|

Pension Funds

A pension fund, also known as a superannuation fund in some countries, is any plan, fund, or scheme which provides retirement income. Pension funds typically have large amounts of money to invest and are the major investors in listed and private companies. They are especially important to the stock market where large institutional investors dominate. The largest 300 pension funds collectively hold about USD$6 trillion in assets. In 2012, PricewaterhouseCoopers estimated that pension funds worldwide hold over $33.9 trillion in assets (and were expected to grow to more than $56 trillion by 2020), the largest for any category of institutional investor An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked co ... ahead of mutual funds, insurance companies, currency reserves, sovereign wealth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pension

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms "retirement plan" and "superannuation" tend to refer to a pension granted upon retirement of the individual. Retirement plans may be set up by employers, insurance companies, the government, or other institutions such as employer associations or trade unions. Called ''retirement plans' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

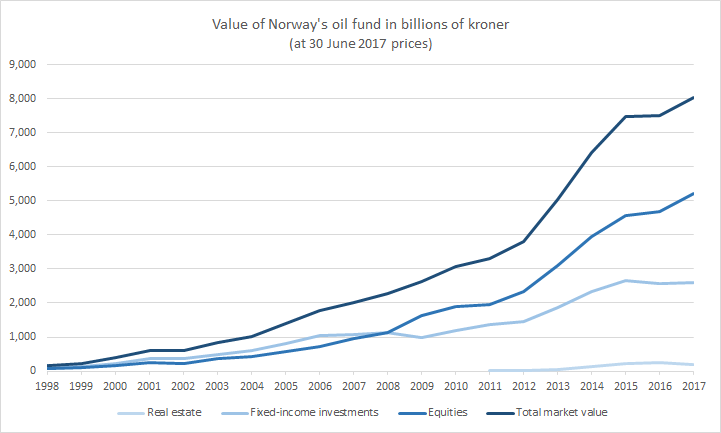

Government Pension Fund Of Norway

The Government Pension Fund of Norway ( no, Statens pensjonsfond) comprises two entirely separate sovereign wealth funds owned by the government of Norway. The Government Pension Fund Global, also known as the Oil Fund, was established in 1990 to invest the surplus revenues of the Norwegian petroleum sector. It has over US$1.19 trillion in assets, and holds 1.4% of all of the world’s listed companies, making it among the world’s largest sovereign wealth funds. In December 2021, it was worth about $250,000 per Norwegian citizen. It also holds portfolios of real estate and fixed-income investments. Many companies are excluded by the fund on ethical grounds. The Government Pension Fund Norway is smaller and was established in 1967 as a type of national insurance fund. It is managed separately from the Oil Fund and is limited to domestic and Scandinavian investments and is therefore a key stock holder in many large Norwegian companies, predominantly via the Oslo Stock Exchange. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CalPERS

The California Public Employees' Retirement System (CalPERS) is an agency in the California executive branch that "manages pension and health benefits for more than 1.5 million California public employees, retirees, and their families".CalPERSFacts at a glance: general. January 2009. Retrieved December 24, 2008. In fiscal year 2020–21, CalPERS paid over $27.4 billion in retirement benefits,CalPERSFacts at a Glance - Public Employees' Retirement Fund (PERF), 2020-21CalPERS. 2021. Retrieved October 09, 2021. and over $9.74 billion in health benefits.CalPERSFacts at a Glance - Health Benefits, 2019-20CalPERS. 2021. Retrieved October 09, 2021. CalPERS manages the largest public pension fund in the United States, with more than $469 billion in assets under management as of June 30, 2021. CalPERS is known for its shareholder activism; stocks placed on its "Focus List" may perform better than other stocks, which has given rise to the term "CalPERS effect".Sidel, Robin. "Ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

California

California is a U.S. state, state in the Western United States, located along the West Coast of the United States, Pacific Coast. With nearly 39.2million residents across a total area of approximately , it is the List of states and territories of the United States by population, most populous U.S. state and the List of U.S. states and territories by area, 3rd largest by area. It is also the most populated Administrative division, subnational entity in North America and the 34th most populous in the world. The Greater Los Angeles area and the San Francisco Bay Area are the nation's second and fifth most populous Statistical area (United States), urban regions respectively, with the former having more than 18.7million residents and the latter having over 9.6million. Sacramento, California, Sacramento is the state's capital, while Los Angeles is the List of largest California cities by population, most populous city in the state and the List of United States cities by population, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Caisse De Dépôt Et Placement Du Québec

Caisse de dépôt et placement du Québec (CDPQ; ) is an institutional investor that manages several public and parapublic pension plans and insurance programs in Quebec. CDPQ was founded in 1965 by an act of the National Assembly, under the government of Jean Lesage. It is the second-largest pension fund in Canada, after the Canada Pension Plan Investment Board. As of June 30, 2022, CDPQ managed assets of C$391 billion, invested in Canada and elsewhere. CDPQ is headquartered in Quebec City at the Price building and has its main business office in Montreal at Édifice Jacques-Parizeau. History The Caisse de dépôt et placement du Québec was established on July 15, 1965, by an Act of Québec's National Assembly to manage the funds of the Quebec Pension Plan, a public pension plan also created by the Québec government. In the years following, CDPQ was entrusted with managing the funds of other public pension and insurance plans: the Supplemental Pension Plan for Employees o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quebec

Quebec ( ; )According to the Canadian government, ''Québec'' (with the acute accent) is the official name in Canadian French and ''Quebec'' (without the accent) is the province's official name in Canadian English is one of the thirteen provinces and territories of Canada. It is the largest province by area and the second-largest by population. Much of the population lives in urban areas along the St. Lawrence River, between the most populous city, Montreal, and the provincial capital, Quebec City. Quebec is the home of the Québécois nation. Located in Central Canada, the province shares land borders with Ontario to the west, Newfoundland and Labrador to the northeast, New Brunswick to the southeast, and a coastal border with Nunavut; in the south it borders Maine, New Hampshire, Vermont, and New York in the United States. Between 1534 and 1763, Quebec was called ''Canada'' and was the most developed colony in New France. Following the Seven Years' War, Quebec b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CPP Investment Board

The Canada Pension Plan Investment Board (CPPIB; french: Office d'investissement du régime de pensions du Canada), operating as CPP Investments (french: Investissements RPC), is a Canadian Crown corporation established by way of the 1997 ''Canada Pension Plan Investment Board Act'' to oversee and invest the funds contributed to and held by the Canada Pension Plan (CPP). CPP Investments is one of the world's largest investors in private equity, having invested over US$28.1 billion between 2010 and 2014 alone. Despite being a Crown corporation, CPPIB is not considered a sovereign wealth fund because it operates at arm's length from the Government of Canada and solely manages CPP contributions paid by workers and employers, not public funds. As of June 30, 2022, the CPP Investment Board manages over C$523 billion in assets under management for the Canada Pension Plan on behalf of 20 million Canadians. History The Canada Pension Plan was first established in 1966. For much of i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canada Pension Plan

The Canada Pension Plan (CPP; french: Régime de pensions du Canada) is a contributory, earnings-related social insurance program. It forms one of the two major components of Canada's public retirement income system, the other component being Old Age Security (OAS). Other parts of Canada's retirement system are private pensions, either employer-sponsored or from tax-deferred individual savings (known in Canada as a Registered Retirement Savings Plan). As of Jun 30, 2022, the CPP Investment Board manages over C$523 billion in investment assets for the Canada Pension Plan on behalf of 20 million Canadians. CPPIB is one of the world's biggest pension funds. Description The CPP mandates all employed Canadians who are 18 years of age and over to contribute a prescribed portion of their earnings income to a federally administered pension plan. The plan is administered by Employment and Social Development Canada on behalf of employees in all provinces and territories except Quebec, whi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stichting Pensioenfonds ABP

Stichting Pensioenfonds ABP ("National Civil Pension Fund"), frequently referred to as ABP, is the pension fund for government and education employees in the Netherlands. For the quarter ended 31 December 2014, ABP had 2.8 million participants and assets under management of €344 billion ($388 billion, 1 EUR=1.13 USD), making it the largest pension fund in the Netherlands and among the five largest pension funds in the world as at September 2016. ABP's predecessor, the Algemeen Burgerlijk Pensioenfonds ("Dutch Civil Servants Pension Fund"), was established in 1922, following the adoption of the superannuation act, which regulated the pensions of civil servants. Originally, the pension fund was a government controlled entity that fell under the authority of the minister of home affairs in The Hague. In January 1996, ABP was privatized although its primary function remains unchanged. Since 1 March 2008, ABP's subsidiary APG administers the ABP pension scheme. ABP is headquar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI), and are regarded as developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP ( Int$54.2 trillion) at purchasing power parity. The OECD is an official United Nations observer. In April 1948, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Pension Service

The National Pension Service of Korea (NPS; ) is a public pension fund in South Korea. It is the third largest in the world with $800 billion in assets, and is the largest investor in South Korea. South Korea's National Pension Service (NPS), which oversees $800 billion in assets, is looking to buy a portfolio of blue-chip stocks from emerging markets. On January 30, 2017, NPS opened up an office in New York City's One Vanderbilt. Timeline * December, 1986 – Promulgated the Nation Pension Act * September, 1987 – Established the National Pension Corporation * January, 1988 – Implemented the national pension system (Limited to workplaces with 10 or more full-time employees) * January, 1992 – Compulsory coverage included workplaces with five or more full-time employees * January, 1993 – Commenced Special Old-age Pension benefit payment * April, 1995 – Established the National Pension Research Institute * July, 1995 – Compulsory coverage was extended to farmers and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thrift Savings Plan

The Thrift Savings Plan (TSP) is a defined contribution plan for United States civil service employees and retirees as well as for members of the uniformed services. As of December 31, 2020, TSP has approximately 6.2million participants (of which approximately 3.8million are actively participating through payroll deductions), and more than $735.2billion in assets under management; it is the largest defined contribution plan in the world. The TSP is administered by the Federal Retirement Thrift Investment Board, an independent agency. The TSP is one of three components of the Federal Employees Retirement System (FERS; the others being the FERS annuity and Social Security) and is designed to closely resemble the dynamics of private sector 401(k) and Roth 401k plans (TSP implemented a Roth option in May 2012). It is also open to employees covered under the older Civil Service Retirement System (CSRS) but with far fewer benefits (mainly the lack of matching contributions). Eligibi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |