|

Boubyan Bank

Boubyan Bank is an Islamic Bank in Kuwait established in 2004. Boubyan Bank has a paid up capital exceeding 196.5 million Kuwaitis Dinars (equivalent to approximately 700 million US Dollars). Boubyan Bank is one of the emerging banks in Kuwait and GCC, benefiting from its relation with National Bank of Kuwait, the major shareholder, which is ranked among the largest 300 banks worldwide. Boubyan Bank provides a variety of banking services to individuals, private, business and corporate customers. The main activities of Boubyan Bank includes accepting deposits, establishing investment funds, and trading in real estate. The Bank deals with all types of Islamic transactions, including: * Mudaraba * Investment agency agreement * Murabaha ''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' ( ar, مرابحة, derived from ''ribh'' ar, ربح, meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the m ... ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kuwait Stock Exchange

Boursa Kuwait Securities Co., is the private-sector corporate owner and operator of the Kuwait Stock Exchange (KSE), the national stock market of Kuwait. History Although several share holding companies (such as National Bank of Kuwait (NBK) in 1952) existed in Kuwait prior to the creation of the Kuwait Stock Exchange, it was not until October 1962 that a law was passed to organize the country's stock market. In April 1977, the stock exchange was initiated and it was named as the Kuwait Stock Exchange (KSE) in 1983. The stock market in Kuwait is regulated by four bodies: the KSE, the Ministry of Commerce and Industry, the Ministry of Finance and the Central Bank of Kuwait. On April 24, 2016, the Kuwait Stock Exchange became fully operated by a private company and its name changed to Boursa Kuwait, making it the only stock exchange in the Middle East owned by the private sector. On September 14, 2020, the Boursa Kuwait Securities Co. was listed on Boursa Kuwait, becoming a self- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Murabaha

''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' ( ar, مرابحة, derived from ''ribh'' ar, ربح, meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the markup (profit) or "cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic (i.e., "shariah compliant") financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments (a contract with deferred payment being known as ''bai-muajjal''). ''Murabaha'' financing is similar to a rent-to-own arrangement in the non-Muslim world, with the intermediary (e.g., the lending bank) retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and ''sukuk'' (Islamic bonds) that use ''murabahah'' contracts. Jamaldeen, ''Islamic Finance For Dummies'', 2012:188-9, 220-1 The purpose o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 2004

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Of Kuwait

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

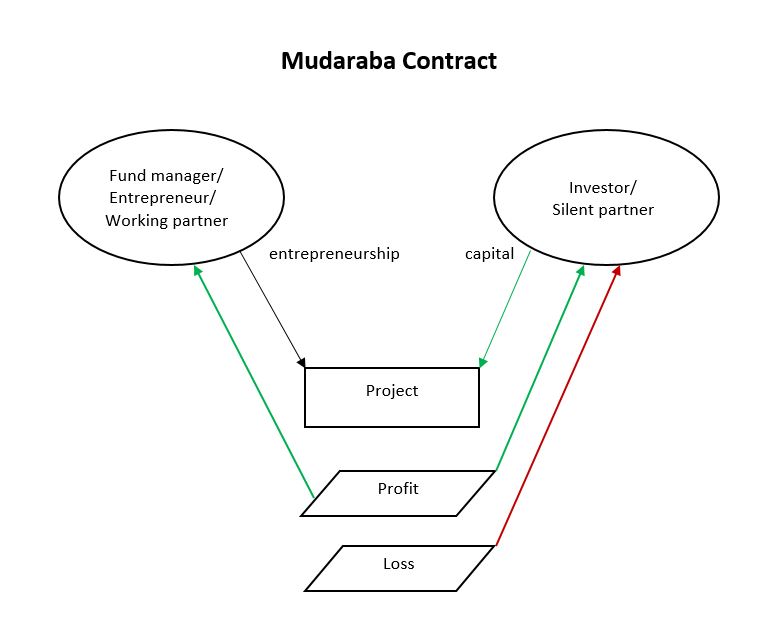

Mudaraba

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslims subscribe to. ''Mudarabah'' (مضاربة) refers to "trustee finance" or passive partnership contract, while ''Musharakah'' (مشاركة or مشركة) refers to equity participation contract. Other sources include sukuk (also called "Islamic bonds") and direct equity investment (such as purchase of common shares of stock) as types of PLS. Khan, ''Islamic Banking in Pakistan'', 2015: p.91 The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used). As financing is repaid, the provider of capital collects some agreed upon percentage of the profits (or deducts if there are losses) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Bank Of Kuwait

The National Bank of Kuwait (NBK) was founded in 1952. It is the largest financial institution in Kuwait Kuwait (; ar, الكويت ', or ), officially the State of Kuwait ( ar, دولة الكويت '), is a country in Western Asia. It is situated in the northern edge of Eastern Arabia at the tip of the Persian Gulf, bordering Iraq to the nort .... With branches and subsidiaries in China, Geneva, London, Paris, New York and Singapore. And a regional presence across the Middle East in Lebanon, Jordan, Egypt, Bahrain, Saudi Arabia, Iraq, Turkey, and the UAE. The group reported a net profit after non-controlling interests of KD 370.7 million compared to KD 322.4 million for 2017, an increase of 15%. Operating profit amounted to KD 606.9 million as compared to KD 557.2 million in 2017, an increase of 8.9%. Net interest income and net income from Islamic financing at KD 690.5 million reflects a 9.8% increase on 2017 (KD 629 million). Net fees and commissions at KD 150.2 mill ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kuwait

Kuwait (; ar, الكويت ', or ), officially the State of Kuwait ( ar, دولة الكويت '), is a country in Western Asia. It is situated in the northern edge of Eastern Arabia at the tip of the Persian Gulf, bordering Iraq to the north and Saudi Arabia to the south. Kuwait also shares maritime borders with Iran. Kuwait has a coastal length of approximately . Most of the country's population reside in the urban agglomeration of the capital city Kuwait City. , Kuwait has a population of 4.45 million people of which 1.45 million are Kuwaiti citizens while the remaining 3.00 million are foreign nationals from over 100 countries. Historically, most of present-day Kuwait was part of ancient Mesopotamia. Pre-oil Kuwait was a strategic trade port between Mesopotamia, Persia and India. Oil reserves were discovered in commercial quantities in 1938. In 1946, crude oil was exported for the first time. From 1946 to 1982, the country underwent large-scale modernization, largely b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking And Finance

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include ''Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), ''Musharaka'' (joint venture), ''Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Savings

Wealth is the abundance of valuable financial assets or physical possessions which can be converted into a form that can be used for transactions. This includes the core meaning as held in the originating Old English word , which is from an Indo-European word stem. The modern concept of wealth is of significance in all areas of economics, and clearly so for growth economics and development economics, yet the meaning of wealth is context-dependent. An individual possessing a substantial net worth is known as ''wealthy''. Net worth is defined as the current value of one's assets less liabilities (excluding the principal in trust accounts). At the most general level, economists may define wealth as "the total of anything of value" that captures both the subjective nature of the idea and the idea that it is not a fixed or static concept. Various definitions and concepts of wealth have been asserted by various individuals and in different contexts.Denis "Authentic Development: Is i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Banking

Private banking is banking, investment and other financial services provided by banks and financial institutions primarily serving high-net-worth individuals (HNWIs)—defined as those with very high levels of income or sizable assets. A bank that specializes in private banking is called a private bank. Private banking is a more exclusive subset of wealth management, geared toward exceptionally affluent clients. The term "private" refers to customer service rendered on a more personal basis than in mass-market retail banking, usually provided via dedicated bank advisers. At least until recently, it largely consisted of banking services (deposit taking and payments), discretionary asset management, brokerage, limited tax advisory services and some basic concierge-type services, offered by a single designated relationship manager. History Private banking is how banking originated. The first banks in Venice were focused on managing personal finance for wealthy families. Private ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Banking

Investment banking pertains to certain activities of a financial services company or a corporate division that consist in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities, FICC services ( fixed income instruments, currencies, and commodities) or research (macroeconomic, credit or equity research). Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket (upper tier), Middle Market (mid-level businesses), and boutique ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states, and therefore have associations and formal designations which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation (though a corporation need not be a public company), in the United Kingdom it is usually a public limited company (plc), i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)