|

Helia Extranea

Helia is an Australian Lenders mortgage insurance provider. It is listed on the ASX and changed its name from Genworth Mortgage Insurance Australia in October 2022. In 2018, Helia invested in Tic:Toc, a mortgage fintech. In 2021, Genworth Financial, an S&P400 insurance provider, sold its 52% of Helia's shares to institutional investors, effectively making Helia an independent company. In 2022, Helia invested in OSQO a "deposit gap funder". In 2022, Helia purchased 22% of Household Capital A household consists of two or more persons who live in the same dwelling. It may be of a single family or another type of person group. The household is the basic unit of analysis in many social, microeconomic and government models, and is impo ..., a reverse mortgage provider. References Insurance companies of Australia Companies with year of establishment missing Companies listed on the Australian Securities Exchange {{Australia-company-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

City

A city is a human settlement of notable size.Goodall, B. (1987) ''The Penguin Dictionary of Human Geography''. London: Penguin.Kuper, A. and Kuper, J., eds (1996) ''The Social Science Encyclopedia''. 2nd edition. London: Routledge. It can be defined as a permanent and densely settled place with administratively defined boundaries whose members work primarily on non-agricultural tasks. Cities generally have extensive systems for housing, transportation, sanitation, utilities, land use, production of goods, and communication. Their density facilitates interaction between people, government organisations and businesses, sometimes benefiting different parties in the process, such as improving efficiency of goods and service distribution. Historically, city-dwellers have been a small proportion of humanity overall, but following two centuries of unprecedented and rapid urbanization, more than half of the world population now lives in cities, which has had profound consequences for g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sydney

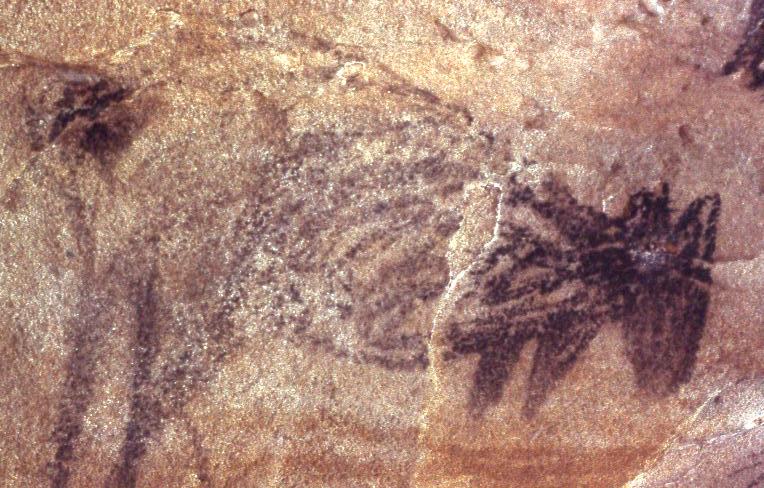

Sydney ( ) is the capital city of the state of New South Wales, and the most populous city in both Australia and Oceania. Located on Australia's east coast, the metropolis surrounds Sydney Harbour and extends about towards the Blue Mountains to the west, Hawkesbury to the north, the Royal National Park to the south and Macarthur to the south-west. Sydney is made up of 658 suburbs, spread across 33 local government areas. Residents of the city are known as "Sydneysiders". The 2021 census recorded the population of Greater Sydney as 5,231,150, meaning the city is home to approximately 66% of the state's population. Estimated resident population, 30 June 2017. Nicknames of the city include the 'Emerald City' and the 'Harbour City'. Aboriginal Australians have inhabited the Greater Sydney region for at least 30,000 years, and Aboriginal engravings and cultural sites are common throughout Greater Sydney. The traditional custodians of the land on which modern Sydney stands are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lenders Mortgage Insurance

Lenders mortgage insurance (LMI), also known as private mortgage insurance (PMI) in the US, is insurance payable to a lender or trustee for a pool of securities that may be required when taking out a mortgage loan. It is insurance to offset losses in the case where a mortgagor is not able to repay the loan and the lender is not able to recover its costs after foreclosure and sale of the mortgaged property. Typical rates are $55/mo. per $100,000 financed, or as high as $125/mo. for a typical $200,000 loan. Mortgage insurance in the US The annual cost of PMI varies and is expressed in terms of the total loan value in most cases, depending on the loan term, loan type, proportion of the total home value that is financed, the coverage amount, and the frequency of premium payments (monthly, annual, or single). The PMI may be payable up front, or it may be capitalized onto the loan in the case of single premium product. This type of insurance is usually only required if the downpayment i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Genworth Mortgage Insurance Australia

Helia is an Australian Lenders mortgage insurance provider. It is listed on the ASX and changed its name from Genworth Mortgage Insurance Australia in October 2022. In 2018, Helia invested in Tic:Toc, a mortgage fintech. In 2021, Genworth Financial, an S&P400 insurance provider, sold its 52% of Helia's shares to institutional investors, effectively making Helia an independent company. In 2022, Helia invested in OSQO a "deposit gap funder". In 2022, Helia purchased 22% of Household Capital, a reverse mortgage A reverse mortgage is a mortgage loan, usually secured by a residential property, that enables the borrower to access the unencumbered value of the property. The loans are typically promoted to older homeowners and typically do not require monthl ... provider. References Insurance companies of Australia Companies with year of establishment missing Companies listed on the Australian Securities Exchange {{Australia-company-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fintech

Fintech, a portmanteau of "financial technology", refers to firms using new technology to compete with traditional financial methods in the delivery of financial services. Artificial intelligence, blockchain, cloud computing, and big data are regarded as the "ABCD" (four key areas) of fintech. The use of smartphones for mobile banking, investing, borrowing services, and cryptocurrency are examples of technologies designed to make financial services more accessible to the general public. Fintech companies consist of both startups and established financial institutions and technology companies trying to replace or enhance the usage of financial services provided by existing financial companies. A subset of fintech companies that focus on the insurance industry are collectively known as insurtech or insuretech companies. Key areas Academics Artificial intelligence (AI), blockchain, cloud computing, and big data are considered the four key areas of FinTech. Artificial intellige ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Genworth Financial

Genworth Financial is an S&P 400 insurance company. The firm was founded as The Life Insurance Company of Virginia in 1871. In 1986, Life of Virginia was acquired by Combined Insurance, which became Aon plc in 1987. In 1996, Life of Virginia was sold to GE Capital. In May 2004, Genworth Financial was formed out of various insurance businesses of General Electric in the largest IPO of that year. Genworth Financial is incorporated in Virginia. Genworth Financial has three segments: Retirement & Protection, US Mortgage Insurance, and International. Products and services include life and long-term care insurance, mortgage insurance, and annuities. Company history A.G. McIlwaine was the company’s first president. Begun by two dozen Petersburg investors, the Life Insurance Company of Virginia offered its first policies to local customers before expanding to Richmond, Virginia. Under general agent F.W. Chamberlayne, the Richmond Department attracted a large number of new clients. Wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Household Capital

A household consists of two or more persons who live in the same dwelling. It may be of a single family or another type of person group. The household is the basic unit of analysis in many social, microeconomic and government models, and is important to economics and inheritance. Household models include families, blended families, shared housing, group homes, boarding houses, houses of multiple occupancy (UK), and single room occupancy (US). In feudal societies, the royal household and medieval households of the wealthy included servants and other retainers. Government definitions For statistical purposes in the United Kingdom, a household is defined as "one person or a group of people who have the accommodation as their only or main residence and for a group, either share at least one meal a day or share the living accommodation, that is, a living room or sitting room". The introduction of legislation to control houses of multiple occupations in the UK Housing Act (2004) S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reverse Mortgage

A reverse mortgage is a mortgage loan, usually secured by a residential property, that enables the borrower to access the unencumbered value of the property. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Borrowers are still responsible for property taxes or homeowner's insurance. Reverse mortgages allow older people to immediately access the home equity they have built up in their homes, and defer payment of the loan until they die, sell, or move out of the home. Because there are no required mortgage payments on a reverse mortgage, the interest is added to the loan balance each month. The rising loan balance can eventually grow to exceed the value of the home, particularly in times of declining home values or if the borrower continues to live in the home for many years. However, the borrower (or the borrower's estate) is generally not required to repay any additional loan balance in excess of the value of the home. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Companies Of Australia

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies With Year Of Establishment Missing

A company, abbreviated as co., is a legal entity representing an association of people, whether natural, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * business entities, whose aim is generating profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duty according to the publicly declared incorporation, or published policy. When a company closes, it may need to be liquidated to avoid further legal obligations. Companies may associate and collectively register themselves as new companies; the resulting entities are often known as corporate groups. Meanings and definitions A company can be defined as an "artificial per ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |