|

Diamond–Dybvig Model

The Diamond–Dybvig model is an influential model of bank runs and related financial crises. The model shows how banks' mix of illiquid assets (such as business or mortgage loans) and liquid liabilities (deposits which may be withdrawn at any time) may give rise to self-fulfilling panics among depositors. Diamond and Dybvig, along with Ben Bernanke, were the recipients of the 2022 Nobel Prize in Economics for their work on the Diamond-Dybvig model. Theory The model, published in 1983 by Douglas W. Diamond of the University of Chicago and Philip H. Dybvig, then of Yale University and now of Washington University in St. Louis, shows how an institution with long-maturity assets and short-maturity liabilities can be unstable. Structure of the model Diamond and Dybvig's paper points out that business investment often requires expenditures in the present to obtain returns in the future. Therefore, they prefer loans with a long maturity (that is, low liquidity). The same princ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Northern Rock Queue

Northern may refer to the following: Geography * North, a point in direction * Northern Europe, the northern part or region of Europe * Northern Highland, a region of Wisconsin, United States * Northern Province, Sri Lanka * Northern Range, a range of hills in Trinidad Schools * Northern Collegiate Institute and Vocational School (NCIVS), a school in Sarnia, Canada * Northern Secondary School, Toronto, Canada * Northern Secondary School (Sturgeon Falls), Ontario, Canada * Northern University (other), various institutions * Northern Guilford High School, a public high school in Greensboro, North Carolina Companies * Arriva Rail North, a former train operating company in northern England * Northern Bank, commercial bank in Northern Ireland * Northern Foods, based in Leeds, England * Northern Pictures, an Australian-based television production company * Northern Rail, a former train operating company in northern England * Northern Railway of Canada, a defunct ra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Correlation

In statistics, correlation or dependence is any statistical relationship, whether causal or not, between two random variables or bivariate data. Although in the broadest sense, "correlation" may indicate any type of association, in statistics it usually refers to the degree to which a pair of variables are '' linearly'' related. Familiar examples of dependent phenomena include the correlation between the height of parents and their offspring, and the correlation between the price of a good and the quantity the consumers are willing to purchase, as it is depicted in the so-called demand curve. Correlations are useful because they can indicate a predictive relationship that can be exploited in practice. For example, an electrical utility may produce less power on a mild day based on the correlation between electricity demand and weather. In this example, there is a causal relationship, because extreme weather causes people to use more electricity for heating or cooling. H ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

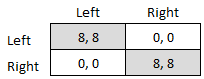

Coordination Game

A coordination game is a type of simultaneous game found in game theory. It describes the situation where a player will earn a higher payoff when they select the same course of action as another player. The game is not one of pure conflict, which results in multiple pure strategy Nash equilibrium, Nash equilibria in which players choose matching strategies. Figure 1 shows a 2-player example. Both (Up, Left) and (Down, Right) are Nash equilibria. If the players expect (Up, Left) to be played, then player 1 thinks their payoff would fall from 2 to 1 if they deviated to Down, and player 2 thinks their payoff would fall from 4 to 3 if they chose Right. If the players expect (Down, Right), player 1 thinks their payoff would fall from 2 to 1 if they deviated to Up, and player 2 thinks their payoff would fall from 4 to 3 if they chose Left. A player's optimal move depends on what they expect the other player to do, and they both do better if they coordinate than if they played an off-eq ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset–liability Mismatch

In finance, an asset–liability mismatch occurs when the financial terms of an institution's assets and liabilities do not correspond. Several types of mismatches are possible. For example, a bank that chose to borrow entirely in US dollars and lend in Russian rubles would have a significant currency mismatch: if the value of the ruble were to fall dramatically, the bank would lose money. In extreme cases, such movements in the value of the assets and liabilities could lead to bankruptcy, liquidity problems and wealth transfer. A bank could also have substantial long-term assets (such as fixed-rate mortgages) funded by short-term liabilities, such as deposits. If short-term interest rates rise, the short-term liabilities re-price at maturity, while the yield on the longer-term, fixed-rate assets remains unchanged. Income from the longer-term assets remains unchanged, while the cost of the newly re-priced liabilities funding these assets increases. This is sometimes called a ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moral Hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. For example, when a corporation is insured, it may take on higher risk knowing that its insurance will pay the associated costs. A moral hazard may occur where the actions of the risk-taking party change to the detriment of the cost-bearing party after a financial transaction has taken place. Moral hazard can occur under a type of information asymmetry where the risk-taking party to a transaction knows more about its intentions than the party paying the consequences of the risk and has a tendency or incentive to take on too much risk from the perspective of the party with less information. One example is a principal–agent problem, where one party, called an agent, acts on behalf of another party, called the principal. If the agent has more information about his or her actions or intentions than the princi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagion began around September and led to the Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century. Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II. Devastating effects were seen in both rich and poor countries with falling personal income, prices, tax revenues, and profits. International trade fell by more than 50%, unemployment in the U.S. rose to 23% ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. The FDIC is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this was increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union, and oversees their commercial banking system. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Most central banks also have supervisory and regulatory powers to ensure the stability of member institutions, to prevent bank runs, and to discourage reckless or fraudulent behavior by member banks. Central banks in most developed nations are institutionally independent from political interference. Still, limited control by the executive and legislative bodies exists. Activities of central banks Functions of a central bank usually include: * Monetary policy: by setting the official interest rate and controlling the money supply; *Financial stability: acting as a government's banker and as the bankers' bank (" lender of last resort"); * Reserve management: managing a cou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deposit Insurance

Deposit insurance or deposit protection is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance systems are one component of a financial system safety net that promotes financial stability. Overview Banks are allowed (and usually encouraged) to lend or invest most of the money deposited with them instead of safe-keeping the full amounts (see fractional-reserve banking). If many of a bank's borrowers fail to repay their loans when due, the bank's creditors, including its depositors, risk loss. Because they rely on customer deposits that can be withdrawn on little or no notice, banks in financial trouble are prone to bank runs, where depositors seek to withdraw funds quickly ahead of a possible bank insolvency. Because banking institution failures have the potential to trigger a broad spectrum of harmful events, including economic recessions, policy makers maint ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fractional Reserve Banking

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve, and are at liberty to lend the remainder to borrowers. Bank reserves are held as cash in the bank or as balances in the bank's account at the central bank. The country's central bank determines the minimum amount that banks must hold in liquid assets, called the "reserve requirement" or "reserve ratio". Most commercial banks hold more than this minimum amount as excess reserves. Bank deposits are usually of a relatively short-term duration, and may be "at call", while loans made by banks tend to be longer-term, resulting in a risk that customers may at any time collectively wish to withdraw cash out of their accounts in excess of the bank reserves. The reserves only provide liquidity to cover withdrawals within the normal pattern. Banks ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pareto Efficiency

Pareto efficiency or Pareto optimality is a situation where no action or allocation is available that makes one individual better off without making another worse off. The concept is named after Vilfredo Pareto (1848–1923), Italian civil engineer and economist, who used the concept in his studies of economic efficiency and income distribution. The following three concepts are closely related: * Given an initial situation, a Pareto improvement is a new situation where some agents will gain, and no agents will lose. * A situation is called Pareto-dominated if there exists a possible Pareto improvement. * A situation is called Pareto-optimal or Pareto-efficient if no change could lead to improved satisfaction for some agent without some other agent losing or, equivalently, if there is no scope for further Pareto improvement. The Pareto front (also called Pareto frontier or Pareto set) is the set of all Pareto-efficient situations. Pareto originally used the word "optimal" for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nash Equilibrium

In game theory, the Nash equilibrium, named after the mathematician John Nash, is the most common way to define the solution of a non-cooperative game involving two or more players. In a Nash equilibrium, each player is assumed to know the equilibrium strategies of the other players, and no one has anything to gain by changing only one's own strategy. The principle of Nash equilibrium dates back to the time of Cournot, who in 1838 applied it to competing firms choosing outputs. If each player has chosen a strategy an action plan based on what has happened so far in the game and no one can increase one's own expected payoff by changing one's strategy while the other players keep their's unchanged, then the current set of strategy choices constitutes a Nash equilibrium. If two players Alice and Bob choose strategies A and B, (A, B) is a Nash equilibrium if Alice has no other strategy available that does better than A at maximizing her payoff in response to Bob choosing B, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |