|

2013 United Kingdom Budget

The 2013 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday 20 March 2013. It was the fourth budget of the Conservative-Liberal Democrat coalition government that was formed after the 2010 general election, and also the fourth to be delivered by Osborne. Its key points included an increase in the personal allowance, a reduction of the rate of corporation tax, a freeze of the rate of fuel duty, and the cancellation of the duty escalator on beer. Key measures Taxes and revenue The personal allowance each UK employee is entitled to earn before income tax is levied was increased for the third consecutive budget, to £10,000, from 2014. The increase had been planned to become effective in 2015 but was brought forward one year. Before the 2012 budget, the rate of corporation tax in the UK was 26%. In his 2013 budget, Osborne announced another reduction in the rate in 2015 to 20%. The reductions would be o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of MPs Elected In The 2010 United Kingdom General Election

The 2010 general election took place on 6 May 2010 and saw each of Parliament's 650 constituencies return one Member of Parliament (MP) to the House of Commons. Parliament, which consists of the House of Lords and the elected House of Commons, was convened on 25 May at the Palace of Westminster by Queen Elizabeth II. It was dissolved at the beginning of 30 March 2015, being 25 working days ahead of the 2015 general election on 7 May 2015. The Conservative Party, led by David Cameron, became the single largest party, though without an overall majority. This resulted in a hung parliament. A Conservative – Liberal Democrat coalition agreement, coalition agreement was then formed following negotiations with the Liberal Democrats (UK), Liberal Democrats and their leader Nick Clegg. John Bercow resumed his role as Speaker of the House of Commons (United Kingdom), Speaker of the House of Commons. In September 2010, Ed Miliband won a Labour Party (UK), Labour Party leadership vote ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Staffordshire Potteries

The Staffordshire Potteries is the industrial area encompassing the six towns Burslem, Fenton, Hanley, Longton, Stoke and Tunstall, which is now the city of Stoke-on-Trent in Staffordshire, England. North Staffordshire became a centre of ceramic production in the early 17th century, Fleming, John & Hugh Honour. (1977) ''The Penguin Dictionary of Decorative Arts. '' London: Allen Lane, p. 752. due to the local availability of clay, salt, lead and coal. Spread Hundreds of companies produced all kinds of pottery, from tablewares and decorative pieces to industrial items. The main pottery types of earthenware, stoneware and porcelain were all made in large quantities, and the Staffordshire industry was a major innovator in developing new varieties of ceramic bodies such as bone china and jasperware, as well as pioneering transfer printing and other glazing and decorating techniques. In general Staffordshire was strongest in the middle and low price ranges, though the finest an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Compliance

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but mos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Procurement In The United Kingdom

At around £290 billion every year, public sector procurement accounts for around a third of all public expenditure in the UK. EU-based laws continue to apply to government procurement: procurement is governed by the Public Contracts Regulations 2015, Part 3 of the Small Business, Enterprise and Employment Act 2015, and (in Scotland) the Public Contracts (Scotland) Regulations of 2015 and 2016. These regulations implement EU law, which applied in the UK prior to Brexit, and also contain rules known as the "Lord Young Rules" promoting access for small and medium enterprise (SMEs) to public sector contracts, based on Lord Young's Review ''Growing Your Business'', published in 2013.Local Government Association'Lord Young' reforms accessed 11 September 2016 In November 2016 an advisory panel of 24 entrepreneurs and business figures was formed to advise the government on purchasing goods and services from SMEs, and a campaign was launched to demonstrate that "government is open for busin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Research And Development

Research and development (R&D or R+D), known in Europe as research and technological development (RTD), is the set of innovative activities undertaken by corporations or governments in developing new services or products, and improving existing ones. Research and development constitutes the first stage of development of a potential new service or the production process. R&D activities differ from institution to institution, with two primary models of an R&D department either staffed by engineers and tasked with directly developing new products, or staffed with industrial scientists and tasked with applied research in scientific or technological fields, which may facilitate future product development. R&D differs from the vast majority of corporate activities in that it is not intended to yield immediate profit, and generally carries greater risk and an uncertain return on investment. However R&D is crucial for acquiring larger shares of the market through the marketisation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gains

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares. A capital gain is only possible when the selling price of the asset is greater than the original purchase price. In the event that the purchase price exceeds the sale price, a capital loss occurs. Capital gains are often subject to taxation, of which rates and exemptions may differ between countries. The history of capital gain originates at the birth of the modern economic system and its evolution has been described as complex and multidimensional by a variety of economic thinkers. The concept of capital gain may be considered comparable with other key economic concepts such as profit and rate of return, however its distinguishing feature is that individuals, not just businesses, can accrue capital gains through everyday acquisition an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Small And Medium Enterprises

Small and medium-sized enterprises (SMEs) or small and medium-sized businesses (SMBs) are businesses whose personnel and revenue numbers fall below certain limits. The abbreviation "SME" is used by international organizations such as the World Bank, the European Union, the United Nations, and the World Trade Organization (WTO). In any given national economy, SMEs sometimes outnumber large companies by a wide margin and also employ many more people. For example, Australian SMEs makeup 98% of all Australian businesses, produce one-third of the total GDP (gross domestic product) and employ 4.7 million people. In Chile, in the commercial year 2014, 98.5% of the firms were classified as SMEs. In Tunisia, the self-employed workers alone account for about 28% of the total non-farm employment, and firms with fewer than 100 employees account for about 62% of total employment. The United States' SMEs generate half of all U.S. jobs, but only 40% of GDP. Developing countries tend to have a lar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Domestic Product

Gross domestic product (GDP) is a money, monetary Measurement in economics, measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is often revised before being considered a reliable indicator. List of countries by GDP (nominal) per capita, GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation, inflation rates of the countries; therefore, using a basis of List of countries by GDP (PPP) per capita, GDP per capita at purchasing power parity (PPP) may be more useful when comparing standard of living, living standards between nations, while nominal GDP is more useful comparing national economies on the international market. Total GDP can also be broken down into the contribution of each industry or sector of the economy. The ratio of GDP to the total population of the region is the GDP per capita, p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt. In 2020, the value of government debt worldwide was $87.4 US trillion, or 99% measured as a share of gross domestic product (GDP). Government debt accounted for almost 40% of all debt (which includes corporate and household debt), the highest share since the 1960s. The rise in government debt since 2007 is largely attributable to the global financial crisis of 2007–2008, and the COVID-19 pandemic. The ability of government to issue debt has been central to state formation and to state building. Public debt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office For Budget Responsibility

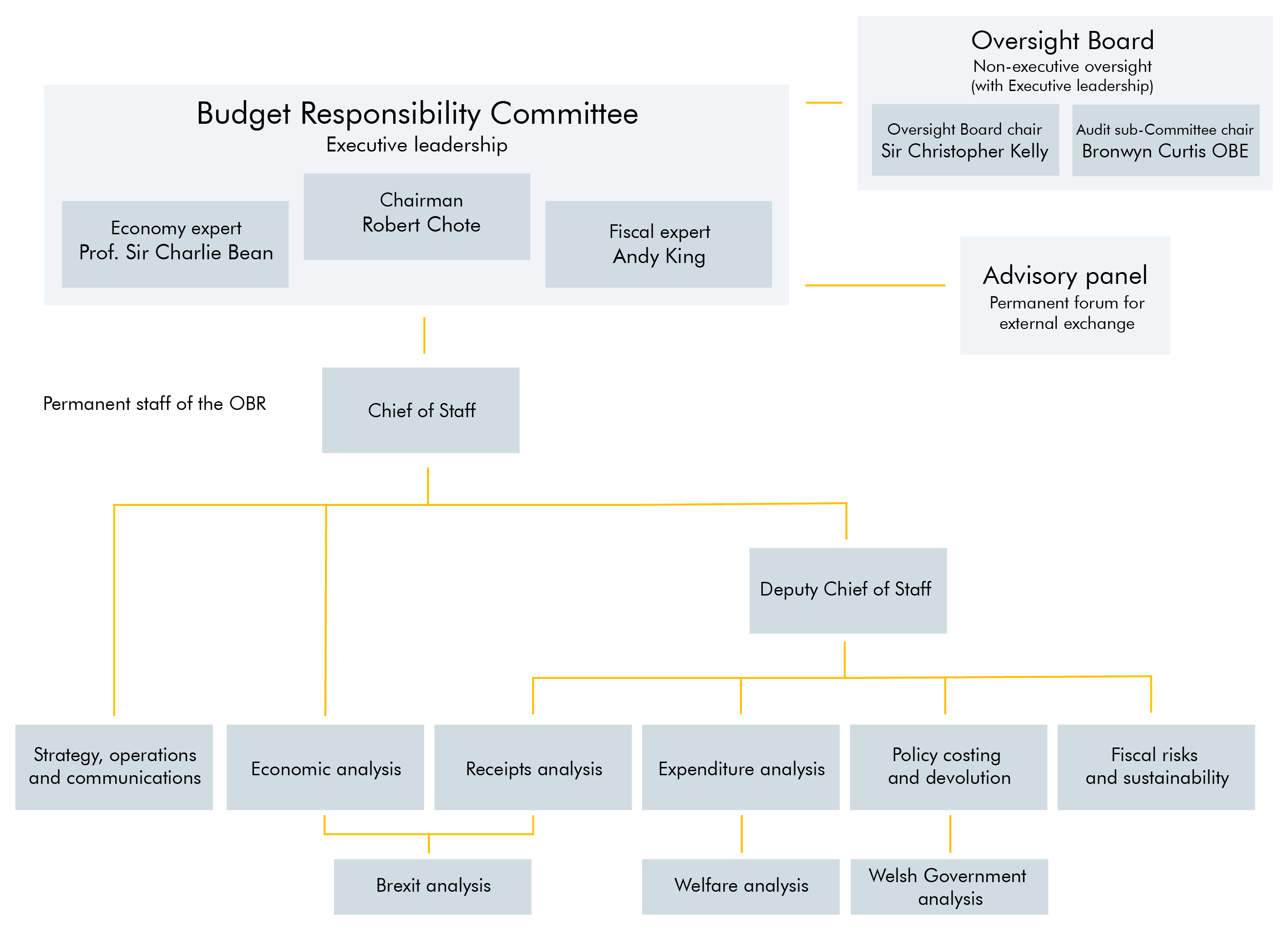

The Office for Budget Responsibility (OBR) is a non-departmental public body funded by the UK Treasury, that the UK government established to provide independent economic forecasts and independent analysis of the public finances. It was formally created in May 2010 following the general election (although it had previously been constituted in shadow form by the Conservative party opposition in December 2009) and was placed on a statutory footing by the Budget Responsibility and National Audit Act 2011. It is one of a growing number of official independent fiscal watchdogs around the world. Richard Hughes, former Director of Fiscal Policy at HM Treasury, has been head since October 2020. Functions The UK government created the OBR in 2010 with the goal of offering independent and authoritative analysis of the UK's public finances. To that end it produces two 5-year-ahead forecasts for the economy and the public finances each year, alongside the Budget and Spring Statements. In it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Sector

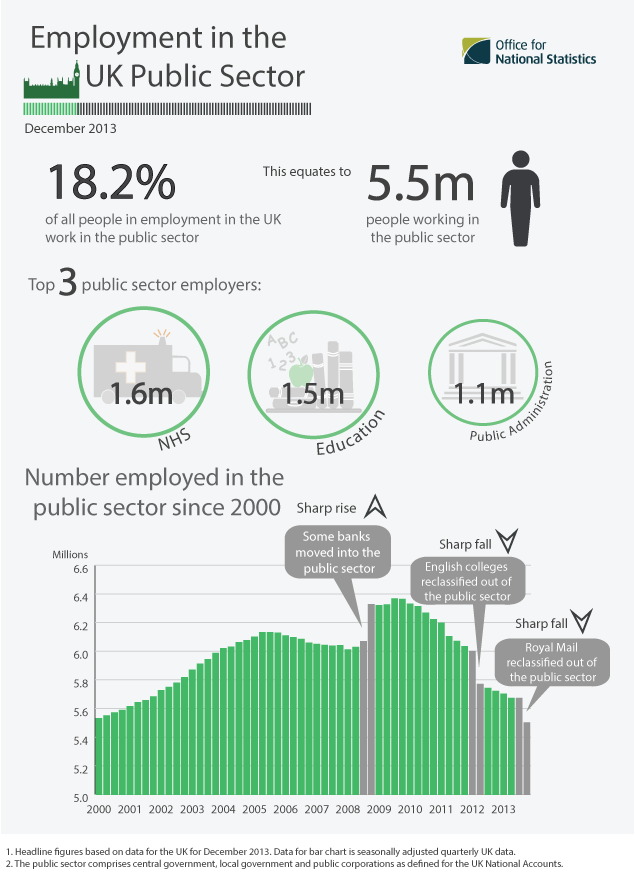

The public sector, also called the state sector, is the part of the economy composed of both public services and public enterprises. Public sectors include the public goods and governmental services such as the military, law enforcement, infrastructure, public transit, public education, along with health care and those working for the government itself, such as elected officials. The public sector might provide services that a non-payer cannot be excluded from (such as street lighting), services which benefit all of society rather than just the individual who uses the service. Public enterprises, or state-owned enterprises, are self-financing commercial enterprises that are under public ownership which provide various private goods and services for sale and usually operate on a commercial basis. Organizations that are not part of the public sector are either part of the private sector or voluntary sector. The private sector is composed of the economic sectors that are intende ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

_respondents_in_East_Africa.png)