|

Banking In Pakistan

Banking in Pakistan formally began during the period of colonialism in South Asia, during which much of Pakistan was controlled by the British Empire. In 1947, Pakistan gained independence from the British Raj. After independence, the State Bank of Pakistan was established as the central bank of the country, with its headquarters in Karachi. Prior to independence, the Reserve Bank of India acted as the central bank for what became Pakistan. In 2018, there were 50.565 million bank accounts in Pakistan for its population of 207.77 million, resulting in a penetration rate of 24.34%. There were 15,053 bank branches, 14,148 ATMs, and 53,269 POS machines active in the country. On 28 April 2022, the Federal Shariat Court (FSC) announced a verdict in a case on Riba, declaring all the provisions of the Interest Act 1839, which facilitate interest, as unlawful. The FSC also declared the prevailing interest-based banking system as against the Shariah. The FSC ruled that the federal govern ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Colonialism

Colonialism is a practice or policy of control by one people or power over other people or areas, often by establishing colonies and generally with the aim of economic dominance. In the process of colonisation, colonisers may impose their religion, language, economics, and other cultural practices. The foreign administrators rule the territory in pursuit of their interests, seeking to benefit from the colonised region's people and resources. It is associated with but distinct from imperialism. Though colonialism has existed since ancient times, the concept is most strongly associated with the European colonial period starting with the 15th century when some European states established colonising empires. At first, European colonising countries followed policies of mercantilism, aiming to strengthen the home-country economy, so agreements usually restricted the colony to trading only with the metropole (mother country). By the mid-19th century, the British Empire gave up me ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Automated Teller Machine

An automated teller machine (ATM) or cash machine (in British English) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account information inquiries, at any time and without the need for direct interaction with bank staff. ATMs are known by a variety of names, including automatic teller machine (ATM) in the United States (sometimes redundantly as "ATM machine"). In Canada, the term ''automated banking machine'' (ABM) is also used, although ATM is also very commonly used in Canada, with many Canadian organizations using ATM over ABM. In British English, the terms ''cashpoint'', ''cash machine'' and ''hole in the wall'' are most widely used. Other terms include ''any time money'', ''cashline'', ''tyme machine'', ''cash dispenser'', ''cash corner'', ''bankomat'', or ''bancomat''. ATMs that are not operated by a financial i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of Pakistan

The Government of Pakistan ( ur, , translit=hakúmat-e pákistán) abbreviated as GoP, is a federal government established by the Constitution of Pakistan as a constituted governing authority of the Administrative units of Pakistan, four provinces, two autonomous territories, and one federal territory of a Parliamentary democracy, parliamentary democratic Parliamentary republic, republic, constitutionally called the Pakistan, Islamic Republic of Pakistan. Effecting the Westminster system for governing the state, the government is mainly composed of the Executive branch, executive, Legislative branch, legislative, and Judicial branch, judicial branches, in which all powers are vested by the Constitution of Pakistan, Constitution in the Parliament of Pakistan, Parliament, the Prime Minister of Pakistan, Prime Minister and the Supreme Court of Pakistan, Supreme Court. The powers and duties of these branches are further defined by acts and amendments of the Parliament, including the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

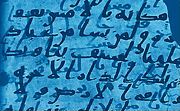

Shariah

Sharia (; ar, شريعة, sharīʿa ) is a body of religious law that forms a part of the Islamic tradition. It is derived from the religious precepts of Islam and is based on the sacred scriptures of Islam, particularly the Quran and the Hadith. In Arabic, the term ''sharīʿah'' refers to God's immutable divine law and is contrasted with ''fiqh'', which refers to its human scholarly interpretations. In the historical course, fiqh sects have emerged that reflect the preferences of certain societies and state administrations on behalf of people who are interested in the theoretical (method) and practical application (Ahkam / fatwa) studies of laws and rules, but sharia has never been a valid legal system on its own. It has been used together with " customary (Urf) law" since Omar or the Umayyads. It may also be wrong to think that the Sharia, as a religious argument or belief, is entirely within or related to Allah's commands and prohibitions. Several non-graded crimes are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest

In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a company to its shareholders (owners) from its profit or reserve, but not at a particular rate decided beforehand, rather on a pro rata basis as a share in the reward gained by risk taking entrepreneurs when the revenue earned exceeds the total costs. For example, a customer would usually pay interest to borrow from a bank, so they pay the bank an amount which is more than the amount they borrowed; or a customer may earn interest on their savings, and so they may withdraw more than they originally deposited. In the case of savings, the customer is the lender, and the bank plays the role of the borrower. Interest diff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Riba

The Royal Institute of British Architects (RIBA) is a professional body for architects primarily in the United Kingdom, but also internationally, founded for the advancement of architecture under its royal charter granted in 1837, three supplemental charters and a new charter granted in 1971. Founded as the Institute of British Architects in London in 1834, the RIBA retains a central London headquarters at 66 Portland Place as well as a network of regional offices. Its members played a leading part in promotion of architectural education in the United Kingdom; the RIBA Library, also established in 1834, is one of the three largest architectural libraries in the world and the largest in Europe. The RIBA also played a prominent role in the development of UK architects' registration bodies. The institute administers some of the oldest architectural awards in the world, including RIBA President's Medals Students Award, the Royal Gold Medal, and the Stirling Prize. It also manages ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Shariat Court

The Federal Shariat Court (FSC) is a constitutional court of the Islamic Republic of Pakistan, which has the power to examine and determine whether the laws of the country comply with Sharia law. The court was established in 1980 during the government of the President General Muhammad Zia-ul-Haq. It is located in the federal capital, Islamabad. It hears appeals under the Hudood Ordinances, a religious legislation in the country introduced in 1979. The Federal Shariat Court is the only constitutional authority in the country designed to prevent enactment of un-Islamic laws by the parliament of Pakistan. It is predominantly focused on to examine new or existing law of Pakistan. If a law violates the Quran, sunnah or hadith, it prohibits its enactment. Justice Dr. Syed Muhammad Anwer, is the currentActing Chief Justiceof the Federal Shariat Court, having taken oath on May 16, 2022. Court structure and mandate It consists of eight Muslim judges appointed by the President of Pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Terminal

A payment terminal, also known as a point of sale (POS) terminal, credit card terminal, EFTPOS terminal (or by the older term as PDQ terminal which stands for "Process Data Quickly"), is a device which interfaces with payment cards to make electronic funds transfers. The terminal typically consists of a secure keypad (called a PINpad) for entering PIN, a screen, a means of capturing information from payments cards and a network connection to access the payment network for authorization. A payment terminal allows a merchant to capture required credit and debit card information and to transmit this data to the merchant services provider or bank for authorization and finally, to transfer funds to the merchant. The terminal allows the merchant or their client to swipe, insert or hold a card near the device to capture the information. They are often connected to point of sale systems so that payment amounts and confirmation of payment can be transferred automatically to the merchant ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Penetration

Market penetration refers to the successful selling of a good or service in a specific market. It is measured by the amount of sales volume of an existing good or service compared to the total target market for that product or service. Market penetration is the key for a business economic growth, growth strategy stemming from the Ansoff Matrix (Richardson, M., & Evans, C. (2007). H. Igor Ansoff first devised and published the Ansoff Matrix in the ''Harvard Business Review'' in 1957, within an article titled "Strategies for Diversification". The grid/matrix is utilized across businesses to help evaluate and determine the next stages the company must take in order to grow and the risks associated with the chosen strategy. With numerous options available, this matrix helps narrow down the best fit for an organization. This strategy involves selling current products or services to the existing market in order to obtain a higher market share. This could involve persuading current cust ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Colonial India

Colonial India was the part of the Indian subcontinent that was occupied by European colonial powers during the Age of Discovery. European power was exerted both by conquest and trade, especially in spices. The search for the wealth and prosperity of India led to the colonisation of the Americas after Christopher Columbus went to the Americas in 1492. Only a few years later, near the end of the 15th century, Portuguese sailor Vasco da Gama became the first European to re-establish direct trade links with India since Roman times by being the first to arrive by circumnavigating Africa (c. 1497–1499). Having arrived in Calicut, which by then was one of the major trading ports of the eastern world, he obtained permission to trade in the city from the Saamoothiri Rajah. The next to arrive were the Dutch, with their main base in Ceylon. Their expansion into India was halted after their defeat in the Battle of Colachel by the Kingdom of Travancore, during the Travancore–Dutch ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Bank Of India

The Reserve Bank of India, chiefly known as RBI, is India's central bank and regulatory body responsible for regulation of the Indian banking system. It is under the ownership of Ministry of Finance, Government of India. It is responsible for the control, issue and maintaining supply of the Indian rupee. It also manages the country's main payment systems and works to promote its economic development. Bharatiya Reserve Bank Note Mudran (BRBNM) is a specialised division of RBI through which it prints and mints Indian currency notes (INR) in two of its currency printing presses located in Nashik (Western India) and Dewas (Central India). RBI established the National Payments Corporation of India as one of its specialised division to regulate the payment and settlement systems in India. Deposit Insurance and Credit Guarantee Corporation was established by RBI as one of its specialised division for the purpose of providing insurance of deposits and guaranteeing of credit facilit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |