|

DST Systems

DST Systems, Inc. is an American company that was acquired by SS&C Technologies in 2018. The company provided advisory, technology and operations outsourcing services to the financial services and healthcare industries. It was founded in February 1969 as Data·Sys·Tance, a subsidiary of Kansas City Southern Industries (KCSI) and is headquartered in Kansas City, Missouri Missouri is a U.S. state, state in the Midwestern United States, Midwestern region of the United States. Ranking List of U.S. states and territories by area, 21st in land area, it is bordered by eight states (tied for the most with Tennessee ..., United States. , DST employed 13,420 people worldwide. History In 2005 and 2006, DST acquired CSC's Health Plan Solutions group and Amisys Synertech, Inc. On January 11, 2018, SS&C Technologies Holdings, Inc. announced that it would acquire all outstanding DST stock at a share price of $84. Expansion, partnerships and acquisitions On February 24, 2016, DST c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Healthcare

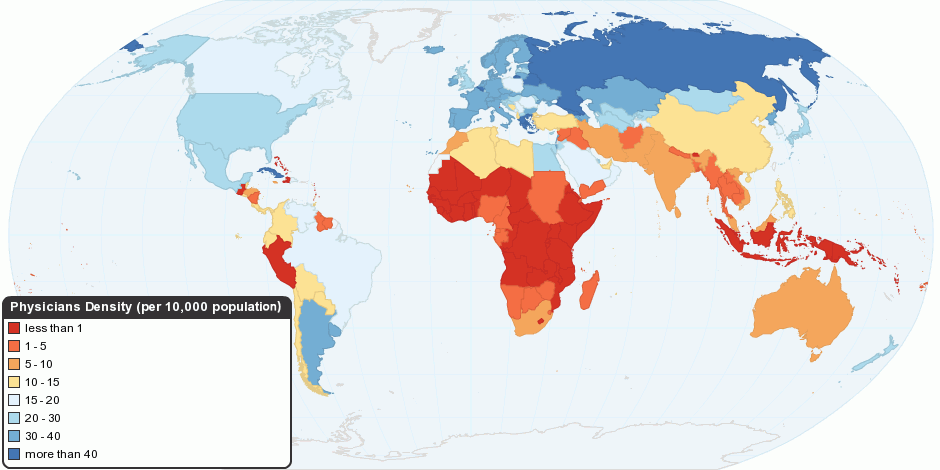

Health care or healthcare is the improvement of health via the prevention, diagnosis, treatment, amelioration or cure of disease, illness, injury, and other physical and mental impairments in people. Health care is delivered by health professionals and allied health fields. Medicine, dentistry, pharmacy, midwifery, nursing, optometry, audiology, psychology, occupational therapy, physical therapy, athletic training, and other health professions all constitute health care. It includes work done in providing primary care, secondary care, and tertiary care, as well as in public health. Access to health care may vary across countries, communities, and individuals, influenced by social and economic conditions as well as health policies. Providing health care services means "the timely use of personal health services to achieve the best possible health outcomes". Factors to consider in terms of health care access include financial limitations (such as insurance cover ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Spin-offs

A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and recognized as such in law for certain purposes. Early incorporated entities were established by charter (i.e. by an ''ad hoc'' act granted by a monarch or passed by a parliament or legislature). Most jurisdictions now allow the creation of new corporations through registration. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: by whether they can issue stock, or by whether they are formed to make a profit. Depending on the number of owners, a corporation can be classified as ''aggregate'' (the subject of this article) or '' sole'' (a legal entity consisting of a single incorporated office occupied by a single natural person). One of the most a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Based In Kansas City, Missouri

A company, abbreviated as co., is a legal entity representing an association of people, whether natural, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * business entities, whose aim is generating profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duty according to the publicly declared incorporation, or published policy. When a company closes, it may need to be liquidated to avoid further legal obligations. Companies may associate and collectively register themselves as new companies; the resulting entities are often known as corporate groups. Meanings and definitions A company can be defined as an "artificial p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kansas City Southern Industries

Kansas City Southern (KCS) is a pure transportation holding company with railroad investments in the United States, Mexico, and Panama. The KCS rail network includes about of track in the U.S. and Mexico.https://www.kcsouthern.com/pdf/community/kcs-sustainability-data-2021.pdf?language_id=1 Its primary U.S. holding is the Kansas City Southern Railway (KCS), a Class I railroad that operates about in 10 states in the midwestern and southeastern United States. KCS's hubs include Kansas City, Missouri; Shreveport, Louisiana; New Orleans; Dallas; and Houston. Among Class I railroads, KCS has the shortest route between Kansas City, the second-largest rail hub in the country, and the Gulf of Mexico. Its primary international holding is Kansas City Southern de México (KCSM), which operates about in 15 states in northeastern, central, southeast-central and southwest-central Mexico. KCSM reaches the Gulf of Mexico ports of Tampico, Altamira, and Veracruz, and the Pacific Ocean d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Healthcare Industry

The healthcare industry (also called the medical industry or health economy) is an aggregation and integration of sectors within the economic system that provides goods and services to treat patients with curative, preventive, rehabilitative, and palliative care. It includes the generation and commercialization of goods and services lending themselves to maintaining and re-establishing health. The modern healthcare industry includes three essential branches which are services, products, and finance and may be divided into many sectors and categories and depends on the interdisciplinary teams of trained professionals and paraprofessionals to meet health needs of individuals and populations.HEALTH PROFESSIONS [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services

Financial services are the economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, investment funds, individual asset managers, and some government-sponsored enterprises. History The term "financial services" became more prevalent in the United States partly as a result of the GrammLeachBliley Act of the late 1990s, which enabled different types of companies operating in the U.S. financial services industry at that time to merge. Companies usually have two distinct approaches to this new type of business. One approach would be a bank that simply buys an insurance company or an investment bank, keeps the original brands of the acquired firm, and adds the acquisition to its holding company simply to diversify its earnings. Outside the U.S. (e.g. Japan), non-fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SS&C Technologies

SS&C Technologies Holdings, Inc. (known as SS&C) is an American multinational holding company headquartered in Windsor, Connecticut, that sells software and software as a service to the financial services industry. The company has offices in the Americas, Europe, Asia, Africa and Australia. Through its numerous acquired subsidiaries, such as Advent Software, Varden Technologies, Eze Software, and Primatics Financial, SS&C specializes in specific fintech markets, such as fund administration, wealth management accounting, and insurance and pension funds. In 2020 SS&C Technologies reported in their balance sheet over $1.69 trillion in Assets Under Custody (AUC). History SS&C was founded by William C. Stone in 1986. The company went through an initial public offering process for the first time in 1996. It was taken private in a leveraged buy-out in 2005 with Sunshine Acquisition Corp., affiliated with The Carlyle Group. And after some years as a private company, SS&C was taken pu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth Management

Wealth management (WM) or wealth management advisory (WMA) is an investment advisory service that provides financial management and wealth advisory services to a wide array of clients ranging from affluent to high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals and families. It is a discipline which incorporates structuring and planning wealth to assist in growing, preserving, and protecting wealth, whilst passing it onto the family in a tax-efficient manner and in accordance with their wishes. Wealth management brings together tax planning, wealth protection, estate planning, succession planning, and family governance. Private wealth management Private wealth management is delivered to high-net-worth investors. Generally, this includes advice on the use of various estate planning vehicles, business-succession or stock-option planning, and the occasional use of hedging derivatives for large blocks of stock. Traditionally, the wealthiest retail clients of investment ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidiary

A subsidiary, subsidiary company or daughter company is a company owned or controlled by another company, which is called the parent company or holding company. Two or more subsidiaries that either belong to the same parent company or having a same management being substantially controlled by same entity/group are called sister companies. The subsidiary can be a company (usually with limited liability) and may be a government- or state-owned enterprise. They are a common feature of modern business life, and most multinational corporations organize their operations in this way. Examples of holding companies are Berkshire Hathaway, Jefferies Financial Group, The Walt Disney Company, Warner Bros. Discovery, or Citigroup; as well as more focused companies such as IBM, Xerox, and Microsoft. These, and others, organize their businesses into national and functional subsidiaries, often with multiple levels of subsidiaries. Details Subsidiaries are separate, distinct legal entit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a Bank regulation, high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concept ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |