|

James B. Lee, Jr.

James Bainbridge Lee, Jr. (October 30, 1952 – June 17, 2015) was an American investment banker, notable for his role in the development of the leveraged finance markets in the U.S. in the 1980s. He is widely credited as the architect of the modern-day syndicated loan market.The New York Public Library Honors James B. Lee, Jr. New York Public Library, June 26, 2008 At the time of his death, Lee was vice chairman of JPMorgan Chase & Co. and a member of the bank's executive committee. He was also Co-Chairman of JPMorgan's investment bank. Early life Lee was born on October 30, 1952 in |

Manhattan, New York

Manhattan (), known regionally as the City, is the most densely populated and geographically smallest of the five boroughs of New York City. The borough is also coextensive with New York County, one of the original counties of the U.S. state of New York. Located near the southern tip of New York State, Manhattan is based in the Eastern Time Zone and constitutes both the geographical and demographic center of the Northeast megalopolis and the urban core of the New York metropolitan area, the largest metropolitan area in the world by urban landmass. Over 58 million people live within 250 miles of Manhattan, which serves as New York City’s economic and administrative center, cultural identifier, and the city’s historical birthplace. Manhattan has been described as the cultural, financial, media, and entertainment capital of the world, is considered a safe haven for global real estate investors, and hosts the United Nations headquarters. New York City is the headquarters of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers And Acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is a legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. A deal may be euphemistically called a ''merger of equals'' if both CEOs agree that joining together is in the best interest of both of their companies. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. In most countries, mergers and acquisitions must co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dell

Dell is an American based technology company. It develops, sells, repairs, and supports computers and related products and services. Dell is owned by its parent company, Dell Technologies. Dell sells personal computers (PCs), servers, data storage devices, network switches, software, computer peripherals, HDTVs, cameras, printers, and electronics built by other manufacturers. The company is known for how it manages its supply chain and electronic commerce. This includes Dell selling directly to customers and delivering PCs that the customer wants. Dell was a pure hardware vendor until 2009 when it acquired Perot Systems. Dell then entered the market for IT services. The company has expanded storage and networking systems. It is now expanding from offering computers only to delivering a range of technology for enterprise customers. Dell is a publicly-traded company (), as well as a component of the NASDAQ-100 and S&P 500. It is the 3rd largest personal computer vendor as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Time Warner Cable

Time Warner Cable, Inc. (TWC) was an American cable television company. Before it was acquired by Charter Communications on May 18, 2016, it was ranked the second largest cable company in the United States by revenue behind only Comcast, operating in 29 states. Its corporate headquarters were located in the Time Warner Center in Midtown Manhattan, New York City, with other corporate offices in Stamford, Connecticut; Charlotte, North Carolina; and Herndon, Virginia. It was controlled by Warner Communications, then by Time Warner (later known as WarnerMedia and now Warner Bros. Discovery). That company spun off the cable operations in March 2009 as part of a larger restructuring. From 2009 to 2016, Time Warner Cable was an entirely independent company, continuing to use the Time Warner name under license from its former parent company (including the " Road Runner" name for its Internet service, now Spectrum Internet). In 2014, the company was the subject of a proposed purchase ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Comcast

Comcast Corporation (formerly known as American Cable Systems and Comcast Holdings),Before the AT&T merger in 2001, the parent company was Comcast Holdings Corporation. Comcast Holdings Corporation now refers to a subsidiary of Comcast Corporation, not the parent company (seeBloomberg profile on Comcast Holdings Corporation. Technically, the current parent company was founded December 7, 2001 as CAB Holdings Corporation, which changed its name to AT&T Comcast Corporation before finally taking on the Comcast Corporation name (seeNov 2002 8K/A Form anNov 2002 S-4) headquartered in Philadelphia, is the largest American multinational telecommunications conglomerate. It is the second-largest broadcasting and cable television company in the world by revenue (behind AT&T), the largest pay-TV company, the largest cable TV company and largest home Internet service provider in the United States, and the nation's third-largest home telephone service provider. It provides services to U.S. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Insider

''Insider'', previously named ''Business Insider'' (''BI''), is an American financial and business news website founded in 2007. Since 2015, a majority stake in ''Business Insider''s parent company Insider Inc. has been owned by the German publishing house Axel Springer. It operates several international editions, including one in the United Kingdom. ''Insider'' publishes original reporting and aggregates material from other outlets. , it maintained a liberal policy on the use of anonymous sources. It has also published native advertising and granted sponsors editorial control of its content. The outlet has been nominated for several awards, but is criticized for using factually incorrect clickbait headlines to attract viewership. In 2015, Axel Springer SE acquired 88 percent of the stake in Insider Inc. for $343 million (€306 million), implying a total valuation of $442 million. In February 2021, the brand was renamed simply ''Insider''. History ''Busi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Restructuring Of Chrysler

Chrysler LLC and 24 of its affiliated subsidiaries filed a consolidated petition for bankruptcy on April 30, 2009, with the federal bankruptcy court in New York. The court filing occurred upon failure of the company to come to an agreement with its creditors for an outside-of-bankruptcy restructuring plan, by the April 30 deadline mandated by the federal government. At the time, Chrysler was controlled by the private investment company, Cerberus Capital Management, which, along with other investors, purchased a majority stake in 2007. Initial court proceedings On Sunday, May 31, 2009, bankruptcy judge Arthur J. Gonzalez approved a proposed government restructuring plan and sale of Chrysler's assets. The sale allows most of the assets of Chrysler to be purchased by a new entity in which Fiat would own 20%, and the autoworker's union retirement health care trust (voluntary benefit association "VEBA") 55%, with the U.S. and Canadian government as minority stakeholders. Secured bon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

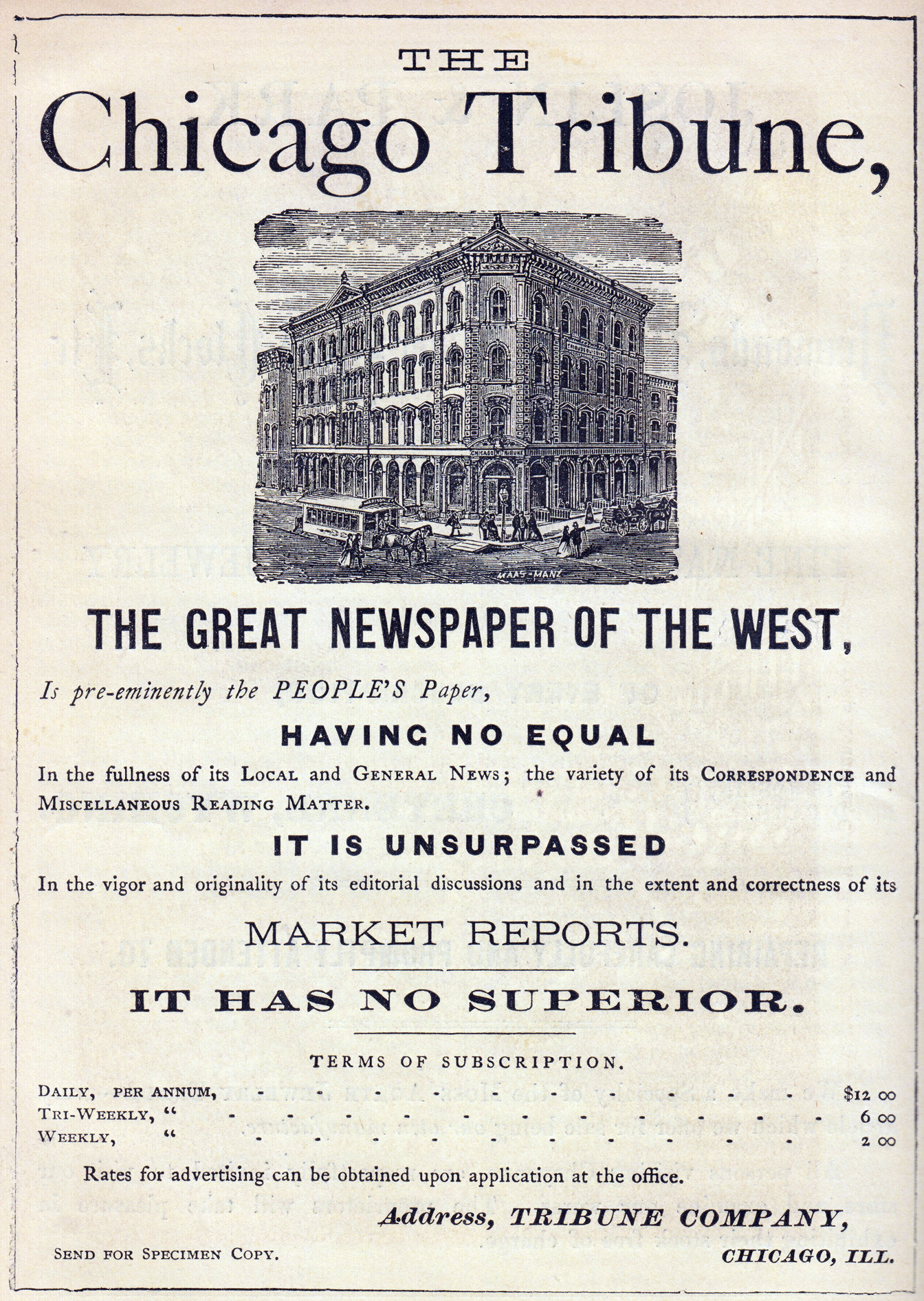

Chicago Tribune

The ''Chicago Tribune'' is a daily newspaper based in Chicago, Illinois, United States, owned by Tribune Publishing. Founded in 1847, and formerly self-styled as the "World's Greatest Newspaper" (a slogan for which WGN radio and television are named), it remains the most-read daily newspaper in the Chicago metropolitan area and the Great Lakes region. It had the sixth-highest circulation for American newspapers in 2017. In the 1850s, under Joseph Medill, the ''Chicago Tribune'' became closely associated with the Illinois politician Abraham Lincoln, and the Republican Party's progressive wing. In the 20th century under Medill's grandson, Robert R. McCormick, it achieved a reputation as a crusading paper with a decidedly more American-conservative anti-New Deal outlook, and its writing reached other markets through family and corporate relationships at the ''New York Daily News'' and the ''Washington Times-Herald.'' The 1960s saw its corporate parent owner, Tribune Company, rea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

General Motors

The General Motors Company (GM) is an American Multinational corporation, multinational Automotive industry, automotive manufacturing company headquartered in Detroit, Michigan, United States. It is the largest automaker in the United States and was the largest in the world for 77 years before losing the top spot to Toyota in 2008. General Motors operates manufacturing plants in eight countries. Its four core automobile brands are Chevrolet, Buick, GMC (automobile), GMC, and Cadillac. It also holds interests in Chinese brands Wuling Motors and Baojun as well as DMAX (engines), DMAX via joint ventures. Additionally, GM also owns the BrightDrop delivery vehicle manufacturer, GM Defense, a namesake Defense vehicles division which produces military vehicles for the United States government and military; the vehicle safety, security, and information services provider OnStar; the auto parts company ACDelco, a GM Financial, namesake financial lending service; and majority ownership in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Variety (magazine)

''Variety'' is an American media company owned by Penske Media Corporation. The company was founded by Sime Silverman in New York City in 1905 as a weekly newspaper reporting on theater and vaudeville. In 1933 it added ''Daily Variety'', based in Los Angeles, to cover the motion-picture industry. ''Variety.com'' features entertainment news, reviews, box office results, cover stories, videos, photo galleries and features, plus a credits database, production charts and calendar, with archive content dating back to 1905. History Foundation ''Variety'' has been published since December 16, 1905, when it was launched by Sime Silverman as a weekly periodical covering theater and vaudeville with its headquarters in New York City. Silverman had been fired by ''The Morning Telegraph'' in 1905 for panning an act which had taken out an advert for $50. As a result, he decided to start his own publication "that ouldnot be influenced by advertising." With a loan of $1,500 from his father- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leveraged Buyout

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money (leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The use of debt, which normally has a lower cost of capital than equity, serves to reduce the overall cost of financing the acquisition. The cost of debt is lower because interest payments often reduce corporate income tax liability, whereas dividend payments normally do not. This reduced cost of financing allows greater gains to accrue to the equity, and, as a result, the debt serves as a lever to increase the returns to the equity. The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)