|

Donald Sussman

Selwyn Donald Sussman (born June 8, 1946) is an American asset manager and philanthropist who is the founder and chief investment officer of the Paloma Funds. Sussman has served on the boards of a number of civic, cultural, educational, and research institutions and is a major contributor to Democratic candidates and causes. Early life and education Sussman was born to a Jewish family in June 1946, the son of Beatrice (née Zimmerman) and William Sussman.New York Times: "S.D. Sussman Weds Miss Tisch" March 15, 1981 His father was a real estate developer. He was raised in and attended high school at |

Miami

Miami ( ), officially the City of Miami, known as "the 305", "The Magic City", and "Gateway to the Americas", is a East Coast of the United States, coastal metropolis and the County seat, county seat of Miami-Dade County, Florida, Miami-Dade County in South Florida, United States. With a population of 442,241 at the 2020 United States census, 2020 census, it is the List of municipalities in Florida, second-most populous city in Florida and the eleventh-most populous city in the Southeastern United States. The Miami metropolitan area is the ninth largest in the U.S. with a population of 6.138 million in 2020. The city has the List of tallest buildings in the United States#Cities with the most skyscrapers, third-largest skyline in the U.S. with over List of tallest buildings in Miami, 300 high-rises, 58 of which exceed . Miami is a major center and leader in finance, commerce, culture, arts, and international trade. Miami's metropolitan area is by far the largest urban econ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cuban Revolution

The Cuban Revolution ( es, Revolución Cubana) was carried out after the 1952 Cuban coup d'état which placed Fulgencio Batista as head of state and the failed mass strike in opposition that followed. After failing to contest Batista in court, Fidel Castro organized an armed attack on the Cuban military's Moncada Barracks. The rebels were arrested and while in prison formed the 26th of July Movement. After gaining amnesty the M-26-7 rebels organized an expedition from Mexico on the Granma yacht to invade Cuba. In the following years the M-26-7 rebel army would slowly defeat the Cuban army in the countryside, while its urban wing would engage in sabotage and rebel army recruitment. Over time the originally critical and ambivalent Popular Socialist Party would come to support the 26th of July Movement in late 1958. By the time the rebels were to oust Batista the revolution was being driven by the Popular Socialist Party, 26th of July Movement, and the Directorio Revoluci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kennebec Journal

The ''Kennebec Journal'' is a six-day morning daily newspaper published in Augusta, Maine. It is owned by MaineToday Media, which also publishes the state's largest newspaper, the ''Portland Press Herald''. The newspaper covers Augusta and the surrounding capital area and southern Kennebec County. Known colloquially as the "KJ". History ''The Kennebec Journal'' began publishing as a weekly newspaper in 1825, five years after Maine had become a state."The Old South". ''The Washington Post''. August 4, 1906. p. 6. James G. Blaine bought half of the newspaper in 1854 and became its editor. Blaine later served as United States Senator from Maine from 1876 to 1881, United States Secretary of State in 1881 and from 1889 to 1892. He was also the Republican Party's nominee for president during the 1884 election. In November 1922, Charles F. Flint, general manager of ''The Kennebec Journal'', and his three sons, Roy, Charles, and Leigh, purchased stock control of the newspaper. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MaineToday Media

MaineToday Media is a privately owned publisher of daily and weekly newspapers in the U.S. state of Maine, based in the state's largest city, Portland. It includes the ''Portland Press Herald'' and ''Maine Sunday Telegram'', the state's largest newspaper. Properties MaineToday's daily newspapers include the ''Portland Press Herald'' and ''Maine Sunday Telegram'' in Portland, the ''Kennebec Journal'' in Augusta and the ''Morning Sentinel'' in Waterville. The company also owns ''The Coastal Journal'', a weekly newspaper in Bath. It previously published ''The Community Leader'', a weekly in Falmouth, and ''The Maine Switch'', a lifestyle and entertainment magazine in Portland. MaineToday also owns local Maine websites dedicated to classified advertising, entertainment listings, parenting and travel, as well as a Yellow Pages site and a digital marketing service. Gannett and Blethen MaineToday's newspaper properties were, for most of the 20th century, the core of Guy Gann ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MIT Sloan School Of Management

The MIT Sloan School of Management (MIT Sloan or Sloan) is the business school of the Massachusetts Institute of Technology, a private university in Cambridge, Massachusetts. MIT Sloan offers bachelor's, master's, and doctoral degree programs, as well as executive education. Its degree programs are among the most selective in the world. MIT Sloan emphasizes innovation in practice and research. Many influential ideas in management and finance originated at the school, including the Black–Scholes model, the Solow–Swan model, the random walk hypothesis, the binomial options pricing model, and the field of system dynamics. The faculty has included numerous Nobel laureates in economics and John Bates Clark Medal winners. History The MIT Sloan School of Management began in 1914 as the engineering administration curriculum ("Course 15") in the MIT Department of Economics and Statistics. The scope and depth of this educational focus grew steadily in response to advances in the the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Empirica Capital

Empirica Capital LLC was a hedge fund founded in 1999 by Nassim Nicholas Taleb in partnership with Mark Spitznagel, that used Taleb's black swan strategy. The firm closed in 2005 as Taleb took time off for health reasons. The investment strategy of the fund has been explained in a ''New Yorker New Yorker or ''variant'' primarily refers to: * A resident of the State of New York ** Demographics of New York (state) * A resident of New York City ** List of people from New York City * ''The New Yorker'', a magazine founded in 1925 * '' The ...'' article. One of Empirica's funds, Empirica Kurtosis LLC, was reported to have made a 60% return in 2000 followed by losses in 2001, 2002, and single digit gains in 2003 and 2004.https://www.wsj.com/articles/SB118429436433665637 http://www.tavakolistructuredfinance.com/2009/06/talebs-stranded-swan/ The article said the fund had a 60% return in 2000 followed by “losses in 2001 and in 2002.” In 2003 and 2004 it had low single-digit gains, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nassim Nicholas Taleb

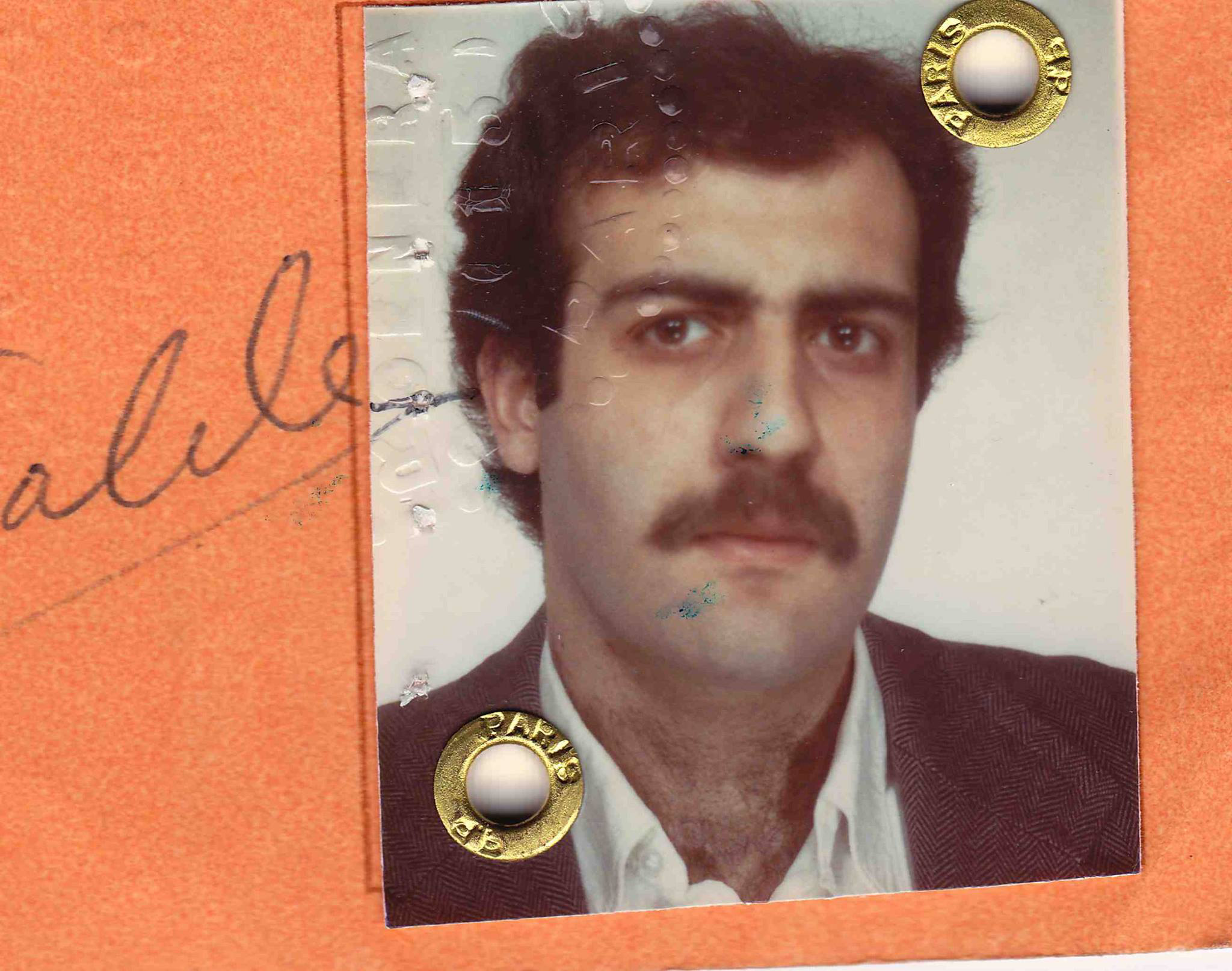

Nassim Nicholas Taleb (; alternatively ''Nessim ''or'' Nissim''; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist whose work concerns problems of randomness, probability, and uncertainty. ''The Sunday Times'' called his 2007 book '' The Black Swan'' one of the 12 most influential books since World War II. Taleb is the author of the ''Incerto'', a five-volume philosophical essay on uncertainty published between 2001 and 2018 (of which the best-known books are ''The Black Swan'' and ''Antifragile''). He has been a professor at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has been co-editor-in-chief of the academic journal ''Risk and Decision Analysis'' since September 2014. He has also been a practitioner of mathematical finance, a hedge fund manager, and a derivatives trader, and i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

JPMorgan

JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of 2022, JPMorgan Chase is the largest bank in the United States, the world's largest bank by market capitalization, and the fifth largest bank in the world in terms of total assets, with total assets of US$3.774 trillion. Additionally, JPMorgan Chase is ranked 24th on the Fortune 500 list of the largest United States corporations by total revenue. It is considered a systemically important bank by the Financial Stability Board. As a " Bulge Bracket" bank, it is a major provider of various investment banking and financial services. It is one of America's Big Four banks, along with Bank of America, Citigroup, and Wells Fargo. JPMorgan Chase is considered to be a universal bank and a custodian bank. The J.P. Morgan brand is used by the investment banking, asset management, private banking, wealth management, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Amaranth Advisors

Amaranth Advisors LLC was an American multi-strategy hedge fund founded by Nicholas M. Maounis and headquartered in Greenwich, Connecticut. At its peak, the firm had up to $9.2 billion in assets under management before collapsing in September 2006, after losing in excess of $6 billion on natural gas futures. Amaranth Advisors collapse is one of the biggest hedge fund collapses in history and at the time (2006) largest known trading losses. History 2000 founding The company was founded in 2000 by Nicholas M. Maounis and based in Greenwich, Connecticut. Throughout much of its history, convertible arbitrage was the firm's primary profit vehicle. Maounis had prior to founding Amaranth Advisors worked at Paloma Partners as a portfolio manager covering debt securities. The company was named after the amaranth an "immortal" flower that retains vivid color even after death. 2004–2005 Focus on energy trading During 2004-2005, the firm shifted its emphasis to energy trading by Canadia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Volatility

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of squa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset Management

Asset management is a systematic approach to the governance and realization of value from the things that a group or entity is responsible for, over their whole life cycles. It may apply both to tangible assets (physical objects such as buildings or equipment) and to intangible assets (such as human capital, intellectual property, goodwill or financial assets). Asset management is a systematic process of developing, operating, maintaining, upgrading, and disposing of assets in the most cost-effective manner (including all costs, risks, and performance attributes). The term is commonly used in the financial sector to describe people and companies who manage investments on behalf of others. Those include, for example, investment managers that manage the assets of a pension fund. It is also increasingly used in both the business world and public infrastructure sectors to ensure a coordinated approach to the optimization of costs, risks, service/performance, and sustainability. IS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institutional Investor

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, REITs, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM). Although institutional investors appear to be more sophisticated than retail investors, it remains unclear if professional active investment managers can reliably enhance risk-adjusted returns by an amount that exceeds fees and expenses of investment managemen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |