|

Blairmore Holdings

Blairmore Holdings, Inc. was an offshore investment company established by Ian Cameron, father of former British Prime Minister, David Cameron. Following the Panama Papers leak, it was discovered that Blairmore Holdings was a customer of Mossack Fonseca, a large Panamanian law firm and corporate service provider at the centre of an international scandal on tax havens, tax avoidance and corruption. Blairmore Holdings is still in operation and has assets of £35 million. History Blairmore Holdings is company operated as a collective investment fund, in which a range of individuals invest collectively in the stock market and other financial instrument. Blairmore Holdings was established in 1982. The company is named after Blairmore House in Aberdeenshire, the house in which the stockbroker Ian Cameron – father of UK Prime Minister David Cameron – was born. The company was incorporated in Panama, but based in the Bahamas. According to the ''Financial Times'': "The idea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

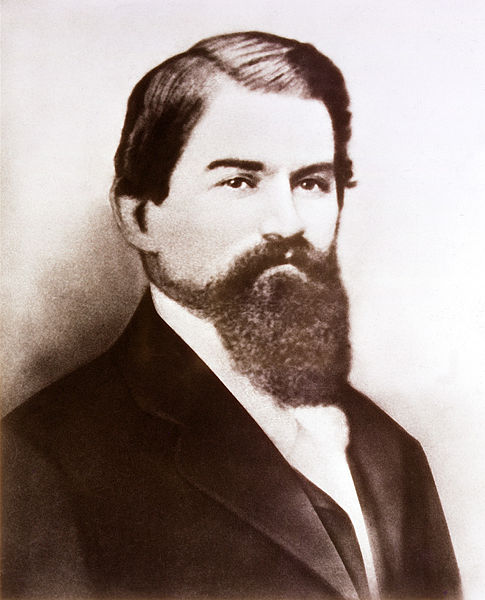

Ian Cameron (stockbroker)

Relatives of the former prime minister of the United Kingdom, David Cameron feature in law, politics and finance, as well connections to the British aristocracy. Immediate family David Cameron is the younger son of stockbroker Ian Donald Cameron (12 October 1932 – 8 September 2010) and his wife Mary Fleur (born Mount, 1934), a retired justice of the peace and second daughter of Sir William Mount. Cameron's father, Ian, was born with both legs deformed and underwent repeated operations to correct them. Cameron's parents were married in 1962. He was born in London, and brought up in Peasemore, Berkshire. His father was born at Blairmore House near Huntly, Aberdeenshire, and died near Toulon in France on 8 September 2010. According to the ''Feminist Times'', as a magistrate, Mary Cameron imposed prison sentences for anti-nuclear weapons protests at the Greenham Common Women's Peace Camp. He has an elder brother, Alexander Cameron KC, and two sisters, Tania Rachel (born 1965) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Church Of God Of Prophecy

The Church of God of Prophecy is a Holiness Pentecostal Christian church. It is one of five ''Church of God'' bodies headquartered in Cleveland, Tennessee, that arose from a small meeting of believers who gathered at the Holiness Church at Camp Creek near the Tennessee/North Carolina border on Saturday, June 13, 1903. The Church of God of Prophecy has congregations and missions in over 130 countries, with a membership of over 1,500,000 History the Church of God of Prophecy , Church of God of Prophecy website, accessed Aug 10, 2008 In 2006, membership in the United States was 84,762 in 1,871 Churches. Ministries of the Church include homes for children, bible training institutes, youth camps, ministerial aid, and Spirit and Life Seminary. The Church operates [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Edward Troup

Sir John Edward Astley Troup (born 26 January 1955) is a British tax lawyer, and was a civil servant at HM Treasury and then HM Revenue & Customs. He spent two periods as a tax partner at the law firm Simmons & Simmons, from 1985 to 1995 and from 1997 to 2004, and was a special adviser to Kenneth Clarke as Chancellor of the Exchequer in 1995-97. He rejoined HM Treasury in 2004, and became Executive Chair and First Permanent Secretary of the HM Revenue and Customs (HMRC) in April 2016. He retired in December 2017, and was knighted in the 2018 New Year Honours. Early and private life Born in Reading, Troup is the son of Cordelia Mary (née Hope) and Vice-Admiral Sir Anthony Troup. His father was the youngest British naval officer to command a submarine in World War II, aged 21 in June 1943, and he was later the last Commander-in-Chief, Far East Fleet. Before his retirement, Anthony Troup was Flag Officer Submarines and then Flag Officer Scotland and Northern Ireland. Troup ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Eye

''Private Eye'' is a British fortnightly satire, satirical and current affairs (news format), current affairs news magazine, founded in 1961. It is published in London and has been edited by Ian Hislop since 1986. The publication is widely recognised for its prominent criticism and Parody, lampooning of public figures. It is also known for its in-depth investigative journalism into under-reported scandals and cover-ups. ''Private Eye'' is Britain's best-selling current affairs magazine, and such is its long-term popularity and impact that many of recurring in-jokes in Private Eye, its recurring in-jokes have entered popular culture in the United Kingdom. The magazine bucks the trend of declining circulation for print media, having recorded its highest ever circulation in the second half of 2016. It is privately owned and highly profitable. With a "deeply conservative resistance to change", it has resisted moves to online content or glossy format: it has always been printed o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gains Tax

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, Bond (finance), bonds, precious metals, real estate, and property. Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. Countries that do not impose a capital gains tax include Bahrain, Barbados, Belize, Cayman Islands, Isle of Man, Jamaica, New Zealand, Sri Lanka, Singapore, and others. In some countries, such as New Zealand and Singapore, professional traders and those who trade frequently are taxed on such profits as a business income. In Sweden, the Investment Savings Account (ISK – ''Investeringssparkonto'') was introduced in 2012 in response to a decision by Parliament to stimulate saving in funds and equities. There is no tax on capital gains in ISKs; instead, the saver pays an annual standard low rate of tax. Fund savers nowadays mainly ch ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bernard Madoff

Bernard Lawrence Madoff ( ; April 29, 1938April 14, 2021) was an American fraudster and financier who was the admitted mastermind of the largest Ponzi scheme in history, worth about $64.8 billion. He was at one time chairman of the NASDAQ stock exchange. He advanced the proliferation of electronic trading platforms and the concept of payment for order flow, which has been described as a "legal kickback." Madoff founded a penny stock brokerage in 1960, which eventually grew into Bernard L. Madoff Investment Securities. He served as the company's chairman until his arrest on December 11, 2008. That year, the firm was the 6th-largest market maker in S&P 500 stocks. At the firm, he employed his brother Peter Madoff as senior managing director and chief compliance officer, Peter's daughter Shana Madoff as the firm's rules and compliance officer and attorney, and his now deceased sons Mark Madoff and Andrew Madoff. Peter was sentenced to 10 years in prison in 2012, and Mark hange ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minutes

Minutes, also known as minutes of meeting (abbreviation MoM), protocols or, informally, notes, are the instant written record of a meeting or hearing. They typically describe the events of the meeting and may include a list of attendees, a statement of the activities considered by the participants, and related responses or decisions for the activities. Etymology The name "minutes" possibly derives from the Latin phrase ''minuta scriptura'' (literally "small writing") meaning "rough notes". Creation Minutes may be created during the meeting by a typist or court reporter, who may use shorthand notation and then prepare the minutes and issue them to the participants afterwards. Alternatively, the meeting can be audio recorded, video recorded, or a group's appointed or informally assigned secretary may take notes, with minutes prepared later. Many government agencies use minutes recording software to record and prepare all minutes in real-time. Purpose Minutes are the officia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HM Revenue And Customs

HM Revenue and Customs (His Majesty's Revenue and Customs, or HMRC) is a non-ministerial government department, non-ministerial Departments of the United Kingdom Government, department of the His Majesty's Government, UK Government responsible for the tax collection, collection of Taxation in the United Kingdom, taxes, the payment of some forms of Welfare state in the United Kingdom, state support, the administration of other regulatory Regime#Politics, regimes including the national minimum wage and the issuance of national insurance numbers. HMRC was formed by the merger of the Inland Revenue and HM Customs and Excise, which took effect on 18 April 2005. The department's logo is the St Edward's Crown enclosed within a circle. Prior to the Elizabeth II, Queen's death on 8 September 2022, the department was known as ''Her'' Majesty's Revenue and Customs and has since been amended to reflect the change of monarch. Departmental responsibilities The department is responsible for the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Offshore Fund

An offshore fund is generally a collective investment scheme domiciled in an offshore jurisdiction. Like the term "offshore company", the term is more descriptive than definitive, and both the words 'offshore' and 'fund' may be construed differently. The reference to offshore, in the classic case, usually means a traditional offshore jurisdiction such as the Cayman Islands, Jersey or the British Virgin Islands. However, the term is also frequently used to include other corporate domiciles popular for cross border investment structuring, such as Delaware and Luxembourg. In the widest sense, offshore is sometimes used to include any type of cross border collective investment scheme, and popular fund domiciles such as Ireland may be included within the definition of offshore, notwithstanding their substantial size as a country. Similarly, although the reference to fund can be taken to include any sort of collective investment, within offshore jurisdictions themselves, the term off ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share Register

A shareholder (in the United States often referred to as stockholder) of a corporation is an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the legal owner of shares of the share capital of a public or private corporation. Shareholders may be referred to as members of a corporation. A person or legal entity becomes a shareholder in a corporation when their name and other details are entered in the corporation's register of shareholders or members, and unless required by law the corporation is not required or permitted to enquire as to the beneficial ownership of the shares. A corporation generally cannot own shares of itself. The influence of a shareholder on the business is determined by the shareholding percentage owned. Shareholders of a corporation are legally separate from the corporation itself. They are generally not liable for the corporation's debts, and the shareholders' liability ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bearer Shares

A bearer instrument is a document that entitles the holder of the document to rights of ownership or title (property), title to the underlying property, such as share (finance), shares or Bond (finance), bonds. Unlike normal registered instruments, no record is kept of who owns bearer instruments or of transactions involving transfer of ownership, enabling the owner, as well as a purchaser, to deal with the property Anonymity, anonymously. Whoever physically holds the bearer document is assumed to be the owner of the property, and the rights arising therefrom, such as dividends. Bearer instruments are used especially by investors and corporate officers who wish to retain anonymity. The OECD in a 2003 report concluded that the use of bearer shares is "perhaps the single most important (and perhaps the most widely used) mechanism" to protect the anonymity of a ship's beneficial owner.OECD 2003, p. 8. Physically possessing a bearer share accords ownership of the corporation, which in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coca-Cola

Coca-Cola, or Coke, is a carbonated soft drink manufactured by the Coca-Cola Company. Originally marketed as a temperance drink and intended as a patent medicine, it was invented in the late 19th century by John Stith Pemberton in Atlanta, Georgia. In 1888, Pemberton sold Coca-Cola's ownership rights to Asa Griggs Candler, a businessman, whose marketing tactics led Coca-Cola to its dominance of the global soft-drink market throughout the 20th and 21st century. The drink's name refers to two of its original ingredients: coca leaves and kola nuts (a source of caffeine). The current formula of Coca-Cola remains a closely guarded trade secret; however, a variety of reported recipes and experimental recreations have been published. The secrecy around the formula has been used by Coca-Cola in its marketing as only a handful of anonymous employees know the formula. The drink has inspired imitators and created a whole classification of soft drink: colas. The Coca-Cola Company p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |