|

Budget Of The United Kingdom

The Budget of His Majesty's Government is an annual budget set by HM Treasury for the following financial year, with the revenues to be gathered by HM Revenue and Customs and the expenditures of the public sector, in compliance with government policy. The budget statement is one of two statements made by the Chancellor of the Exchequer in the House of Commons, with the Spring Statement being made the following year. Budgets are usually set once every year and are announced in the House of Commons by the Chancellor of the Exchequer. Since autumn 2017 the United Kingdom budget typically takes place in the Autumn in order to allow major tax changes to occur annually, well before the start of the fiscal year. The most recent budget was presented by Rishi Sunak on 27 October 2021. Sunak’s successor, Kwasi Kwarteng, delivered a fiscal event in September 2022. His successor Jeremy Hunt delivered another fiscal event in November 2022. Although not an official budget statement, t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

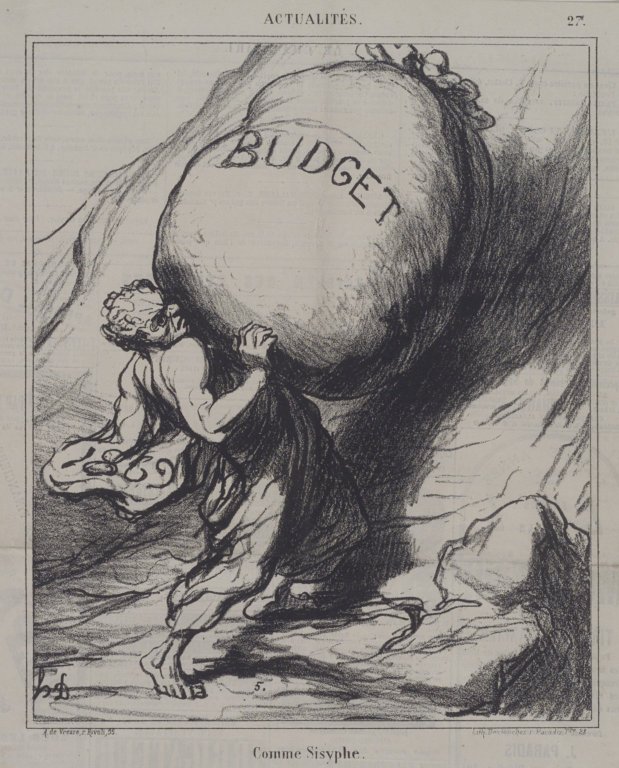

Budget

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms. A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. Government The budget of a government is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment budg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Parliament

In modern politics, and history, a parliament is a legislative body of government. Generally, a modern parliament has three functions: representing the electorate, making laws, and overseeing the government via hearings and inquiries. The term is similar to the idea of a senate, synod or congress and is commonly used in countries that are current or former monarchies. Some contexts restrict the use of the word ''parliament'' to parliamentary systems, although it is also used to describe the legislature in some presidential systems (e.g., the Parliament of Ghana), even where it is not in the official name. Historically, parliaments included various kinds of deliberative, consultative, and judicial assemblies, an example being the French medieval and early modern parlements. Etymology The English term is derived from Anglo-Norman and dates to the 14th century, coming from the 11th century Old French , "discussion, discourse", from , meaning "to talk". The meanin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2012 United Kingdom Budget

The 2012 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday 21 March 2012. It was the third budget of the Conservative-Liberal Democrat coalition government that was formed in 2010, and also the third to be delivered by Osborne. Its key points included a rise in the personal tax allowance, a cut in the top rate of income tax and in the rate of corporation tax, and a new level of stamp duty on high-value properties. Key measures Taxes Osborne announced that from April 2013, the annual personal income tax allowance will be raised from £8,105 to £9,205. It was estimated this would make 24 million people better-off by up to £220 per year. The 40% tax band will become applicable for incomes over £41,450 per year (a reduction of £1,025 from £42,475) and the top tax band for high-earners will be reduced to 45% from 50%; Osborne said the 50% rate introduced by the previous Labour government was "dama ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2013 United Kingdom Budget

The 2013 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday 20 March 2013. It was the fourth budget of the Conservative-Liberal Democrat coalition government that was formed after the 2010 general election, and also the fourth to be delivered by Osborne. Its key points included an increase in the personal allowance, a reduction of the rate of corporation tax, a freeze of the rate of fuel duty, and the cancellation of the duty escalator on beer. Key measures Taxes and revenue The personal allowance each UK employee is entitled to earn before income tax is levied was increased for the third consecutive budget, to £10,000, from 2014. The increase had been planned to become effective in 2015 but was brought forward one year. Before the 2012 budget, the rate of corporation tax in the UK was 26%. In his 2013 budget, Osborne announced another reduction in the rate in 2015 to 20%. The reductions would be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2014 United Kingdom Budget

The 2014 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday, 19 March 2014. It was the fifth budget of the Conservative–Liberal Democrat coalition government formed after the 2010 general election, and also the fifth to be delivered by Osborne. Taxes Spending References External links2014 United Kingdom budgetat Gov.uk {{United Kingdom budget United Kingdom Budget 2014 United Kingdom budget The Budget of His Majesty's Government is an annual budget set by HM Treasury for the following financial year, with the revenues to be gathered by HM Revenue and Customs and the expenditures of the public sector, in compliance with government p ... George Osborne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

March 2015 United Kingdom Budget

The 2015 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday, 18 March 2015. It was the sixth and final budget of the Conservative–Liberal Democrat coalition government formed after the 2010 general election, and also the sixth to be delivered by Osborne. After the UK general election a second 2015 budget to be presented by Chancellor George Osborne was announced for 8 July 2015. Taxes Spending Supply-side reform Supply-side measures included digital infrastructure investment, transport, energy and environment and the sharing economy.H M TreasuryBudget 2015 published 18 March 2015, accessed 21 August 2022, pp. 94-100 References External links2015 United Kingdom budgetat Gov.uk2015 United Kingdom Budgetat the Guardian {{United Kingdom budget United Kingdom Budget A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A bud ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

July 2015 United Kingdom Budget

The 2015 United Kingdom summer budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday, 8 July 2015. This was the first fully Conservative budget since that presented by Kenneth Clarke in 1996. Background The background to the budget was that of significant economic growth at 3%. The budget proposes spending of £742 billion and an income of £673 billion in 2015-16; a deficit of £69 billion (almost 10% of UK public spending). The budget passed with a majority of 30 votes (320 votes for, 290 against with 36 abstentions). All Conservative MPs voted for the budget (with 9 abstentions). The Labour party voted against the bill with 19 MPs abstaining. Measures * £750 million extra granted to HM Revenue and Customs to tackle tax avoidance * Income tax personal allowance raised to £11,000 * Ordoliberal measures to introduce tax incentives for large corporations to create apprenticeships, aiming for 3 million new apprentic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2016 United Kingdom Budget

The 2016 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday, 16 March 2016. It was the second fully Conservative budget delivered by Osborne, after the July 2015 budget. This was to be Osborne's last budget as Chancellor, as he was replaced by Philip Hammond on 13 July by way of Theresa May's cabinet reshuffle. Background In the November 2015 Autumn Statement, the independent Office for Budget Responsibility predicted that the UK economy would grow by 2.4% in 2016. Budget announcements * Osborne will introduce a sugar tax on soft drinks from 2018, raising around half a billion pounds which will be used to fund after-school activities such as sport and art. * The predicted GDP growth for 2016 was lowered to 2% from 2.4%. * The tax-free allowance will be raised to £11,500 and the 40p tax threshold will increase to £45,000. * There will be a new savings account, the Lifetime ISA, for the under-40s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

March 2017 United Kingdom Budget

The March 2017 United Kingdom budget was delivered by Philip Hammond, the Chancellor of the Exchequer, to the House of Commons on Wednesday, 8 March 2017. The last budget to be held in the spring until 2020, it was Hammond's first as Chancellor of the Exchequer since being appointed to the role in July 2016. 2017–18 taxes and spending Taxes Spending References March 2017 events in the United Kingdom 2017 File:2017 Events Collage V2.png, From top left, clockwise: The War Against ISIS at the Battle of Mosul (2016-2017); aftermath of the Manchester Arena bombing; The Solar eclipse of August 21, 2017 ("Great American Eclipse"); North Korea tests a ser ... 2017 in British politics 2017 government budgets {{UK-gov-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

November 2017 United Kingdom Budget

The November 2017 United Kingdom budget was delivered by Philip Hammond, the Chancellor of the Exchequer, to the House of Commons on Wednesday, 22 November 2017. It was Hammond's second as Chancellor of the Exchequer since being appointed to the role in July 2016. The budget Economic statistics Government borrowing #It reached £49.9bn in 2016–17, down by £8.4bn from the previous forecast.budget-deficit.htm #Forecasts were down from £39.5bn for 2017–18 to £25.6bn in 2022–23. A balanced budget #The government's fiscal target of reducing the structural deficit to 2% of GDP by 2021. GDP #At time of the budget the UK was seen to have slipped to the 6th largest economy in 2017. but the recent strengthening of the Pound Sterling means the UK is still the 5th largest economy, according to the IMF. Meanwhile, France slipped to 7th place. #The top 6 economies are: ##United States ##China ##Japan ##Germany ##United Kingdom ##India NHS (England) #£10bn capital investment in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2018 United Kingdom Budget

The 2018 United Kingdom budget was delivered by Philip Hammond, the Chancellor of the Exchequer, to the House of Commons on Monday, 29 October 2018. It was Hammond's third as Chancellor of the Exchequer since being appointed to the role in July 2016, and his last before being replaced by Sajid Javid by means of Boris Johnson's cabinet reshuffle upon becoming prime minister in July 2019. Following the budget in March 2017 the government moved the annual budget to the Autumn, with the following budget held on 22 November of the same year. On 26 September 2018, Hammond announced that the 2018 budget would be held earlier, in October, so as to avoid clashing with the final stage of Brexit negotiations. On 28 October he suggested that a second budget would be needed in the event of a failure to negotiate a Brexit deal, since the scenario would require a "different response", with a need for "fiscal buffers" to provide support for the economy. Delivering the budget, Hammond said ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |