|

Internal Revenue Service Restructuring And Reform Act Of 1998

The Internal Revenue Service Restructuring and Reform Act of 1998, also known as Taxpayer Bill of Rights III (), resulted from hearings held by the United States Congress in 1996 and 1997. The Act included numerous amendments to the Internal Revenue Code of 1986. The bill was passed in the Senate unanimously, and was seen as a major reform of the Internal Revenue Service. Provisions Individuals The Act provides that individuals who fail to provide their taxpayer identification numbers are not allowed to take the earned income credit for the year in which the failure occurs. Individuals are allowed to deduct interest expense paid on certain student loans. The exclusion, from income, of gain on the sale of a principal residence (up to $250,000 for individuals or $500,000 on a joint return) is pro-rated for certain taxpayers. The use of a continuous levy—a levy attaching to both property held on the date of levy and to property acquired after that date—must be specifically app ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code Of 1986

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, effe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commissioner Of Internal Revenue

The Commissioner of Internal Revenue is the head of the Internal Revenue Service (IRS), an agency within the United States Department of the Treasury. The office of Commissioner was created by Congress as part of the Revenue Act of 1862. Section 7803 of the Internal Revenue Code provides for the appointment of a Commissioner of Internal Revenue to administer and supervise the execution and application of the internal revenue laws. The Commissioner is appointed by the President of the United States, with the consent of the U.S. Senate, for a five-year term. Douglas O’Donnell became the current and Acting Commissioner of Internal Revenue after Charles P. Rettig's term as Commissioner ended on November 12, 2022. Responsibilities The Commissioner's duties include administering, managing, conducting, directing, and supervising "the execution and application of the internal revenue laws or related statutes and tax conventions to which the United States is a party" and advising the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Tax Court

The United States Tax Court (in case citations, T.C.) is a federal trial court of record established by Congress under Article I of the U.S. Constitution, section 8 of which provides (in part) that the Congress has the power to "constitute Tribunals inferior to the supreme Court". The Tax Court specializes in adjudicating disputes over federal income tax, generally prior to the time at which formal tax assessments are made by the Internal Revenue Service. Though taxpayers may choose to litigate tax matters in a variety of legal settings, outside of bankruptcy, the Tax Court is the only forum in which taxpayers may do so without having first paid the disputed tax in full. Parties who contest the imposition of a tax may also bring an action in any United States District Court, or in the United States Court of Federal Claims; however these venues require that the tax be paid first, and that the party then file a lawsuit to recover the contested amount paid (the "full payment rule" ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Installment Agreement

An Installment Agreement in the United States is an Internal Revenue Service (IRS) program which allows individuals to pay tax debt in monthly payments. The total amount paid can be the full amount of what is owed, or it can be a partial amount. There are several different kinds of Installment Agreements: Guaranteed, Streamline, Partial and Full Pay. Usually, one must owe less than ''$50,000'' to get a streamlined installment agreement. The payment amount is the total amount of debt divided by 72 months. If the amount owed is less than ''$25,000'' one can complete the Form 9465. If you owe more than 25,000 but less than $50,000 you need to submit a 433-D. If you owe more than $50,000 you will need to submit a financial statement or 433f or 433a. If you owe business taxes like 941 or 940 taxes your payment plan will be 24 months not 72 months. There are benefits to having an installment agreement with the IRS in that in most cases you can avoid a tax lien if you have a direct debit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act (FDCPA), Pub. L. 95-109; 91 Stat. 874, codified as –1692p, approved on September 20, 1977 (and as subsequently amended) is a consumer protection amendment, establishing legal protection from abusive debt collection practices, to the Consumer Credit Protection Act, as Title VIII of that Act. The statute's stated purposes are: to eliminate abusive practices in the collection of consumer debts, to promote fair debt collection, and to provide consumers with an avenue for disputing and obtaining validation of debt information in order to ensure the information's accuracy. The Act creates guidelines under which debt collectors may conduct business, defines rights of consumers involved with debt collectors, and prescribes penalties and remedies for violations of the Act.; It is sometimes used in conjunction with the Fair Credit Reporting Act. People and entities covered by the FDCPA The FDCPA broadly defines a debt collector as "any person w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Protester (United States)

A tax protester is someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. Tax protesters are different from tax resisters, who refuse to pay taxes as a protest against a government or its policies, or a moral opposition to taxation in general, not out of a belief that the tax law itself is invalid. The United States has a large and organized culture of people who espouse such theories. Tax protesters also exist in other countries. Legal commentator Daniel B. Evans has defined tax protesters as people who "refuse to pay taxes or file tax returns out of a mistaken belief that the federal income tax is unconstitutional, invalid, voluntary, or otherwise does not apply to them under one of a number of bizarre arguments" (divided into several classes: constitutional, conspiracy, administrative, statutory, and arguments based on 16th Amendment and the "861" section of the tax code; see the Tax protester arguments article for an ov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IRS Oversight Board

The IRS Oversight Board is a nine-member board established by the Internal Revenue Service Restructuring and Reform Act of 1998 to oversee the Internal Revenue Service. It usually meets four times a year. The board made recommendations such as delaying the IRS target for taxpayers who file electronically, and giving electronic filers more time, and opposing the idea of contracting debt collection to private companies. The board released an ''Annual Report to Congress'' as well as an annual ''Taxpayer Attitude Survey''. The survey covered topics like how Americans felt about cheating on taxes. The board was criticized as acting more like an advisory board, rather than providing meaningful independent oversight. Operations of the board has been suspended since 2015, due to the lack of a quorum. There are various legislative proposals to revamp the board (), or to eliminate it completely (). Senators Rob Portman and Bob Kerrey, who were involved in writing the 1998 bill, both suppor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

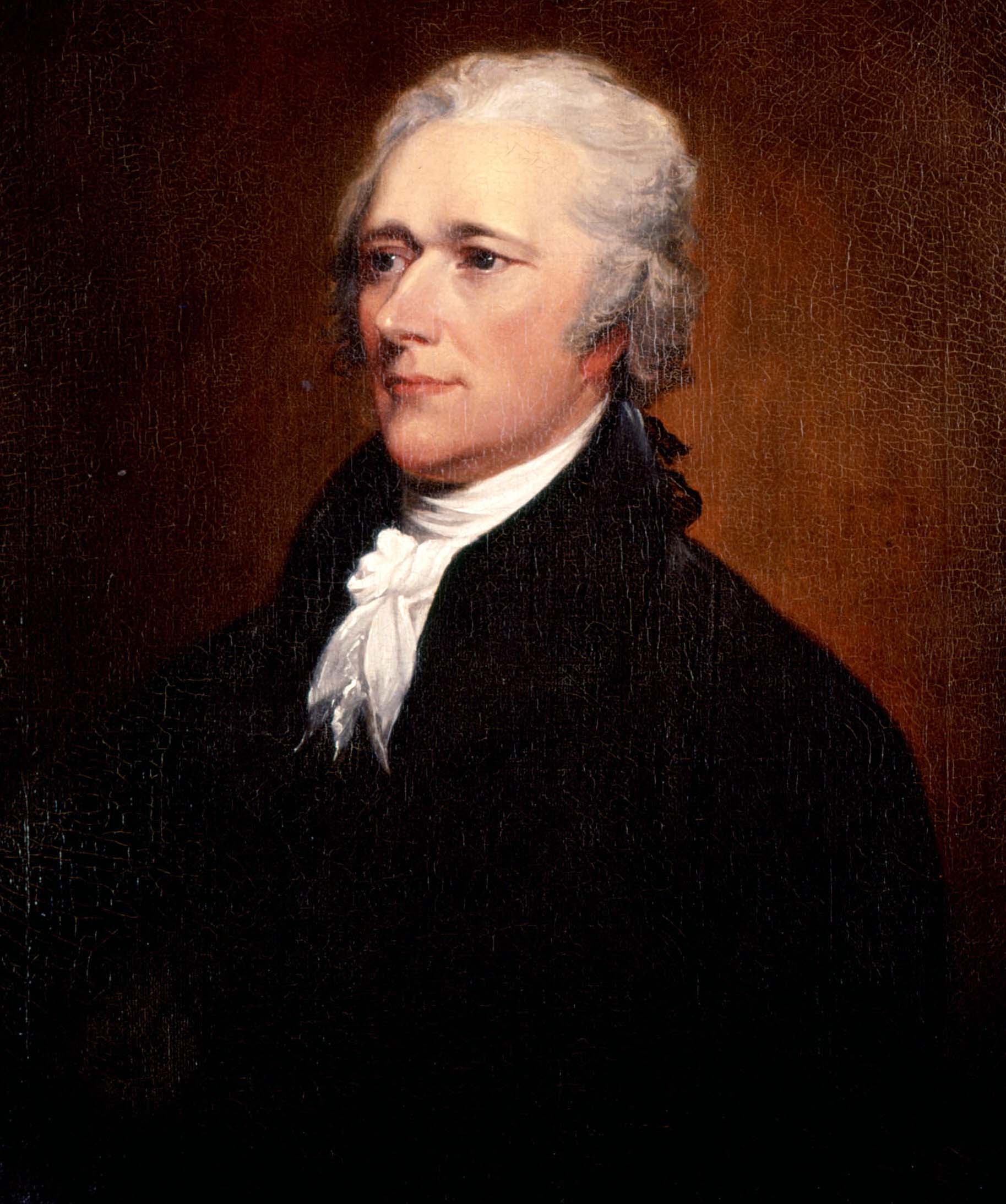

Secretary Of The Treasury

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal advisor to the president of the United States on all matters pertaining to economic and fiscal policy. The secretary is a statutory member of the Cabinet of the United States, and is fifth in the presidential line of succession. Under the Appointments Clause of the United States Constitution, the officeholder is nominated by the president of the United States, and, following a confirmation hearing before the Senate Committee on Finance, is confirmed by the United States Senate. The secretary of state, the secretary of the treasury, the secretary of defense, and the attorney general are generally regarded as the four most important Cabinet officials, due to the size and importance of their respective departments. The current secretary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Taxpayer Advocate

The Office of the Taxpayer Advocate, also called the Taxpayer Advocate Service (TAS), is an office within the Internal Revenue Service (IRS) of the U.S. Department of the Treasury, reporting directly to the Commissioner of Internal Revenue. The office is under the supervision and direction of the National Taxpayer Advocate who is appointed by the Secretary of Treasury. History Established in 1996, the Office of the Taxpayer Advocate has its origins in other Internal Revenue Service programs, such as the Taxpayer Service Program (formalized in 1963) and Problem Resolution Program (established in 1977). On the recommendation of the House Government Operations Committee, the Taxpayer Ombudsman was established within the Office of the IRS Commissioner in 1979, reporting directly to the Commissioner of Internal Revenue. In 1984, the problem resolution offices (PRO) consisted of 80 full time employees and was headed by George A. O'Hanlon, the IRS ombudsman at the time. Commentators call ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill Archer

William Reynolds Archer Jr. (born March 22, 1928) is a retired American lawyer and politician. Archer served two terms, from 1967 to 1971, in the Texas House of Representatives – changing from the Democratic to the Republican party in 1969 – and later represented Texas in the United States House of Representatives as a Republican for 30 years, from 1971 until 2001, serving for his last six years as chairman of the powerful House Ways and Means Committee. Background Archer was born in Houston, Texas. After graduating from St. Thomas High School, Archer attended Rice University and then transferred to the University of Texas at Austin, where he obtained his BBA and law degrees (LL.B.). At the University of Texas, he was a member of the Texas Rho chapter of Sigma Alpha Epsilon. Upon graduating from law school in 1951, Archer was admitted to the State Bar of Texas and started up his practice in Houston, Texas. Within months, Archer was drafted and served as a captain in the Un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, eff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |