|

Banca Popolare Del Molise

Banca Popolare del Molise was an Italian bank based in Campobasso, Molise. The bank was one of the "big three" banks in the Molise region in 1994 (in terms of deposit and lending market), as well as ranked the 181st by client deposits in the whole Italy. The bank was absorbed by Rolo Banca, a subsidiary of Credito Italiano in June 1998. The successor of the parent company of the bank (Credito Italiano), and its main competitor (Banca di Roma): UniCredit (Credito Italiano) and Capitalia (Banca di Roma) respectively was merged in 2007. UniCredit Banca di Roma, had 38 branches in the Molise region in 2008, which included 19 via Pietrunto, the former headquarter of BPM. However, the site was assigned to UniCredit Banca from 2002 to 2007. History The bank had a market shares (in lending market, year missing, short term) of 19.5% in Molise region, comparing to competitors Banca di Roma (30.99%) and Banco di Napoli (14.95%) respectively, according to reports from Autorità Garante della ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rolo Banca

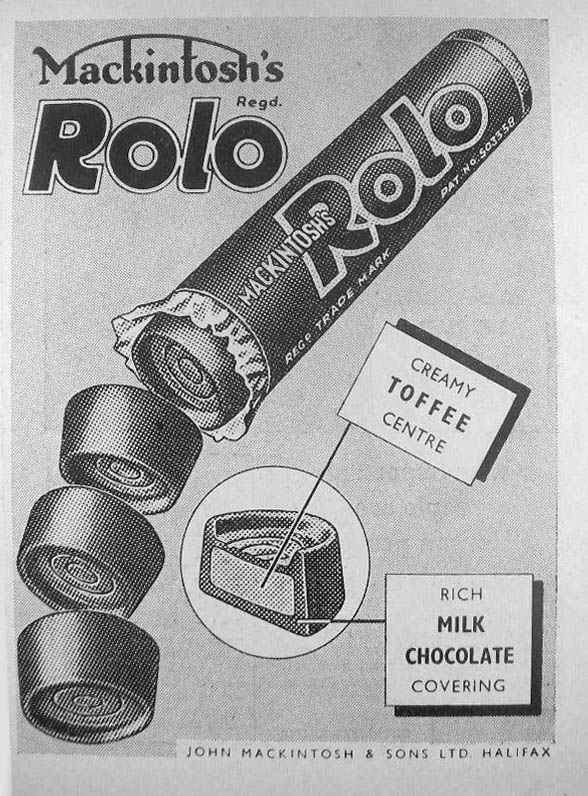

Rolo (pronounced /ˈrəʊləʊ/), referring to the roll-styled chocolates, is a brand of truncated cone-shaped or conical frustum-shaped chocolates with a caramel inside. First manufactured in Norwich, Norfolk in the United Kingdom by Mackintosh's in 1937 (followed by Rowntree's after the takeover in 1969), they are made by Nestlé (except in the United States, where production has been licensed to The Hershey Company). A long-running British advertising slogan for the brand was "Do you love anyone enough to give them your last Rolo?" A YouGov poll saw Rolo ranked the eleventh most popular and seventeenth most famous confectionery in the UK. History The Rolo product was developed in England by Mackintosh's, (later Rowntree-Mackintosh), simply a combination of caramel and a chocolate coating. Rolo was launched in the United Kingdom in 1937. In 1956, the New England Confectionery Company acquired a licence to produce Rolos in the US. In 1969, the license for US Manufacturing w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credito Italiano

Credito Italiano also known as just Credit, was an Italian bank, now part of UniCredit. It was merged with Unicredito in 1998, forming Unicredito Italiano (now UniCredit). Circa 1999 to 2002 UniCredit created a new subsidiary of the same name to run the retail network of Credito Italiano. On 1 July 2002 the subsidiary received the assets of sister banks to become UniCredit Banca. History Founded on 28 April 1870 in Genoa as Banca di Genova, it took part in the establishment of the Bank of Italy ( it, Banca d'Italia) and opened the first trans-Atlantic banking business with Buenos Aires (1872). Local shareholders were local nobility (Pallavicino and Balbi), bankers (Quartara, Polleri) and merchants (Lagorio, Dodero, Bacigalupo), creating an initial capital of 3 million Italian lira. It acquired "Banca Vonwiller" of Milan. In the 1890s, the international financial crisis led to refinancing by German and Swiss banks and name change to "Credito Italiano" (1895) With a paid-in capit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UniCredit Banca

UniCredit Banca S.p.A. was the retail banking division of UniCredit Group. On 1 July 2002, Rolo Banca, Banca CRT, Cariverona Banca, Cassamarca, Cassa di Risparmio di Trento e Rovereto and Cassa di Risparmio di Trieste were merged into Credito Italiano S.p.A. (a new subsidiary of UniCredit incorporated in December 1999), with Credito Italiano was renamed into UniCredit Banca S.p.A.. On 1 January 2003 UniCredit Private Banking and UniCredit Banca d'Impresa were spin off from UniCredit Banca After UniCredit acquired Capitalia Group in an all-share deal in 2007, UniCredit Group gained the brand Banca di Roma and Banco di Sicilia. UniCredit Banca exchanged branches with the two sister companies (as well as absorbing Bipop Carire), making UniCredit Banca was specialized in the northern Italy. 3 branches of former UniCredit Banca were sold to fellow Italian bank Banca Carige Banca Carige S.p.A., historically known as Cassa di Risparmio di Genova e Imperia (Ca.Ri.Ge.) is an Itali ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banca Di Roma

UniCredit Banca di Roma S.p.A. was an Italian bank based in Rome, Lazio region. It was a subsidiary of UniCredit Group. In 2010 the subsidiary was absorbed into the bank, but retained as a registered trademark. In 2008 the bank had 1533 branches: 608 in Lazio, 219 in Campania, 173 in Apulia, 171 in Tuscany, 99 in Marche, 84 in Umbria, 59 in Sardegna, 49 in Abruzzo, 38 in Molise, 23 in Calabria and 10 in Basilicata. (Sicily and Northern Italy were served by sister companies Banco di Sicilia and UniCredit Banca respectively) History Banca di Roma S.p.A. was formed by the merger of Banco di Santo Spirito, Banco di Roma and Cassa di Risparmio di Roma. In 1991 the banking section of Cassa di Risparmio di Roma was absorbed by Banco di Santo Spirito, as Legge Amato required all saving banks of Italy ( it, Cassa di Risparmio) had to transform into S.p.A. (company limited by shares). The owner, Fondazione Cassa di Risparmio di Roma, chose not to form an independent bank but a holding comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banco Di Napoli

Banco di Napoli S.p.A., among the oldest banks in the world, was an Italian banking subsidiary of Intesa Sanpaolo group, as one of the 6 retail brands other than "Intesa Sanpaolo". It was acquired by the Italian banking group Sanpaolo IMI (the predecessor of Intesa Sanpaolo) in 2002 and ceased being an independent bank. In February 2018, Intesa Sanpaolo announced their new business plan, which would retire Banco di Napoli and other brands; the legal person of Banco di Napoli would be absorbed into Intesa Sanpaolo S.p.A. History The Banco of Naples is one of the most important and oldest historic banks, as its origins date back to the so-called public benches of charitable institutions, which arose in Naples between the sixteenth and seventeenth centuries, especially at a mount of piety founded in 1539 on a pledge to lend without interest, which in 1584 opened a case of deposits, recognised by a proclamation of the viceroy of Naples in the same year. According to some scholars its ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Autorità Garante Della Concorrenza E Del Mercato

The Italian Competition Authority ( it, Autorità Garante della Concorrenza e del Mercato, AGCM) is the competition regulator in Italy. It is an Italian quasi-autonomous non-governmental organization established on the basis of Law №287 of 10 October 1990. As of 2004, the Italian Competition Authority has also been in charge of enforcing laws against conflicts of interest for Holders of Public Office. As the Italian competition regulator, the Authority has the task of enforcing both Italian and European consumer protection laws. It is financed by annual allocations through a special chapter of the Ministry of Economic Development's budget. The Financial Law of 2006 introduced partial self-financing: ''AGCM'' has full control over the management of these funds for its own operations. An annual report is presented to the President of the Council of Ministers of Italy. Duties The main duties of the authority are: * Vigilance against abuses from market dominance. * Vigilance agai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banca D'Italia

The Bank of Italy (Italian: ''Banca d'Italia'', informally referred to as ''Bankitalia''), (), is the central bank of Italy and part of the European System of Central Banks. It is located in Palazzo Koch, via Nazionale, Rome. The bank's current governor is Ignazio Visco, who took the office on 1 November 2011. Functions After the charge of monetary and exchange rate policies was shifted in 1998 to the European Central Bank, within the European institutional framework, the bank implements the decisions, issues euro banknotes and withdraws and destroys worn pieces. The main function has thus become banking and financial supervision. The objective is to ensure the stability and efficiency of the system and compliance with rules and regulations; the bank pursues it through secondary legislation, controls and cooperation with governmental authorities. Following a reform in 2005, which was prompted by takeover scandals, the bank has lost exclusive antitrust authority in the credit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banca Nazionale Del Lavoro

Banca Nazionale del Lavoro S.p.A. (BNL) is an Italian bank headquartered in Rome. It is Italy's sixth largest bank and has been a subsidiary of BNP Paribas since 2006. History Founded in 1913 as Istituto Nazionale di Credito per la Cooperazione, it was nationalized in 1929. It was re-privatized and listed on the Milan Stock Exchange in 1998, before being acquired by French banking group BNP Paribas in 2006. Banca Nazionale del Lavoro began Argentine operations in 1960, ultimately opening 91 branches, before selling its operation there to HSBC Bank Argentina in 2006. In 2016 the company opened a contemporary all glass building for their headquarter: BNL BNP Paribas headquarters. Scandals The bank was involved in a major political scandal (dubbed Iraqgate by the media) when it was revealed in 1989 that the Atlanta, Georgia, branch of the bank was making unauthorized loans of more than US$4.5 billion to Iraq. Many of the loans that the branch made were guaranteed by the Un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credito Romagnolo

Credito Romagnolo nicknamed Rolo was an Italian bank based in Bologna, Emilia-Romagna. In 1995 it was acquired by Credito Italiano. In 1996 Credito Romagnolo Group (Credito Romagnolo Holding and Credito Romagnolo S.p.A.) were merged with Group Carimonte Banca to form Rolo Banca. History Banca Piccolo Credito Romagnolo was found in 1896. In 1987 the bank acquired Banca Venturi, a bank based in Apulia. In 1992–94 the bank absorbed Banca del Friuli, a bank based in Friuli – Venezia Giulia region. In 1991 Credito Romagnolo had a market share of 11.9% in lending in Emilia-Romagna, while Banca del Friuli had a market share of 8.5% in Friuli – Venezia Giulia. In 1994 the bank acquired Banca Popolare del Molise. The bank also owned Banca Agricola Commerciale (San Marino) at that time. In 1994 the bank proposed a merger plan to the shareholders of Casse Emiliano Romagnole (CAER), which all shares of CAER would be offer for new shares of Credito Romagnolo. However, it was rejected. C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carimonte Banca

Carimonte Banca was an Italian bank based in Bologna, Emilia–Romagna region. The bank was formed on 12 July 1991 (gazetted on 21 August) by the merger of Banca del Monte di Bologna e Ravenna and Cassa di Risparmio di Modena. On 31 December 1995 was merged with Credito Romagnolo (a subsidiary of Credito Italiano) to form Rolo Banca. In 1995 the bank also acquired a minority interests in Banca Popolare di Rieti. History The predecessor of the bank could be traced back to Mount of Piety of Bologna, found 1473, which was merged with Mount of Piety of Ravenna (found 1492) to form Banca del Monte di Bologna e Ravenna in 1966. In 1991 Carimonte Banca was formed by the merger of the Banca Monte and Cassa di Risparmio di Modena (found 1846). The holding company of the bank was Carimonte Holding, a joint venture of Fondazione Carimodena and Fondazione del Monte di Bologna e Ravenna in 50–50 voting rights and 60–40 share capitals. Sponsorship The bank was a sponsor of Modena Vo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Defunct Cooperative Banks Of Italy

{{Disambiguation ...

Defunct (no longer in use or active) may refer to: * ''Defunct'' (video game), 2014 * Zombie process or defunct process, in Unix-like operating systems See also * * :Former entities * End-of-life product * Obsolescence Obsolescence is the state of being which occurs when an object, service, or practice is no longer maintained or required even though it may still be in good working order. It usually happens when something that is more efficient or less risky r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)