|

Harleysville Group

Harleysville Group Inc. is an insurance company based in Harleysville, Pennsylvania. It writes predominantly commercial insurances policies constituting more than 80% of premium volume received by the corporation per annum. History Harleysville was started by Alvin C. Alderfer because he and many automobile owners had no way of insuring against the risk of theft. Within two years he received an order from the state of Pennsylvania's Department of Insurance that he had to either disband the association or charter it according to the states regulations. On October 9, 1917 the Mutual Auto Theft Insurance Company and the Mutual Auto Fire Insurance Company were chartered. In 1922 after changes in state regulations and increased business by automobile owners the Harleysville Mutual Casualty Company was formed. In 1933 they merged with the Auto Theft Company. Over the coming years the company made strives to predict market trends and to keep ahead of those trends. In 1956 it c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidiary

A subsidiary, subsidiary company or daughter company is a company owned or controlled by another company, which is called the parent company or holding company. Two or more subsidiaries that either belong to the same parent company or having a same management being substantially controlled by same entity/group are called sister companies. The subsidiary can be a company (usually with limited liability) and may be a government- or state-owned enterprise. They are a common feature of modern business life, and most multinational corporations organize their operations in this way. Examples of holding companies are Berkshire Hathaway, Jefferies Financial Group, The Walt Disney Company, Warner Bros. Discovery, or Citigroup; as well as more focused companies such as IBM, Xerox, and Microsoft. These, and others, organize their businesses into national and functional subsidiaries, often with multiple levels of subsidiaries. Details Subsidiaries are separate, distinct legal entities f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harleysville, Pennsylvania

Harleysville is a census-designated place (CDP) in Montgomery County, Pennsylvania, United States. It is a suburb of Philadelphia. The population was 9,286 at the 2010 census. It is located mostly within Lower Salford Township and also in Franconia Township. Harleysville was settled by Pennsylvania Dutch in the 18th century and was named after Samuel Harley. History Harleysville was settled early in Pennsylvania's history, . The Klein Meetinghouse was listed on the National Register of Historic Places in 1973. Pennsylvania Historical and Museum Commission, 1972, NRHP Nomination Form for Klein MeetinghouseEnter "public" for ID and "public" for password to access the site. Geography According to the U.S. Census Bureau, the CDP has a total area of , all land. Pennsylvania Route 63 (Main Street) and Pennsylvania Route 113 (Harleysville Pike) meet in Harleysville and provide access to other routes on the main grid. Interstate 476 is a five-minute drive via PA 63 from Harle ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nationwide Mutual Insurance Company

Nationwide Mutual Insurance Company and affiliated companies, commonly shortened to Nationwide, is a group of large U.S. insurance and financial services companies based in Columbus, Ohio. The company also operates regional headquarters in Scottsdale, Arizona; Des Moines, Iowa and San Antonio, Texas. Nationwide currently has approximately 25,391 employees, and is ranked No. 80 in the 2022 Fortune 500 list. Nationwide is currently ranked No. 21 in Fortune's "100 Best Companies to Work For". Nationwide Financial Services (NFS), a component of the group, was partially floated on the New York Stock Exchange prior to being repurchased by Nationwide Mutual in 2009. It had owned the majority of NFS common stock since it had gone public in 1997. History Beginnings as Farm Bureau Mutual In the 1920s, farmers were paying the same rates on their automobile insurance as city drivers even though they had fewer accidents and claims than city drivers. The Ohio Farm Bureau decided to set up t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

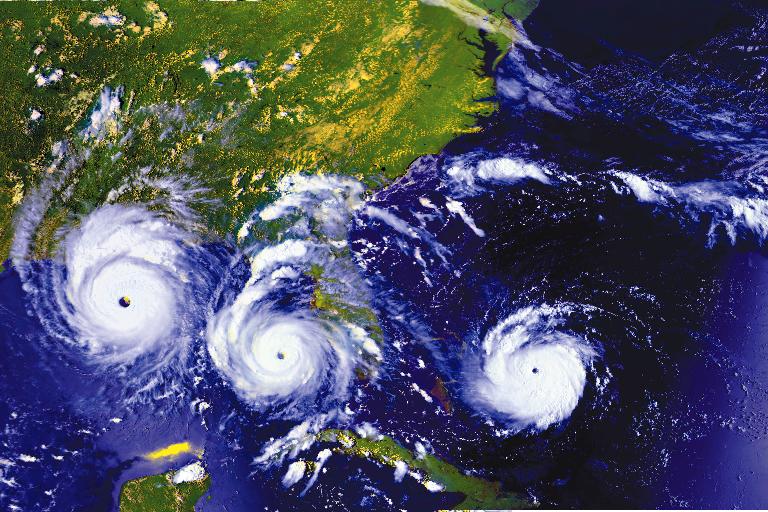

Hurricane Andrew

Hurricane Andrew was a very powerful and destructive Category 5 Atlantic hurricane that struck the Bahamas, Florida, and Louisiana in August 1992. It is the most destructive hurricane to ever hit Florida in terms of structures damaged or destroyed, and remained the costliest in financial terms until Hurricane Irma surpassed it 25 years later. Andrew was also the strongest landfalling hurricane in the United States in decades and the costliest hurricane to strike anywhere in the country, until it was surpassed by Katrina in 2005. In addition, Andrew is one of only four tropical cyclones to make landfall in the continental United States as a Category 5, alongside the 1935 Labor Day hurricane, 1969's Camille, and 2018's Michael. While the storm also caused major damage in the Bahamas and Louisiana, the greatest impact was felt in South Florida, where the storm made landfall as a Category 5 hurricane, with 1-minute sustained wind speeds as high as 165 mp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1993 Atlantic Hurricane Season

The 1993 Atlantic hurricane season was a below average Atlantic hurricane season that produced ten tropical cyclones, eight tropical storms, four hurricanes, and one major hurricane. It officially started on June 1 and ended on November 30, dates which conventionally delimit the period during which most tropical cyclones form in the Atlantic Ocean. The first tropical cyclone, Tropical Depression One, developed on May 31, while the final storm, Tropical Depression Ten, dissipated on September 30, well before the average dissipation date of a season's last tropical cyclone; this represented the earliest end to the hurricane season in ten years. The most intense hurricane, Emily, was a Category 3 on the Saffir–Simpson Hurricane Scale that paralleled close to the North Carolina coastline causing minor damage and a few deaths before moving out to sea. The most significant named storm of the season was Hurricane Gert, a tropical cyclone that devastated several ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ohio

Ohio () is a state in the Midwestern region of the United States. Of the fifty U.S. states, it is the 34th-largest by area, and with a population of nearly 11.8 million, is the seventh-most populous and tenth-most densely populated. The state's capital and largest city is Columbus, with the Columbus metro area, Greater Cincinnati, and Greater Cleveland being the largest metropolitan areas. Ohio is bordered by Lake Erie to the north, Pennsylvania to the east, West Virginia to the southeast, Kentucky to the southwest, Indiana to the west, and Michigan to the northwest. Ohio is historically known as the "Buckeye State" after its Ohio buckeye trees, and Ohioans are also known as "Buckeyes". Its state flag is the only non-rectangular flag of all the U.S. states. Ohio takes its name from the Ohio River, which in turn originated from the Seneca word ''ohiːyo'', meaning "good river", "great river", or "large creek". The state arose from the lands west of the Appalachian Mountai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Companies Of The United States

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Formerly Listed On The Nasdaq

A company, abbreviated as co., is a legal entity representing an association of people, whether natural, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * business entities, whose aim is generating profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duty according to the publicly declared incorporation, or published policy. When a company closes, it may need to be liquidated to avoid further legal obligations. Companies may associate and collectively register themselves as new companies; the resulting entities are often known as corporate groups. Meanings and definitions A company can be defined as an "artificial per ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Companies Established In 1912

American(s) may refer to: * American, something of, from, or related to the United States of America, commonly known as the "United States" or "America" ** Americans, citizens and nationals of the United States of America ** American ancestry, people who self-identify their ancestry as "American" ** American English, the set of varieties of the English language native to the United States ** Native Americans in the United States, indigenous peoples of the United States * American, something of, from, or related to the Americas, also known as "America" ** Indigenous peoples of the Americas * American (word), for analysis and history of the meanings in various contexts Organizations * American Airlines, U.S.-based airline headquartered in Fort Worth, Texas * American Athletic Conference, an American college athletic conference * American Recordings (record label), a record label previously known as Def American * American University, in Washington, D.C. Sports teams Soccer * B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 1912

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitabi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |