|

Canadian Crude Index

The Canadian Crude Oil Index (CCI) serves as a benchmark for oil produced in Canada.http://boereport.com/2016/01/04/auspice-capital-advisors-launches-first-live-index-tied-to-canadian-crude-oil/, http://boereport.com/2016/01/04/auspice-capital-advisors-launches-first-live-index-tied-to-canadian-crude-oil/ It allows investors to track the price, risk, and volatility of the Canadian commodity. The CCI was launched by Auspice Capital Advisors in 2014. https://hfm.global/ctaintelligence/news/proshares-launches-managed-futures-etf-2/ The Index moved from a day end posting to live in January 2016. The CCI can be used to identify opportunities to speculate outright on the price of Canadian crude oil or in conjunction with |

Benchmark (crude Oil)

A benchmark crude or marker crude is a crude oil that serves as a reference price for buyers and sellers of crude oil. There are three primary benchmarks, West Texas Intermediate (WTI), Brent Blend, and Dubai Crude. Other well-known blends include the OPEC Reference Basket used by OPEC, Tapis Crude which is traded in Singapore, Bonny Light used in Nigeria, Urals oil used in Russia and Mexico's Isthmus. Energy Intelligence Group publishes a handbook which identified 195 major crude streams or blends in its 2011 edition. Benchmarks are used because there are many different varieties and grades of crude oil. Using benchmarks makes referencing types of oil easier for sellers and buyers. There is always a spread between WTI, Brent and other blends due to the relative volatility (high API gravity is more valuable), sweetness/sourness (low sulfur is more valuable) and transportation cost. This is the price that controls world oil market price. West Texas Intermediate (WTI) West Te ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

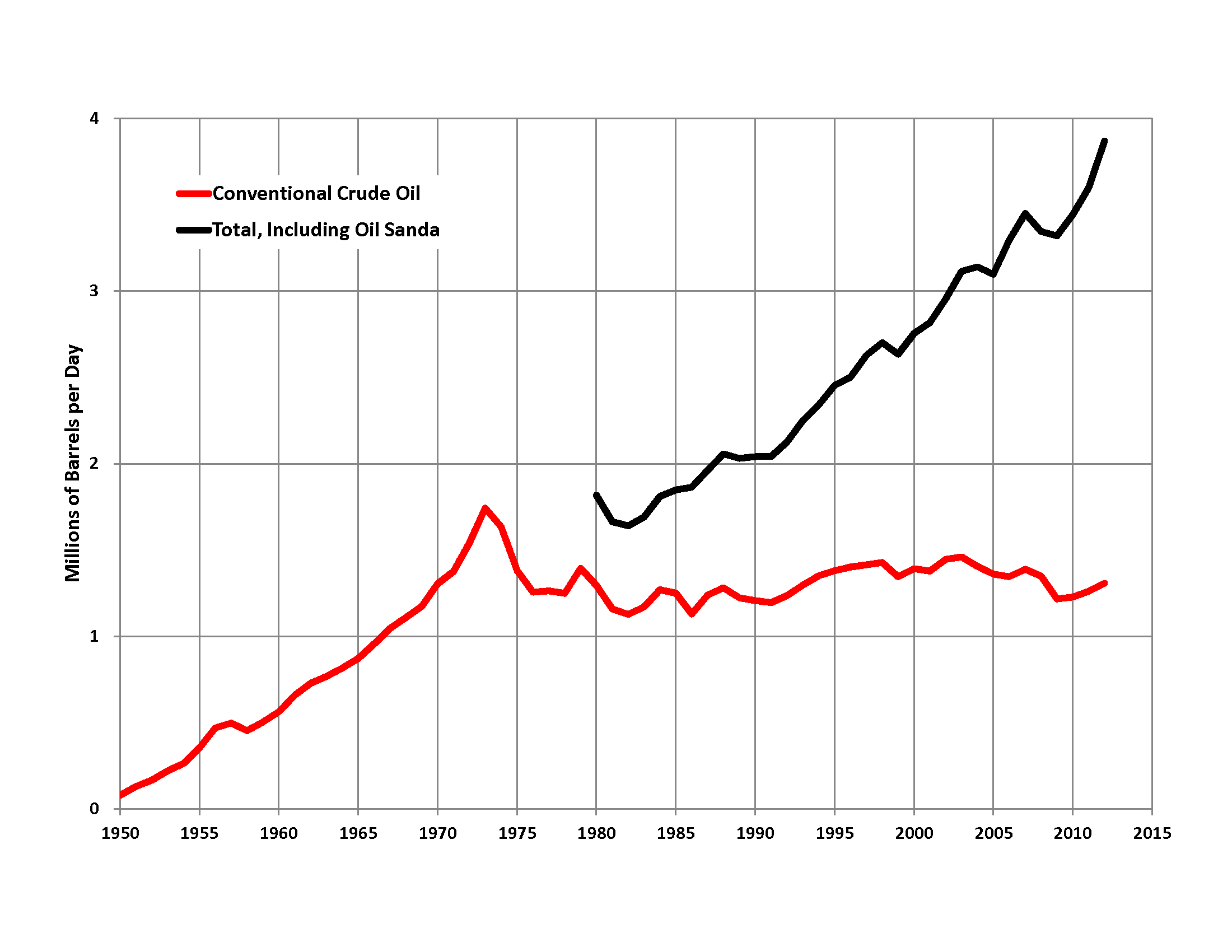

Petroleum Production In Canada

Petroleum production in Canada is a major industry which is important to the economy of North America. Canada has the third largest oil reserves in the world and is the world's fourth largest oil producer and fourth largest oil exporter. In 2019 it produced an average of of crude oil and equivalent. Of that amount, 64% was upgraded from unconventional oil sands, and the remainder light crude oil, heavy crude oil and natural-gas condensate. Most of Canadian petroleum production is exported, approximately in 2019, with 98% of the exports going to the United States. Canada is by far the largest single source of oil imports to the United States, providing 43% of US crude oil imports in 2015. The petroleum industry in Canada is also referred to as the "Canadian Oil Patch"; the term refers especially to upstream operations (exploration and production of oil and gas), and to a lesser degree to downstream operations (refining, distribution, and selling of oil and gas products) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of squ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

West Texas Intermediate

West Texas Intermediate (WTI) is a grade or mix of crude oil; the term is also used to refer to the spot price, the futures price, or assessed price for that oil. In colloquial usage, WTI usually refers to the WTI Crude Oil futures contract traded on the New York Mercantile Exchange (NYMEX). The WTI oil grade is also known as Texas light sweet, oil produced from any location can be considered WTI if the oil meets the required qualifications. Spot and futures prices of WTI are used as a benchmark in oil pricing. This grade is described as light crude oil because of its low density and sweet because of its low sulfur content. The price of WTI is often included in news reports on oil prices, alongside the price of Brent crude from the North Sea. Other important oil markers include the Dubai crude, Oman crude, Urals oil, and the OPEC reference basket. WTI is lighter and sweeter, containing less sulfur than Brent, and considerably lighter and sweeter than Dubai or Oman. WTI crud ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

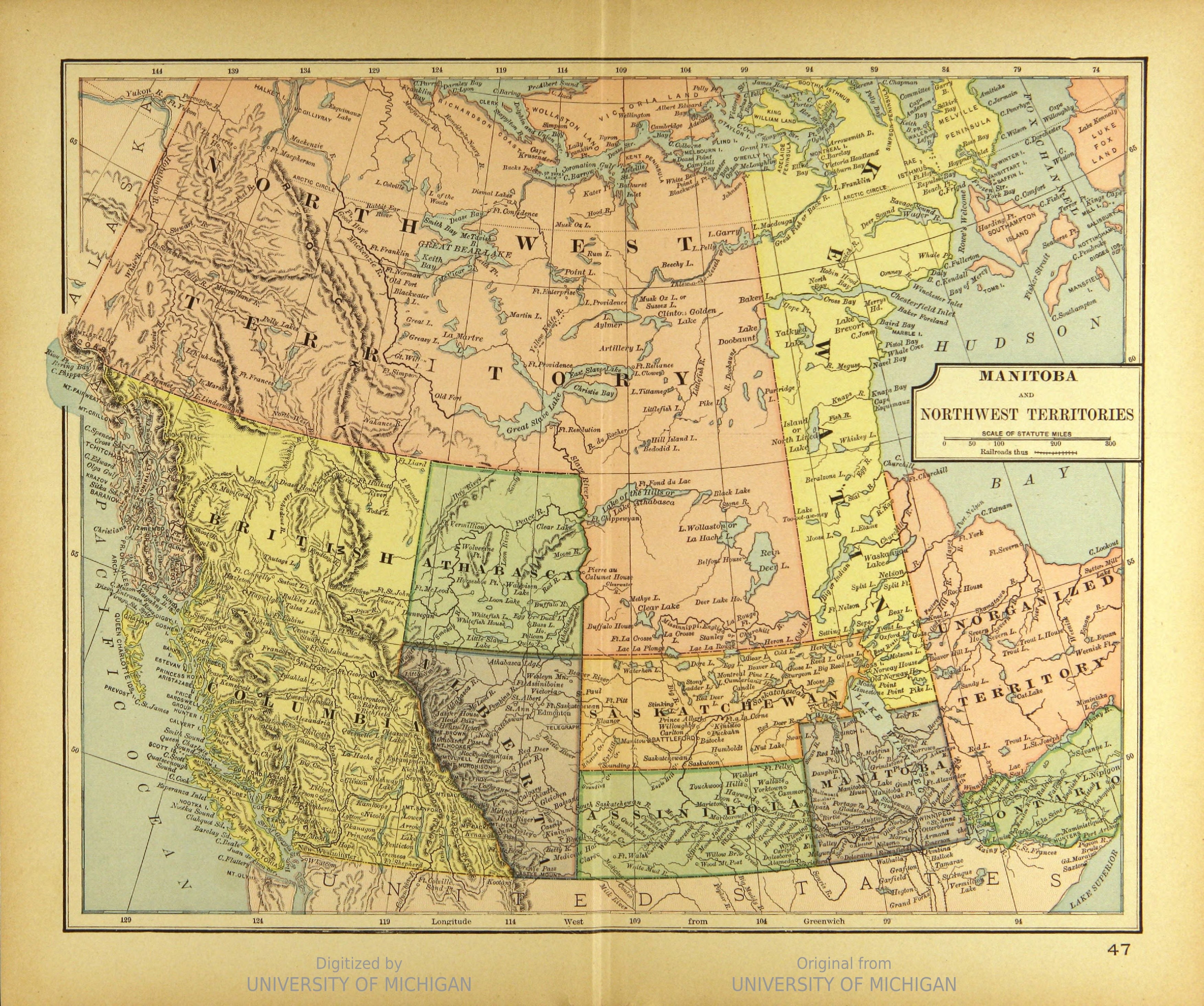

Western Canada

Western Canada, also referred to as the Western provinces, Canadian West or the Western provinces of Canada, and commonly known within Canada as the West, is a Canadian region that includes the four western provinces just north of the Canada–United States border namely (from west to east) British Columbia, Alberta, Saskatchewan and Manitoba. The people of the region are often referred to as "Western Canadians" or "Westerners", and though diverse from province to province are largely seen as being collectively distinct from other Canadians along cultural, linguistic, socioeconomic, geographic, and political lines. They account for approximately 32% of Canada's total population. The region is further subdivided geographically and culturally between British Columbia, which is mostly on the western side of the Canadian Rockies and often referred to as the " west coast", and the "Prairie Provinces" (commonly known as "the Prairies"), which include those provinces on the easter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sour Crude Oil

Sour crude oil is crude oil containing a high amount of the impurity sulfur. It is common to find crude oil containing some impurities. When the total sulfur level in the oil is more than 0.5% (by weight), the oil is called "sour". The impurities need to be removed before this lower-quality crude can be refined into petrol, thereby increasing the cost of processing. This results in a higher-priced gasoline than that made from sweet crude oil. Current environmental regulations in the United States strictly limit the sulfur content in refined fuels such as diesel and gasoline. The majority of the sulfur in crude oil occurs bonded to carbon atoms, with a small amount occurring as elemental sulfur in solution and as hydrogen sulfide gas. Sour oil can be toxic and corrosive, especially when the oil contains higher levels of hydrogen sulfide, which is a breathing hazard. At low concentrations the gas gives the oil the smell of rotting eggs. For safety reasons, sour crude oil needs to be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cushing, Oklahoma

Cushing ( sac, Koshineki, iow, Amína P^óp^oye Chína, ''meaning: "Soft-seat town"'') is a city in Payne County, Oklahoma, United States. The population was 7,826 at the time of the 2010 census, a decline of 6.5% since 8,371 in 2000. Cushing was established after the Land Run of 1891 by William "Billy Rae" Little. It was named for Marshall Cushing, private secretary to U.S. Postmaster General John Wanamaker. A 1912 oil boom led to the city's development as a refining center.''Encyclopedia of Oklahoma History and Culture'"Cushing" By D. Earl Newsome, Accessed June 9, 2010. Today, Cushing is a major trading hub for crude oil and a price settlement point for West Texas Intermediate on the New York Mercantile Exchange and is known as the "Pipeline Crossroads of the World." History The area that became Cushing was part of the Sac and Fox Reservation. With the Land Run of 1891, a former government trader for the tribe, Billy Rae Little, built a house, established his claim, and l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed companies at US$30.1 trillion as of February 2018. The average daily trading value was approximately 169 billion in 2013. The NYSE trading floor is at the New York Stock Exchange Building on 11 Wall Street and 18 Broad Street and is a National Historic Landmark. An additional trading room, at 30 Broad Street, was closed in February 2007. The NYSE is owned by Intercontinental Exchange, an American holding company that it also lists (). Previously, it was part of NYSE Euronext (NYX), which was formed by the NYSE's 2007 merger with Euronext. History The earliest recorded organization of securities trading in New York among brokers directly dealing with each other can be traced to the Buttonwood Agreement. Previously, securiti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ICE Futures Europe

Intercontinental Exchange, Inc. (ICE) is an American company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell 1000, the company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and OTC energy, credit and equity markets. ICE also owns and operates six central clearing houses: ICE Clear U.S., ICE Clear Europe, ICE Clear Singapore, ICE Clear Credit, ICE Clear Netherlands and ICE NGX. ICE has offices in Atlanta, New York, London, Chicago, Bedford, Houston, Winnipeg, Amsterdam, Calgary, Washington, D.C., San Francisco, Tel Aviv, Rome, Hyderabad, Singapore and Melbourne. History Jeffrey Sprecher was a power plant deve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of Canada

The economy of Canada is a highly developed mixed-market economy. It is the 8th-largest GDP by nominal and 15th-largest GDP by PPP in the world. As with other developed nations, the country's economy is dominated by the service industry which employs about three quarters of Canadians. Canada has the third-highest total estimated value of natural resources, valued at US$33.98 trillion in 2019. It has the world's third-largest proven oil reserves and is the fourth-largest exporter of crude oil. It is also the fifth-largest exporter of natural gas. According to the Corruption Perceptions Index, Canada is perceived as one of the least corrupt countries in the world, and is one of the world's top ten trading nations, with a highly globalized economy. , Canada is ranked 15th on The Heritage Foundation's index of economic freedom. Its average household disposable income per capita is "well above" the OECD average. The Toronto Stock Exchange is the eighth-largest stock exc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |