|

Exchange-traded Products

An exchange-traded product (ETP) is a regularly priced security which trades during the day on a national stock exchange. ETPs may embed derivatives but it is not a requirement that they do so - and the investment memorandum (or offering documents) should be read with care to ensure that the pricing methodology and use (or not) of derivatives is explicitly stated. Typically, individual underlying securities, such as stocks and bonds, are not considered ETPs. ETPs are often benchmarked to indices, stocks, commodities, or may be actively managed. There are several types of ETPs, including: *Closed-end funds (CEFs) are collective investment vehicles which restrict the investors right to redeem their units at net asset value (NAV) *Exchange-traded derivative contracts *Exchange-traded funds (ETFs) are mutual funds trading at a stock exchange having agreements in place to ensure that the stock exchange price always is close to the NAV *Exchange-traded notes (ETNs) are unsecured deriv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Note

An exchange-traded product (ETP) is a regularly priced security which trades during the day on a national stock exchange. ETPs may embed derivatives but it is not a requirement that they do so - and the investment memorandum (or offering documents) should be read with care to ensure that the pricing methodology and use (or not) of derivatives is explicitly stated. Typically, individual underlying securities, such as stocks and bonds, are not considered ETPs. ETPs are often benchmarked to indices, stocks, commodities, or may be actively managed. There are several types of ETPs, including: *Closed-end funds (CEFs) are collective investment vehicles which restrict the investors right to redeem their units at net asset value (NAV) *Exchange-traded derivative contracts *Exchange-traded funds (ETFs) are mutual funds trading at a stock exchange having agreements in place to ensure that the stock exchange price always is close to the NAV *Exchange-traded notes (ETNs) are unsecured deriv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Silver Exchange-traded Product

Silver exchange-traded products are exchange-traded funds (ETFs), exchange-traded notes (ETNs) and closed-end funds (CEFs) that aim to track the price of silver. Silver exchange-traded products are traded on the major stock exchanges including the London and New York Stock Exchanges. The U.S Geological Survey cites the emergence of silver ETFs as a significant factor in the 2007-2011 price rise of silver. As of September 2011, the largest of these funds holds the equivalent of over one third of the world's total annual silver production. Products Physically backed funds * Central Fund of Canada and Silver Bullion Trust are closed-end funds created by the same Canadian founders and mandated to keep the bulk of their net assets in precious metals, with a small percentage of cash. The Central Fund of Canada holds a mix of gold and silver, while the Silver Bullion Trust holds only silver. The Central Fund of Canada and Silver Bullion Trust initial public offerings were completed in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gold Exchange-traded Product

Gold exchange-traded products are exchange-traded funds (ETFs), closed-end funds (CEFs) and exchange-traded notes (ETNs) that are used to own gold as an investment. Gold exchange-traded products are traded on the major stock exchanges including the SIX Swiss Exchange, the Bombay Stock Exchange, the London Stock Exchange, the Paris Bourse, and the New York Stock Exchange. Each gold ETF, ETN, and CEF has a different structure outlined in its prospectus. Some such instruments do not necessarily hold physical gold. For example, gold ETNs generally track the price of gold using derivatives. The funds pay their annual expenses such as storage, insurance, and management fees to the sponsor by selling a small amount of gold; therefore, the amount of gold in each share will gradually decline over time. The annual fee charged by State Street Corporation as sponsor of SPDR Gold Shares, the largest gold-backed fund in the world, is 0.40% of the assets in the fund. In some countries, gold ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Exchange-traded Funds

The exchange-traded funds available on exchanges vary from country to country. Many of the ETFs listed below are available exclusively on that nation's primary stock exchange and cannot be purchased on a foreign stock exchange. *List of American exchange-traded funds *List of Australian exchange-traded funds *List of Canadian exchange-traded funds *List of European exchange-traded funds *List of Hong Kong exchange-traded funds *List of Indian exchange-traded funds *List of Indonesian exchange-traded funds *List of Japanese exchange-traded funds *List of New Zealand exchange-traded funds *List of Singaporean exchange-traded funds *List of South African exchange-traded funds *List of South Korean exchange-traded funds *List of Taiwan exchange-traded funds *List of Turkish exchange-traded funds See also * Exchange-traded fund * Exchange-traded product * List of hedge funds * List of private-equity firms * List of investment banks * Boutique investment bank * Fund of funds * Boutique ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

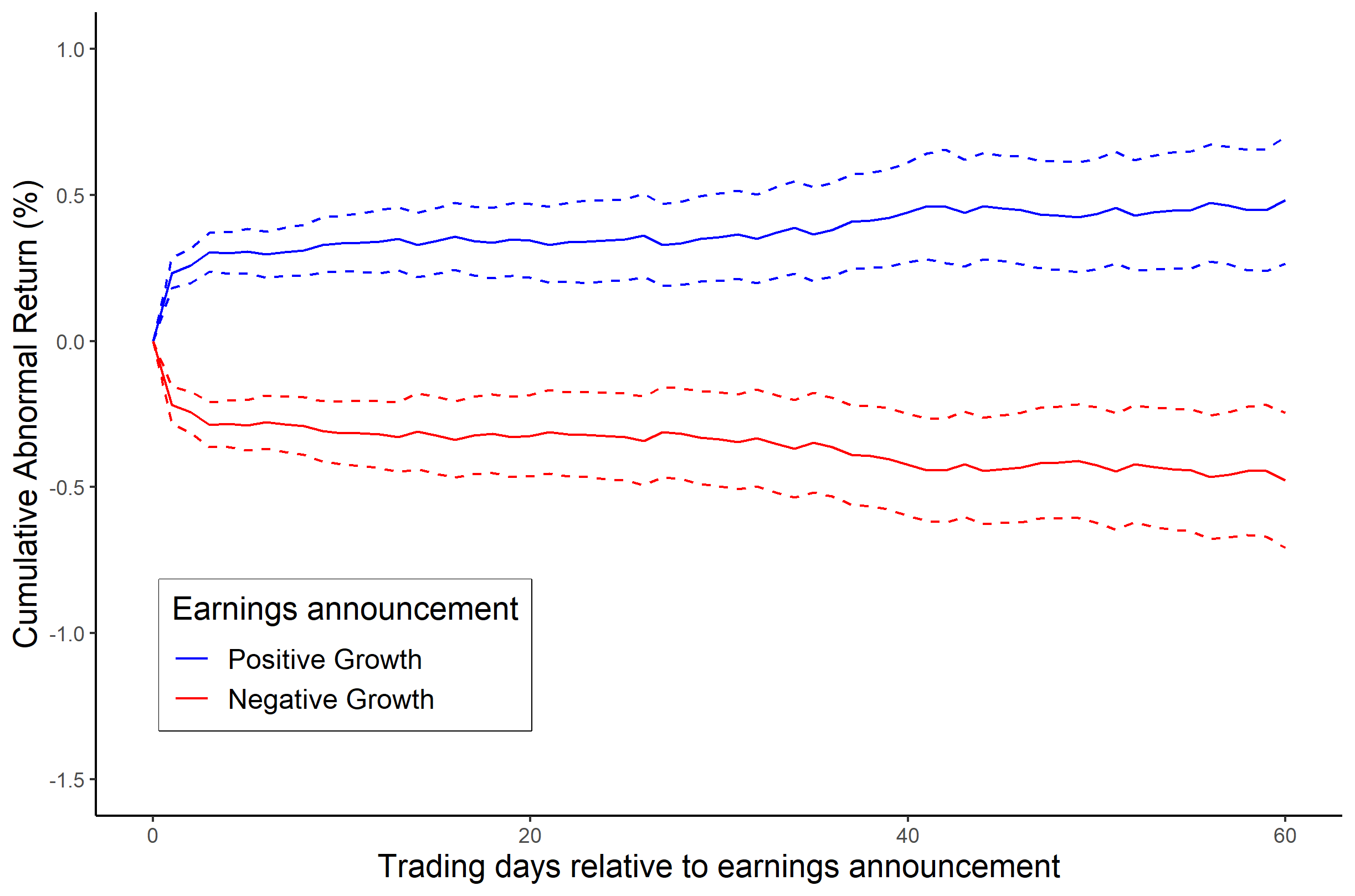

Efficient-market Hypothesis

The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information. Because the EMH is formulated in terms of risk adjustment, it only makes testable predictions when coupled with a particular model of risk. As a result, research in financial economics since at least the 1990s has focused on market anomalies, that is, deviations from specific models of risk. The idea that financial market returns are difficult to predict goes back to Bachelier, Mandelbrot, and Samuelson, but is closely associated with Eugene Fama, in part due to his influential 1970 review of the theoretical and empirical research. The EMH provides the basic logic for modern risk-based theories of asset prices, and frameworks such as consumption-based asset pricing and int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leverage (finance)

In finance, leverage (or gearing in the United Kingdom and Australia) is any technique involving borrowing funds to buy things, hoping that future profits will be many times more than the cost of borrowing. This technique is named after a lever in physics, which amplifies a small input force into a greater output force, because successful leverage amplifies the comparatively small amount of money needed for borrowing into large amounts of profit. However, the technique also involves the high risk of not being able to pay back a large loan. Normally, a lender will set a limit on how much risk it is prepared to take and will set a limit on how much leverage it will permit, and would require the acquired asset to be provided as collateral security for the loan. Leveraging enables gains to be multiplied.Brigham, Eugene F., ''Fundamentals of Financial Management'' (1995). On the other hand, losses are also multiplied, and there is a risk that leveraging will result in a loss if financi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gary Gensler

Gary Gensler (born October 18, 1957) is an American government official and former investment banker serving as the chair of the U.S. Securities and Exchange Commission. Gensler previously led the Presidential transition of Joe Biden, Biden–Harris transition's Federal Reserve, Banking, and Securities Regulators agency review team. Prior to his appointment, he was professor of Practice of Global Economics and Management at the MIT Sloan School of Management. Gensler served as the 11th chairman of the Commodity Futures Trading Commission, under President Barack Obama, from May 26, 2009, to January 3, 2014. He was the Under Secretary of the Treasury for Domestic Finance (1999–2001), and the Assistant Secretary of the Treasury for Financial Markets (1997–1999). Prior to his career in the federal government, Gensler worked at Goldman Sachs, where he was a partner and co-head of finance. Gensler also served as the CFO for the Hillary Clinton 2016 presidential campaign. President ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SEC Chair

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation. In addition to the Securities Exchange Act of 1934, which created it, the SEC enforces the Securities Act of 1933, the Trust Indenture Act of 1939, the Investment Company Act of 1940, the Investment Advisers Act of 1940, the Sarbanes–Oxley Act of 2002, and other statutes. The SEC was created by Section 4 of the Securities Exchange Act of 1934 (now codified as and commonly referred to as the Exchange Act or the 1934 Act). Overview The SEC has a three-part mission: to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation. To achieve its mandate, the SEC enforces the statutory requirement that public companies and other regulated companies submit quarterly and annual reports ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Fund

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investment company with variable capital') and open-ended investment company (OEIC) in the UK. Mutual funds are often classified by their principal investments: money market funds, bond or fixed income funds, stock or equity funds, or hybrid funds. Funds may also be categorized as index funds, which are passively managed funds that track the performance of an index, such as a stock market index or bond market index, or actively managed funds, which seek to outperform stock market indices but generally charge higher fees. Primary structures of mutual funds are open-end funds, closed-end funds, unit investment trusts. Open-end funds are purchased from or sold to the issuer at the net asset value of each share as of the close ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Order (exchange)

An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or cryptocurrency exchange. These instructions can be simple or complicated, and can be sent to either a broker or directly to a trading venue via direct market access. There are some standard instructions for such orders. Market order A market order is a buy or sell order to be executed immediately at the ''current'' ''market'' prices. As long as there are willing sellers and buyers, market orders are filled. Market orders are used when certainty of execution is a priority over the price of execution. A market order is the simplest of the order types. This order type does not allow any control over the price received. The order is filled at the best price available at the relevant time. In fast-moving markets, the price paid or received may be quite different from the last price quoted before the order was entered. A market order may be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limit Order

An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or cryptocurrency exchange. These instructions can be simple or complicated, and can be sent to either a broker or directly to a trading venue via direct market access. There are some standard instructions for such orders. Market order A market order is a buy or sell order to be executed immediately at the ''current'' ''market'' prices. As long as there are willing sellers and buyers, market orders are filled. Market orders are used when certainty of execution is a priority over the price of execution. A market order is the simplest of the order types. This order type does not allow any control over the price received. The order is filled at the best price available at the relevant time. In fast-moving markets, the price paid or received may be quite different from the last price quoted before the order was entered. A market order may be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)