|

Taxation In The United States

The United States, United States of America has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey. Taxes fall much more heavily on labor income than on capital income. Divergent taxes and subsidies for different forms of income and spending can also constitute a form of indirect taxation of some activities over others. For example, individual spending on higher education can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the certificate (or its ID number) to a seller at the point of purchase, al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Civil War (US)

The American Civil War (April 12, 1861 – May 26, 1865; also known by other names) was a civil war in the United States. It was fought between the Union ("the North") and the Confederacy ("the South"), the latter formed by states that had seceded. The central cause of the war was the dispute over whether slavery would be permitted to expand into the western territories, leading to more slave states, or be prevented from doing so, which was widely believed would place slavery on a course of ultimate extinction. Decades of political controversy over slavery were brought to a head by the victory in the 1860 U.S. presidential election of Abraham Lincoln, who opposed slavery's expansion into the west. An initial seven southern slave states responded to Lincoln's victory by seceding from the United States and, in 1861, forming the Confederacy. The Confederacy seized U.S. forts and other federal assets within their borders. Led by Confederate President Jefferson Davis, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Abraham Lincoln

Abraham Lincoln ( ; February 12, 1809 – April 15, 1865) was an American lawyer, politician, and statesman who served as the 16th president of the United States from 1861 until his assassination in 1865. Lincoln led the nation through the American Civil War and succeeded in preserving the Union, abolishing slavery, bolstering the federal government, and modernizing the U.S. economy. Lincoln was born into poverty in a log cabin in Kentucky and was raised on the frontier, primarily in Indiana. He was self-educated and became a lawyer, Whig Party leader, Illinois state legislator, and U.S. Congressman from Illinois. In 1849, he returned to his successful law practice in central Illinois. In 1854, he was angered by the Kansas–Nebraska Act, which opened the territories to slavery, and he re-entered politics. He soon became a leader of the new Republican Party. He reached a national audience in the 1858 Senate campaign debates against Stephen A. Douglas. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Act Of 1861

The Revenue Act of 1861, formally cited as Act of August 5, 1861, Chap. XLV, 12 Stat. 292', included the first U.S. Federal income tax statute (seSec.49. The Act, motivated by the need to fund the Civil War, imposed an income tax to be "levied, collected, and paid, upon the annual income of every person residing in the United States, whether such income is derived from any kind of property, or from any profession, trade, employment, or vocation carried on in the United States or elsewhere, or from any other source whatever . . . . The tax imposed was a flat tax, with a rate of 3% on incomes above $800. The Revenue Act of 1861 was signed into law by Abraham Lincoln. The income tax provisionSections 49, 50 and 51 was repealed by the Revenue Act of 1862. (SeSec.89 which replaced the flat rate with a progressive scale of 3% on annual incomes beyond $600 (which was 3.4 times the 1862 nominal gross domestic product per capita of $177.69; the corresponding income in 2021 is $234K) an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

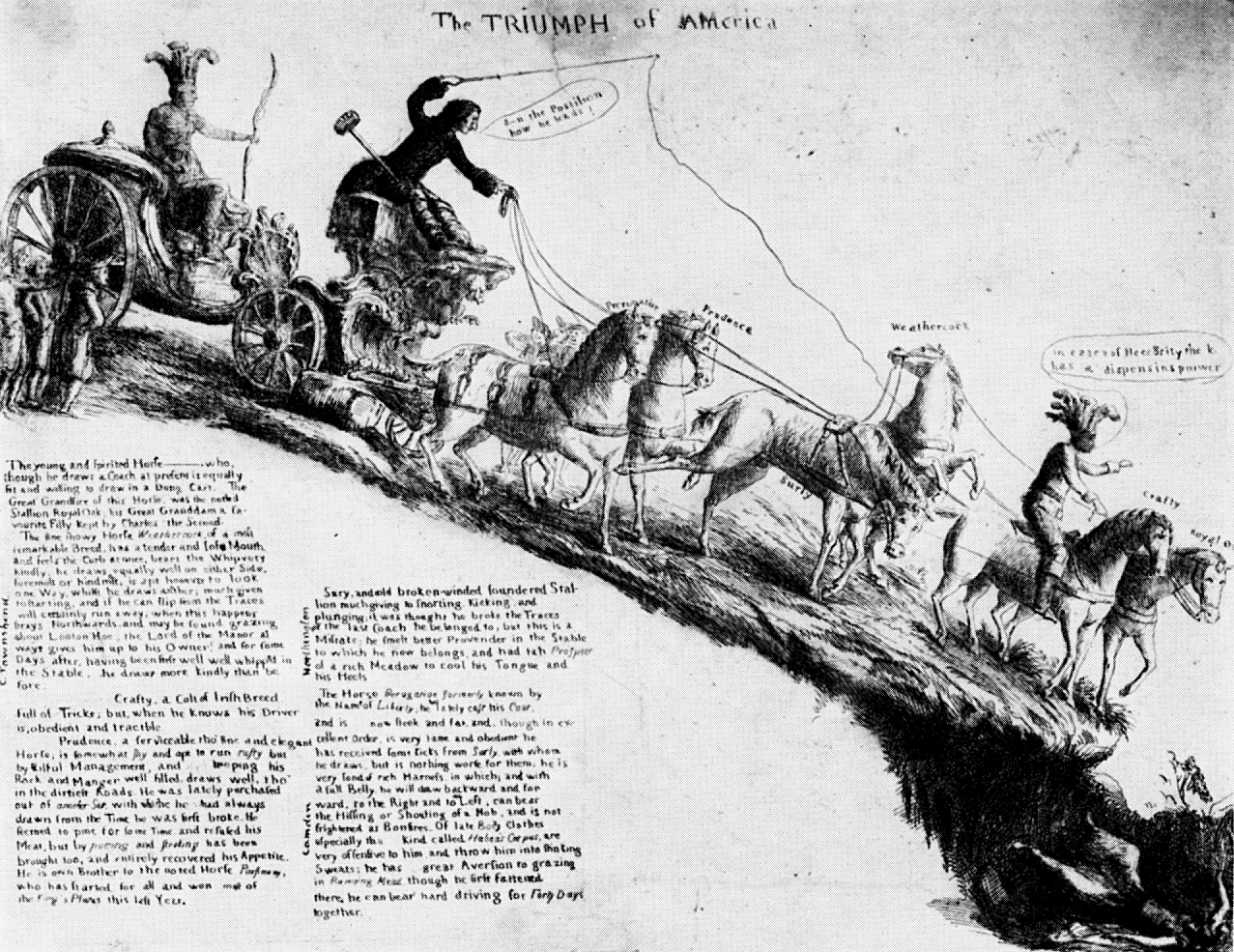

History Of Taxation In The United States

The history of taxation in the United States begins with the colonial protest against British taxation policy in the 1760s, leading to the American Revolution. The independent nation collected taxes on imports ( "tariffs"), whiskey, and (for a while) on glass windows. States and localities collected poll taxes on voters and property taxes on land and commercial buildings. In addition, there were the state and federal excise taxes. State and federal inheritance taxes began after 1900, while the states (but not the federal government) began collecting sales taxes in the 1930s. The United States imposed income taxes briefly during the Civil War and the 1890s. In 1913, the 16th Amendment was ratified, however, the United States Constitution Article 1, Section 9 defines a direct tax. The Sixteenth Amendment to the United States Constitution did not create a new tax. Colonial taxation Taxes were low at the local, colonial, and imperial levels throughout the colonial era. The issu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Federal Effective Tax Rates By Income Percentile And Component

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Ameri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |