Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territorie ...

. Sales tax is governed at the state level and no national general

sales tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a govern ...

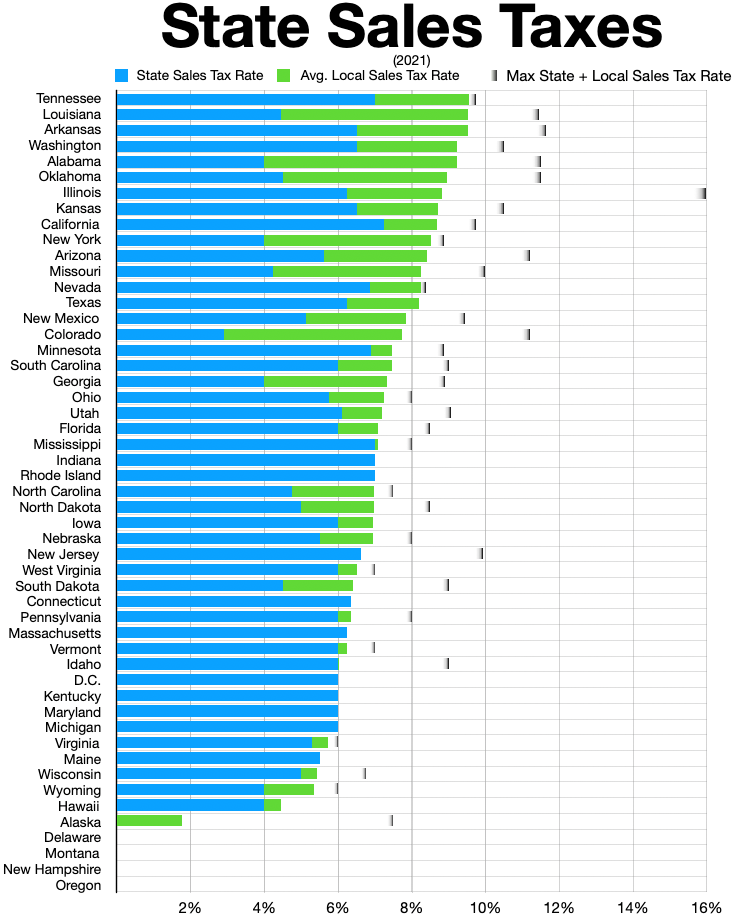

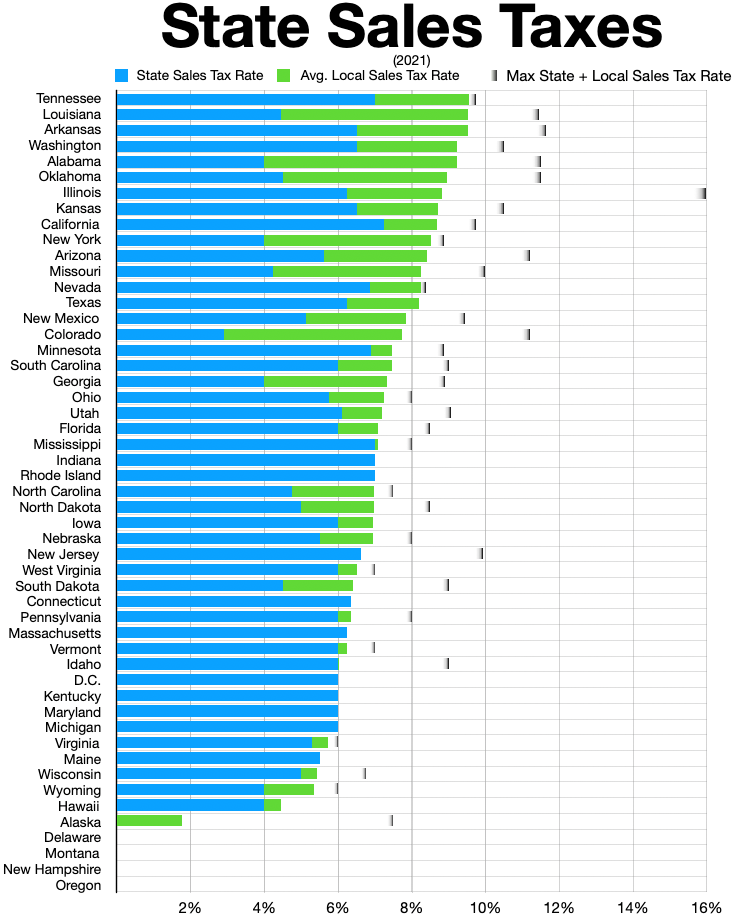

exists. 45 states, the District of Columbia, the territories of Puerto Rico, and Guam impose general sales taxes that apply to the sale or lease of most goods and some services, and states also may levy selective sales taxes on the sale or lease of particular goods or services. States may grant local governments the authority to impose additional general or selective sales taxes.

As of 2017, 5 states (Alaska, Delaware, Montana, New Hampshire and Oregon) do not levy a statewide sales tax.

California

California is a U.S. state, state in the Western United States, located along the West Coast of the United States, Pacific Coast. With nearly 39.2million residents across a total area of approximately , it is the List of states and territori ...

has the highest base sales tax rate, 7.25%. Including county and city sales taxes, the highest total sales tax is in

Arab, Alabama

Arab () is a city in Marshall and Cullman counties in the northern part of the U.S. state of Alabama, located from Guntersville Lake and Guntersville Dam, and is included in the Huntsville-Decatur Combined Statistical Area. As of the 2020 cen ...

, 13.50%.

Sales tax is calculated by multiplying the purchase price by the applicable tax rate. The seller collects it at the time of the sale.

Use tax

A use tax is a type of tax levied in the United States by numerous state governments. It is essentially the same as a sales tax but is applied not where a product or service was sold but where a merchant bought a product or service and then conve ...

is self-assessed by a buyer who has not paid sales tax on a taxable purchase. Unlike the

value added tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end ...

, a sales tax is imposed only at the

retail

Retail is the sale of goods and services to consumers, in contrast to wholesaling, which is sale to business or institutional customers. A retailer purchases goods in large quantities from manufacturers, directly or through a wholesaler, and t ...

level. In cases where items are sold at retail more than once, such as used cars, the sales tax can be charged on the same item indefinitely.

The definitions of retail sales and taxable items vary among the states. Nearly all jurisdictions provide numerous categories of goods and services that are exempt from sales tax, or taxed at reduced rates. The purchase of goods for further manufacture or for resale is uniformly exempt from sales tax. Most jurisdictions exempt food sold in grocery stores, prescription medications, and many agricultural supplies.

Sales taxes, including those imposed by local governments, are generally administered at the state level. States imposing sales tax either impose the tax on retail sellers, such as with Transaction Privilege Tax in Arizona, or impose it on retail buyers and require sellers to collect it. In either case, the seller files returns and remits the tax to the state. In states where the tax is on the seller, it is customary for the seller to demand reimbursement from the buyer. Procedural rules vary widely. Sellers generally must collect tax from in-state purchasers unless the purchaser provides an exemption certificate. Most states allow or require electronic remittance.

Taxable items

Sales taxes are imposed only on ''taxable'' transfers of goods or services. The tax is computed as the tax rate times the taxable transaction value. Rates vary by state, and by locality within a state. Not all types of transfers are taxable. The tax may be imposed on sales to consumers and to businesses.

Taxable sales

Transfers of tangible personal property for cash or the promise to pay cash (sales) are often subject to sales tax, with exceptions. Sales tax does not apply to transfers of real property, though some states impose a real estate transfer or documentary tax on such transfers. All states provide some exemptions from sales tax for wholesale sales, that is, sales for resale. However, some states tax sales for resale through vending machines.

Purchases of gift cards are not subject to sales tax in all states. These purchases are considered to be similar to exchange of cash. The sales tax will be charged when gift cards are used as a method of payment for taxable goods or services. There was a proposal in New York State to impose a sales tax when a gift card is purchased instead of imposing it when the card is used, but it failed.

Most states also exempt bulk sales, such as sales of an entire business. Most states exempt from sales tax goods purchased for use as ingredients or parts in further manufacturing. Buyers in exempt sales must follow certain procedures or face tax.

Sales to businesses and to consumers are generally taxed the same, except as noted in the preceding paragraph. Businesses receive no offset to sales tax collection and payment obligations for their own purchases. This differs significantly from value added taxes.

The place and manner of sale may affect whether a sale of particular goods is taxable. Many states tax food for consumption on premises but not food sold for off premises consumption. The use to which goods are put may also affect whether the sale is subject to tax. Goods used as ingredients in manufacturing may avoid tax, where the same goods used as supplies may not.

Rentals

Many states tax rental of tangible personal property. Often the tax is not dependent on the use to which the property will be put. Only Florida charges sales tax on the rental of commercial real estate.

Exempt organizations

Many states

exempt charitable, religious, and certain other organizations from sales or use taxes on goods purchased for the organization's use. Generally such exemption does not apply to a trade or business conducted by the organization.

Use tax

The states imposing sales taxes also impose a similar tax on buyers of taxable property or services in those cases where sales tax is not paid. Use taxes are functionally equivalent to sales taxes. The sales and use taxes, taken together, "provide a uniform tax upon either the sale or the use of all tangible personal property irrespective of where it may be purchased." Some states permit offset of sales taxes paid in other states on the purchased goods against use tax in the taxpayer's state.

Taxable value

The amount subject to sales tax is generally the net sales price. Such price is generally after any applicable discounts.

Some states exempt a portion of sales or purchase price from tax for some classes of goods.

Taxable goods

No state imposes sales tax on all types of goods. State laws vary widely as to what goods are subject to tax. Food for preparation and consumption in the home is often not taxable, nor are prescription medications. By contrast, restaurant meals are often taxed.

Many states provide exemptions for some specific types of goods and not for other types. Certain types of foods may be exempt, and certain types taxable, even when sold in a grocery store for home consumption. Lists of what goods are taxable and what are not may be voluminous.

Services

Most states tax some services, and some states tax many services. However, taxation of services is the exception rather than the rule. Few states tax the services of a doctor, dentist, or attorney. Services performed in connection with sale of tangible personal property are often taxed. Most states, however, tax services that are an integral part of producing goods, such as printing or cabinet making.

Telecommunications services are subject to a tax similar to a sales tax in most states. Only a few states tax internet access or other information services. Construction services are rarely taxed by states. Materials used in construction of real property may be subject to sales tax to the builder, the subcontractor, or the person engaging the builder, or may be wholly exempt from sales tax.

Intangible property

Most sales tax laws do not apply to most payments for intangible property. Some states tax certain forms of intangible property transfers or licenses. A common transaction subject to sales tax is license of "shrink wrap" software. State courts have often found that numerous transfers of intangible rights are to be considered subject to sales tax where not specifically exempted.

Sales for resale

All states exempt from sales or use tax purchases of goods made for resale in the same form. In many states, resale includes rental of the purchased property. Where the purchased property is not exactly the property resold, the purchase may be taxable. Further, use of the property before sale may defeat the resale exemption. Goods purchased for free distribution may be taxed on purchase in some states, and not in others.

Goods purchased to be used as ingredients in manufacturing tangible personal property are generally not taxable. Purchases of food by a restaurant generally are not taxable in those states that tax sales by restaurants, even though the ingredients are transformed. Steel purchased to be part of machines is generally not taxable. However, supplies consumed by the same businesses may be taxable. Criteria vary widely by state.

Purchase of goods to be provided as part of performance of services may be taxed. Airlines and hotels may be taxed on purchases of food to be provided as part of their services, such as in-flight meals or free breakfast. Where there is a separate charge for such goods, they may be considered purchased for resale.

Distinguishing goods from nontaxable items

Since services and intangibles are typically not taxed, the distinction between a taxable sale of tangible property and a nontaxable service or intangible transfer is a major source of controversy. Many state tax administrators and courts look to the "true object" or "dominant purpose" of the transaction to determine if it is a taxable sale. Some courts have looked at the significance of the property in relation to the services provided. Where property is sold with an agreement to provide service (such as an extended warranty or service contract), the service agreement is generally treated as a separate sale if it can be purchased separately. Michigan and Colorado courts have adopted a more holistic approach, looking at various factors for a particular transaction.

Collection, payment and tax returns

Sales taxes are collected by vendors in most states. Use taxes are self assessed by purchasers. Many states require individuals and businesses who regularly make sales to register with the state. All states imposing sales tax require that taxes collected be paid to the state at least annually. Most states have thresholds at which more frequent payment is required. Some states provide a discount to vendors upon payment of collected tax.

Sales taxes collected in some states are considered to be money owned by the state, and consider a vendor failing to remit the tax as in breach of its fiduciary duties. Sellers of taxable property must file tax returns with each jurisdiction in which they are required to collect sales tax. Most jurisdictions require that returns be filed monthly, though sellers with small amounts of tax due may be allowed to file less frequently.

Sales tax returns typically report all sales, taxable sales, sales by category of exemption, and the amount of tax due. Where multiple tax rates are imposed (such as on different classes of property sold), these amounts are typically reported for each rate. Some states combine returns for state and local sales taxes, but many local jurisdictions require separate reporting. Some jurisdictions permit or require electronic filing of returns.

Purchasers of goods who have not paid sales tax in their own jurisdiction must file use tax returns to report taxable purchases. Many states permit such filing for individuals as part of individual income tax returns.

Exemption certificates

Purchasers are required to pay sales tax unless they present the seller with certification that the purchase is exempt from tax (exemption certificate). The certificate must be on a form approved by the state. 38 states have approved use of the

Multistate Tax Commission

The Multistate Tax Commission (MTC) is an interstate instrumentality located in the United States. It is the executive agency charged with administering thMultistate Tax Compact(1967). As of 2021, the District of Columbia and all 50 states except f ...

's Uniform Sales and Use Tax Certificate.

Exemptions typically fall into two categories: usage based or entity based. Use based exemptions are when an otherwise taxable item or service is used in a manner that has been deemed exempt. The resale exemption is the most common use based exemption. Other use based exemptions could be items or services to be used in manufacturing, research & development, or teleproduction. Entity based exemptions are when the item or service is exempt solely because the purchaser falls into a category the state has granted an exempt status. Exempt entities could be government (federal, state or local), non-profit organizations, religious organizations, tribal governments, or foreign diplomats. Every state decides for themselves which use based and entity based exemption they will grant.

Penalties

Persons required to file sales or use tax returns who do not file are subject to penalties. Persons who fail to properly pay sales and use tax when due are also subject to penalties. The penalties tend to be based on the amount of tax not paid, and vary by jurisdiction.

Tax audits

All states imposing sales taxes examine sales and use tax returns of many taxpayers each year. Upon such audit, the state may propose adjustment of the amount of tax due. Taxpayers have certain rights of appeal, which vary by jurisdiction. Some states require payment of tax prior to judicial appeal, and some states consider payment of tax an admission of the tax liability.

Constitutional limitations

Under two now-overturned Supreme Court decisions, ''

Quill Corp. v. North Dakota

''Quill Corp. v. North Dakota'', 504 U.S. 298 (1992), was a Supreme Court of the United States, United States Supreme Court ruling, since overturned, concerning use tax. The decision effectively prevented states from collecting any sales tax from ...

'' (1992) and ''

National Bellas Hess v. Illinois

In ''National Bellas Hess v. Department of Revenue of Illinois'', 386 U.S. 753 (1967), the Supreme Court ruled that a mail order reseller was not required to collect sales tax unless it had some physical contact with the state.

Background

Nationa ...

'' (1967), states were not allowed to charge sales tax on sellers who did not have a physical presence or "nexus" in the state, such as companies doing

mail order

Mail order is the buying of goods or services by mail delivery. The buyer places an order for the desired products with the merchant through some remote methods such as:

* Sending an order form in the mail

* Placing a telephone call

* Placing a ...

,

online shopping

Online shopping is a form of electronic commerce which allows consumers to directly buy goods or services from a seller over the Internet using a web browser or a mobile app. Consumers find a product of interest by visiting the website of the r ...

, and

home shopping Home shopping is the electronic retailing and home shopping channels industry, which includes such billion dollar television-based and e-commerce companies as Shop LC, HSN, Gemporia, TJC, QVC, eBay, ShopHQ, Buy.com and Amazon.com, as well as tradit ...

by phone. Some states do attempt to charge consumers an identical per-transaction

use tax

A use tax is a type of tax levied in the United States by numerous state governments. It is essentially the same as a sales tax but is applied not where a product or service was sold but where a merchant bought a product or service and then conve ...

instead, but compliance is relatively low due to the difficulty of enforcement. The June 2018 decision ''

South Dakota v. Wayfair

''South Dakota v. Wayfair, Inc.'', 585 U.S. ___ (2018), was a United States Supreme Court case that held by a 5–4 majority that states may charge tax on purchases made from out-of-state sellers even if the seller does not have a physical prese ...

'' reversed this interpretation of the

Commerce Clause

The Commerce Clause describes an enumerated power listed in the United States Constitution ( Article I, Section 8, Clause 3). The clause states that the United States Congress shall have power "to regulate Commerce with foreign Nations, and amon ...

, allowing states to collect sales tax from out-of-state merchants when the consumer is in the state.

Several state constitutions impose limitations on sales tax. These limitations restrict or prohibit the taxing of certain items, such as food.

By jurisdiction

Sales tax rates and what is taxed vary by jurisdiction. The following table compares taxes on selected classes of goods in the states. Significant other differences apply. Following the table is abbreviated coverage of selected sales tax rates by state.

Summary table

Notes:

* These states tax food but give an income tax credit to compensate poor households: Hawaii, Idaho, Kansas, Oklahoma, South Dakota, and Wyoming.

* Uniform local taxes are included in the base rate in California & Utah (1.25%), and Virginia (1.0%).

Alabama

Alabama

(We dare defend our rights)

, anthem = "Alabama (state song), Alabama"

, image_map = Alabama in United States.svg

, seat = Montgomery, Alabama, Montgomery

, LargestCity = Huntsville, Alabama, Huntsville

, LargestCounty = Baldwin County, Al ...

has a state general sales tax of 4%, plus any additional local city and county taxes. , the highest total general sales tax rate in Alabama is in the portions of

Arab

The Arabs (singular: Arab; singular ar, عَرَبِيٌّ, DIN 31635: , , plural ar, عَرَب, DIN 31635: , Arabic pronunciation: ), also known as the Arab people, are an ethnic group mainly inhabiting the Arab world in Western Asia, ...

that are in

Cullman County, which total to 13.5%. Alabama is one of the last three states to still tax groceries at the full state sales tax rate, which disproportionately affects minorities and low income families with children.

City Tax Rates

*

Montgomery has a total sales tax of 10%,

as do

Birmingham

Birmingham ( ) is a city and metropolitan borough in the metropolitan county of West Midlands in England. It is the second-largest city in the United Kingdom with a population of 1.145 million in the city proper, 2.92 million in the West ...

and

Mobile

Mobile may refer to:

Places

* Mobile, Alabama, a U.S. port city

* Mobile County, Alabama

* Mobile, Arizona, a small town near Phoenix, U.S.

* Mobile, Newfoundland and Labrador

Arts, entertainment, and media Music Groups and labels

* Mobile ( ...

.

*

Huntsville

Huntsville is a city in Madison County, Limestone County, and Morgan County, Alabama, United States. It is the county seat of Madison County. Located in the Appalachian region of northern Alabama, Huntsville is the most populous city in th ...

has a total sales tax of 9% in most of the city which is in Madison County. The smaller portion of Huntsville that is in Limestone County has 10.5% sales tax due to the 2% higher Limestone County sales tax. This only affects a few retail businesses on I-565 service road.

* Decatur has a 9% total sales tax in most of its city limits, but has a 10% total sales tax in the small portion of the city that is in Limestone County, due to the higher county tax.

* The highest sales tax in Alabama is

Flomation, Alabama, with a sales tax of 11%.

Alaska

There is no state sales tax in

Alaska

Alaska ( ; russian: Аляска, Alyaska; ale, Alax̂sxax̂; ; ems, Alas'kaaq; Yup'ik: ''Alaskaq''; tli, Anáaski) is a state located in the Western United States on the northwest extremity of North America. A semi-exclave of the U.S., ...

;

however, local governments – which include

boroughs

A borough is an administrative division in various English-speaking countries. In principle, the term ''borough'' designates a self-governing walled town, although in practice, official use of the term varies widely.

History

In the Middle Ag ...

, the Alaska equivalent of

counties

A county is a geographic region of a country used for administrative or other purposesChambers Dictionary, L. Brookes (ed.), 2005, Chambers Harrap Publishers Ltd, Edinburgh in certain modern nations. The term is derived from the Old French ...

, and municipalities – may levy up to 7.5 percent. As of January 2009, 108 of them do so.

Municipal sales taxes are collected in addition to borough sales taxes, if any. Regulations and exemptions vary widely across the state. The two largest cities,

Anchorage

Anchorage () is the largest city in the U.S. state of Alaska by population. With a population of 291,247 in 2020, it contains nearly 40% of the state's population. The Anchorage metropolitan area, which includes Anchorage and the neighboring Ma ...

and

Fairbanks

Fairbanks is a home rule city and the borough seat of the Fairbanks North Star Borough in the U.S. state of Alaska. Fairbanks is the largest city in the Interior region of Alaska and the second largest in the state. The 2020 Census put the po ...

, do not charge a local sales tax.

The state capital,

Juneau

The City and Borough of Juneau, more commonly known simply as Juneau ( ; tli, Dzánti K'ihéeni ), is the capital city of the state of Alaska. Located in the Gastineau Channel and the Alaskan panhandle, it is a unified municipality and the se ...

, has a 5 percent sales tax rate.

Arizona

Arizona

Arizona ( ; nv, Hoozdo Hahoodzo ; ood, Alĭ ṣonak ) is a state in the Southwestern United States. It is the 6th largest and the 14th most populous of the 50 states. Its capital and largest city is Phoenix. Arizona is part of the Fou ...

has a

transaction privilege tax (TPT) that differs from a true sales tax in that it is a

gross receipts tax

A gross receipts tax or gross excise tax is a tax on the total gross revenues of a company, regardless of their source. A gross receipts tax is often compared to a sales tax; the difference is that a gross receipts tax is levied upon the seller of ...

, a tax levied on the gross receipts of the vendor and not a liability of the consumer. Vendors are permitted to pass the amount of the tax on to the consumer, but remain the liable parties for the tax to the state. TPT is imposed under 16 tax classifications, but most retail transactions are taxed at 6.6%.

Cities and counties can add as much as 6 percent to the total rate. Food for home consumption, prescription drugs (including

prescription drug

A prescription drug (also prescription medication or prescription medicine) is a pharmaceutical drug that legally requires a medical prescription to be dispensed. In contrast, over-the-counter drugs can be obtained without a prescription. The rea ...

s and certain prescribed

homeopathic remedies

Homeopathy or homoeopathy is a pseudoscientific system of alternative medicine. It was conceived in 1796 by the German physician Samuel Hahnemann. Its practitioners, called homeopaths, believe that a substance that causes symptoms of a dise ...

), and many other items of tangible personal property are exempt from the state retail TPT; cities can charge tax on food, and many do. Arizona's TPT is one of the few excise taxes in the country imposed on contracting activities rather than sales of construction materials.

Phoenix

Phoenix most often refers to:

* Phoenix (mythology), a legendary bird from ancient Greek folklore

* Phoenix, Arizona, a city in the United States

Phoenix may also refer to:

Mythology

Greek mythological figures

* Phoenix (son of Amyntor), a ...

, the capital and largest city, has a 2% TPT rate.

A use tax applies to purchases made from out-of-state online retailers and catalogs. A law passed in July 2011 requires Arizona residents to declare how much use tax they owe.

Indian reservations in Arizona have their own sales taxes, and these are some of the highest sales tax rates in the United States. The highest sales tax in the country as of 2012, 13.725%, was found in

Tuba City

Tuba City ( nv, ) is an unincorporated town in Coconino County, Arizona, on the Navajo Nation, United States. It is the second-largest community in Coconino County. The population of the census-designated place (CDP) was 8,611 at the 2010 cen ...

.

Arkansas

Arkansas

Arkansas ( ) is a landlocked state in the South Central United States. It is bordered by Missouri to the north, Tennessee and Mississippi to the east, Louisiana to the south, and Texas and Oklahoma to the west. Its name is from the Osage ...

has a state sales tax of 6.50%. City taxes range from an additional 0.25% to 3.5% and county taxes could be as much as 3.25%. Including city and county taxes, the highest sales tax rate is 11.625% in the portions of

Mansfield

Mansfield is a market town and the administrative centre of Mansfield District in Nottinghamshire, England. It is the largest town in the wider Mansfield Urban Area (followed by Sutton-in-Ashfield). It gained the Royal Charter of a market tow ...

that are in

Scott County.

Effective January 1, 2019, Arkansas' state sales tax on unprepared food (groceries) was reduced to 0.125% (1/8 of 1%) from 1.5%. Sales taxes on groceries had previously been reduced to 1.5% from 2% on July 1, 2011, to 2% from 3% on July 1, 2009, and to 3% from 6% on July 1, 2007. Local sales taxes on groceries remained unchanged.

California

California

California is a U.S. state, state in the Western United States, located along the West Coast of the United States, Pacific Coast. With nearly 39.2million residents across a total area of approximately , it is the List of states and territori ...

, from 1991 to 2012 and since 2017, has a base sales tax of 7.25%, composed of a 6% state tax and a 1.25% uniform local tax.

California is ranked as having the tenth highest average combined state and local sales tax rate in the United States at 8.25%.

As of July 2019, the city's rates vary, from 7.25% to 10.5% (

Santa Fe Springs

Santa Fe Springs (''Santa Fe'', Spanish for "Holy Faith") is a city in Los Angeles County, California, United States. It is one of the Gateway Cities of southeast Los Angeles County. The population was 16,223 at the 2010 census, down from 17,43 ...

). Sales and use taxes are collected by the

California Department of Tax and Fee Administration

The California Department of Tax and Fee Administration (CDTFA) is the public agency charged with assessing and collecting sales and use taxes, as well as a variety of excise fees and taxes, for the U.S. state of California. The department has sev ...

(prior to July 2017, those taxes were collected by the

California State Board of Equalization). Income and franchise taxes are collected separately by the

California Franchise Tax Board

The California Franchise Tax Board (FTB) administers and collects state personal income tax and corporate franchise and income tax of California. It is part of the California Government Operations Agency.

The board is composed of the Californi ...

.

In general, sales tax is required on all purchases of tangible personal property to its ultimate consumer. Medical devices such as prosthetics and dental implant fixtures are exempt from sales tax with the exception of prosthetic teeth such as dentures, dental orthotics/orthopedic devices, and dental crowns which the state treats as personal property.

Grocery goods, bakery items, hot beverages, candies, livestock, crops and seeds, fertilizer used to grow food, certain devices related to alternative energy, and one-time sales are also exempt from sales tax.

Colorado

Colorado

Colorado (, other variants) is a state in the Mountain West subregion of the Western United States. It encompasses most of the Southern Rocky Mountains, as well as the northeastern portion of the Colorado Plateau and the western edge of t ...

's state sales tax is 2.9% with some cities and counties levying additional taxes.

Denver

Denver () is a consolidated city and county, the capital, and most populous city of the U.S. state of Colorado. Its population was 715,522 at the 2020 census, a 19.22% increase since 2010. It is the 19th-most populous city in the Unit ...

's tangibles tax is 3.62%, with food eaten away from the home being taxed at 4%, most unprepared food (groceries) are exempt. A football stadium tax which expired December 31, 2011, but still has a mass transit tax, and scientific and cultural facilities tax. The total sales tax varies by city and county. Total sales tax on an item purchased in

Falcon, Colorado

Falcon is an Unincorporated area, unincorporated community Commuter town, exurb in El Paso County, Colorado, El Paso County, Colorado, United States. It lies along U.S. Route 24 in Colorado, US 24 about 14 miles northeast of Colorado Springs, Col ...

, would be 5.13% (2.9% state, 1.23% county, and 1% PPRTA). The sales tax rate in Larimer County is roughly 7.5%. Most transactions in Denver and the surrounding area are taxed at a total of about 8%. The sales tax rate for non food items in Denver is 7.62%. Food and beverage items total 8.00%, and rental cars total 11.25%.

Connecticut

Connecticut

Connecticut () is the southernmost state in the New England region of the Northeastern United States. It is bordered by Rhode Island to the east, Massachusetts to the north, New York to the west, and Long Island Sound to the south. Its cap ...

has a 6.35% sales tax, raised from 6 percent effective July 1, 2011, 6.25% to the state, 0% to the county and 0.1% to the city/town.

Most non-prepared food products are exempt, as are prescription medications, all internet services, all magazine and newspaper subscriptions, and textbooks (for college students only). Also

compact fluorescent light bulbs are tax exempt per Connecticut state law.

Shipping and delivery charges, including charges for US postage, made by a retailer to a customer are subject to sales and use taxes when provided in connection with the sales of taxable tangible personal property or services. The tax applies even if the charges are separately stated and applies regardless of whether the shipping or delivery is provided by the seller or by a third party. No tax is due on shipping and delivery charges in connection with any sale that is not subject to sales or use tax. Shipping or delivery charges related to sales for resale or sales of exempt items are not taxable. Likewise, charges for mailing or delivery services are not subject to tax if they are made in connection with the sale of nontaxable services.

Delaware

Delaware

Delaware ( ) is a state in the Mid-Atlantic region of the United States, bordering Maryland to its south and west; Pennsylvania to its north; and New Jersey and the Atlantic Ocean to its east. The state takes its name from the adjacent Del ...

does not assess a sales tax on consumers. The state does, however, impose a tax on the gross receipts of most businesses, and a 4.25% document fee on vehicle registrations. Business and occupational license tax rates range from 0.096 percent to 1.92 percent, depending upon the category of business activity.

District of Columbia

District of Columbia

)

, image_skyline =

, image_caption = Clockwise from top left: the Washington Monument and Lincoln Memorial on the National Mall, United States Capitol, Logan Circle, Jefferson Memorial, White House, Adams Morgan, ...

, has a sales tax rate of 5.75% as of October 1, 2013. The tax is imposed on sale of tangible personal property and selected services. (Non-prepared food, including bottled water and pet food, is not subject to the sales tax; however, soda and sports drinks are subject to the sales tax.) A 10% tax is imposed on liquor sold for off premises consumption, 10% on restaurant meals (including carry-out) and rental cars, 18% on parking, and 14.5% on hotel accommodations. Portions of the hotel and restaurant meals tax rate are allocated to the Convention Center Fund. Groceries, prescription and non-prescription drugs, and residential utilities services are exempt from the district's sales tax.

The district once had two sales tax holidays each year, one during "back-to-school" and one immediately preceding Christmas. The "back to school" tax holiday was repealed on May 12, 2009.

On January 1, 2010, the district began levying a 5-cent-per-bag tax on each plastic or paper bag provided by a retailer at the point of sale, if that retailer sells food or alcohol. The retailer retains one cent of the tax, or two cents if it offers a refund to customers for bringing their own bags. The remaining three or four cents goes to the district's

Anacostia River

The Anacostia River is a river in the Mid Atlantic region of the United States. It flows from Prince George's County in Maryland into Washington, D.C., where it joins with the Washington Channel to empty into the Potomac River at Buzzard Point. ...

cleanup fund.

Florida

Florida

Florida is a state located in the Southeastern region of the United States. Florida is bordered to the west by the Gulf of Mexico, to the northwest by Alabama, to the north by Georgia, to the east by the Bahamas and Atlantic Ocean, and to ...

has a general sales tax rate of 6%. Miami-Dade County, like most Florida counties, has an additional county sales surtax of 1%.

The tax is imposed on the sale or rental of goods, the sale of admissions, the lease, license, or rental of real property, the lease or rental of transient living accommodations, and the sale of a limited number of services such as commercial pest control, commercial cleaning, and certain protection services. There are a variety of exemptions from the tax, including groceries and prescriptions.

Sales tax and discretionary sales surtax are calculated on each taxable transaction. Florida uses a bracket system for calculating sales tax when the transaction falls between two whole dollar amounts. Multiply the whole dollar amount by the tax rate (6 percent plus the county surtax rate) and use the bracket system to figure the tax on the amount less than a dollar. The Department of Revenue has rate tables (Form DR-2X) to assist residents.

A "discretionary sales surtax" may be imposed by the counties of up to 2.5%, charged at the rate of the destination county (if shipped). This is 1% in most counties, 0.5% in many, and 1.5% in a few such as

Leon

Leon, Léon (French) or León (Spanish) may refer to:

Places

Europe

* León, Spain, capital city of the Province of León

* Province of León, Spain

* Kingdom of León, an independent state in the Iberian Peninsula from 910 to 1230 and again f ...

. Effective in 2019, Hillsborough County's surtax rate was raised to 2.5%. A few counties have no additional surtax. Most have an expiration date, but a few do not. Only the first $5,000 of a large purchase is subject to the surtax rate. Most counties levy the surtax for education or transportation improvements.

There are annual sales tax holidays, such as a back-to-school tax holiday in August on clothing, shoes and school supplies under a certain price that may change each year, as well as one in June 2007 to promote

hurricane preparedness

Cyclone mitigation encompasses the actions and planning taken before a tropical cyclone strikes to mitigate damage and injury from the storm. Knowledge of tropical cyclone impacts on an area help plan for future possibilities. Preparedness ma ...

. The 2008 Legislators did not enact any sales tax holidays.

Florida also permits counties to raise a "tourist development tax" of up to an additional 13% for stays of 6 months or less on any hotel, apartment hotel, motel, resort motel, apartment, apartment motel, rooming house, mobile home park, recreational vehicle park, condominium, or timeshare resort.

In May 2010, Florida passed a law that capped sales tax on boats or vessels to a maximum of $18,000, regardless of the purchase price. This was to encourage owners not to leave the State after purchase or to flag "offshore" which most owners were doing prior to the passing of this law. As a result, the Florida Dept. of Revenue has seen a dramatic increase in sales tax revenues from the sale of boats.

Florida is the only state to charge sales tax on the rental of real estate, commercial or residential, raising more than a billion dollars a year from the tax. Residential rentals of more than six months are exempted from the tax.

Georgia

Georgia

Georgia most commonly refers to:

* Georgia (country), a country in the Caucasus region of Eurasia

* Georgia (U.S. state), a state in the Southeast United States

Georgia may also refer to:

Places

Historical states and entities

* Related to the ...

has had a 4% state sales tax rate since April 1, 1989, when it was raised from 3%.

Services (including

postage

The mail or post is a system for physically transporting postcards, letters, and parcels. A postal service can be private or public, though many governments place restrictions on private systems. Since the mid-19th century, national postal syst ...

but not

shipping

Freight transport, also referred as ''Freight Forwarding'', is the physical process of transporting Commodity, commodities and merchandise goods and cargo. The term shipping originally referred to transport by sea but in American English, it h ...

) and

prescription drug

A prescription drug (also prescription medication or prescription medicine) is a pharmaceutical drug that legally requires a medical prescription to be dispensed. In contrast, over-the-counter drugs can be obtained without a prescription. The rea ...

s are not taxed at all, while

over-the-counter drug

Over-the-counter (OTC) drugs are medicines sold directly to a consumer without a requirement for a prescription from a healthcare professional, as opposed to prescription drugs

A prescription drug (also prescription medication or prescripti ...

s,

drugstore

A pharmacy (also called "drugstore" in American English or "community pharmacy" or "chemist" in Commonwealth English, or rarely, apothecary) is a retail shop which provides pharmaceutical drugs, among other products. At the pharmacy, a pharmacis ...

medical device

A medical device is any device intended to be used for medical purposes. Significant potential for hazards are inherent when using a device for medical purposes and thus medical devices must be proved safe and effective with reasonable assura ...

s, and other basic needs are fully taxed. Since the 1990s,

groceries

A grocery store ( AE), grocery shop ( BE) or simply grocery is a store that primarily retails a general range of food products, which may be fresh or packaged. In everyday U.S. usage, however, "grocery store" is a synonym for supermarket, a ...

(packaged foods not intended for on-premises consumption) are exempt from the state sales tax, but still subject to the local sales tax rate. Since the early 2010s, items ''prepared'' in grocery stores (even those without

café

A coffeehouse, coffee shop, or café is an establishment that primarily serves coffee of various types, notably espresso, latte, and cappuccino. Some coffeehouses may serve cold drinks, such as iced coffee and iced tea, as well as other non-ca ...

s), such as fresh

bread

Bread is a staple food prepared from a dough of flour (usually wheat) and water, usually by baking. Throughout recorded history and around the world, it has been an important part of many cultures' diet. It is one of the oldest human-made f ...

from the

bakery

A bakery is an establishment that produces and sells flour-based food baked in an oven such as bread, cookies, cakes, donuts, pastries, and pies. Some retail bakeries are also categorized as cafés, serving coffee and tea to customers who ...

, are taxed as if they were not grocery items, despite clearly being basic needs for consumption at home.

Counties in Georgia

The U.S. state of Georgia is divided into 159 counties, more than any other state except for Texas, which has 254 counties. Under the Georgia State Constitution, all of its counties are granted home rule to deal with problems that are purely lo ...

may impose local sales tax of 1%, 2%, or 3%, consisting of up to three 1% local-option sales taxes (out of a set of five) as permitted by Georgia law. These include a special-purpose tax (

SPLOST

A special-purpose local-option sales tax (SPLOST) is a financing method for funding capital outlay projects in the U.S. state of Georgia. It is an optional 1% sales tax levied by any county for the purpose of funding the building of parks, school ...

) for specific project lists, a general-purpose LOST, a

homestead exemption

The homestead exemption is a legal regime to protect the value of the homes of residents from property taxes, creditors, and circumstances that arise from the death of the homeowner's spouse.

Such laws are found in the statutes or the constitution ...

(HOST), and an educational one for

public schools (ELOST) which can be put forth for a

referendum

A referendum (plural: referendums or less commonly referenda) is a direct vote by the electorate on a proposal, law, or political issue. This is in contrast to an issue being voted on by a representative. This may result in the adoption of a ...

by the

school board

A board of education, school committee or school board is the board of directors or board of trustees of a school, local school district or an equivalent institution.

The elected council determines the educational policy in a small regional are ...

s (the county's and any of its cities' must agree), instead of the

county commission

A county commission (or a board of county commissioners) is a group of elected officials (county commissioners) collectively charged with administering the county government in some states of the United States; such commissions usually comprise ...

(in cooperation with its

city council

A municipal council is the legislative body of a municipality or local government area. Depending on the location and classification of the municipality it may be known as a city council, town council, town board, community council, rural counc ...

s) as the other taxes are. Also, the city of

Atlanta

Atlanta ( ) is the capital and most populous city of the U.S. state of Georgia. It is the seat of Fulton County, the most populous county in Georgia, but its territory falls in both Fulton and DeKalb counties. With a population of 498,715 ...

imposes an additional 1% municipal-option sales tax (MOST), as allowed by

special legislation

Special legislation is a legal term of art used in the United States to refer to legislation that targets an individual or a small, identifiable group for treatment that does not apply to all the members of a given class. A statute is often called ...

of the

Georgia General Assembly

The Georgia General Assembly is the state legislature of the U.S. state of Georgia. It is bicameral, consisting of the Senate and the House of Representatives.

Each of the General Assembly's 236 members serve two-year terms and are directly ...

, and last renewed by voters in the

February 2016 presidential primaries until 2020. This is for fixing its

water

Water (chemical formula ) is an inorganic, transparent, tasteless, odorless, and nearly colorless chemical substance, which is the main constituent of Earth's hydrosphere and the fluids of all known living organisms (in which it acts as a ...

and

sewerage

Sewerage (or sewage system) is the infrastructure that conveys sewage or surface runoff (stormwater, meltwater, rainwater) using sewers. It encompasses components such as receiving drainage, drains, manholes, pumping stations, storm overflows, a ...

systems, mainly by separating

storm sewer

A storm drain, storm sewer (United Kingdom, U.S. and Canada), surface water drain/sewer (United Kingdom), or stormwater drain ( Australia and New Zealand) is infrastructure designed to drain excess rain and ground water from impervious surface ...

s from

sanitary sewer

A sanitary sewer is an underground pipe or tunnel system for transporting sewage from houses and commercial buildings (but not stormwater) to a sewage treatment plant or disposal. Sanitary sewers are a type of gravity sewer and are part of an o ...

s.

In April 2016, a November referendum for an extra half percent was signed into law for MARTA, but only for the city of Atlanta, after legislators from the wealthy northern suburbs refused to allow the bill to advance unless their districts were excluded. This essentially limits the use of the funds to the

Atlanta Beltline

The Atlanta BeltLine (also Beltline or Belt Line) is a open and planned loop of multi-use trail and light rail transit system on a former railway corridor around the core of Atlanta, Georgia. The Atlanta BeltLine is designed to reconnect neig ...

through 2057, being the only expansion project needed within the city limits, and blocking an extension of the north (red) line to Roswell and

Alpharetta

Alpharetta is a city in northern Fulton County, Georgia, United States, and is a part of the Atlanta metropolitan area. As of the 2020 US Census, Alpharetta's population was 65,818 The population in 2010 was 57,551.

History

In the 1830s, the Ch ...

where it is most needed to relieve congestion.

As of March 2016, total sales tax rates in Georgia are 3% for groceries and 7% for other items in 107 of

its 159 counties. Seven counties charge only 2% local tax (6% total on non-grocery items), and no county charged zero or 1%, but 45 now charge 4% (8% total) due to the TSPLOSTs. Some partially (but none fully) exempt groceries from the local tax by charging 1% less on non-restaurant food than on other items.

Fulton

Fulton may refer to:

People

* Robert Fulton (1765–1815), American engineer and inventor who developed the first commercially successful steam-powered ship

* Fulton (surname)

Given name

* Fulton Allem (born 1957), South African golfer

* Fult ...

and

DeKalb DeKalb or De Kalb may refer to:

People

* Baron Johann de Kalb (1721–1780), major general in the American Revolutionary War

Places Municipalities in the United States

* DeKalb, Illinois, the largest city in the United States named DeKalb

**DeKal ...

(and since 2015,

Clayton) counties charge 1% for

MARTA, and adjacent

metro Atlanta

Metro Atlanta, designated by the United States Office of Management and Budget as the Atlanta–Sandy Springs–Alpharetta, GA Metropolitan Statistical Area, is the most populous metropolitan statistical area in the U.S. state of Georgia and the ...

counties may do so by referendum if they so choose. For the portions of Fulton and DeKalb within the city of Atlanta, the total is at 4% and 3% respectively on groceries and 8% on other items due to the MOST, and DeKalb's exemption of groceries from the HOST.

Towns

A town is a human settlement. Towns are generally larger than villages and smaller than cities, though the criteria to distinguish between them vary considerably in different parts of the world.

Origin and use

The word "town" shares an ori ...

and

Muscogee

The Muscogee, also known as the Mvskoke, Muscogee Creek, and the Muscogee Creek Confederacy ( in the Muscogee language), are a group of related indigenous (Native American) peoples of the Southeastern Woodlands[transportation

Transport (in British English), or transportation (in American English), is the intentional movement of humans, animals, and goods from one location to another. Modes of transport include air, land (rail and road), water, cable, pipeline, ...]

projects, including

public transportation

Public transport (also known as public transportation, public transit, mass transit, or simply transit) is a system of transport for passengers by group travel systems available for use by the general public unlike private transport, typical ...

and

rapid transit

Rapid transit or mass rapid transit (MRT), also known as heavy rail or metro, is a type of high-capacity public transport generally found in urban areas. A rapid transit system that primarily or traditionally runs below the surface may be c ...

(which only play a significant role in

metro Atlanta

Metro Atlanta, designated by the United States Office of Management and Budget as the Atlanta–Sandy Springs–Alpharetta, GA Metropolitan Statistical Area, is the most populous metropolitan statistical area in the U.S. state of Georgia and the ...

, and are

constitutionally

A constitution is the aggregate of fundamental principles or established precedents that constitute the legal basis of a polity, organisation or other type of entity and commonly determine how that entity is to be governed.

When these princip ...

blocked from using the state's

fuel tax

A fuel tax (also known as a petrol, gasoline or gas tax, or as a fuel duty) is an excise tax imposed on the sale of fuel. In most countries the fuel tax is imposed on fuels which are intended for transportation. Fuels used to power agricultural v ...

revenues). Most of the regions voted against it, except for the three regions of

middle Georgia from

Columbus

Columbus is a Latinized version of the Italian surname "''Colombo''". It most commonly refers to:

* Christopher Columbus (1451-1506), the Italian explorer

* Columbus, Ohio, capital of the U.S. state of Ohio

Columbus may also refer to:

Places ...

to

Augusta. The TSPLOST is not subject to the 3% limit on local taxes, making the local rate in those counties up to 8%. In 2015, the situation for

alternative transportation in the state was made even worse when the per-

gallon

The gallon is a unit of volume in imperial units and United States customary units. Three different versions are in current use:

*the imperial gallon (imp gal), defined as , which is or was used in the United Kingdom, Ireland, Canada, Austral ...

excise tax was raised and the sales tax was eliminated on gasoline, blocking even more state funding from being used for

traffic

Traffic comprises pedestrians, vehicles, ridden or herded animals, trains, and other conveyances that use public ways (roads) for travel and transportation.

Traffic laws govern and regulate traffic, while rules of the road include traffic ...

-reducing investments like

commuter rail

Commuter rail, or suburban rail, is a passenger rail transport service that primarily operates within a metropolitan area, connecting commuters to a central city from adjacent suburbs or commuter towns. Generally commuter rail systems are con ...

and others.

Similar to Florida and certain other states, Georgia used to have two

sales-tax holidays per year, starting in 2002. One was for

back-to-school sales the first weekend in August, but sometimes starting at the end of July. A second usually occurred in October, for

energy-efficient home appliance

A home appliance, also referred to as a domestic appliance, an electric appliance or a household appliance, is a machine which assists in household functions such as cooking, cleaning and food preservation.

Appliances are divided into three ty ...

s with the

Energy Star

Energy Star (trademarked ''ENERGY STAR'') is a program run by the U.S. Environmental Protection Agency (EPA) and U.S. Department of Energy (DOE) that promotes energy efficiency. The program provides information on the energy consumption of pro ...

certification

Certification is the provision by an independent body of written assurance (a certificate) that the product, service or system in question meets specific requirements. It is the formal attestation or confirmation of certain characteristics of a ...

. There were no sales-tax holidays in 2010 and 2011, but they were reinstated in 2012 after the worst of the

late-2000s recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At t ...

had passed.

Starting in 2013, Georgia now imposes a one-time

title

A title is one or more words used before or after a person's name, in certain contexts. It may signify either generation, an official position, or a professional or academic qualification. In some languages, titles may be inserted between the f ...

ad valorem tax (TAVT) on all vehicles sold within the state (both

dealer

Dealer may refer to:

Film and TV

* ''Dealers'' (film), a 1989 British film

* ''Dealers'' (TV series), a reality television series where five art and antique dealers bid on items

* ''The Dealer'' (film), filmed in 2008 and released in 2010

* ...

and private sales are included in this tax). The TAVT is based on the fair market value of the vehicle. However, Georgia no longer charges sales tax on motorized vehicles, and those purchases that fall into the TAVT taxation system no longer pay the annual ad valorem taxes on vehicles. Essentially, the new TAVT combined the annual vehicle ad valorem tax and sales tax on vehicles. Non-motorized vehicles do not qualify for the TAVT system and are therefore subject to annual ad valorem tax. Vehicles being brought from out of state are also subject to TAVT. Vehicle sales or use taxes paid to other states are not credited towards TAVT in Georgia.

Georgia has many exemptions available to specific businesses and industries, and

charities

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being (e.g. educational, religious or other activities serving the public interest or common good).

The legal definition of a cha ...

and other

nonprofit

A nonprofit organization (NPO) or non-profit organisation, also known as a non-business entity, not-for-profit organization, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in co ...

s such as

church

Church may refer to:

Religion

* Church (building), a building for Christian religious activities

* Church (congregation), a local congregation of a Christian denomination

* Church service, a formalized period of Christian communal worship

* Chris ...

es are exempt. To identify potential exemptions, businesses and consumers must research the laws and rules for sales and use tax and review current exemption forms.

Guam

Guam

Guam (; ch, Guåhan ) is an organized, unincorporated territory of the United States in the Micronesia subregion of the western Pacific Ocean. It is the westernmost point and territory of the United States (reckoned from the geographic cent ...

has no general sales tax imposed on the consumer with the exception of admissions, use, and hotel occupancy taxes; however, businesses must pay 5% tax on their monthly gross income. There are no separate municipal, county, school district or improvement district taxes.

Use tax is 5% on non-exempt personal property imported to Guam. Hotel tax is 11% of daily room rate. Alcoholic beverage tax varies depending on the beverage. Additionally there are tobacco taxes, real property taxes, amusement taxes, recreational facility taxes, and liquid fuel taxes.

That Business Privilege Tax rate increased from 4% to 5% effective June 1, 2018. It was originally expected to be changed back to 4% on October 1, 2018, when Guam anticipated enacting a 2% sales and use tax. That bill was repealed, and the expiration of the reduced Business Privilege Tax rate was repealed, leaving the 5% rate in effect.

Hawaii

Hawaii

Hawaii ( ; haw, Hawaii or ) is a state in the Western United States, located in the Pacific Ocean about from the U.S. mainland. It is the only U.S. state outside North America, the only state that is an archipelago, and the only stat ...

does not have a sales tax ''per se'', but it does have a

gross receipts tax

A gross receipts tax or gross excise tax is a tax on the total gross revenues of a company, regardless of their source. A gross receipts tax is often compared to a sales tax; the difference is that a gross receipts tax is levied upon the seller of ...

(called the General Excise Tax) and a Use Tax which apply to nearly every conceivable type of

transaction (including

services), and is technically charged to the

business

Business is the practice of making one's living or making money by producing or Trade, buying and selling Product (business), products (such as goods and Service (economics), services). It is also "any activity or enterprise entered into for pr ...

rather than the

consumer

A consumer is a person or a group who intends to order, or uses purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. T ...

. Hawaii law allows businesses to pass on the tax to the consumer in similar fashion to a sales tax.

Unlike other states, rent, medical services and perishable foods are subject to the excise tax. Also, unlike other states, businesses are not required to show the tax separately on the

receipt

A receipt (also known as a packing list, packing slip, packaging slip, (delivery) docket, shipping list, delivery list, bill of the parcel, manifest, or customer receipt) is a document acknowledging that a person has received money or propert ...

, as it is technically part of the selling price. Most retail businesses in Hawaii, however, do list the tax as a separate line item. 4.0% is charged at

retail

Retail is the sale of goods and services to consumers, in contrast to wholesaling, which is sale to business or institutional customers. A retailer purchases goods in large quantities from manufacturers, directly or through a wholesaler, and t ...

with an additional 0.5% surcharge in the

City and County of Honolulu

Honolulu County (officially known as the City and County of Honolulu, formerly Oahu County) is a consolidated city–county in the U.S. state of Hawaii. The city–county includes both the city of Honolulu (the state's capital and largest city ...

(for a total of 4.5% on Oahu sales), and 0.5% is charged on

wholesale

Wholesaling or distributing is the sale of goods or merchandise to retailers; to industrial, commercial, institutional or other professional business users; or to other wholesalers (wholesale businesses) and related subordinated services. In ...

.

However, the state also allows "tax on tax" to be charged, which effectively means a customer can be billed as much as 4.166% (4.712% on

Oahu

Oahu () (Hawaiian language, Hawaiian: ''Oʻahu'' ()), also known as "The Gathering place#Island of Oʻahu as The Gathering Place, Gathering Place", is the third-largest of the Hawaiian Islands. It is home to roughly one million people—over t ...

). The exact dollar or percentage amount to be added must be quoted to customers within or along with the price. The 0.5% surcharge on Oahu was implemented to fund the

new rail transport system. As with sales tax in other states, nonprofit organizations may apply for an exemption from the tax.

Hawaii also imposes a "use tax" on businesses that provide services that are "LANDED" In Hawaii. One example is: A property owner in Hawaii contracts with a mainland architect to design their Hawaii home. Even though the architect perhaps does all of their work in a mainland location, the architect needs to pay the State of Hawaii a 4% use tax on the architect's fee because the designed house is located in Hawaii (even if the house is never built). The tax is on the produced product which is the design and provided building plans. This applies to commercial property designs as well.

Idaho

Idaho

Idaho ( ) is a state in the Pacific Northwest region of the Western United States. To the north, it shares a small portion of the Canada–United States border with the province of British Columbia. It borders the states of Montana and Wyom ...

initiated a sales tax of 3.0% in 1965 and the current rate is 6.0%. Some localities levy an additional local sales tax.

Illinois

Illinois

Illinois ( ) is a U.S. state, state in the Midwestern United States, Midwestern United States. Its largest metropolitan areas include the Chicago metropolitan area, and the Metro East section, of Greater St. Louis. Other smaller metropolita ...

' sales and use tax scheme includes four major divisions: Retailers' Occupation Tax, Use Tax, Service Occupation Tax and the Service Use Tax. Each of these taxes is administered by the Illinois Department of Revenue. The Retailers' Occupation Tax is imposed upon persons engaged in the business of selling tangible personal property to purchasers for use or consumption. It is measured by the gross receipts of the retailer. The base rate of 6.25% is broken down as follows: 5% State, 1% City, 0.25% County. Local governments may impose additional tax resulting in a combined rate that ranges from the State minimum of 6.25% to 9.00% as of May 2013.

Springfield charges 8.00% total (including state tax). A complementary Use Tax is imposed upon the privilege of using or consuming property purchased anywhere at retail from a retailer. Illinois registered retailers are authorized to collect the Use Tax from their customers and use it to offset their obligations under the Retailers' Occupation Tax Act. Since the Use Tax rate is equivalent to the corresponding Retailers' Occupation Tax rate, the amount collected by the retailer matches the amount the retailer must submit to the Illinois Department of Revenue. The combination of these two taxes is what is commonly referred to as "sales tax". If the purchaser does not pay the Use Tax directly to a retailer (for instance, on an item purchased from an Internet seller), they must remit it directly to the Illinois Department of Revenue.

The Service Occupation Tax is imposed upon the privilege of engaging in service businesses and is measured by the selling price of tangible personal property transferred as an incident to providing a service. The Service Use Tax is imposed upon the privilege of using or consuming tangible personal property transferred as an incident to the provision of a service. An example would be a printer of business cards. The printer owes Service Occupation Tax on the value of the paper and ink transferred to the customer in the form of printed business cards. The serviceperson may satisfy this tax by paying Use Tax to his supplier of paper and ink or, alternatively, may charge Service Use Tax to the purchaser of the business cards and remit the amount collected as Service Occupation Tax on the serviceperson's tax return. The service itself, however, is not subject to tax.

Qualifying food, drugs, medicines and medical appliances have sales tax of 1% plus local home rule tax depending on the location where purchased. Newspapers and magazines are exempt from sales tax as are legal tender, currency, medallions, bullion or gold or silver coinage issued by the State of Illinois, the government of the United States of America, or the government of any foreign country.

Feminine care products, such as tampons and pads, are not subject to sales tax. Illinois is one of only three states with such an exemption (the others being Connecticut and New York).

The city of

Chicago

(''City in a Garden''); I Will

, image_map =

, map_caption = Interactive Map of Chicago

, coordinates =

, coordinates_footnotes =

, subdivision_type = Country

, subdivision_name ...

has one of the highest total sales tax of all major U.S. cities (10.25%). It was previously this high (10.25%), however, it was reduced when Cook County lowered its sales tax by 0.5% in July 2010, another 0.25% in January 2012, and another 0.25% in January 2013. Chicago charges a 2.25% food tax on regular groceries and drug purchases, and has an additional 3% soft drink tax (totaling 13.25%). An additional 1% is charged for prepared food and beverage purchases in the Loop and nearby neighborhoods (the area roughly bordered by Diversey Parkway, Ashland Avenue, the Stevenson Expressway, and Lake Michigan).

Illinois requires residents who make purchases online or when traveling out-of-state to report those purchases on their state income tax form and pay use tax. In 2014, Illinois passed legislation which required sales tax to be collected by "catalog, mail-order and similar retailers along with online sellers... if they have sales of $10,000 or more in the prior year." Although the law went into effect January 1, 2015, retailers were given an additional month to comply with the legislation.

Indiana

Indiana

Indiana () is a U.S. state in the Midwestern United States. It is the 38th-largest by area and the 17th-most populous of the 50 States. Its capital and largest city is Indianapolis. Indiana was admitted to the United States as the 19th s ...

has a 7% state sales tax. The tax rate was raised from 6% on April 1, 2008, to offset the loss of revenue from the statewide property tax reform, which is expected to significantly lower property taxes. Previous to this it was 5 percent from 1983 to 2002. It was 6 percent from 2002 to 2008. The rate currently stands at 7 percent. Untaxed retail items include medications, water, ice and unprepared, raw staple foods or fruit juices. Many localities, inclusive of either counties or cities, in the state of Indiana also have a sales tax on restaurant food and beverages consumed in the restaurant or purchased to go.

Revenues are usually used for economic development and tourism projects. This additional tax rate may be 1% or 2% or other amounts depending on the county in which the business is located. For example, in

Marion County, the sales tax for restaurants is 9%. There is an additional 2% tax on restaurant sales in Marion County to pay for

Lucas Oil Stadium

Lucas Oil Stadium is a multi-purpose stadium in downtown Indianapolis, Indiana, United States. It replaced the RCA Dome as the home field of the National Football League (NFL)'s Indianapolis Colts and opened on August 16, 2008. The stadium was ...

and expansion of the

Indiana Convention Center

The Indiana Convention Center is a major convention center located in Downtown Indianapolis, Indiana. The original structure was completed in 1972 and has undergone five expansions. In total, there are 71 meeting rooms, 11 exhibit halls, and th ...

.

Iowa

Iowa

Iowa () is a state in the Midwestern region of the United States, bordered by the Mississippi River to the east and the Missouri River and Big Sioux River to the west. It is bordered by six states: Wisconsin to the northeast, Illinois to the ...

has a 6% state sales tax and an optional local sales tax of 1% imposed by most cities and unincorporated portions of most counties, bringing the total up to a maximum of 7%. There is no tax on most unprepared food, except candy and soda. The Iowa Department of Revenue provides information about local option sales taxes, including sales tax rate lookup. Iowa also has sales tax on services when rendered, furnished, or performed.

Kansas

Kansas

Kansas () is a state in the Midwestern United States. Its capital is Topeka, and its largest city is Wichita. Kansas is a landlocked state bordered by Nebraska to the north; Missouri to the east; Oklahoma to the south; and Colorado to the ...

has a 6.5% statewide sales tax rate that began on 1 July 2015. More than 900 jurisdictions within the state (cities, counties, and special districts) may impose additional taxes. For example, in the capital city of

Topeka

Topeka ( ; Kansa: ; iow, Dópikˀe, script=Latn or ) is the capital city of the U.S. state of Kansas and the seat of Shawnee County. It is along the Kansas River in the central part of Shawnee County, in northeast Kansas, in the Central Un ...

, retailers must collect 6.5% for the state, 1.15% for

Shawnee County

Shawnee County (county code SN) is located in northeast Kansas, in the central United States. As of the 2020 census, the population was 178,909, making it the third-most populous county in Kansas. Its most populous city, Topeka, is the state ...

, and 1.5% for the city, for a total rate of 9.15%.

To date, the highest combined rate of sales tax is 11.6%, at a

Holiday Inn Express

Holiday Inn Express is a mid-priced hotel chain within the InterContinental Hotels Group family of brands. Originally founded as an "express" hotel, their focus is on offering limited services at a reasonable price. Standard amenities lean tow ...

in

Ottawa

Ottawa (, ; Canadian French: ) is the capital city of Canada. It is located at the confluence of the Ottawa River and the Rideau River in the southern portion of the province of Ontario. Ottawa borders Gatineau, Quebec, and forms the core ...

. Additionally, if a consumer in Kansas does not pay any sales tax at time of purchase, they must declare the unpaid tax on their yearly income tax.

Kentucky

Kentucky

Kentucky ( , ), officially the Commonwealth of Kentucky, is a state in the Southeastern region of the United States and one of the states of the Upper South. It borders Illinois, Indiana, and Ohio to the north; West Virginia and Virginia to ...

has a 6% state sales tax. Most staple grocery foods are exempt. Alcohol sales were previously exempt until April 1, 2009, when a 6% rate was applied to this category as well.

Louisiana

Louisiana

Louisiana , group=pronunciation (French: ''La Louisiane'') is a state in the Deep South and South Central regions of the United States. It is the 20th-smallest by area and the 25th most populous of the 50 U.S. states. Louisiana is borde ...

has a 4.45% state sales tax as of 1 July 2018. The state sales tax is not charged on unprepared food. There are also taxes on the

parish

A parish is a territorial entity in many Christian denominations, constituting a division within a diocese. A parish is under the pastoral care and clerical jurisdiction of a priest, often termed a parish priest, who might be assisted by one or m ...

(county) level and some on the city levels,

Baton Rouge

Baton Rouge ( ; ) is a city in and the capital of the U.S. state of Louisiana

Louisiana , group=pronunciation (French: ''La Louisiane'') is a state in the Deep South and South Central regions of the United States. It is the 20th-sma ...

has a 5% sales tax. Parishes may add local taxes up to 5%, while local jurisdictions within parishes may add more. In Allen Parish, the combined sales tax is up to 9.45% (0.7% for Parish Council, 3% for School Board, 1% to 1.3% for City/Town).

(coterminous with Orleans Parish) collects the maximum 5% tax rate for a total of 9.45% on general purpose items. For food and drugs the tax rate is 4.5%, for a total of 8.95%. Louisiana bids out sales tax audits to private companies, with many being paid on a percentage collected basis.

Maine

Maine

Maine () is a state in the New England and Northeastern regions of the United States. It borders New Hampshire to the west, the Gulf of Maine to the southeast, and the Canadian provinces of New Brunswick and Quebec to the northeast and north ...

has a 5.5% general, service provider and use tax (raised, temporarily until further notice, from 5% on October 1, 2013). The tax on lodging and prepared food is 8% and short term auto rental is 10%. These are all officially known as "sales tax".

Maryland

Maryland

Maryland ( ) is a state in the Mid-Atlantic region of the United States. It shares borders with Virginia, West Virginia, and the District of Columbia to its south and west; Pennsylvania to its north; and Delaware and the Atlantic Ocean to ...

has a 6% state sales and use tax (raised from 5% in 2007) as of January 3, 2008, with exceptions for medicine, residential energy, and most non-prepared foods (with the major exceptions of alcoholic beverages, candy, soda, single-serving ice cream packages, ice, bottled water

ncluding both still and carbonated water and sports drinks). While most goods are taxed, many services (e.g., repair, haircuts, accounting) are not. Maryland's sales tax includes Internet purchases and other mail items such as magazine subscriptions. Maryland has a "back-to-school" tax holiday on a limited number of consumer items. On July 1, 2011, the selective sales tax on alcohol was raised from 6% to 9%.

On January 1, 2012,

Montgomery County began levying a 5-cent-per-bag tax on plastic and paper bags provided by retailers at the point of sale, pickup, or delivery (with few exceptions, most notably bags for loose produce in grocery stores, bags for prescription drugs, and paper bags at fast-food restaurants). Four cents of this tax goes to the county's water quality fund, and one cent is returned to the retailer.

Massachusetts

has a 6.25% state sales tax on most goods (raised from 5% in 2009). There is no sales tax on food items, but prepared meals purchased in a restaurant are subject to a meal tax of 6.25% (in some towns voters chose to add a local 0.75% tax, raising the meal tax to 7%, with that incremental revenue coming back to the town). Sales tax on liquor

was repealed in a 2010 referendum vote.

Sales of individual items of clothing costing $175 or less are generally exempt; on individual items costing more than $175, sales tax is due only on the amount over $175. There have been attempts by

initiative petition

In political science, an initiative (also known as a popular initiative or citizens' initiative) is a means by which a petition signed by a certain number of registered voters can force a government to choose either to enact a law or hold a pu ...

referendum voting in Massachusetts state elections to alter the level of sales taxation overall within Massachusetts, or on certain classes of sold items: examples include the aforementioned end of taxation on alcoholic beverages that was up for voting in the

2010 state general election, and the separate

overall reduction to a 3% sales tax on most in-state sales that same year.

Michigan

Michigan

Michigan () is a state in the Great Lakes region of the upper Midwestern United States. With a population of nearly 10.12 million and an area of nearly , Michigan is the 10th-largest state by population, the 11th-largest by area, and the ...

has a 6% sales tax. Michigan has a use tax of 6%, which is applied to items bought outside Michigan and brought in, to the extent that sales taxes were not paid in the state of purchase. Residents are supposed to declare and pay this tax when filing the annual income tax. Groceries, periodicals, and prescription drugs are not taxed, but restaurant meals and other "prepared food" is taxed at the full rate. The tax applies to the total amount of online orders, including shipping charges.

Local government cannot impose a sales tax.

Michigan raised the sales tax rate to 6% from 4% in 1994.

Michigan Ballot Proposal 2015-1, which was opposed by 80% of voters, would have raised the sales and use taxes to 7%. In 2007, Michigan passed a law extending the sales tax to services, but repealed it the day it was to go into effect.

Minnesota

Minnesota

Minnesota () is a state in the upper midwestern region of the United States. It is the 12th largest U.S. state in area and the 22nd most populous, with over 5.75 million residents. Minnesota is home to western prairies, now given over to ...

currently has a 6.875% statewide sales tax. The statewide portion consists of two parts: a 6.5% sales tax with receipts going to the state General Fund, and a 0.375% tax going to arts and environmental projects. The 0.375% tax was passed by a statewide referendum on Nov. 4, 2008, and went into effect on July 1, 2009.