|

Alternative Investment

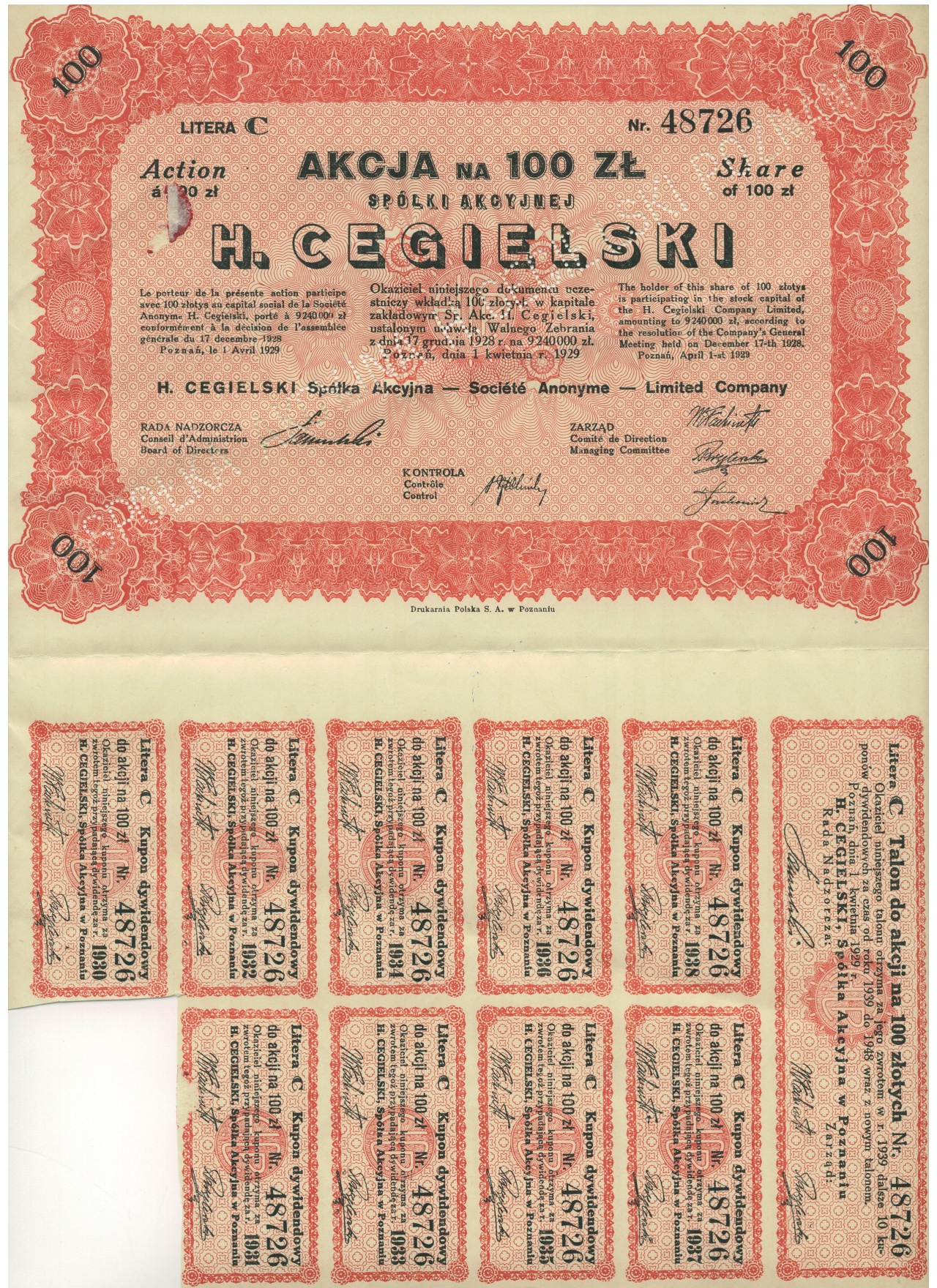

An alternative investment, also known as an alternative asset or alternative investment fund (AIF), is an investment in any asset class excluding stocks, bonds, and cash. The term is a relatively loose one and includes tangible assets such as precious metals, collectibles (art, wine, antiques, cars, coins, musical instruments, or stamps) and some financial assets such as real estate, commodities, private equity, distressed securities, hedge funds, exchange funds, carbon credits, venture capital, film production, financial derivatives, cryptocurrencies, non-fungible tokens, and tax receivable agreements. Investments in real estate, forestry and shipping are also often termed "alternative" despite the ancient use of such real assets to enhance and preserve wealth. Alternative investments are to be contrasted with traditional investments. Research As the definition of alternative investments is broad, data and research vary widely across the investment classes. For example, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carbon Credits

A carbon credit is a generic term for any tradable certificate or permit representing the right to emit a set amount of carbon dioxide or the equivalent amount of a different greenhouse gas (tCO2e). Carbon credits and carbon markets are a component of national and international attempts to mitigate the growth in concentrations of greenhouse gases (GHGs). One carbon credit is equal to one tonne of carbon dioxide, or in some markets, carbon dioxide equivalent gases. Carbon trading is an application of an emissions trading approach. Greenhouse gas emissions are capped and then markets are used to allocate the emissions among the group of regulated sources. The goal is to allow market mechanisms to drive industrial and commercial processes in the direction of low emissions or less carbon intensive approaches than those used when there is no cost to emitting carbon dioxide and other GHGs into the atmosphere. Since GHG mitigation projects generate credits, this approach can be used ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William Baumol

William Jack Baumol (February 26, 1922 – May 4, 2017) was an American economist. He was a professor of economics at New York University, Academic Director of the Berkley Center for Entrepreneurship and Innovation, and Professor Emeritus at Princeton University. He was a prolific author of more than eighty books and several hundred journal articles. Baumol wrote extensively about labor market and other economic factors that affect the economy. He also made significant contributions to the theory of entrepreneurship and the history of economic thought. He is among the most influential economists in the world according to IDEAS/RePEc. He was elected a Fellow of the American Academy of Arts and Sciences in 1971, the American Philosophical Society in 1977, and the United States National Academy of Sciences in 1987. Baumol was considered a candidate for the Nobel Prize in Economics for 2003, and Thomson Reuters cited him as a potential recipient in 2014, but he died without rece ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge Fund

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and ETFs. They are also considered distinct from private equity funds and other similar closed-end funds as hedge funds generally invest in relatively liquid assets and are usually open-ended. This means they typically allow investors to invest and withdraw capital periodically based on the fund's net asset value, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emory Center For Alternative Investments

The Emory Center for Alternative Investments is a part of the Goizueta Business School at Emory University. The Center seeks to provide independent research to the Alternative Investments Industry through papers, conferences, and education. The Center primarily focuses on the needs of Institutional Investors as they navigate the many options available in the Alternative Investment Industry but also partners with asset managers to conduct research in an effort to remain objective. The Center for Alternative Investments focuses on hedge funds, Private Equity, Venture Capital, and Real Estate. History In 2007, Emory University's Goizueta Business School received a $10 million gift to establish the Emory Center for Alternative Investments. In the Spring of the following year, Klaas Baks was appointed executive director of the center. The primary objective of the Center for Alternative Investments is to provide research into the most important challenges faced by Institutional investo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emory University

Emory University is a private research university in Atlanta, Georgia. Founded in 1836 as "Emory College" by the Methodist Episcopal Church and named in honor of Methodist bishop John Emory, Emory is the second-oldest private institution of higher education in Georgia. Emory University has nine academic divisions: Emory College of Arts and Sciences, Oxford College, Goizueta Business School, Laney Graduate School, School of Law, School of Medicine, Nell Hodgson Woodruff School of Nursing, Rollins School of Public Health, and the Candler School of Theology. Emory University, the Georgia Institute of Technology, and Peking University in Beijing, China jointly administer the Wallace H. Coulter Department of Biomedical Engineering. The university operates the Confucius Institute in Atlanta in partnership with Nanjing University. Emory has a growing faculty research partnership with the Korea Advanced Institute of Science and Technology (KAIST). Emory University students ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Goizueta Business School

Emory University's Goizueta Business School (also known as ''Goizueta Business School'', ''Emory Business School'', or simply ''Goizueta'' – pronounced ''goy-swet-ah'') is the private business school of Emory University located in Atlanta, Georgia, United States. It is named after Roberto C. Goizueta, former Chairman and CEO of The Coca-Cola Company. Emory University (Goizueta) is ranked No. 21 in Best Business Schools and No. 11 (tie) in Part-time MBA. One of the few business schools in the United States that offers both Two-Year and One-Year Full-Time MBA programs, Goizueta enables customization of academic journey with more than 20 concentrations, a Certificate of Advanced Leadership, and a wide range of experiential learning opportunities. History On February 18, 1919, the dean of Emory College, Howard Odum, recommended the creation of a "school of economics and business administration" to the Board of Trustees. Thus, in the fall of 1919, the new school worked with Emory ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Traditional Investments

In finance, the notion of traditional investments refers to putting money into well-known assets (such as bonds, cash, real estate, and equity shares) with the expectation of capital appreciation, dividends, and interest earnings. Traditional investments are to be contrasted with alternative investments. Bonds Here the investor purchases debt issued by companies or governments which promises to pay an annual return until the debt is repaid. The value of the investment changes as the level of general interest rates fluctuates, causing the bond to become more or less valuable. Cash In cash investing, money is typically invested in short-term, low-risk investment vehicles like certificates of deposit, money market funds, and high yield bank accounts. Real estate In real estate, money is used to purchase property for the purpose of holding, reselling or leasing for income and there is an element of capital risk. Residential real estate Investment in residential real estate is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shipping Investments

Shipping investments are a form of alternative investment into an asset related to worldwide shipping. This could be into ships themselves, or a related asset such as containers, with the expectation of capital appreciation, dividends, and/or interest earnings. Characteristics Some of the characteristics of shipping investments may include: * Low correlation with traditional financial investments such as stocks and bonds * Considered to be a relatively liquid investment as there is a second-hand market for shipping assets * Considered to be a cyclical industry, with long supply and demand cycles since ships are large physical assets that take time to build, transport and dispose of * Costs of purchase and sale may be moderately high * There may be limited risk and return data Ship ownership Investment in ships involves purchasing or leasing new or second-hand vessels and either operating them directly or chartering them to other operators. Investors seek either profits generated ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forestry

Forestry is the science and craft of creating, managing, planting, using, conserving and repairing forests, woodlands, and associated resources for human and environmental benefits. Forestry is practiced in plantations and natural stands. The science of forestry has elements that belong to the biological, physical, social, political and managerial sciences. Forest management play essential role of creation and modification of habitats and affect ecosystem services provisioning. Modern forestry generally embraces a broad range of concerns, in what is known as multiple-use management, including: the provision of timber, fuel wood, wildlife habitat, natural water quality management, recreation, landscape and community protection, employment, aesthetically appealing landscapes, biodiversity management, watershed management, erosion control, and preserving forests as "sinks" for atmospheric carbon dioxide. Forest ecosystems have come to be seen as the most important comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-fungible Token

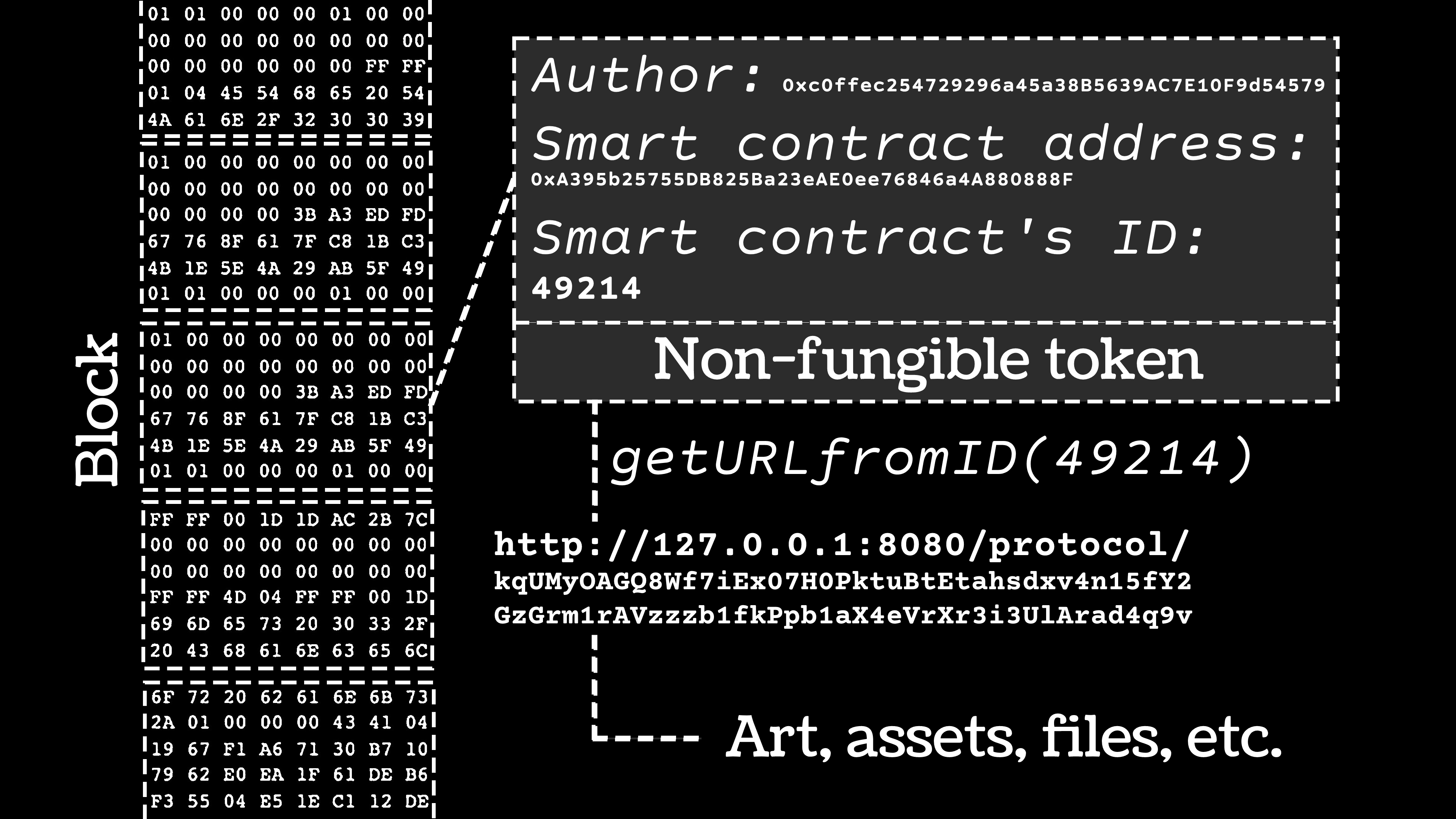

A non-fungible token (NFT) is a unique digital identifier that cannot be copied, substituted, or subdivided, that is recorded in a blockchain, and that is used to certify authenticity and ownership. The ownership of an NFT is recorded in the blockchain and can be transferred by the owner, allowing NFTs to be sold and traded. NFTs can be created by anybody, and require few or no coding skills to create. NFTs typically contain references to digital files such as photos, videos, and audio. Because NFTs are uniquely identifiable assets, they differ from cryptocurrencies, which are fungible. Proponents of NFTs claim that NFTs provide a public certificate of authenticity or proof of ownership, but the legal rights conveyed by an NFT can be uncertain. The ownership of an NFT as defined by the blockchain has no inherent legal meaning and does not necessarily grant copyright, intellectual property rights, or other legal rights over its associated digital file. An NFT does not res ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |