|

BN66

Budget Note 66 (BN66) is the mechanism by which the UK government introduced clause 55 of the Finance Bill 2008, which would later become Section 58 of the Finance Act 2008. This specifically targeted tax planning and tax avoidance schemes that made use of offshore trusts and double taxation treaties to reduce the tax paid by the scheme's users which had previously been legal. This arrangement was originally used by property developers but was then heavily marketed to the freelance community after the introduction of intermediaries legislation known as IR35, because it appeared to offer more certainty concerning tax liabilities than would be the case if running a limited company. In introducing S58 the government retrospectively changed the law so that not only could these arrangements not operate in future but they were effectively made unlawful from the day they were first introduced. Origins of BN66 BN66 has its origins in the result of ''Padmore vs IRC''.''Padmore v IRC ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance Act 2008

The Finance Act 2008 (c 9) is an Act of the Parliament of the United Kingdom which changes the United Kingdom's tax law as announced in the budget on 12 March 2008 by Chancellor of the Exchequer Alistair Darling. It received royal assent on 21 July 2008, and pursuant to section 1 of the Parliament Act 1911, the Act was not read a third time by the House of Lords. See also *Finance Act *BN66 Budget Note 66 (BN66) is the mechanism by which the UK government introduced clause 55 of the Finance Bill 2008, which would later become Section 58 of the Finance Act 2008. This specifically targeted tax planning and tax avoidance schemes tha ... References {{UK legislation United Kingdom Acts of Parliament 2008 2008 in economics Tax legislation in the United Kingdom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance Act (No

A Finance Act is the headline fiscal (budgetary) legislation enacted by the UK Parliament, containing multiple provisions as to taxes, duties, exemptions and reliefs at least once per year, and in particular setting out the principal tax rates for each fiscal year. Overview In the UK, the Chancellor of the Exchequer delivers a Budget speech on Budget Day, outlining changes in spending, as well as tax and duty. The changes to tax and duty are passed as law, and each year form the respective Finance Act. Additional Finance Acts are also common and are the result of a change in governing party due to a general election, a pressing loophole or defect in the law of taxation, or a backtrack with regard to government spending or taxation. The rules governing the various taxation methods are contained within the relevant taxation acts. Capital Gains Tax legislation, for example, is contained within Taxation of Chargeable Gains Act 1992. The Finance Act details amendments to be made to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joint Committee On Human Rights

The Joint Committee on Human Rights is a joint committee of the Parliament of the United Kingdom. The remit of the committee is to consider human rights issues in the United Kingdom. Membership As at November 2022, the members of the committee are as follows: See also *Joint Committee of the Parliament of the United Kingdom *Parliamentary Committees of the United Kingdom The parliamentary committees of the United Kingdom are committees of the Parliament of the United Kingdom. Each consists of a small number of Members of Parliament from the House of Commons, or peers from the House of Lords, or a mix of both, app ... References External links *The records of the Joint Committee on Human Rights are held by the Parliamentary Archives {{DEFAULTSORT:Joint Committee On Human Rights Huma Select Committees of the British House of Commons Human rights in the United Kingdom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retrospective

A retrospective (from Latin ''retrospectare'', "look back"), generally, is a look back at events that took place, or works that were produced, in the past. As a noun, ''retrospective'' has specific meanings in medicine, software development, popular culture and the arts. It is applied as an adjective, synonymous with the term '' retroactive'', to laws, standards, and awards. Medicine A medical retrospective is an examination of a patient's medical history and lifestyle. Arts and popular culture A retrospective exhibition presents works from an extended period of an artist's activity. Similarly, a retrospective compilation album is assembled from a recording artist's past material, usually their greatest hits. A television or newsstand special about an actor, politician, or other celebrity will present a retrospective of the subject's career highlights. A leading (usually elderly) academic may be honored with a Festschrift, an honorary book of articles or a lecture series relating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax (Trading And Other Income) Act 2005

The Income Tax (Trading and Other Income) Act 2005 (c 5) is an Act of the Parliament of the United Kingdom. It restated certain legislation relating to income tax, with minor changes that were mainly intended "to clarify existing provisions, make them consistent or bring the law into line with well established practice." The Bill was the work of the Tax Law Rewrite Project team at the Inland Revenue.Explanatory notesparagraph 10 (and see paragraph 1 for their name)/ref> Part 1 Section 1 Section 1(2) was repealed by Part 1 of Schedule 3 to the Income Tax Act 2007. Part 2 Chapter 4 Section 51 This section was repealed by Part 1 of Schedule 3 to the Income Tax Act 2007. Section 75 Section 75(5) was repealed by paragraph 42 of the Schedule to the Finance Act 2009, Schedule 47 (Consequential Amendments) Order 2009 (SI 2009/2035). Section 79 Section 79(2) was repealed by Part 1 of Schedule 3 to the Corporation Tax Act 2009. Chapter 5 Section 88 Section 88(4)(a) was repealed by se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation Of Chargeable Gains Act 1992

The Taxation of Chargeable Gains Act 1992c 12 is an Act of Parliament which governs the levying of capital gains tax in the United Kingdom. This is a tax on the increase in the value of an asset between the date of purchase and the date of sale of that asset. The tax operates under two different regimes for a natural person and a body corporate. For a natural person, the rates of the capital gains tax are the same as those for earned income. The tax is levied at a rate determined by the highest rate of income tax which that person pays. Each year a natural person has an amount of gain, fixed by law, which is exempt from tax. By contrast, for bodies corporate, the chargeable gain is treated as additional profits for the accounting period in question. The capital gains tax is charged as additional corporation tax. Bodies corporate have no allowance for gains free from tax. Various reliefs from capital gains tax exist. These include indexation relief, where the amount of gain subje ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income And Corporation Tax Act 1988

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. For example, a person's income in an economic sense may be different from their income as defined by law. An extremely important definition of income is Haig–Simons income, which defines income as ''Consumption + Change in net worth'' and is widely used in economics. For households and individuals in the United States, income is defined by tax law as a sum that includes any wage, salary, profit, interest payment, rent, or other form of earnings received in a calendar year.Case, K. & Fair, R. (2007). ''Principles of Economics''. Upper Saddle River, NJ: Pearson Education. p. 54. Discretionary income is often defined as gross income minus taxes and other deductions (e.g., mandatory pension contributions), and is widely used as a basis to comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Enactment Of A Bill

A bill is proposed legislation under consideration by a legislature. A bill does not become law until it is passed by the legislature as well as, in most cases, approved by the executive. Once a bill has been enacted into law, it is called an '' act of the legislature'', or a ''statute''. Bills are introduced in the legislature and are discussed, debated and voted upon. Usage The word ''bill'' is primarily used in Anglophone United Kingdom and United States, the parts of a bill are known as ''clauses'', until it has become an act of parliament, from which time the parts of the law are known as ''sections''. In Napoleonic law nations (including France, Belgium, Luxembourg, Spain and Portugal), a proposed law may be known as a "law project" (Fr. ''projet de loi''), which is a government-introduced bill, or a "law proposition" (Fr. ''proposition de loi''), a private member's bill. For example the Dutch parliamentary system does not make this terminological distinction (''wetsontwe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

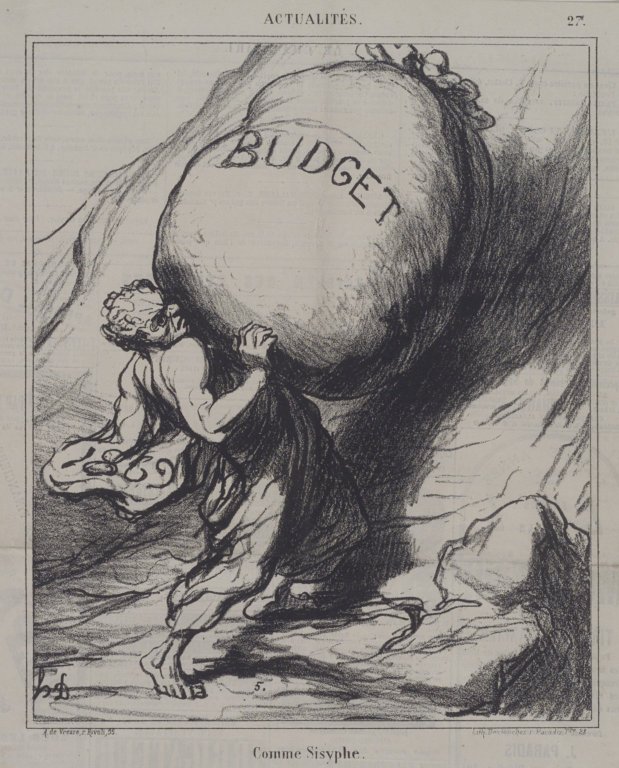

Budget

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms. A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. Government The budget of a government is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment budget, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HMRC

, patch = , patchcaption = , logo = HM Revenue & Customs.svg , logocaption = , badge = , badgecaption = , flag = , flagcaption = , image_size = , commonname = , abbreviation = , motto = , formed = , preceding1 = Inland Revenue , preceding2 = HM Customs and Excise , dissolved = , superseding = , employees = 63,042 FTE , volunteers = , budget = (2018–2019) , country = United Kingdom , constitution1 = Commissioners for Revenue and Customs Act 2005 , speciality1 = customs , speciality2 = tax , headquarters = 100 Parliament Street, London, SW1A 2BQ , sworntype = , sworn = , unsworntype = , unsworn = , minister1name = Andrew Griffith MP , minister1pfo = Economic Secretary to the Treasury and mi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Court Of Appeal

A court of appeals, also called a court of appeal, appellate court, appeal court, court of second instance or second instance court, is any court of law that is empowered to hear an appeal of a trial court or other lower tribunal. In much of the world, court systems are divided into at least three levels: the trial court, which initially hears cases and reviews evidence and testimony to determine the facts of the case; at least one intermediate appellate court; and a supreme court (or court of last resort) which primarily reviews the decisions of the intermediate courts, often on a discretionary basis. A particular court system's supreme court is its highest appellate court. Appellate courts nationwide can operate under varying rules. Under its standard of review, an appellate court decides the extent of the deference it would give to the lower court's decision, based on whether the appeal were one of fact or of law. In reviewing an issue of fact, an appellate court ordinaril ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance And Tax Evasion

Tax noncompliance (informally tax avoision) is a range of activities that are unfavorable to a government's tax system. This may include tax avoidance, which is tax reduction by legal means, and tax evasion which is the criminal non-payment of tax liabilities. The use of the term "noncompliance" is used differently by different authors. Its most general use describes non-compliant behaviors with respect to different institutional rules resulting in what Edgar L. Feige calls unobserved economies. Non-compliance with fiscal rules of taxation gives rise to unreported income and a tax gap that Feige estimates to be in the neighborhood of $500 billion annually for the United States. In the United States, the use of the term 'noncompliance' often refers only to illegal misreporting. Laws known as a General Anti-Avoidance Rule (GAAR) statutes which prohibit "tax aggressive" avoidance have been passed in several developed countries including the United States (since 2010), Canada, Au ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)