|

Jackson Hole Economic Symposium

The Federal Reserve's Jackson Hole Economic Symposium is a three-day annual international conference put on by the Federal Reserve Bank of Kansas City at Jackson Hole in the United States attended by central bank leaders from around the world. Central bankers discuss world events and financial trends and the discussions at Jackson Hole are watched for economic news and specifically the likely direction of global interest rates. The event is held at vacation destination Jackson Lake Lodge in Grand Teton National Park, in Wyoming's Teton County. It was held in a few different locations in the late 1970s, but Jackson Hole has been the location since 1981. The conference was placed there partly because Paul Volcker, the then-Federal Reserve chairman, wanted to attend the great fly fishing in the area, which is held in late August. Among the regular attendees are top economists from the Federal Reserve Board, as well as other policymakers such as foreign central bank governors. Econo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of Japan

The is the central bank of Japan.Louis Frédéric, Nussbaum, Louis Frédéric. (2005). "Nihon Ginkō" in The bank is often called for short. It has its headquarters in Chūō, Tokyo, Chūō, Tokyo. History Like most modern Japanese institutions, the Bank of Japan was founded after the Meiji Restoration. Prior to the Restoration, Japan's feudal fiefs all issued their own money, ''Scrip of Edo period Japan, hansatsu'', in an array of incompatible denominations, but the ''New Currency Act'' of Meiji 4 (1871) did away with these and established the yen as the new decimal currency, which had parity with the Mexican silver dollar. The former Han (Japan), han (fiefs) became Prefectures of Japan, prefectures and their mints became private chartered banks which, however, initially retained the right to print money. For a time both the central government and these so-called "national" banks issued money. A period of unanticipated consequences was ended when the Bank of Japan was founded ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. U.S. Congress, Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and bank regulation, regulating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Regulatory Authorities Of The United States

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability ass ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve System Governors

Federal or foederal (archaic) may refer to: Politics General *Federal monarchy, a federation of monarchies *Federation, or ''Federal state'' (federal system), a type of government characterized by both a central (federal) government and states or regional governments that are partially self-governing; a union of states *Federal republic, a federation which is a republic *Federalism, a political philosophy *Federalist, a political belief or member of a political grouping *Federalization, implementation of federalism Particular governments *Federal government of the United States **United States federal law **United States federal courts *Government of Argentina *Government of Australia *Government of Pakistan *Federal government of Brazil *Government of Canada *Government of India *Federal government of Mexico * Federal government of Nigeria *Government of Russia *Government of South Africa *Government of Philippines Other *''The Federalist Papers'', critical early arguments in fa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Banks

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union, and oversees their commercial banking system. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Most central banks also have supervisory and regulatory powers to ensure the stability of member institutions, to prevent bank runs, and to discourage reckless or fraudulent behavior by member banks. Central banks in most developed nations are institutionally independent from political interference. Still, limited control by the executive and legislative bodies exists. Activities of central banks Functions of a central bank usually include: * Monetary policy: by setting the official interest rate and controlling the money supply; *Financial stability: acting as a government's banker and as the bankers' bank ("lender of last resort"); * Reserve management: managing a country's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Regulation In The United States

Bank regulation in the United States is highly fragmented compared with other G10 countries, where most countries have only one bank regulator. In the U.S., banking is regulated at both the federal and state level. Depending on the type of charter a banking organization has and on its organizational structure, it may be subject to numerous federal and state banking regulations. Apart from the bank regulatory agencies the U.S. maintains separate securities, commodities, and insurance regulatory agencies at the federal and state level, unlike Japan and the United Kingdom (where regulatory authority over the banking, securities and insurance industries is combined into one single financial-service agency). Bank examiners are generally employed to supervise banks and to ensure compliance with regulations. U.S. banking regulation addresses privacy, disclosure, fraud prevention, anti-money laundering, anti-terrorism, anti-usury lending, and the promotion of lending to lower-income po ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Highest-income Counties In The United States

There are 3,144 counties and county-equivalents in the United States. The source of the data is the U.S. Census Bureau and the data is current as of the indicated year. Independent cities are considered county-equivalent by the Census Bureau. Summary Before the American Civil War, the wealthiest counties were primarily located in Louisiana and Mississippi, because of the high number of slaves, who were not counted as part of the population. Loudoun County, Virginia, a suburb of District of Columbia, is the highest-income county by median household income. Another District of Columbia suburb, Arlington County, Virginia, ranked as the highest-income county by median family income as of 2013. Many of the top counties in the following lists are found in the Northeast Megalopolis, particularly in the Washington metropolitan area and the New York metropolitan area. Median household income 2020 Census Presented below are the 100 highest income counties in the United States by medi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

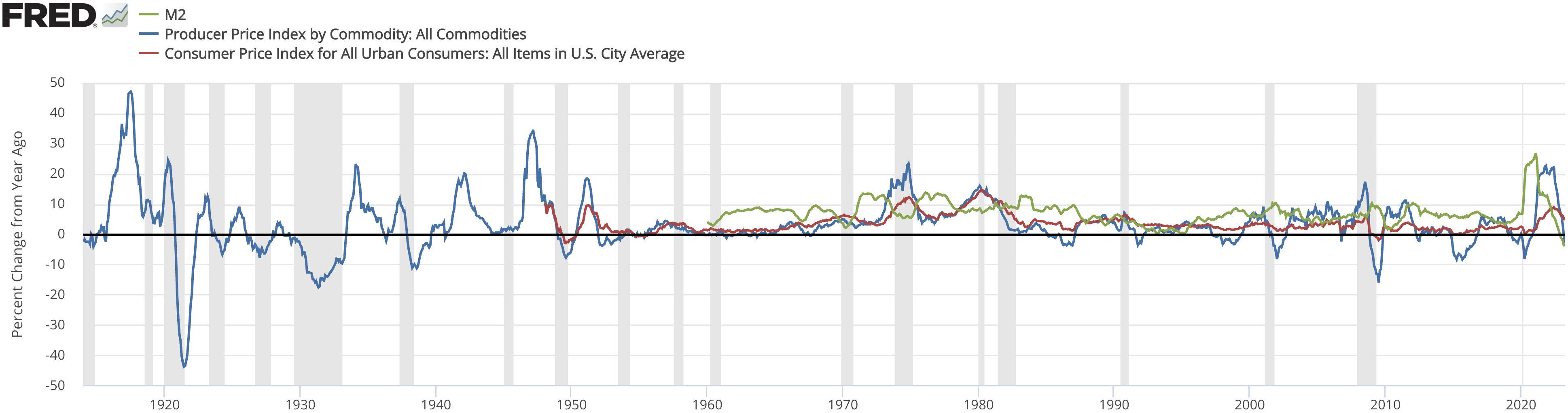

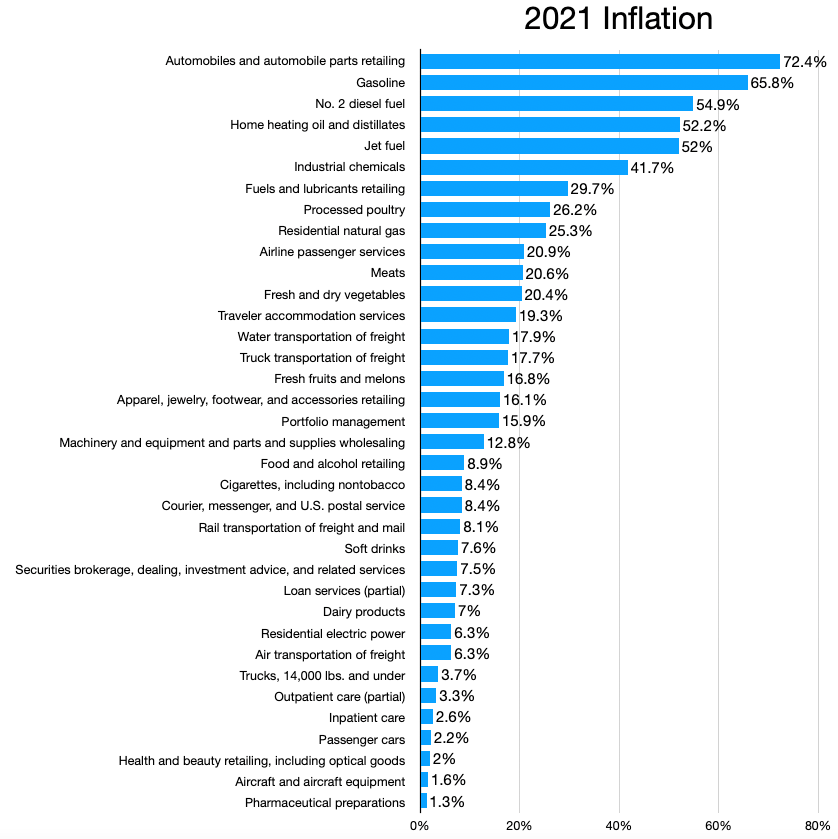

2020s Commodities Boom

The 2020s commodities boom refers to the rise of many commodity prices in the early 2020s following the COVID-19 pandemic. The COVID-19 recession initially made commodity prices drop, but lockdowns, supply chain bottlenecks, and dovish monetary policy limited supply and created excess demand causing a commodity super cycle rise. The 2022 Russian invasion of Ukraine worsened the bottlenecks, creating the 2022 Russia–European Union gas dispute and the 2021–2022 United Kingdom natural gas supplier crisis, contributing to the 2021–present global energy crisis. As Russia and Belarus are major fertilizer exporters and natural gas is a primary component in many fertilizers, fertilizer prices rose accordingly, starting the 2022 food crises. The previous commodity super cycle was the 2000s commodities boom, which was attributed to emerging markets, especially that of China, providing a high demand for raw materials. Food Global food shortages already existed due to the COVID ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2022 Food Crises

2022 saw a rapid increase in food prices and shortages of food supplies around the world. The compounding crises in distinct parts of the world were caused by compounding geopolitical and economic crisis. The crises followed food security and economic crises during the COVID-19 pandemic. Following the 2022 Russian invasion of Ukraine, the Food and Agriculture Organization, as well as other observers of the food commodities markets, warned of a collapse in food supply and price increases. Much of the concern is related to supply shortages of key commodity crops, such as wheat, corn, and oil seeds, which could cause price increases. The invasion also led to fuel and associated fertilizer price increases, causing further food shortfalls and price increases. Even before the invasion, food prices were already at record highs. As of February 2022, year-over-year food prices were up 20%, according to the Food and Agriculture Organization. The war further increased year-over-year p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2021–2022 Inflation Surge

The 2021–2022 inflation surge is the higher-than-average economic inflation throughout much of the world that began in early 2021. It has been attributed to the 2021 global supply chain crisis caused by the COVID-19 pandemic, and unexpected demands for certain goods. As a result, many countries have seen their highest rates of inflation in decades. Background and causes While there is no unanimous agreement by economists as to the exact cause of the inflation surge, there are several theories. Most attribute it to product shortages resulting from global supply-chain problems, largely caused by the COVID-19 pandemic. Other causes cited include strong consumer demand; turmoil in the labor market; and the fact that 2021 prices are being compared to 2020 prices, which were depressed due to pandemic-related shutdowns. Additionally, many economists cite the unprecedented level of spending from the passage of COVID-19 relief programs by the Biden Administration as a key factor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Bank

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve Act of 1913. The banks are jointly responsible for implementing the monetary policy set forth by the Federal Open Market Committee, and are divided as follows: Some banks also possess branches, with the whole system being headquartered at the Eccles Building in Washington, D.C. History The Federal Reserve Banks are the most recent institutions that the United States government has created to provide functions of a central bank. Prior institutions have included the First (1791–1811) and Second (1818–1824) Banks of the United States, the Independent Treasury (1846–1920) and the National Banking System (1863–1935). Several policy questions have arisen with these institutions, including the degree of influence by private interes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |