|

Finance Act 2015

The Finance Act 2015 is an Act of the Parliament of the United Kingdom enacting the 2015 United Kingdom budget. The Chancellor of the Exchequer delivers the annual budget speech outlining changes in spending, tax, duty and other financial matters. The respective year's Finance Act is the mechanism to enact the changes. Levels of excise duties, value-added tax, income tax, corporation tax and capital gains tax) are often modified. The rules governing the various taxation methods are contained within the relevant taxation acts. (For instance, capital gains tax legislation is contained within Taxation of Chargeable Gains Act 1992 The Taxation of Chargeable Gains Act 1992c 12 is an Act of Parliament which governs the levying of capital gains tax in the United Kingdom. This is a tax on the increase in the value of an asset between the date of purchase and the date of sale of ...). The Finance Act details amendments to be made to each one of these Acts. The bill for consideration w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Act Of Parliament

Acts of Parliament, sometimes referred to as primary legislation, are texts of law passed by the Legislature, legislative body of a jurisdiction (often a parliament or council). In most countries with a parliamentary system of government, acts of parliament begin as a Bill (law), bill, which the legislature votes on. Depending on the structure of government, this text may then be subject to assent or approval from the Executive (government), executive branch. Bills A draft act of parliament is known as a Bill (proposed law), bill. In other words, a bill is a proposed law that needs to be discussed in the parliament before it can become a law. In territories with a Westminster system, most bills that have any possibility of becoming law are introduced into parliament by the government. This will usually happen following the publication of a "white paper", setting out the issues and the way in which the proposed new law is intended to deal with them. A bill may also be introduced in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Parliament Of The United Kingdom

The Parliament of the United Kingdom is the supreme legislative body of the United Kingdom, the Crown Dependencies and the British Overseas Territories. It meets at the Palace of Westminster, London. It alone possesses legislative supremacy and thereby ultimate power over all other political bodies in the UK and the overseas territories. Parliament is bicameral but has three parts, consisting of the sovereign ( King-in-Parliament), the House of Lords, and the House of Commons (the primary chamber). In theory, power is officially vested in the King-in-Parliament. However, the Crown normally acts on the advice of the prime minister, and the powers of the House of Lords are limited to only delaying legislation; thus power is ''de facto'' vested in the House of Commons. The House of Commons is an elected chamber with elections to 650 single-member constituencies held at least every five years under the first-past-the-post system. By constitutional convention, all governme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

March 2015 United Kingdom Budget

The 2015 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday, 18 March 2015. It was the sixth and final budget of the Conservative–Liberal Democrat coalition government formed after the 2010 general election, and also the sixth to be delivered by Osborne. After the UK general election a second 2015 budget to be presented by Chancellor George Osborne was announced for 8 July 2015. Taxes Spending Supply-side reform Supply-side measures included digital infrastructure investment, transport, energy and environment and the sharing economy.H M TreasuryBudget 2015 published 18 March 2015, accessed 21 August 2022, pp. 94-100 References External links2015 United Kingdom budgetat Gov.uk2015 United Kingdom Budgetat the Guardian {{United Kingdom budget United Kingdom Budget A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chancellor Of The Exchequer

The chancellor of the Exchequer, often abbreviated to chancellor, is a senior minister of the Crown within the Government of the United Kingdom, and head of His Majesty's Treasury. As one of the four Great Offices of State, the Chancellor is a high-ranking member of the British Cabinet. Responsible for all economic and financial matters, the role is equivalent to that of a finance minister in other countries. The chancellor is now always Second Lord of the Treasury as one of at least six lords commissioners of the Treasury, responsible for executing the office of the Treasurer of the Exchequer the others are the prime minister and Commons government whips. In the 18th and early 19th centuries, it was common for the prime minister also to serve as Chancellor of the Exchequer if he sat in the Commons; the last Chancellor who was simultaneously prime minister and Chancellor of the Exchequer was Stanley Baldwin in 1923. Formerly, in cases when the chancellorship was vacant, the L ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

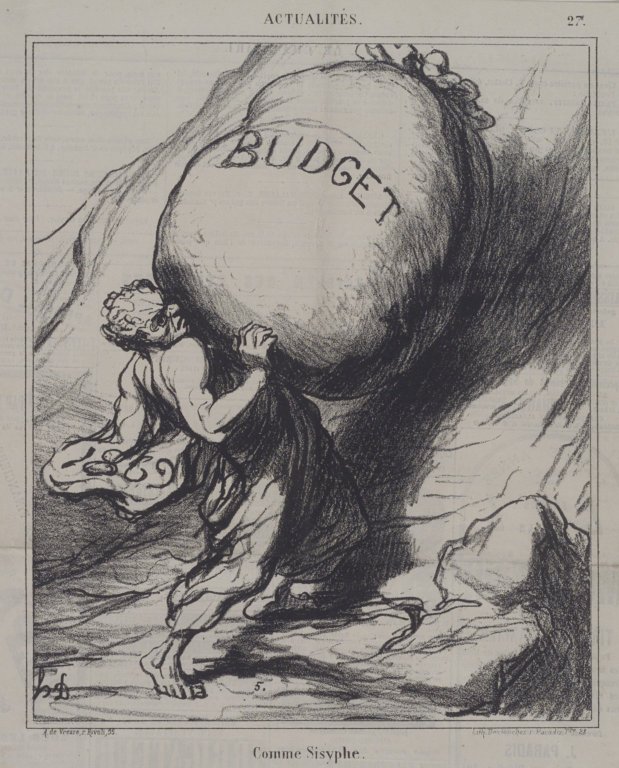

Budget

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms. A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. Government The budget of a government is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment budget, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance Act

A Finance Act is the headline fiscal (budgetary) legislation enacted by the UK Parliament, containing multiple provisions as to taxes, duties, exemptions and reliefs at least once per year, and in particular setting out the principal tax rates for each fiscal year. Overview In the UK, the Chancellor of the Exchequer delivers a Budget speech on Budget Day, outlining changes in spending, as well as tax and duty. The changes to tax and duty are passed as law, and each year form the respective Finance Act. Additional Finance Acts are also common and are the result of a change in governing party due to a general election, a pressing loophole or defect in the law of taxation, or a backtrack with regard to government spending or taxation. However, a repeal order can also be made by statutory instrument. The rules governing the various taxation methods are contained within the relevant taxation acts. Capital Gains Tax legislation, for example, is contained within Taxation of Chargeable ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excises are typically impos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value-added Tax (United Kingdom)

In the United Kingdom, the value added tax (VAT) was introduced in 1973, replacing Purchase Tax, and is the third-largest source of government revenue, after income tax and National Insurance. It is administered and collected by HM Revenue and Customs, primarily through the Value Added Tax Act 1994. VAT is levied on most goods and services provided by registered businesses in the UK and some goods and services imported from outside the UK. The default VAT rate is the standard rate, 20% since 4 January 2011. Some goods and services are subject to VAT at a reduced rate of 5% (such as domestic fuel) or 0% (such as most food and children's clothing). Others are exempt from VAT or outside the system altogether. VAT is an indirect tax because the tax is paid to the government by the seller (the business) rather than the person who ultimately bears the economic burden of the tax (the consumer). Opponents of VAT claim it is a regressive tax because the poorest people spend a higher pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom Corporation Tax

: ''Throughout this article, the term "pound" and the £ symbol refer to the Pound sterling.'' Corporation tax in the United Kingdom is a corporate tax levied in on the profits made by UK-resident companies and on the profits of entities registered overseas with permanent establishments in the UK. Until 1 April 1965, companies were taxed at the same income tax rates as individual taxpayers, with an additional profits tax levied on companies. Finance Act 1965 replaced this structure for companies and associations with a single corporate tax, which took its basic structure and rules from the income tax system. Since 1997, the UK's Tax Law Rewrite ProjectTax Law Rewrite , |

Capital Gains Tax

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, Bond (finance), bonds, precious metals, real estate, and property. Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. Countries that do not impose a capital gains tax include Bahrain, Barbados, Belize, Cayman Islands, Isle of Man, Jamaica, New Zealand, Sri Lanka, Singapore, and others. In some countries, such as New Zealand and Singapore, professional traders and those who trade frequently are taxed on such profits as a business income. In Sweden, the Investment Savings Account (ISK – ''Investeringssparkonto'') was introduced in 2012 in response to a decision by Parliament to stimulate saving in funds and equities. There is no tax on capital gains in ISKs; instead, the saver pays an annual standard low rate of tax. Fund savers nowadays mainly ch ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation Of Chargeable Gains Act 1992

The Taxation of Chargeable Gains Act 1992c 12 is an Act of Parliament which governs the levying of capital gains tax in the United Kingdom. This is a tax on the increase in the value of an asset between the date of purchase and the date of sale of that asset. The tax operates under two different regimes for a natural person and a body corporate. For a natural person, the rates of the capital gains tax are the same as those for earned income. The tax is levied at a rate determined by the highest rate of income tax which that person pays. Each year a natural person has an amount of gain, fixed by law, which is exempt from tax. By contrast, for bodies corporate, the chargeable gain is treated as additional profits for the accounting period in question. The capital gains tax is charged as additional corporation tax. Bodies corporate have no allowance for gains free from tax. Various reliefs from capital gains tax exist. These include indexation relief, where the amount of gain subje ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |