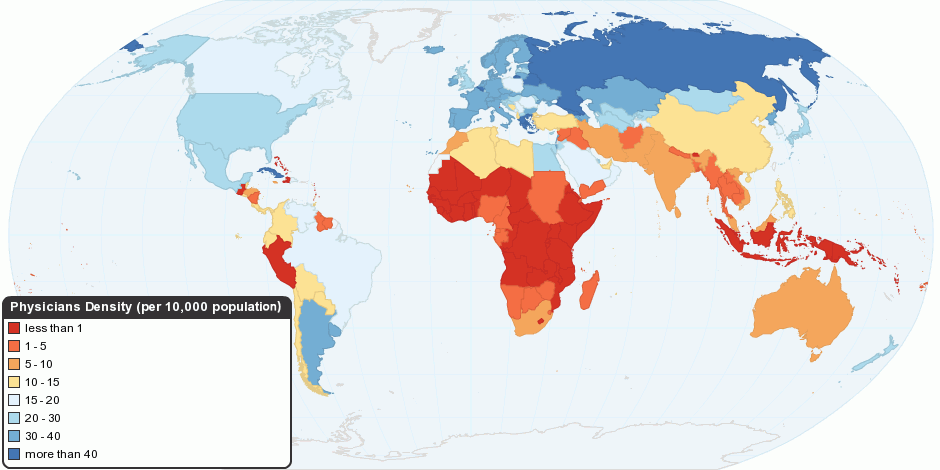

Healthcare

Health care or healthcare is the improvement of health via the prevention, diagnosis, treatment, amelioration or cure of disease, illness, injury, and other physical and mental impairments in people. Health care is delivered by health professionals and allied health fields. Medicine, dentistry, pharmacy, midwifery, nursing, optometry, audiology, psychology, occupational therapy, physical therapy, athletic training, and other health professions all constitute health care. It includes work done in providing primary care, secondary care, and tertiary care, as well as in public health. Access to health care may vary across countries, communities, and individuals, influenced by social and economic conditions as well as health policies. Providing health care services means "the timely use of personal health services to achieve the best possible health outcomes". Factors to consider in terms of health care access include financial limitations (such as insurance coverage), geo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Layoff

A layoff or downsizing is the temporary suspension or permanent termination of employment of an employee or, more commonly, a group of employees (collective layoff) for business reasons, such as personnel management or downsizing (reducing the size of) an organization. Originally, ''layoff'' referred exclusively to a temporary interruption in work, or employment but this has evolved to a permanent elimination of a position in both British and US English, requiring the addition of "temporary" to specify the original meaning of the word. A layoff is not to be confused with wrongful termination. ''Laid off workers'' or ''displaced workers'' are workers who have lost or left their jobs because their employer has closed or moved, there was insufficient work for them to do, or their position or shift was abolished (Borbely, 2011). Downsizing in a company is defined to involve the reduction of employees in a workforce. Downsizing in companies became a popular practice in the 1980s and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Schools

A school is an educational institution designed to provide learning spaces and learning environments for the teaching of students under the direction of teachers. Most countries have systems of formal education, which is sometimes compulsory. In these systems, students progress through a series of schools. The names for these schools vary by country (discussed in the '' Regional terms'' section below) but generally include primary school for young children and secondary school for teenagers who have completed primary education. An institution where higher education is taught is commonly called a university college or university. In addition to these core schools, students in a given country may also attend schools before and after primary (elementary in the U.S.) and secondary (middle school in the U.S.) education. Kindergarten or preschool provide some schooling to very young children (typically ages 3–5). University, vocational school, college or seminary may be availabl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Police

The police are a constituted body of persons empowered by a state, with the aim to enforce the law, to ensure the safety, health and possessions of citizens, and to prevent crime and civil disorder. Their lawful powers include arrest and the use of force legitimized by the state via the monopoly on violence. The term is most commonly associated with the police forces of a sovereign state that are authorized to exercise the police power of that state within a defined legal or territorial area of responsibility. Police forces are often defined as being separate from the military and other organizations involved in the defense of the state against foreign aggressors; however, gendarmerie are military units charged with civil policing. Police forces are usually public sector services, funded through taxes. Law enforcement is only part of policing activity. Policing has included an array of activities in different situations, but the predominant ones are concerned with the pre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale Anthropogenic hazard, anthropogenic or natural disaster (e.g. a pandemic). In the United States, a recession is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." The European Union has adopted a similar definition. In the United Kingdom, a recession is defined as negative economic growth for two consecutive quarters. Governments usually respond to recessions by adopting expansionary macroeconomic policies, such as monetary policy, incr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |