|

Mark Rubinstein

Mark Edward Rubinstein (June 8, 1944 – May 9, 2019) was a leading financial economist and financial engineer. He was ''Paul Stephens Professor of Applied Investment Analysis'' at the Haas School of Business of the University of California, Berkeley. He held various other professional offices, directing the American Finance Association, amongst others, especially portfolio insurance and the binomial options pricing model (also known as the Cox- Ross-Rubinstein model), as well as his work on discrete time stochastic calculus more generally. Along with fellow Berkeley finance professor Hayne E. Leland and adjunct professor John O'Brien, Rubinstein developed the portfolio insurance financial product in 1976. (This strategy later became associated with the October 19, 1987, Stock Market Crash; see ). With Leland and O'Brien he also introduced the first exchange-traded fund (ETF) in the United States. Rubinstein popularized the term " exotic option" in 1990/92 working pape ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Economics

Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on ''both sides'' of a trade". William F. Sharpe"Financial Economics", in Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus:Merton H. Miller, (1999). The History of Finance: An Eyewitness Account, ''Journal of Portfolio Management''. Summer 1999. asset pricing, commonly known as "Investments", and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance. The subject is concerned with "the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment".See Fama ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Fund

An exchange-traded fund (ETF) is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold from other owners throughout the day on stock exchanges whereas mutual funds are bought and sold from the issuer based on their price at day's end. An ETF holds assets such as stocks, bonds, currencies, futures contracts, and/or commodities such as gold bars, and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occasionally occur. Most ETFs are index funds: that is, they hold the same securities in the same proportions as a certain stock market index or bond market index. The most popular ETFs in the U.S. replicate the S&P 500, the total market index, the NASDAQ-100 index, the price of gold, the "growth" stocks in the Russell 1000 Index, or the index of the largest technology compan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lattice Model (finance)

In finance, a lattice model is a technique applied to the valuation of derivatives, where a discrete time model is required. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at "all" times (any time) before and including maturity. A continuous model, on the other hand, such as Black–Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par. The method is also used for valuing certain exotic options, where because of path dependence in the payoff, Monte Carlo methods for option pricing fail to account for optimal decisions to terminate the derivative by early exercise, though methods now exist for solving this problem. Equity and commodity derivatives In general the approach is to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Implied Binomial Tree

In finance, a lattice model is a technique applied to the valuation of derivatives, where a discrete time model is required. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at "all" times (any time) before and including maturity. A continuous model, on the other hand, such as Black–Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par. The method is also used for valuing certain exotic options, where because of path dependence in the payoff, Monte Carlo methods for option pricing fail to account for optimal decisions to terminate the derivative by early exercise, though methods now exist for solving this problem. Equity and commodity derivatives In general the approach is to divi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Edgeworth Binomial Tree

In finance, a lattice model is a technique applied to the valuation of derivatives, where a discrete time model is required. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at "all" times (any time) before and including maturity. A continuous model, on the other hand, such as Black–Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par. The method is also used for valuing certain exotic options, where because of path dependence in the payoff, Monte Carlo methods for option pricing fail to account for optimal decisions to terminate the derivative by early exercise, though methods now exist for solving this problem. Equity and commodity derivatives In general the approach is to divi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Compound Option

A compound option or split-fee option is an option on an option. The exercise payoff of a compound option involves the value of another option. A compound option then has two expiration dates and two strike prices. Usually, compounded options are used for currency or fixed income Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the pri ... markets where insecurity exists regarding the option's risk protection. Another common business application that compound options are used for is to hedge bids for business projects that may or may not be accepted. Variants Compound options provide their owners with the right to buy or sell another option. These options create positions with greater leverage than do traditional options. There are four basic types of compound options: * Call on Call (CoC) * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

University Of California, Los Angeles

The University of California, Los Angeles (UCLA) is a public university, public Land-grant university, land-grant research university in Los Angeles, California. UCLA's academic roots were established in 1881 as a Normal school, teachers college then known as the southern branch of the California State Normal School (now San Jose State University, San José State University). This school was absorbed with the official founding of UCLA as the Southern Branch of the University of California in 1919, making it the second-oldest of the 10-campus University of California system (after UC Berkeley). UCLA offers 337 undergraduate and graduate degree programs in a wide range of disciplines, enrolling about 31,600 undergraduate and 14,300 graduate and professional students. UCLA received 174,914 undergraduate applications for Fall 2022, including transfers, making the school the most applied-to Higher education in the United States, university in the United States. The university is or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stanford University

Stanford University, officially Leland Stanford Junior University, is a Private university, private research university in Stanford, California. The campus occupies , among the largest in the United States, and enrolls over 17,000 students. Stanford is considered among the most prestigious universities in the world. Stanford was founded in 1885 by Leland Stanford, Leland and Jane Stanford in memory of their only child, Leland Stanford Jr., who had died of typhoid fever at age 15 the previous year. Leland Stanford was a List of United States senators from California, U.S. senator and former List of governors of California, governor of California who made his fortune as a Big Four (Central Pacific Railroad), railroad tycoon. The school admitted its first students on October 1, 1891, as a Mixed-sex education, coeducational and non-denominational institution. Stanford University struggled financially after the death of Leland Stanford in 1893 and again after much of the campus was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

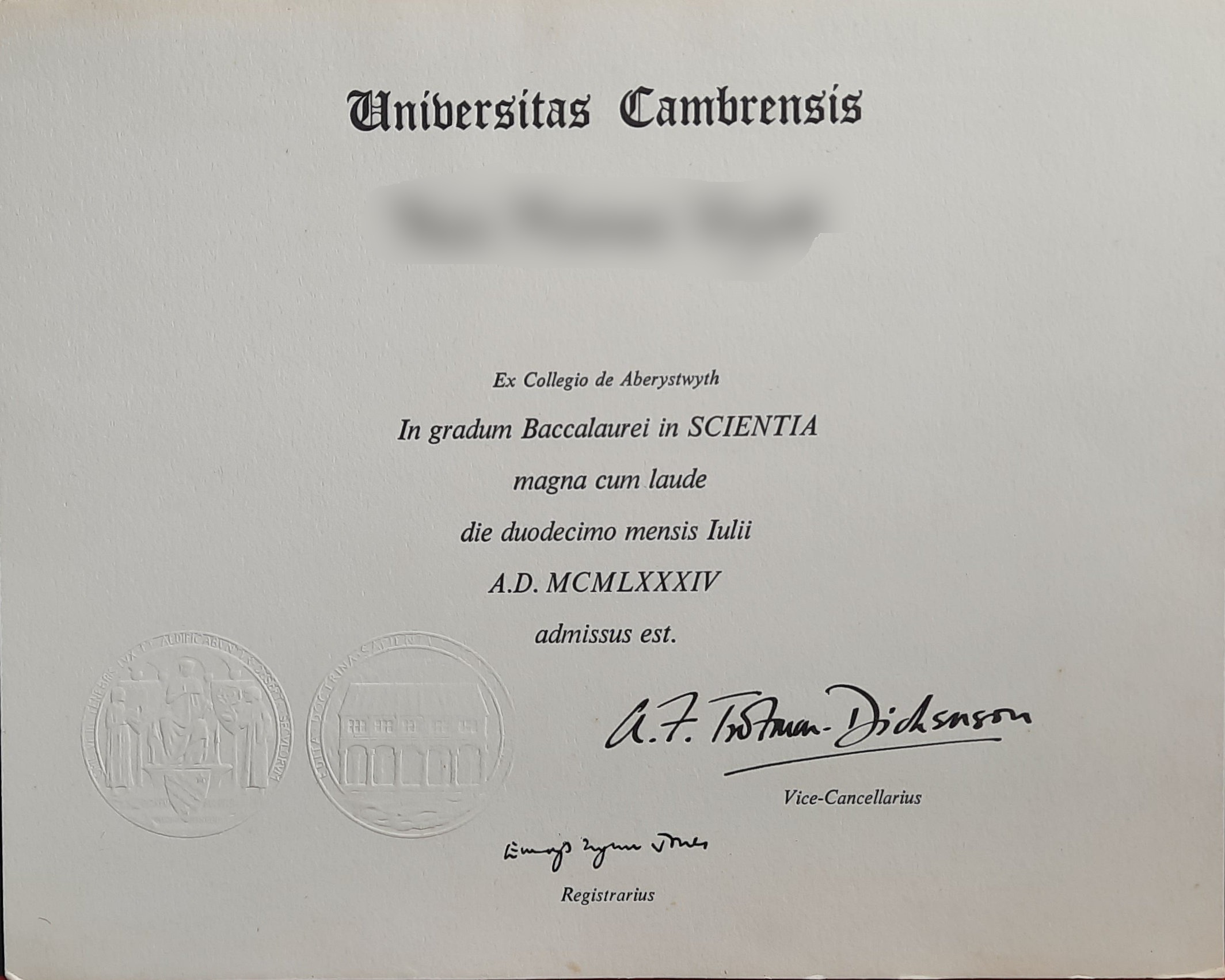

Magna Cum Laude

Latin honors are a system of Latin phrases used in some colleges and universities to indicate the level of distinction with which an academic degree has been earned. The system is primarily used in the United States. It is also used in some Southeastern Asian countries with European colonial history, such as Indonesia and the Philippines, although sometimes translations of these phrases are used instead of the Latin originals. The honors distinction should not be confused with the honors degrees offered in some countries, or with honorary degrees. The system usually has three levels of honor: ''cum laude'', ''magna cum laude'', and ''summa cum laude''. Generally, a college or university's regulations set out definite criteria a student must meet to obtain a given honor. For example, the student might be required to achieve a specific grade point average, submit an honors thesis for evaluation, be part of an honors program, or graduate early. Each school sets its own standards. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harvard University

Harvard University is a private Ivy League research university in Cambridge, Massachusetts. Founded in 1636 as Harvard College and named for its first benefactor, the Puritan clergyman John Harvard, it is the oldest institution of higher learning in the United States and one of the most prestigious and highly ranked universities in the world. The university is composed of ten academic faculties plus Harvard Radcliffe Institute. The Faculty of Arts and Sciences offers study in a wide range of undergraduate and graduate academic disciplines, and other faculties offer only graduate degrees, including professional degrees. Harvard has three main campuses: the Cambridge campus centered on Harvard Yard; an adjoining campus immediately across Charles River in the Allston neighborhood of Boston; and the medical campus in Boston's Longwood Medical Area. Harvard's endowment is valued at $50.9 billion, making it the wealthiest academic institution in the world. Endo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bachelor Of Arts

Bachelor of arts (BA or AB; from the Latin ', ', or ') is a bachelor's degree awarded for an undergraduate program in the arts, or, in some cases, other disciplines. A Bachelor of Arts degree course is generally completed in three or four years, depending on the country and institution. * Degree attainment typically takes four years in Afghanistan, Armenia, Azerbaijan, Bangladesh, Brazil, Brunei, China, Egypt, Ghana, Greece, Georgia, Hong Kong, Indonesia, Iran, Iraq, Ireland, Japan, Kazakhstan, Kenya, Kuwait, Latvia, Lebanon, Lithuania, Mexico, Malaysia, Mongolia, Myanmar, Nepal, Netherlands, Nigeria, Pakistan, the Philippines, Qatar, Russia, Saudi Arabia, Scotland, Serbia, South Korea, Spain, Sri Lanka, Taiwan, Thailand, Turkey, Ukraine, the United States and Zambia. * Degree attainment typically takes three years in Albania, Australia, Bosnia and Herzegovina, the Caribbean, Iceland, India, Israel, Italy, New Zealand, Norway, South Africa, Switzerland, the Canadian province ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quantitative Analyst

Quantitative may refer to: * Quantitative research, scientific investigation of quantitative properties * Quantitative analysis (other) * Meter (poetry), Quantitative verse, a metrical system in poetry * Statistics, also known as quantitative analysis * Numerical data, also known as quantitative data * Quantification (science) See also *Qualitative (other), Qualitative {{disambig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)