|

Equity Risk Premium

The equity premium puzzle refers to the inability of an important class of economic models to explain the average equity risk premium (ERP) provided by a diversified portfolio of equities over that of government bonds, which has been observed for more than 100 years. There is a significant disparity between returns produced by stocks compared to returns produced by government treasury bills. The equity premium puzzle addresses the difficulty in understanding and explaining this disparity. This disparity is calculated using the equity risk premium: The equity risk premium is equal to the difference between equity returns and returns from government bonds. It is equal to around 5% to 8% in the United States. The risk premium represents the compensation awarded to the equity holder for taking on a higher risk by investing in equities rather than government bonds. However, the 5% to 8% premium is considered to be an implausibly high difference and the equity premium puzzle refers to t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Model

An economic model is a theoretical construct representing economic processes by a set of variables and a set of logical and/or quantitative relationships between them. The economic model is a simplified, often mathematical, framework designed to illustrate complex processes. Frequently, economic models posit structural parameters. A model may have various exogenous variables, and those variables may change to create various responses by economic variables. Methodological uses of models include investigation, theorizing, and fitting theories to the world. Overview In general terms, economic models have two functions: first as a simplification of and abstraction from observed data, and second as a means of selection of data based on a paradigm of econometric study. ''Simplification'' is particularly important for economics given the enormous complexity of economic processes. This complexity can be attributed to the diversity of factors that determine economic activity; t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prospect Theory

Prospect theory is a theory of behavioral economics, judgment and decision making that was developed by Daniel Kahneman and Amos Tversky in 1979. The theory was cited in the decision to award Kahneman the 2002 Nobel Memorial Prize in Economics. Based on results from controlled studies, it describes how individuals assess their loss and gain perspectives in an asymmetric manner (see loss aversion). For example, for some individuals, the pain from losing $1,000 could only be compensated by the pleasure of earning $2,000. Thus, contrary to the expected utility theory (which models the decision that perfectly rational agents would make), prospect theory aims to describe the actual behavior of people. In the original formulation of the theory, the term ''prospect'' referred to the predictable results of a lottery. However, prospect theory can also be applied to the prediction of other forms of behaviors and decisions. Prospect theory challenges the expected utility theory deve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistical Power

In frequentist statistics, power is the probability of detecting a given effect (if that effect actually exists) using a given test in a given context. In typical use, it is a function of the specific test that is used (including the choice of test statistic and significance level), the sample size (more data tends to provide more power), and the effect size (effects or correlations that are large relative to the variability of the data tend to provide more power). More formally, in the case of a simple hypothesis test with two hypotheses, the power of the test is the probability that the test correctly rejects the null hypothesis (H_0) when the alternative hypothesis (H_1) is true. It is commonly denoted by 1-\beta, where \beta is the probability of making a type II error (a false negative) conditional on there being a true effect or association. Background Statistical testing uses data from samples to assess, or make inferences about, a statistical population. Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption Smoothing

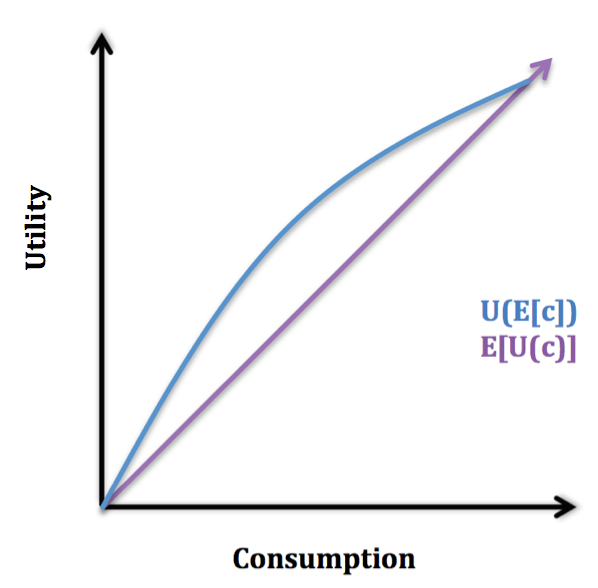

Consumption smoothing is an economic concept for the practice of optimizing a person's standard of living through an appropriate balance between savings and consumption over time. An optimal consumption rate should be relatively similar at each stage of a person's life rather than fluctuate wildly. Luxurious consumption at an old age does not compensate for an impoverished existence at other stages in one's life. Since income tends to be hump-shaped across an individual's life, economic theory suggests that individuals should on average have low or negative savings rate at early stages in their life, high in middle age, and negative during retirement. Although many popular books on personal finance advocate that individuals should at all stages of their careers set aside money in savings, economist James Choi states that this deviates from the advice of economists. Expected utility model The graph below illustrates the expected utility model, in which U(c) is increasing in and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transaction Cost

In economics, a transaction cost is a cost incurred when making an economic trade when participating in a market. The idea that transactions form the basis of economic thinking was introduced by the institutional economist John R. Commons in 1931. Oliver E. Williamson's ''Transaction Cost Economics'' article, published in 2008, popularized the concept of transaction costs. Douglass C. North argues that institutions, understood as the set of rules in a society, are key in the determination of transaction costs. In this sense, institutions that facilitate low transaction costs can boost economic growth.North, Douglass C. 1992. "Transaction costs, institutions, and economic performance", San Francisco, CA: ICS Press. Alongside production costs, transaction costs are one of the most significant factors in business operation and management. Definition Williamson defines transaction costs as a cost innate in running an economic system of companies, comprising the total costs of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moral Hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs associated with that risk, should things go wrong. For example, when a corporation is insured, it may take on higher risk knowing that its insurance will pay the associated costs. A moral hazard may occur where the actions of the risk-taking party change to the detriment of the cost-bearing party after a financial transaction has taken place. Moral hazard can occur under a type of information asymmetry where the risk-taking party to a transaction knows more about its intentions than the party paying the consequences of the risk and has a tendency or incentive to take on too much risk from the perspective of the party with less information. One example is a principal–agent approach (also called agency theory), where one party, called an agent, acts on behalf of another party, called the principal. However, a principa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adverse Selection

In economics, insurance, and risk management, adverse selection is a market situation where Information asymmetry, asymmetric information results in a party taking advantage of undisclosed information to benefit more from a contract or trade. In an ideal world, buyers should pay a price which reflects their willingness to pay and the value to them of the product or service, and sellers should sell at a price which reflects the quality of their goods and services. However, when one party holds information that the other party does not have, they have the opportunity to damage the other party by maximizing self-utility, concealing relevant information, and perhaps even lying. This opportunity has secondary effects: the party without the information may take steps to avoid entering into an unfair contract, perhaps by withdrawing from the interaction; a party may ask for higher or lower prices, diminishing the volume of trade in the market; or parties may be deterred from participatin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Failure

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value.Paul Krugman and Robin Wells Krugman, Robin Wells (2006). ''Economics'', New York, Worth Publishers. The first known use of the term by economists was in 1958,Francis M. Bator (1958). "The Anatomy of Market Failure," ''Quarterly Journal of Economics'', 72(3) pp351–379(press +). but the concept has been traced back to the Victorian writers John Stuart Mill and Henry Sidgwick.Steven G. Medema (2007). "The Hesitant Hand: Mill, Sidgwick, and the Evolution of the Theory of Market Failure," ''History of Political Economy'', 39(3)pp. 331��358. 200Online Working Paper. Market failures are often associated with public goods, time-inconsistent preferences, Information asymmetry, information asymmetries, Market structure, failures of competition, principal–agent problems, externalities,Jean-Jacques L ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by "sigma, σ") is the Variability (statistics), degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Info-gap Decision Theory

Info-gap decision theory seeks to optimize robustness to failure under severe uncertainty,Yakov Ben-Haim, ''Information-Gap Theory: Decisions Under Severe Uncertainty,'' Academic Press, London, 2001.Yakov Ben-Haim, ''Info-Gap Theory: Decisions Under Severe Uncertainty,'' 2nd edition, Academic Press, London, 2006. in particular applying sensitivity analysis of the stability radius type to perturbations in the value of a given estimate of the parameter of interest. It has some connections with Wald's maximin model; some authors distinguish them, others consider them instances of the same principle. It was developed by Yakov Ben-Haim, and has found many applications and described as a theory for decision-making under "''severe'' uncertainty". It has been criticized as unsuited for this purpose, and alternatives proposed, including such classical approaches as robust optimization. Applications Info-gap theory has generated a lot of literature. Info-gap theory has been studied o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Satisficing

Satisficing is a decision-making strategy or cognitive heuristic that entails searching through the available alternatives until an acceptability threshold is met, without necessarily maximizing any specific objective. The term ''satisficing'', a portmanteau of ''satisfy'' and ''suffice'', was introduced by Herbert A. Simon in 1956, although the concept was first posited in his 1947 book ''Administrative Behavior''. Simon used satisficing to explain the behavior of decision makers under circumstances in which an optimal solution cannot be determined. He maintained that many natural problems are characterized by computational intractability or a lack of information, both of which preclude the use of mathematical optimization procedures. He observed in his Nobel Prize in Economics speech that "decision makers can satisfice either by finding optimum solutions for a simplified world, or by finding satisfactory solutions for a more realistic world. Neither approach, in general, dominat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |