|

American College Of Trust And Estate Counsel

The American College of Trust and Estate Counsel (ACTEC) was established in 1949. It is a professional organization of lawyers, fiduciary counsel and law professors, peer-elected to membership by demonstrating the highest level of integrity, commitment to the profession, expertise, and experience as trust and estate counselors. Members of ACTEC are also known as 'Fellows'. Fellows specialize in the fields of trust and estate law, tax law, estate planning and other related legal specialties by speaking, writing, teaching and participating in local, state and national bar association activities. ACTEC is a legal organization based in the United States. ACTEC has more than 2,400 members or 'Fellows' who practice or teach in the United States, Canada and other countries. ACTEC's national headquarters is located in Washington, D.C. This organization relates to Law in the United States. History ACTEC was established in 1949 as the Probate Attorney Association. After several name change ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Professional Organization

A professional association (also called a professional body, professional organization, or professional society) usually seeks to further a particular profession, the interests of individuals and organisations engaged in that profession, and the public interest. In the United States, such an association is typically a nonprofit business league for tax purposes. Roles The roles of professional associations have been variously defined: "A group, of people in a learned occupation who are entrusted with maintaining control or oversight of the legitimate practice of the occupation;" also a body acting "to safeguard the public interest;" organizations which "represent the interest of the professional practitioners," and so "act to maintain their own privileged and powerful position as a controlling body." Professional associations are ill defined although often have commonality in purpose and activities. In the UK, the Science Council defines a professional body as "an organisation wit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Defense Authorization Act

The National Defense Authorization Act (NDAA) is the name for each of a series of United States federal laws specifying the annual budget and expenditures of the U.S. Department of Defense. The first NDAA was passed in 1961. The U.S. Congress oversees the defense budget primarily through two yearly bills: the National Defense Authorization Act and defense appropriations bills. The authorization bill is the jurisdiction of the Senate Armed Services Committee and House Armed Services Committee and determines the agencies responsible for defense, establishes recommended funding levels, and sets the policies under which money will be spent. The appropriations bill provides funds. The passage of a Defense Authorization Act is often used by Congress to honour a senior congress member or other individual. For example, the National Defense Authorization Act for Fiscal Year 2001 is known as the "Floyd D. Spence National Defense Authorization Act for Fiscal Year 2001" in honour of Repre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Retirement Account

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, ''Individual Retirement Arrangements (IRAs)''. Other arrangements include employer-established benefit trusts and individual retirement annuities, by which a taxpayer purchases an annuity contract or an endowment contract from a life insurance company. Types There are several types of IRAs: * Traditional IRA – Contributions are often tax-deductible (often simplified as "money is deposited before tax" or "contributions are made with pre-tax assets"), all transactions and earnings within the IRA have no tax impact, and withdrawals at retirement are taxed as income (e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

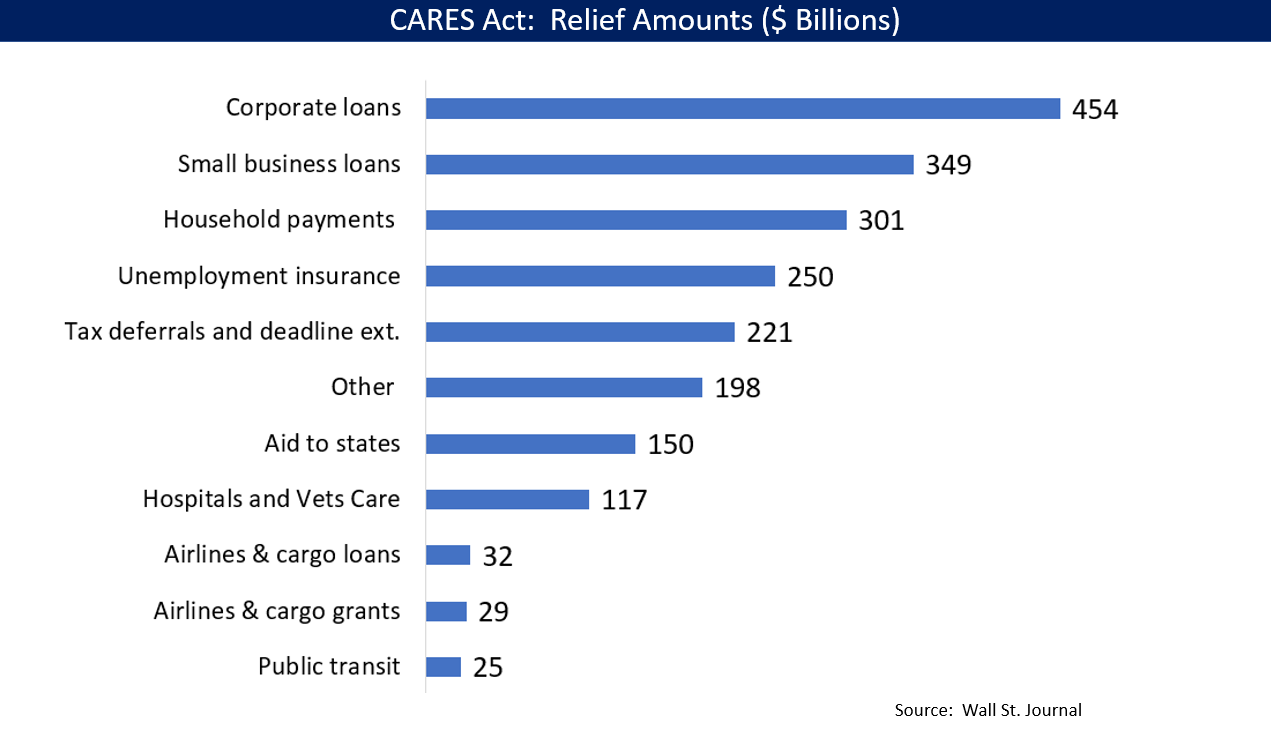

CARES Act

The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, is a $2.2trillion Stimulus (economics), economic stimulus bill passed by the 116th U.S. Congress and signed into law by President Donald Trump on March 27, 2020, in response to the economic fallout of the COVID-19 pandemic in the United States. The spending primarily includes $300billion in one-time cash payments to individual people who submit a tax return in America (with most single adults receiving $1,200 and families with children receiving more), $260billion in increased unemployment benefits, the creation of the Paycheck Protection Program that provides forgivable loans to small businesses with an initial $350billion in funding (later increased to $669billion by subsequent legislation), $500billion in loans for corporations, and $339.8 billion to state and local governments. The original CARES Act proposal included $500billion in direct payments to Americans, $208billion in loans ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, eff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SECURE Act Of 2019

The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, , was signed into law by President Donald Trump on December 20, 2019 as part of the Further Consolidated Appropriations Act, 2020 (2020 United States federal budget). The SECURE Act changed the most popular retirement plans used in the United States and was the first major retirement-related legislation enacted since the 2006 Pension Protection Act. Major elements of the bill include: raising the minimum age for required minimum distributions from 70.5 years of age to 72 years of age; allowing workers to contribute to traditional IRAs after turning 70.5 years of age; allowing individuals to use 529 plan money to repay student loans; eliminating the so-called stretch IRA by requiring non-spouse beneficiaries of inherited IRAs to withdraw and pay taxes on all distributions from inherited accounts within 10 years; and making it easier for 401(k) plan administrators to offer annuities. Legislative his ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and coins, while the treasury executes its circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes. The departm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

COVID-19

Coronavirus disease 2019 (COVID-19) is a contagious disease caused by a virus, the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The first known case was COVID-19 pandemic in Hubei, identified in Wuhan, China, in December 2019. The disease quickly spread worldwide, resulting in the COVID-19 pandemic. The symptoms of COVID‑19 are variable but often include fever, cough, headache, fatigue, breathing difficulties, Anosmia, loss of smell, and Ageusia, loss of taste. Symptoms may begin one to fourteen days incubation period, after exposure to the virus. At least a third of people who are infected Asymptomatic, do not develop noticeable symptoms. Of those who develop symptoms noticeable enough to be classified as patients, most (81%) develop mild to moderate symptoms (up to mild pneumonia), while 14% develop severe symptoms (dyspnea, Hypoxia (medical), hypoxia, or more than 50% lung involvement on imaging), and 5% develop critical symptoms (respiratory failure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beneficiaries

A beneficiary (also, in trust law, '' cestui que use'') in the broadest sense is a natural person or other legal entity who receives money or other benefits from a benefactor. For example, the beneficiary of a life insurance policy is the person who receives the payment of the amount of insurance after the death of the insured. Most beneficiaries may be designed to designate where the assets will go when the owner(s) dies. However, if the primary beneficiary or beneficiaries are not alive or do not qualify under the restrictions, the assets will probably pass to the ''contingent beneficiaries''. Other restrictions such as being married or more creative ones can be used by a benefactor to attempt to control the behavior of the beneficiaries. Some situations such as retirement accounts do not allow any restrictions beyond death of the primary beneficiaries, but trusts allow any restrictions that are not illegal or for an illegal purpose. The concept of a "beneficiary" will also fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Crimes Enforcement Network

The Financial Crimes Enforcement Network (FinCEN) is a bureau of the United States Department of the Treasury that collects and analyzes information about financial transactions in order to combat domestic and international money laundering, terrorist financing, and other financial crimes. Mission FinCEN's director expressed its mission in November 2013 as "to safeguard the financial system from illicit use, combat money laundering and promote national security." FinCEN serves as the U.S. Financial Intelligence Unit (FIU) and is one of 147 FIUs making up the Egmont Group of Financial Intelligence Units. FinCEN's self-described motto is " follow the money." The website states: "The primary motive of criminals is financial gain, and they leave financial trails as they try to launder the proceeds of crimes or attempt to spend their ill-gotten profits." It is a network bringing people and information together, by coordinating information sharing with law enforcement agencies, regulat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lawyers

A lawyer is a person who practices law. The role of a lawyer varies greatly across different legal jurisdictions. A lawyer can be classified as an advocate, attorney, barrister, canon lawyer, civil law notary, counsel, counselor, solicitor, legal executive, or public servant — with each role having different functions and privileges. Working as a lawyer generally involves the practical application of abstract legal theories and knowledge to solve specific problems. Some lawyers also work primarily in advancing the interests of the law and legal profession. Terminology Different legal jurisdictions have different requirements in the determination of who is recognized as being a lawyer. As a result, the meaning of the term "lawyer" may vary from place to place. Some jurisdictions have two types of lawyers, barrister and solicitors, while others fuse the two. A barrister (also known as an advocate or counselor in some jurisdictions) is a lawyer who typically specializes in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |