|

John Burr Williams

John Burr Williams (November 27, 1900 – September 15, 1989) was an American economist, recognized as an important figure in the field of fundamental analysis, and for his analysis of stock prices as reflecting their " intrinsic value". He is best known for his 1938 text ''The Theory of Investment Value'', based on his PhD thesis, in which he articulated the theory of discounted cash flow (DCF) based valuation, and in particular, dividend based valuation. Biography Williams studied mathematics and chemistry at Harvard University, and enrolled at Harvard Business School in 1923. After graduating, he worked as a security analyst, where he realised that "how to estimate the fair value was a puzzle indeed... To be a good investment analyst, one needs to be an expert economist also." In 1932 he enrolled at Harvard for a PhD in economics, with the hopes of learning what had caused the Wall Street Crash of 1929 and the subsequent economic depression of the 1930s. For his thesis, J ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Weston, Massachusetts

Weston is a town in Middlesex County, Massachusetts, Middlesex County, Massachusetts, about 15 miles west of Boston. At the time of the 2020 United States Census, the population of Weston was 11,851. Weston was incorporated in 1713, and protection of the town's historic resources is driven by the Weston Historical Commission and Weston Historical Society. The town has one Local Historic District, 10 National Register Districts, 26 Historic Areas, and seven houses individually listed on the National Register of Historic Places. Weston's predominance as a residential community is reflected in its population density, which is among the lowest of Boston's suburbs near or within Massachusetts Route 128, Route 128. More than 2,000 acres, or 18 percent of the town's total acreage, have been preserved as parks, fields, wetlands, and forests, with 90 miles of trails for hiking, horseback riding, and cross-country skiing. Thirty-seven scenic roads, as defined by Massachusetts law, maintain ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Analyst

A financial analyst is a professional, undertaking financial analysis for external or internal clients as a core feature of the job. The role may specifically be titled securities analyst, research analyst, equity analyst, investment analyst, or ratings analyst.Financial Analysts Bureau of Labor StatisticsFinancial Analysts collegegrad.com The job title is a broad one: [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Visiting Professor

In academia, a visiting scholar, visiting researcher, visiting fellow, visiting lecturer, or visiting professor is a scholar from an institution who visits a host university to teach, lecture, or perform research on a topic for which the visitor is valued. In many cases the position is not salaried because visitor is salaried by their home institution (or partially salaried, as in some cases of sabbatical leave from US universities). Some visiting positions are salaried. Typically, a visiting scholar may stay for a couple of months or even a year,UT"Visiting Scholar". The University of Texas at Austin. though the stay can be extended. Typically, a visiting scholar is invited by the host institution, and it is not unusual for them to provide accommodation. Such an invitation is often regarded as recognizing the scholar's prominence in the field. Attracting prominent visiting scholars often allows the permanent faculty and graduate students to cooperate with prominent academic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security Analysis

Security analysis is the analysis of tradeable financial instruments called securities. It deals with finding the proper value of individual securities (i.e., stocks and bonds). These are usually classified into debt securities, equities, or some hybrid of the two. Tradeable credit derivatives are also securities. Commodities or futures contracts are not securities. They are distinguished from securities by the fact that their performance is not dependent on the management or activities of an outside or third party. Options on these contracts are however considered securities, since performance is now dependent on the activities of a third party. The definition of what is and what is not a security comes directly from the language of a United States Supreme Court decision in the case of SEC v. W. J. Howey Co. Security analysis for the purpose to state the effective value of an enterprise is typically based on the examination of fundamental business factors such as financial state ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Portfolio (finance)

In finance, a portfolio is a collection of investments. Definition The term “portfolio” refers to any combination of financial assets such as stocks, bonds and cash. Portfolios may be held by individual investors or managed by financial professionals, hedge funds, banks and other financial institutions. It is a generally accepted principle that a portfolio is designed according to the investor's risk tolerance, time frame and investment objectives. The monetary value of each asset may influence the risk/reward ratio of the portfolio. When determining asset allocation, the aim is to maximise the expected return and minimise the risk. This is an example of a multi-objective optimization problem: many efficient solutions are available and the preferred solution must be selected by considering a tradeoff between risk and return. In particular, a portfolio A is dominated by another portfolio A' if A' has a greater expected gain and a lesser risk than A. If no portfolio dominate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Management

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts or, more commonly, via collective investment schemes like mutual funds, exchange-traded funds, or REITs. The term asset management is often used to refer to the management of investment funds, while the more generic term fund management may refer to all forms of institutional investment, as well as investment management for private investors. Investment managers who specialize in ''advisory'' or ''discretionary'' management on behalf of (normally wealthy) private investors may often refer to their services as money management or portfolio management within the context of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mark Rubinstein

Mark Edward Rubinstein (June 8, 1944 – May 9, 2019) was a leading financial economist and financial engineer. He was ''Paul Stephens Professor of Applied Investment Analysis'' at the Haas School of Business of the University of California, Berkeley. He held various other professional offices, directing the American Finance Association, amongst others, especially portfolio insurance and the binomial options pricing model (also known as the Cox-Ross-Rubinstein model), as well as his work on discrete time stochastic calculus more generally. Along with fellow Berkeley finance professor Hayne E. Leland and adjunct professor John O'Brien, Rubinstein developed the portfolio insurance financial product in 1976. (This strategy later became associated with the October 19, 1987, Stock Market Crash; see ). With Leland and O'Brien he also introduced the first exchange-traded fund (ETF) in the United States. Rubinstein popularized the term "exotic option" in 1990/92 working pape"Exotic Op ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harvard University Press

Harvard University Press (HUP) is a publishing house established on January 13, 1913, as a division of Harvard University, and focused on academic publishing. It is a member of the Association of American University Presses. After the retirement of William P. Sisler in 2017, the university appointed as Director George Andreou. The press maintains offices in Cambridge, Massachusetts near Harvard Square, and in London, England. The press co-founded the distributor TriLiteral LLC with MIT Press and Yale University Press. TriLiteral was sold to LSC Communications in 2018. Notable authors published by HUP include Eudora Welty, Walter Benjamin, E. O. Wilson, John Rawls, Emily Dickinson, Stephen Jay Gould, Helen Vendler, Carol Gilligan, Amartya Sen, David Blight, Martha Nussbaum, and Thomas Piketty. The Display Room in Harvard Square, dedicated to selling HUP publications, closed on June 17, 2009. Related publishers, imprints, and series HUP owns the Belknap Press imprint, whi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Elementary Algebra

Elementary algebra encompasses the basic concepts of algebra. It is often contrasted with arithmetic: arithmetic deals with specified numbers, whilst algebra introduces variables (quantities without fixed values). This use of variables entails use of algebraic notation and an understanding of the general rules of the operations introduced in arithmetic. Unlike abstract algebra, elementary algebra is not concerned with algebraic structures outside the realm of real and complex numbers. It is typically taught to secondary school students and builds on their understanding of arithmetic. The use of variables to denote quantities allows general relationships between quantities to be formally and concisely expressed, and thus enables solving a broader scope of problems. Many quantitative relationships in science and mathematics are expressed as algebraic equations. Algebraic notation Algebraic notation describes the rules and conventions for writing mathematical expressio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Model

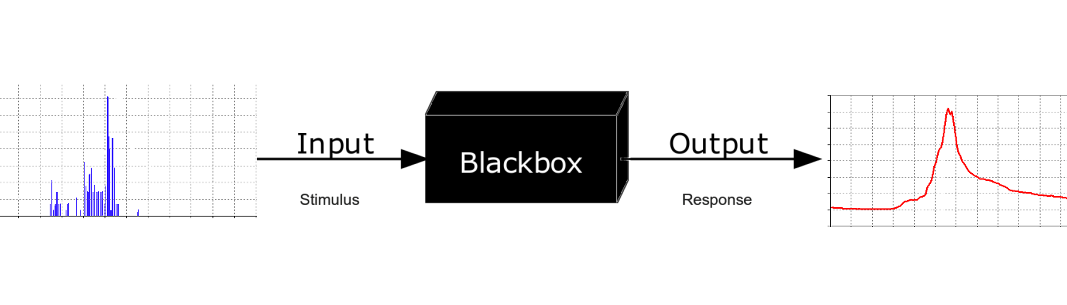

A mathematical model is a description of a system using mathematical concepts and language. The process of developing a mathematical model is termed mathematical modeling. Mathematical models are used in the natural sciences (such as physics, biology, earth science, chemistry) and engineering disciplines (such as computer science, electrical engineering), as well as in non-physical systems such as the social sciences (such as economics, psychology, sociology, political science). The use of mathematical models to solve problems in business or military operations is a large part of the field of operations research. Mathematical models are also used in music, linguistics, and philosophy (for example, intensively in analytic philosophy). A model may help to explain a system and to study the effects of different components, and to make predictions about behavior. Elements of a mathematical model Mathematical models can take many forms, including dynamical systems, statisti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Common Stock

Common stock is a form of corporate equity ownership, a type of security. The terms voting share and ordinary share are also used frequently outside of the United States. They are known as equity shares or ordinary shares in the UK and other Commonwealth realms. This type of share gives the stockholder the right to share in the profits of the company, and to vote on matters of corporate policy and the composition of the members of the board of directors. The owners of common stock do not own any particular assets of the company, which belong to all the shareholders in common. A corporation may issue both ordinary and preference shares, in which case the preference shareholders have priority to receive dividends. In the event of liquidation, ordinary shareholders receive any remaining funds after bondholders, creditors (including employees), and preference shareholders are paid. When the liquidation happens through bankruptcy, the ordinary shareholders typically receive nothing. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagion began around September and led to the Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century. Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II. Devastating effects were seen in both rich and poor countries with falling personal income, prices, tax revenues, and profits. International trade fell by more than 50%, unemployment in the U.S. rose to 23% and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |