|

Tax Protester (United States)

A tax protester is someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. Tax protesters are different from tax resisters, who refuse to pay taxes as a protest against a government or its policies, or a moral opposition to taxation in general, not out of a belief that the tax law itself is invalid. The United States has a large and organized culture of people who espouse such theories. Tax protesters also exist in other countries. Legal commentator Daniel B. Evans has defined tax protesters as people who "refuse to pay taxes or file tax returns out of a mistaken belief that the federal income tax is unconstitutional, invalid, voluntary, or otherwise does not apply to them under one of a number of bizarre arguments" (divided into several classes: constitutional, conspiracy, administrative, statutory, and arguments based on 16th Amendment and the "861" section of the tax code; see the Tax protester arguments article for an ov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Resisters

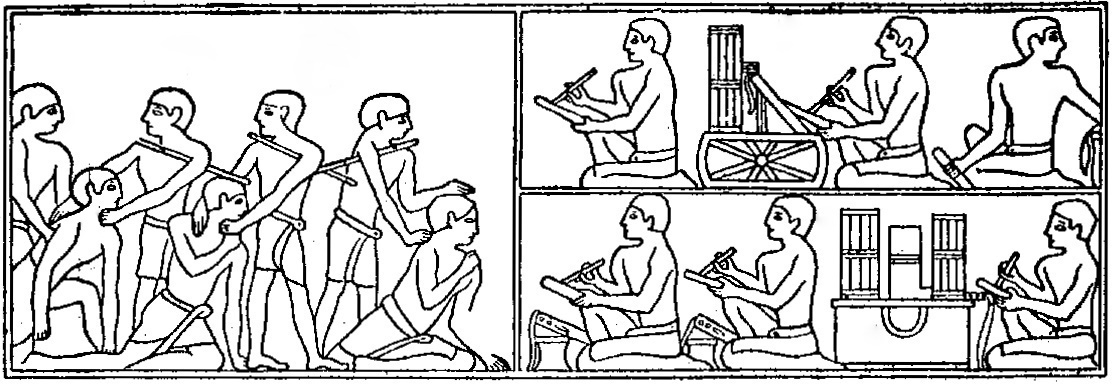

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of direct action and, if in violation of the tax regulations, also a form of civil disobedience. Examples of tax resistance campaigns include those advocating home rule, such as the Salt March led by Mahatma Gandhi, and those promoting women's suffrage, such as the Women's Tax Resistance League. War tax resistance is the refusal to pay some or all taxes that pay for war, and may be practiced by conscientious objectors, pacifists, or those protesting against a particular war. Tax resisters are distinct from "tax protesters", who deny that the legal obligation to pay taxes exists or applies to them. Tax resisters may accept that some law commands them to pay taxes but they still choose to resist taxation. History The earliest and most widespread forms of taxation were the corvée and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Act Of 1924

The United States Revenue Act of 1924 () (June 2, 1924), also known as the Mellon tax bill (after U.S. Secretary of the Treasury Andrew Mellon) cut Federal Government of the United States, federal tax rates for 1924 income. The bottom rate, on income under $4,000, fell from 1.5% to 1.125% (both rates are after reduction by the "earned income credit"). The Act also: * Established the U.S. Board of Tax Appeals, which was later renamed the United States Tax Court in 1942. * Gave the chair of the House Ways and Means Committee the power to obtain the records for any taxpayer, in response to the Teapot Dome scandal. * Declared that there were no longer any "Indians, not taxed" to be not counted for purposes of United States congressional apportionment. A parallel act, the Indian Citizenship Act of 1924 (, Ch. 233 (1924)), granted all non-citizen resident Indians citizenship. President Calvin Coolidge signed the bill into law. From 2019 to 2022, the law was the subject of a court batt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposing military alliances: the Allies and the Axis powers. World War II was a total war that directly involved more than 100 million personnel from more than 30 countries. The major participants in the war threw their entire economic, industrial, and scientific capabilities behind the war effort, blurring the distinction between civilian and military resources. Aircraft played a major role in the conflict, enabling the strategic bombing of population centres and deploying the only two nuclear weapons ever used in war. World War II was by far the deadliest conflict in human history; it resulted in 70 to 85 million fatalities, mostly among civilians. Tens of millions died due to genocides (including the Holocaust), starvation, ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Frivolous Litigation

Frivolous litigation is the use of legal processes with apparent disregard for the merit of one's own arguments. It includes presenting an argument with reason to know that it would certainly fail, or acting without a basic level of diligence in researching the relevant law and facts. That a claim was lost does not imply the claim in itself was frivolous. Frivolous litigation may be based on absurd legal theories, may involve a superabundance or repetition of motions or additional suits, may be uncivil or harassing to the court, or may claim extreme remedies. A claim or defense may be frivolous because it had no underlying justification in fact, or because it was not presented with an argument for a reasonable extension or reinterpretation of the law. A claim may be deemed frivolous because existing laws unequivocally prohibit such a claim, such as a so-called Good Samaritan law. In the United States, Rule 11 of the Federal Rules of Civil Procedure and similar state rules req ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reporter

The ''Federal Reporter'' () is a case law reporter in the United States that is published by West Publishing and a part of the National Reporter System. It begins with cases decided in 1880; pre-1880 cases were later retroactively compiled by West Publishing into a separate reporter, ''Federal Cases''. The fourth and current ''Federal Reporter'' series publishes decisions of the United States courts of appeals and the United States Court of Federal Claims; prior series had varying scopes that covered decisions of other federal courts as well. Though the ''Federal Reporter'' is an unofficial reporter and West is a private company that does not have a legal monopoly over the court opinions it publishes, it has so dominated the industry in the United States that legal professionals, including judges, uniformly cite to the ''Federal Reporter'' for included decisions. Approximately 30 new volumes are published each year. Distinctions The ''Federal Reporter'' has always published de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CCH (company)

CCH, formerly Commerce Clearing House, is a provider of Business software, software and information services for Tax advisor, tax, Accountant, accounting and Auditor, audit workers. Since 1995 it has been a subsidiary of Wolters Kluwer. History CCH has been publishing materials on U.S. tax law and tax compliance since the inception of the modern Income tax in the United States, U.S. federal income tax in 1913. Wolters Kluwer bought the company in 1995. Today, the company is also recognized , IRS, Internal Revenue Service. for its software and integrated workflow tools. CCH operates on a global scale and includes operations in the United States, Europe, Asia-Pacific and Canada. Case law reporters The following is a list of case law reporters published by CCH: *Bankruptcy Law ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

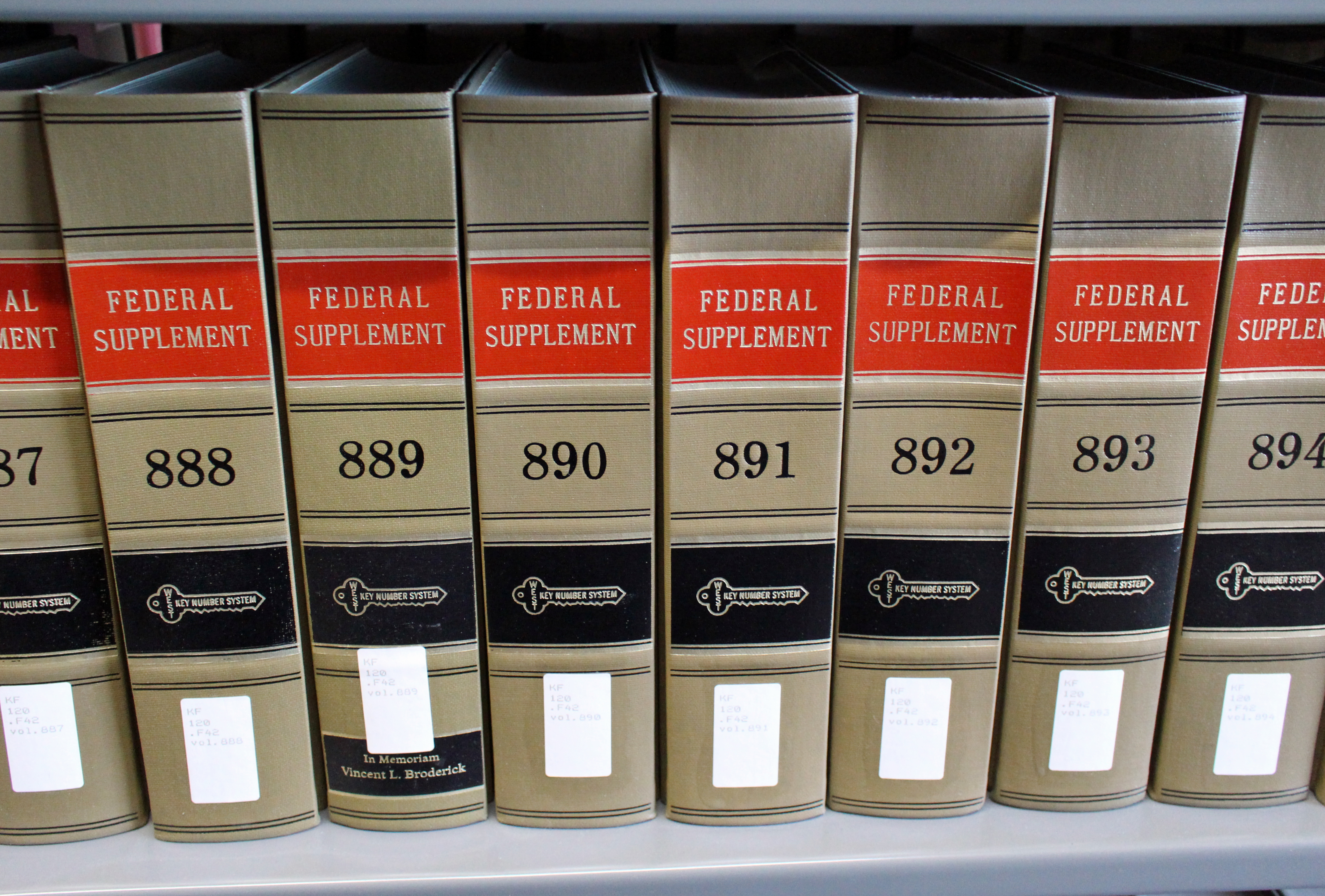

Federal Supplement

The ''Federal Supplement'' ( is a case law reporter published by West Publishing in the United States that includes select opinions of the United States district courts since 1932, and is part of the National Reporter System. Although the ''Federal Supplement'' is an unofficial reporter and West is a private company that does not have a legal monopoly over the court opinions it publishes, it has so dominated the industry in the U.S. that legal professionals uniformly cite the ''Federal Supplement'' for included decisions. Approximately 40 new volumes are published per year. Distinctions Before 1932, federal district court cases were published in the ''Federal Reporter'', which now publishes only case law from the United States Courts of Appeals and the United States Court of Federal Claims; prior series had varying scopes that covered opinions of other federal courts as well. The ''United States Reports'' are the official law reports of the rulings, orders, case tables, and o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Resister

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of direct action and, if in violation of the tax regulations, also a form of civil disobedience. Examples of tax resistance campaigns include those advocating home rule, such as the Salt March led by Mahatma Gandhi, and those promoting women's suffrage, such as the Women's Tax Resistance League. War tax resistance is the refusal to pay some or all taxes that pay for war, and may be practiced by conscientious objectors, pacifists, or those protesting against a particular war. Tax resisters are distinct from "tax protesters", who deny that the legal obligation to pay taxes exists or applies to them. Tax resisters may accept that some law commands them to pay taxes but they still choose to resist taxation. History The earliest and most widespread forms of taxation were the corvée and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form W-4

Form W-4 (otherwise known as the "Employee's Withholding Allowance Certificate") is an Internal Revenue Service (IRS) tax form completed by an employee in the United States to indicate his or her tax situation ( exemptions, status, etc.) to the employer. The W-4 form tells the employer the correct amount of federal tax to withhold from an employee's paycheck. Motivation The W-4 is based on the idea of "allowances"; the more allowances claimed, the less money the employer withholds for tax purposes. The W-4 Form is usually not sent to the IRS; rather, the employer uses the form in order to calculate how much of an employee's salary is withheld. An employee may claim allowances for oneself, one's spouse, and any dependents, along with other miscellaneous reasons, such as being single with only one job. In the latter case, this creates an oddity in that the employee will have one more exemption on the W-4 than on the 1040 tax return. This is not a tax deduction in itself, but a proc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Vietnam War

The Vietnam War (also known by other names) was a conflict in Vietnam, Laos, and Cambodia from 1 November 1955 to the fall of Saigon on 30 April 1975. It was the second of the Indochina Wars and was officially fought between North Vietnam and South Vietnam. The north was supported by the Soviet Union, China, and other communist states, while the south was supported by the United States and other anti-communist allies. The war is widely considered to be a Cold War-era proxy war. It lasted almost 20 years, with direct U.S. involvement ending in 1973. The conflict also spilled over into neighboring states, exacerbating the Laotian Civil War and the Cambodian Civil War, which ended with all three countries becoming communist states by 1975. After the French military withdrawal from Indochina in 1954 – following their defeat in the First Indochina War – the Viet Minh took control of North Vietnam, and the U.S. assumed financial and military support for the South Viet ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commissioner Of Internal Revenue

The Commissioner of Internal Revenue is the head of the Internal Revenue Service (IRS), an agency within the United States Department of the Treasury. The office of Commissioner was created by Congress as part of the Revenue Act of 1862. Section 7803 of the Internal Revenue Code provides for the appointment of a Commissioner of Internal Revenue to administer and supervise the execution and application of the internal revenue laws. The Commissioner is appointed by the President of the United States, with the consent of the U.S. Senate, for a five-year term. Douglas O’Donnell became the current and Acting Commissioner of Internal Revenue after Charles P. Rettig's term as Commissioner ended on November 12, 2022. Responsibilities The Commissioner's duties include administering, managing, conducting, directing, and supervising "the execution and application of the internal revenue laws or related statutes and tax conventions to which the United States is a party" and advising the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |