|

IRS Modernization Plan

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure funded over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitution was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Service

A revenue service, revenue agency or taxation authority is a government agency responsible for the intake of government revenue, including taxes and sometimes non-tax revenue. Depending on the jurisdiction, revenue services may be charged with tax collection, investigation of tax evasion Tax evasion or tax fraud is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to red ..., or carrying out audits. In certain instances, they also administer payments to certain relevant individuals (such as statutory sick pay, statutory maternity pay) as well as targeted financial support ( welfare) to families and individuals (through payment of tax credits or transfer payments). The chief executive of the revenue agency is usually styled as Commissioner, Minister, Secretary or Director. Revenue services by jurisdiction ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Duty (tax)

In economics, a duty is a target-specific form of tax levied by a state (polity), state or other political entity. It is often associated with customs, in which context they are also known as tariffs or dues. The term is often used to describe a tax on certain items purchased abroad. A duty is levied on specific commodity, commodities, financial transactions, estate (law), estates, etc. rather than being a direct imposition on individuals or corporations such income tax, income or property taxes. Examples include customs duty, excise duty, stamp duty, inheritance tax, estate duty, and gift duty. Customs duty A customs duty or due is the indirect tax levied on the import or export of goods in international trade. In economics a duty is also a kind of consumption tax. A duty levied on goods being imported is referred to as an 'import duty', and one levied on exports an 'export duty'. Estate duty An estate duty (in the U.S. inheritance tax) is a tax levied on the Estate (law), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

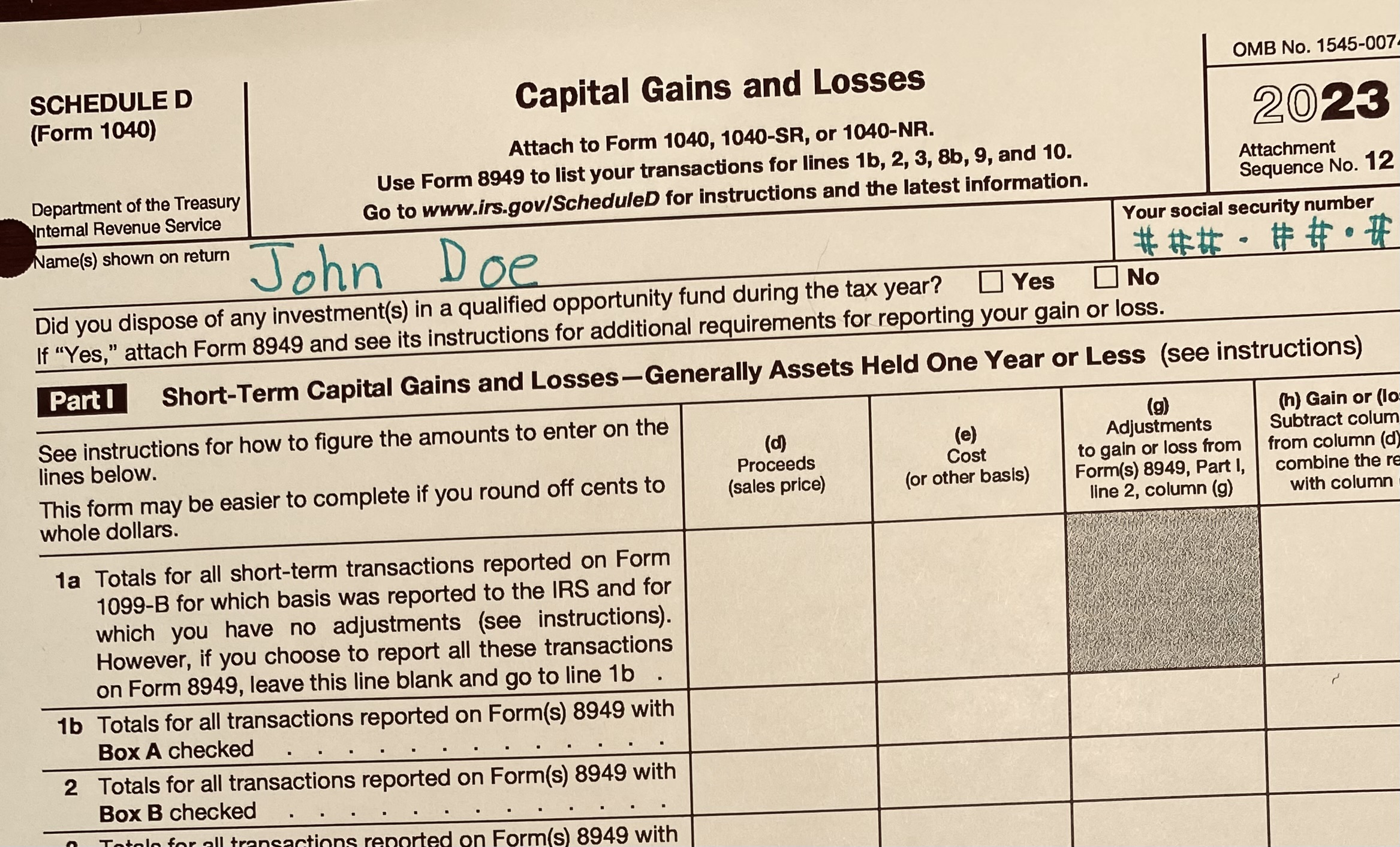

Tax Return

A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for tax. Tax returns are usually processed by each country's tax authority, known as a revenue service, such as the Internal Revenue Service in the United States, the State Taxation Administration in China, and HM Revenue and Customs in the United Kingdom. Preparing the tax return A tax return reports income, expenses, tax payments made during the year and other relevant information to the taxing authority. It helps to determine whether a tax refund is due. This will depend on whether a person has overpaid on taxes, or was late in paying tax for previous years. A person or organization may not be required to file a tax return depending on circumstances, which are different in each country. Generally, a tax return does not need to be filed if income is less than a certain amount, but other factors such as the type of in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Enforcement

Enforcement is the proper execution of the process of ensuring compliance with laws, regulations, rules, standards, and social norms. Governments attempt to effectuate successful implementation of policies by enforcing laws and regulations. Enactment refers to application of a law or regulation, or carrying out of an executive or judicial order. Theories of enforcement Enforcement serves a number of functions; the enforcement of social norms can ensure conformity within insular communities, the enforcements of laws can maximize social benefits and protect the public interest, and enforcement may also serve the self-interest of the institutions that oversee enforcement. Enforcement can be effectuated by both public institutions and private, non-governmental actors. Enforcement is often accomplished through coercive means or by utilizing power disparities to constrain action. Some scholars, such as Kate Andrias, have also argued that institutions enforce rules when deciding "whe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Workforce

In macroeconomics, the workforce or labour force is the sum of people either working (i.e., the employed) or looking for work (i.e., the unemployed): \text = \text + \text Those neither working in the marketplace nor looking for work are out of the labour force. The sum of the labour force and out of the labour force results in the noninstitutional civilian population, that is, the number of people who (1) work (i.e., the employed), (2) can work but don't, although they are looking for a job (i.e., the unemployed), or (3) can work but don't, and are not looking for a job (i.e., out of the labour force). Stated otherwise, the noninstitutional civilian population is the total population minus people who cannot or choose not to work (children, retirees, soldiers, and incarcerated people). The noninstitutional civilian population is the number of people potentially available for civilian employment. \begin \text &= \text + \text \\ & ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue

In accounting, revenue is the total amount of income generated by the sale of product (business), goods and services related to the primary operations of a business. Commercial revenue may also be referred to as sales or as turnover. Some company, companies receive revenue from interest, royalties, or other fees. This definition is based on International Accounting Standard, IAS 18. "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, company X had revenue of $42 million". Profit (accounting), Profits or net income generally imply total revenue minus total expenses in a given period. In accountancy, accounting, revenue is a subsection of the equity section of the balance statement, since it increases equity. It is often referred to as the "top line" due to its position at the very top of the income statement. This is to be contrasted with the "bottom line" which denotes net income (gross reve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government Gross fixed capital formation, gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product. Spending by a government that issues its own currency is nominally self-financing. However, under a full employment assumption, to acquire resources produced by its population without potential inflationary pressures, removal of purchasing power m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Budget Balance

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government revenues and spending. For a government that uses accrual accounting (rather than cash accounting) the budget balance is calculated using only spending on current operations, with expenditure on new capital assets excluded. A positive balance is called a ''government budget surplus'', and a negative balance is a ''government budget deficit''. A government budget presents the government's proposed revenues and spending for a financial year. The government budget balance can be broken down into the ''primary balance'' and interest payments on accumulated government debt; the two together give the budget balance. Furthermore, the budget balance can be broken down into the ''structural balance'' (also known as ''cyclically-adjusted balance'') and the cyclical component: the structural budget balance attempts ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as "born out of statute"; a legal person in a legal context) and recognized as such in Corporate law, law for certain purposes. Early incorporated entities were established by charter (i.e., by an ''ad hoc'' act granted by a monarch or passed by a parliament or legislature). Most jurisdictions now allow the creation of new corporations through List of company registers, registration. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: whether they can issue share capital, stock, or whether they are formed to make a profit (accounting), profit. Depending on the number of owners, a corporation can be classified as ''aggregate'' (the subject of this articl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth Inequality In The United States

The inequality of wealth (i.e., inequality in the distribution of resources, assets) has substantially increased in the United States since the late 1980s. Wealth commonly includes the values of any homes, automobiles, personal valuables, businesses, savings, and investments, as well as any associated debts. Although different from Income inequality in the United States, income inequality, the two are related. Wealth is usually not used for daily expenditures or factored into household budgets, but combined with income, it represents a family's total opportunity to secure stature and a meaningful standard of living, or to pass their Social class in the United States, class status down to their children. Moreover, wealth provides for both short- and long-term financial security, bestows social prestige, contributes to political power, and can be leveraged to obtain more wealth. Hence, wealth provides mobility and agency—the ability to act. The accumulation of wealth enables a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation As Theft

The position that taxation is theft, and therefore immoral, is found in a number of political philosophies. Its popularization marks a significant departure from conservatism and classical liberalism, and has been considered radical by many as a result. The position is often held by anarcho-capitalists, objectivists, most minarchists, right-wing libertarians, and voluntaryists, as well as left-anarchists, libertarian socialists and some anarcho-communists. Proponents of this position see taxation as a violation of the non-aggression principle. Under this view, government transgresses property rights by enforcing compulsory tax collection, regardless of what the amount may be. Some opponents of taxation, like Michael Huemer, argue that rightful ownership of property should be based on what he calls "natural property rights", not those determined by the law of the state. Defenders of taxation argue that the notions of both legal private property rights and theft are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IRS Targeting Controversy

In 2013, the United States Internal Revenue Service (IRS), under the Obama administration, revealed that it had selected political groups applying for tax-exempt status for intensive scrutiny based on their names or political themes. This led to wide condemnation of the agency and triggered several investigations, including a Federal Bureau of Investigation (FBI) criminal probe ordered by United States Attorney General Eric Holder. Conservatives claimed that they were specifically targeted by the IRS, but an exhaustive report released by the United States Department of the Treasury, Treasury Department's Treasury Inspector General for Tax Administration, Inspector General in 2017 found that from 2004 to 2013, the IRS used both conservative and liberal keywords to choose targets for further scrutiny. Initial reports described the selections as nearly exclusively of conservatism in the United States, conservative groups with terms such as "Tea Party movement, Tea Party" in their na ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |