|

Islamic Development Bank

The Islamic Development Bank ( ar, البنك الإسلامي للتنمية, abbreviated as IsDB) is a multilateral development finance institution that is focused on Islamic finance for infrastructure development and located in Jeddah, Saudi Arabia. There are 57 shareholding member states with the largest single shareholder being Saudi Arabia. History It was founded in 1973 by the Finance Ministers at the first Organisation of the Islamic Conference (now called the Organisation of Islamic Cooperation) with the support of the King of Saudi Arabia at the time ( Faisal), and began its activities on 3 April 1975. On the 22 May 2013, IDB tripled its authorized capital to $150 billion to better serve Muslims in member and non-member countries. The Bank has received credit ratings of AAA from Standard & Poor's, Moody's, and Fitch. Saudi Arabia holds about one quarter of the bank's paid up capital. The IDB is an observer at the United Nations General Assembly. Membership The presen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

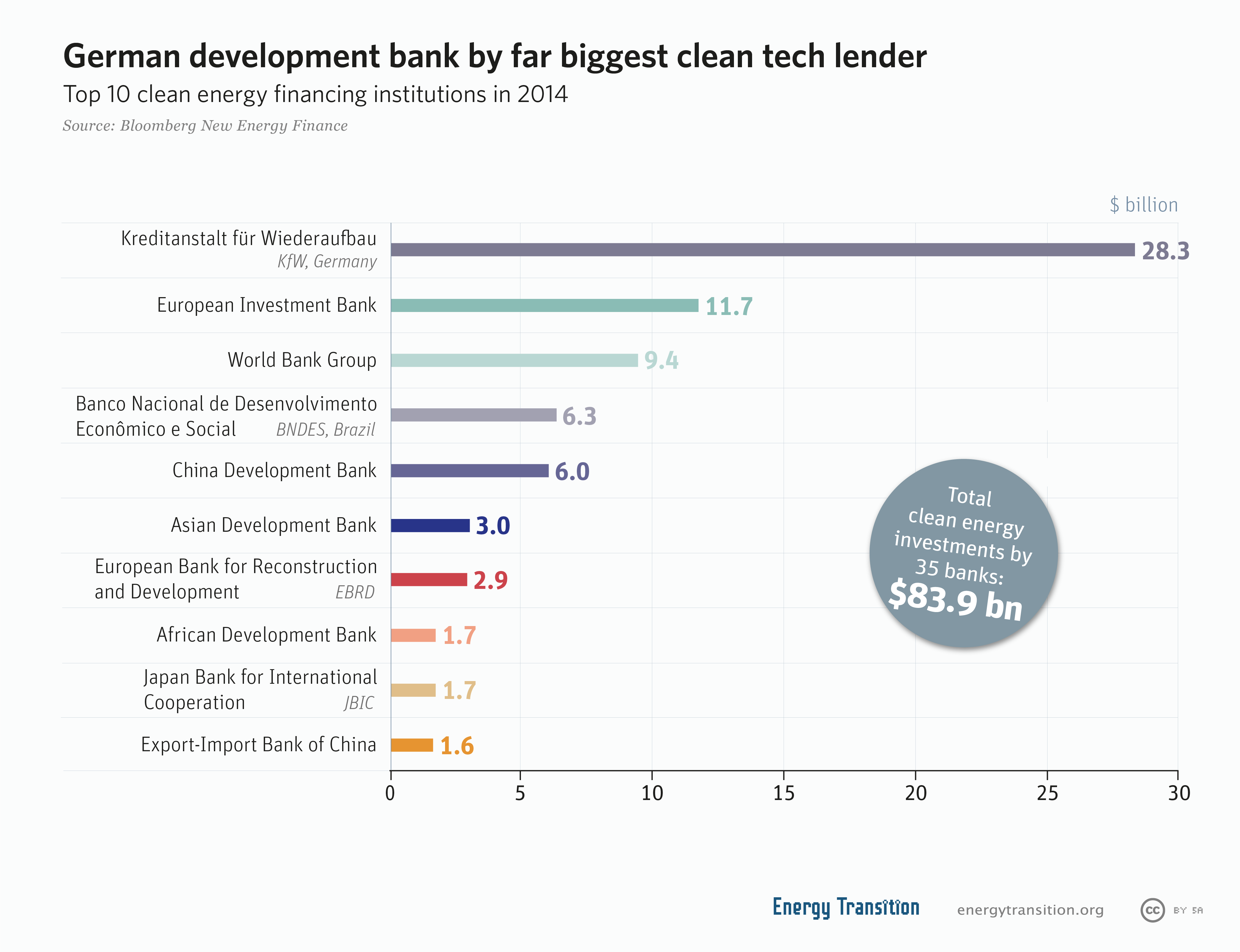

Development Bank

A development financial institution (DFI), also known as a development bank or development finance company (DFC), is a financial institution that provides risk capital for economic development projects on a non-commercial basis. , total commitments (as loans, equity, guarantees and debt securities) of the major regional, multilateral and bilateral DFIs totaled US$45 billion (US$21.3 billion of which went to support the private sector). Mandate DFIs can play a crucial role in financing private and public sector investments in developing countries, in the form of higher risk loans, equity positions, and guarantees.Dirk Willem te Velde and Michael Warner (2007Use of subsidies by Development Finance Institutions in the infrastructure sector Overseas Development Institute DFIs often provide finance to the private sector for investments that promote development and to help companies to invest, especially in countries with various restrictions on the market. Some development banks i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

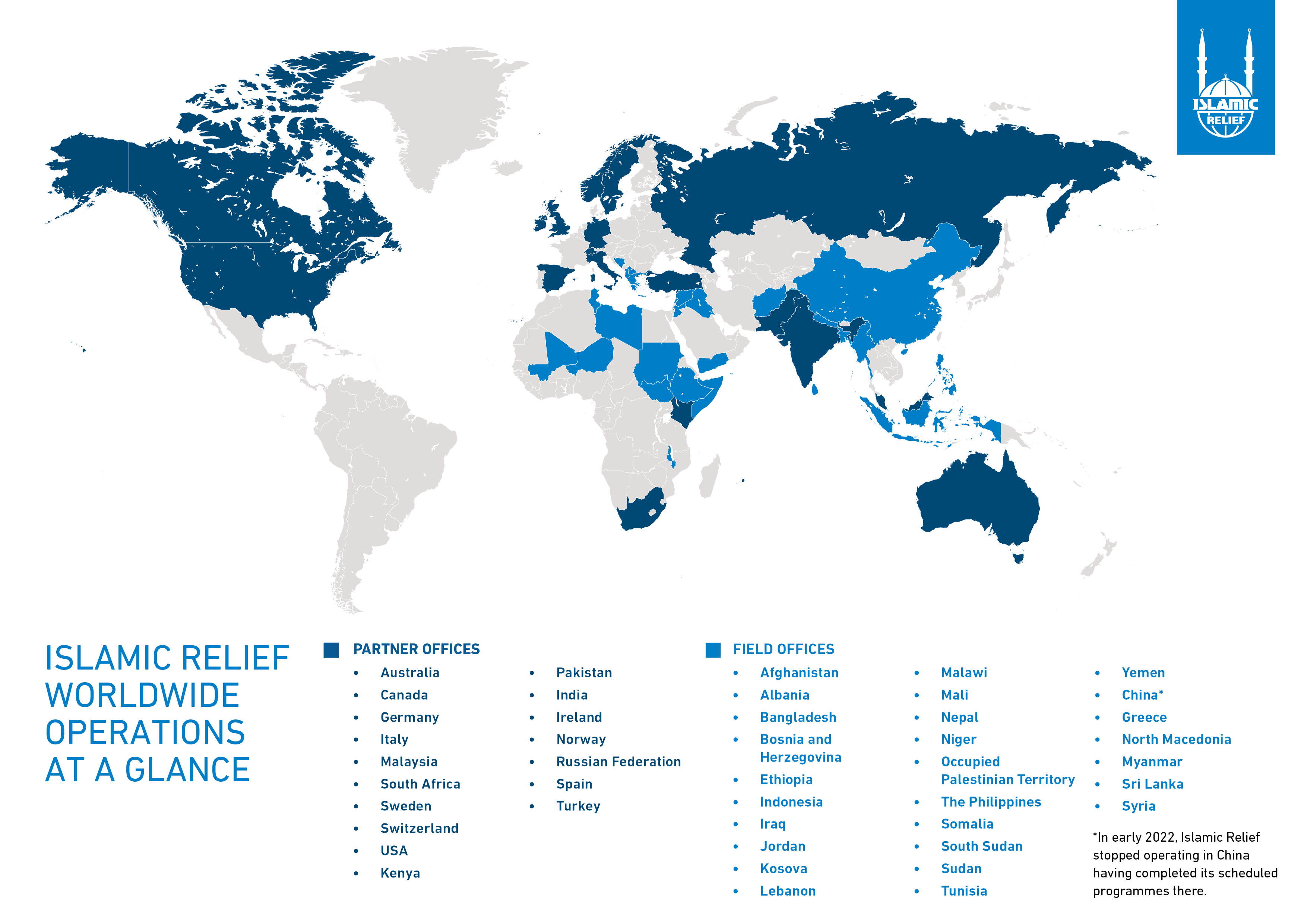

Islamic Relief Worldwide

Islamic Relief Worldwide is a faith-inspired humanitarian and development agency which is working to support and empower the world’s most vulnerable people. Founded in the United Kingdom in 1984, Islamic Relief has international headquarters in Birmingham and a network of national offices, affiliated partners, registered branches and country offices spread over more than 40 countries. The charity typically assists more than 10 million people each year through emergency response, and development programmes in areas including education, health and livelihood support. It also advocates on behalf of those in need, focusing particularly in its campaigns on climate change, the rights of women and girls, and supporting refugees and displaced people. Islamic Relief has been registered with the Charity Commission of England and Wales since 1989 and is an independent, non-political non-governmental organisation (NGO). In 2021, Islamic Relief’s income was £183 million. History I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Organisation For Food Security

french: Organisation islamique pour la sécurité alimentaire , logo = Логотип ИОПБ.svg , logo_size = , logo_alt = , logo_caption = , image = , image_size = , alt = , caption = Flag of the OIC , map = Map of the Islamic Organisation for Food Security.png , map_size = , map_alt = , map_caption = , map2 = , map2_size = , map2_alt = , map2_caption = , abbreviation = IOFS , nickname = , pronounce = , pronounce ref = , pronounce comment = , pronounce 2 = , named_after = , predecessor = , merged = , successor = , formation = , founder = , founding_location = Conakry, Guinea , dissolved = , merger = , type ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include ''Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), ''Musharaka'' (joint venture), ''Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Islamic Trade Finance Corporation

The International Islamic Trade Finance Corporation (ITFC) aims to develop and expand intra-Organisation of Islamic Cooperation trade. History Since its inception in 1395H (1975G), the aim of the Islamic Development Bank (IDB) has been to improve the lives of ordinary people across the Islamic world by raising economic standards and increasing prosperity within the member countries of the Organisation of Islamic Cooperation (OIC, formerly the Organisation of the Islamic Conference). IDB recognized that this goal could be achieved by advancing trade within the Islamic world. The development of trade between OIC member countries is fundamental to this process. The first formal proposal was made by the Custodian of the Two Holy Mosques during the 10th OIC Summit held in Putrajaya, Malaysia in 1424H (2003G) and supported the following year by the United Arab Emirates at an IDB Board of Governors Meeting in Iran. The ITFC was mandated to streamline and consolidate operations within the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Investment Bank

The European Investment Bank (EIB) is the European Union's investment bank and is owned by the EU Member States. It is one of the largest supranational lenders in the world. The EIB finances and invests both through equity and debt solutions projects that achieve the policy aims of the European Union through loans, guarantees and technical assistance. The EIB focuses on the areas of climate, environment, small and medium sized enterprises (SMEs), development, cohesion and infrastructure. It has played a large role in providing finance during crises including the 2008 financial crash and the COVID-19 pandemic. Since its inception in 1958 the EIB has invested over one trillion euros. It primarily funds projects that "cannot be entirely financed by the various means available in the individual Member States". The EIB is one of the biggest financiers of Sustainable finance, green finance in the world. In 2007, the EIB became the first institution in the world to issue Green bond, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CAF – Development Bank Of Latin America

The Corporacion Andina de Fomento (CAF) – Banco de Desarrollo de América Latina ( pt, Corporação Andina de Fomento (CAF) – Banco de Desenvolvimento da América Latina, is a development bank that has a mission of stimulating sustainable development and regional integration by financing projects in the public and private sectors in Latin America, and providing technical cooperation and other specialized services. Founded in 1970 and currently with 19 member countries from Latin America, the Caribbean, and Europe along with 13 private banks, CAF is one of the main sources of multilateral financing and an important generator of knowledge for the region. CAF is headquartered in Caracas, Venezuela. Additionally, it has Representative Offices in Madrid, Lima, Brasilia, Bogota, Buenos Aires, Quito, Panama, Montevideo, Asuncion, Mexico City, Port Spain and La Paz. History The CAF was founded in 1966 following the historic signing of the Declaration of Bogotá in the presence of i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Caribbean Development Bank

The Caribbean Development Bank (CDB) is a financial institution that helps Caribbean nations finance social and economic programs in its member countries. CDB was established by an Agreement signed on October 18, 1969, in Kingston, Jamaica, and entered into force on January 26, 1970. The permanent headquarters of the bank is located at Wildey, St. Michael, Barbados; adjacent to the campus of the Samuel Jackman Prescod Polytechnic. On September 21, 2018, the Bank officially opened its Country Office in Haiti, the first outside its Headquarters in Barbados. The Barbados headquarters serves all of the regional borrowing member countries with staff recruited from its member countries. CDB's membership of 28 countries consists of 19 regional borrowing members, four regional, non-borrowing members (Brazil, Colombia, Mexico and Venezuela) and five non-regional, non-borrowing members (Canada, China, Germany, Italy, and the United Kingdom). CDB’s total assets as at December 31, 2021 sto ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

African Development Bank

The African Development Bank Group (AfDB) or (BAD) is a multilateral development finance institution headquartered in Abidjan, Ivory Coast, since September 2014. The AfDB is a financial provider to African governments and private companies investing in the regional member countries (RMC). The AfDB was founded in 1964 by the Organisation of African Unity, which is the predecessor of the African Union. The AfDB comprises three entities: The African Development Bank, the African Development Fund and the Nigeria Trust Fund. Mission The AfDB's mission is to fight poverty and improve living conditions on the continent through promoting the investment of public and private capital in projects and programs that are likely to contribute to the economic and social development of the region. History Following the end of the colonial period in Africa, a growing desire for more unity within the continent led to the establishment of two draft charters, one for the establishment of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

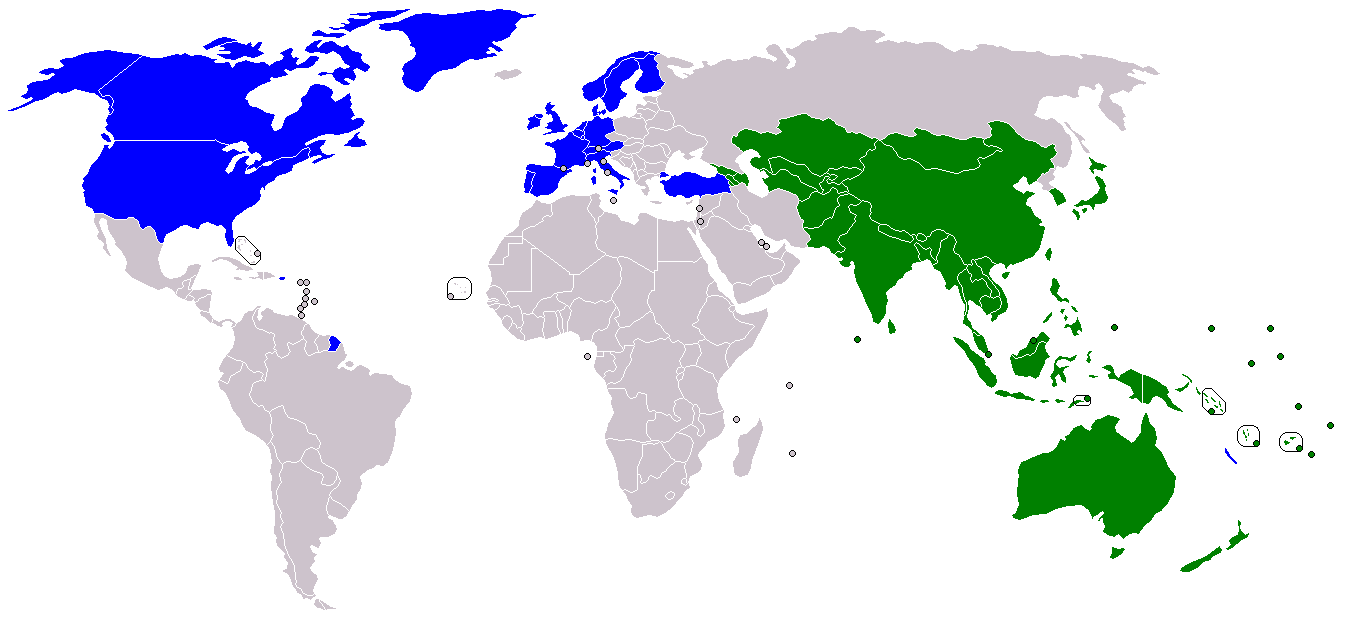

European Bank For Reconstruction And Development

The European Bank for Reconstruction and Development (EBRD) is an international financial institution founded in 1991. As a multilateral developmental investment bank, the EBRD uses investment as a tool to build market economies. Initially focused on the countries of the former Eastern Bloc it expanded to support development in more than 30 countries from Central Europe to Central Asia. Similar to other multilateral development banks, the EBRD has members from all over the world (North America, Africa, Asia and Australia, see below), with the biggest single shareholder being the United States, but only lends regionally in its countries of operations. Headquartered in London, the EBRD is owned by 71 countries and two European Union institutions, the newest shareholder being Algeria since October 2021. Despite its public sector shareholders, it invests in private enterprises, together with commercial partners. The EBRD is not to be confused with the European Investment Bank (EIB), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asian Infrastructure Investment Bank

The Asian Infrastructure Investment Bank (AIIB) is a multilateral development bank that aims to improve economic and social outcomes in Asia. The bank currently has 105 members, including 14 prospective members from around the world. The breakdown of the 105 members by continents are as follows: 42 in Asia, 26 in Europe, 20 in Africa, 8 in Oceania, 8 in South America, and 1 in North America. The bank started operation after the agreement entered into force on 25 December 2015, after ratifications were received from 10 member states holding a total number of 50% of the initial subscriptions of the Authorized Capital Stock. The United Nations has addressed the launch of AIIB as having potential for "scaling up financing for sustainable development" and to improve the global economic governance. The starting capital of the bank was US Dollar, US$100 billion, equivalent to of the capital of the Asian Development Bank and about half that of the World Bank. The bank was pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asian Development Bank

The Asian Development Bank (ADB) is a regional development bank established on 19 December 1966, which is headquartered in the Ortigas Center located in the city of Mandaluyong, Metro Manila, Philippines. The bank also maintains 31 field offices around the world to promote social and economic development in Asia. The bank admits the members of the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP, formerly the Economic Commission for Asia and the Far East or ECAFE) and non-regional developed countries. From 31 members at its establishment, ADB now has 68 members. The ADB was modeled closely on the World Bank, and has a similar weighted voting system where votes are distributed in proportion with members' capital subscriptions. ADB releases an annual report that summarizes its operations, budget and other materials for review by the public. The ADB-Japan Scholarship Program (ADB-JSP) enrolls about 300 students annually in academic institutions locate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |