|

SEC Chair

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation. In addition to the Securities Exchange Act of 1934, which created it, the SEC enforces the Securities Act of 1933, the Trust Indenture Act of 1939, the Investment Company Act of 1940, the Investment Advisers Act of 1940, the Sarbanes–Oxley Act of 2002, and other statutes. The SEC was created by Section 4 of the Securities Exchange Act of 1934 (now codified as and commonly referred to as the Exchange Act or the 1934 Act). Overview The SEC has a three-part mission: to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation. To achieve its mandate, the SEC enforces the statutory requirement that public companies and other regulated companies submit quarterly and annual repo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Washington, D

Washington commonly refers to: * Washington (state), United States * Washington, D.C., the capital of the United States ** A metonym for the federal government of the United States ** Washington metropolitan area, the metropolitan area centered on Washington, D.C. * George Washington (1732–1799), the first president of the United States Washington may also refer to: Places England * Washington, Tyne and Wear, a town in the City of Sunderland metropolitan borough ** Washington Old Hall, ancestral home of the family of George Washington * Washington, West Sussex, a village and civil parish Greenland * Cape Washington, Greenland * Washington Land Philippines * New Washington, Aklan, a municipality *Washington, a barangay in Catarman, Northern Samar *Washington, a barangay in Escalante, Negros Occidental *Washington, a barangay in San Jacinto, Masbate *Washington, a barangay in Surigao City United States * Washington, Wisconsin (other) * Fort Washington (disambigu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Online And Offline

In computer technology and telecommunications, online indicates a state of connectivity and offline indicates a disconnected state. In modern terminology, this usually refers to an Internet connection, but (especially when expressed "on line" or "on the line") could refer to any piece of equipment or functional unit that is connected to a larger system. Being online means that the equipment or subsystem is connected, or that it is ready for use. "Online" has come to describe activities performed on and data available on the Internet, for example: "online identity", " online predator", " online gambling", "online game", "online shopping", "online banking", and " online learning". Similar meaning is also given by the prefixes "cyber" and "e", as in the words "cyberspace", "cybercrime", "email", and "ecommerce". In contrast, "offline" can refer to either computing activities performed while disconnected from the Internet, or alternatives to Internet activities (such as shopping in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Self-regulatory Organization

A self-regulatory organization (SRO) is an organization that exercises some degree of regulatory authority over an industry or profession. The regulatory authority could exist in place of government regulation, or applied in addition to government regulation. The ability of an SRO to exercise regulatory authority does not necessarily derive from a grant of authority from the government. United States In United States securities law, a self-regulatory organization is a defined term. The principal federal regulatory authority—the Securities and Exchange Commission (SEC)—was established by the Federal Securities Exchange Act of 1934. The SEC originally delegated authority to the National Association of Securities Dealers (NASD, now Financial Industry Regulatory Authority (FINRA)) and to the national stock exchanges (e.g., the NYSE) to enforce certain industry standards and requirements related to securities trading and brokerage. On July 26, 2007 the SEC approved a merger o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed companies at US$30.1 trillion as of February 2018. The average daily trading value was approximately 169 billion in 2013. The NYSE trading floor is at the New York Stock Exchange Building on 11 Wall Street and 18 Broad Street and is a National Historic Landmark. An additional trading room, at 30 Broad Street, was closed in February 2007. The NYSE is owned by Intercontinental Exchange, an American holding company that it also lists (). Previously, it was part of NYSE Euronext (NYX), which was formed by the NYSE's 2007 merger with Euronext. History The earliest recorded organization of securities trading in New York among brokers directly dealing with each other can be traced to the Buttonwood Agreement. Previously, secu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Secondary Market

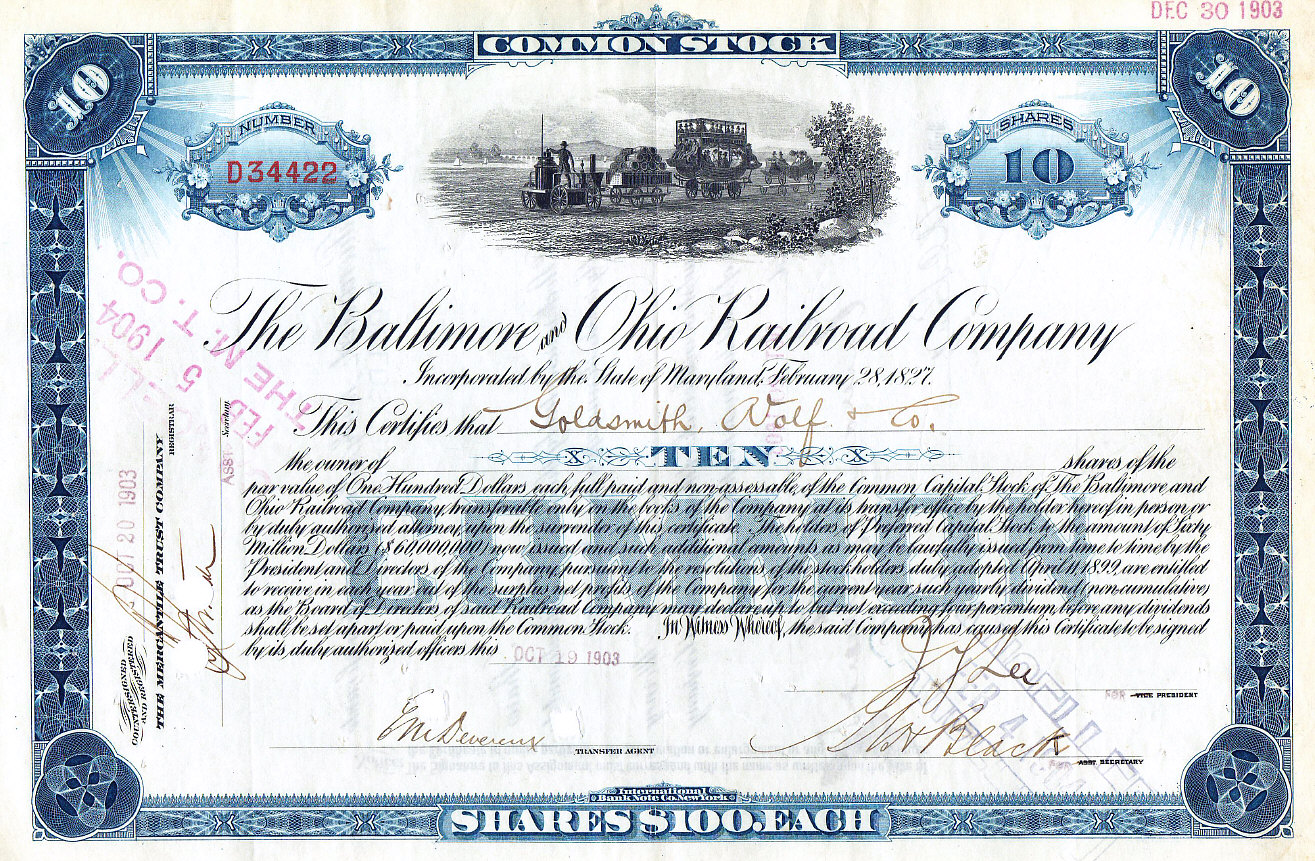

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of the security by the issuer to a purchaser, who pays proceeds to the issuer, is the primary market. All sales after the initial sale of the security are sales in the secondary market. Whereas the term primary market refers to the market for new issues of securities, and " market is primary if the proceeds of sales go to the issuer of the securities sold," the secondary market in contrast is the market created by the later trading of such securities. With primary issuances of securities or financial instruments (the primary market), often an underwriter purchases these securities directly from issuers, such as corporations issuing shares in an IPO or private placement. Then the underwriter re-sells the securities to other buyers, in what is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Primary Market

:''"Primary market" may also refer to a market in art valuation.'' The primary market is the part of the capital market that deals with the issuance and sale of securities to purchasers directly by the issuer, with the issuer being paid the proceeds. A primary market means the market for new issues of securities, as distinguished from the secondary market, where previously issued securities are bought and sold. "A market is primary if the proceeds of sales go to the issuer of the securities sold." Buyers buy securities that were not previously traded. Concept In a primary market, companies, governments, or public sector institutions can raise funds through bond issues, and corporations can raise capital through the sale of new stock through an initial public offering (IPO). This is often done through an investment bank or underwriter or finance syndicate of securities dealers. The process of selling new shares to buyers is called underwriting. Dealers earn a commission that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pecora Commission

The Pecora Investigation was an inquiry begun on March 4, 1932, by the United States Senate Committee on Banking and Currency to investigate the causes of the Wall Street Crash of 1929. The name refers to the fourth and final chief counsel for the investigation, Ferdinand Pecora. His exposure of abusive practices in the financial industry galvanized broad public support for stricter regulations. As a result, the U.S. Congress passed the Glass–Steagall Banking Act of 1933, the Securities Act of 1933, and the Securities Exchange Act of 1934. History Following the 1929 Wall Street Crash, the U.S. economy had gone into a depression, and a large number of banks failed. The Pecora Investigation sought to uncover the causes of the financial collapse. As chief counsel, Ferdinand Pecora personally examined many high-profile witnesses, who included some of the nation's most influential bankers and stockbrokers. Among these witnesses were Richard Whitney, president of the New York Stoc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Deal

The New Deal was a series of programs, public work projects, financial reforms, and regulations enacted by President Franklin D. Roosevelt in the United States between 1933 and 1939. Major federal programs agencies included the Civilian Conservation Corps (CCC), the Works Progress Administration (WPA), the Civil Works Administration (CWA), the Farm Security Administration (FSA), the National Industrial Recovery Act of 1933 (NIRA) and the Social Security Administration (SSA). They provided support for farmers, the unemployed, youth, and the elderly. The New Deal included new constraints and safeguards on the banking industry and efforts to re-inflate the economy after prices had fallen sharply. New Deal programs included both laws passed by Congress as well as presidential executive orders during the first term of the presidency of Franklin D. Roosevelt. The programs focused on what historians refer to as the "3 R's": relief for the unemployed and for the poor, recove ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Franklin D

Franklin may refer to: People * Franklin (given name) * Franklin (surname) * Franklin (class), a member of a historical English social class Places Australia * Franklin, Tasmania, a township * Division of Franklin, federal electoral division in Tasmania * Division of Franklin (state), state electoral division in Tasmania * Franklin, Australian Capital Territory, a suburb in the Canberra district of Gungahlin * Franklin River, river of Tasmania * Franklin Sound, waterway of Tasmania Canada * District of Franklin, a former district of the Northwest Territories * Franklin, Quebec, a municipality in the Montérégie region * Rural Municipality of Franklin, Manitoba * Franklin, Manitoba, an unincorporated community in the Rural Municipality of Rosedale, Manitoba * Franklin Glacier Complex, a volcano in southwestern British Columbia * Franklin Range, a mountain range on Vancouver Island, British Columbia * Franklin River (Vancouver Island), British Columbia * Fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stockbroker

A stockbroker is a regulated broker, broker-dealer, or registered investment adviser (in the United States) who may provide financial advisory and investment management services and execute transactions such as the purchase or sale of stocks and other investments to financial market participants in return for a commission, markup, or fee, which could be based on a flat rate, percentage of assets, or hourly rate. The term also refers to financial companies, offering such services. Examples of professional designations held by individuals in this field, which affects the types of investments they are permitted to sell and the services they provide include chartered financial consultants, certified financial planners or chartered financial analysts (in the United States and UK), chartered strategic wealth professionals (in Canada), chartered financial planners (in the UK). The Financial Industry Regulatory Authority provides an online tool designed to help understand pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Blue Sky Law

A blue sky law is a state law in the United States that regulates the offering and sale of securities to protect the public from fraud. Though the specific provisions of these laws vary among states, they all require the registration of all securities offerings and sales, as well as of stockbrokers and brokerage firms. Each state's blue sky law is administered by its appropriate regulatory agency, and most also provide private causes of action for private investors who have been injured by securities fraud. The first blue sky law was enacted in Kansas in 1911 at the urging of its banking commissioner, Joseph Norman Dolley, and served as a model for similar statutes in other states. Between 1911 and 1933, 47 states adopted blue-sky statutes (Nevada was the lone holdout). Today, the blue sky laws of 40 of the 50 states are patterned after the Uniform Securities Act of 1956. Historically, the federal securities laws and the state blue sky laws complemented and often duplicated ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fraud

In law, fraud is intentional deception to secure unfair or unlawful gain, or to deprive a victim of a legal right. Fraud can violate civil law (e.g., a fraud victim may sue the fraud perpetrator to avoid the fraud or recover monetary compensation) or criminal law (e.g., a fraud perpetrator may be prosecuted and imprisoned by governmental authorities), or it may cause no loss of money, property, or legal right but still be an element of another civil or criminal wrong. The purpose of fraud may be monetary gain or other benefits, for example by obtaining a passport, travel document, or driver's license, or mortgage fraud, where the perpetrator may attempt to qualify for a mortgage by way of false statements. Internal fraud, also known as "insider fraud", is fraud committed or attempted by someone within an organisation such as an employee. A hoax is a distinct concept that involves deliberate deception without the intention of gain or of materially damaging or depriving a v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |