A fixed exchange rate, often called a pegged exchange rate, is a type of

exchange rate regime in which a

currency

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins.

A more general ...

's value is fixed or pegged by a

monetary authority against the value of another currency, a

basket of other currencies, or another measure of value, such as

gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile ...

.

There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a

floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow primarily in foreign currency and in which external trade forms a large part of their

GDP.

A fixed exchange rate system can also be used to control the behavior of a currency, such as by limiting rates of

inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

. However, in doing so, the pegged currency is then controlled by its reference value. As such, when the reference value rises or falls, it then follows that the value(s) of any currencies pegged to it will also rise and fall in relation to other currencies and commodities with which the pegged currency can be traded. In other words, a pegged currency is dependent on its reference value to dictate how its current worth is defined at any given time. In addition, according to the

Mundell–Fleming model, with perfect

capital mobility, a fixed exchange rate prevents a government from using domestic

monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often ...

to achieve

macroeconomic stability.

In a fixed exchange rate system, a country's

central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a centra ...

typically uses an open market mechanism and is committed at all times to buy and/or sell its currency at a fixed price in order to maintain its pegged ratio and, hence, the stable value of its currency in relation to the reference to which it is pegged. To maintain a desired exchange rate, the central bank during a time of private sector net demand for the foreign currency, sells foreign currency from its reserves and buys back the domestic money. This creates an artificial

demand

In economics, demand is the quantity of a good that consumers are willing and able to purchase at various prices during a given time. The relationship between price and quantity demand is also called the demand curve. Demand for a specific item ...

for the domestic money, which increases its exchange rate value. Conversely, in the case of an incipient appreciation of the domestic money, the central bank buys back the foreign money and thus adds domestic money into the market, thereby maintaining market equilibrium at the intended fixed value of the exchange rate.

In the 21st century, the currencies associated with large economies typically do not fix (peg) their exchange rates to other currencies. The last large economy to use a fixed exchange rate system was the

People's Republic of China

China, officially the People's Republic of China (PRC), is a country in East Asia. It is the world's List of countries and dependencies by population, most populous country, with a Population of China, population exceeding 1.4 billion, sli ...

, which, in July 2005, adopted a slightly more flexible exchange rate system, called a

managed exchange rate. The

European Exchange Rate Mechanism is also used on a temporary basis to establish a final conversion rate against the

euro

The euro (symbol: €; code: EUR) is the official currency of 19 out of the member states of the European Union (EU). This group of states is known as the eurozone or, officially, the euro area, and includes about 340 million citizens . ...

from the local currencies of countries joining the

Eurozone

The euro area, commonly called eurozone (EZ), is a currency union of 19 member states of the European Union (EU) that have adopted the euro ( €) as their primary currency and sole legal tender, and have thus fully implemented EMU polic ...

.

History

The

gold standard

A gold standard is a Backed currency, monetary system in which the standard economics, economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the ...

or gold exchange standard of fixed

exchange rates prevailed from about 1870 to 1914, before which many countries followed

bimetallism.

The period between the two world wars was transitory, with the

Bretton Woods system emerging as the new fixed exchange rate regime in the aftermath of World War II. It was formed with an intent to rebuild war-ravaged nations after World War II through a series of currency stabilization programs and

infrastructure loans. The early 1970s saw the

breakdown of the system and its replacement by a mixture of fluctuating and fixed exchange rates.

Chronology

Timeline of the fixed exchange rate system:

Gold standard

The earliest establishment of a gold standard was in the United Kingdom in 1821 followed by Australia in 1852 and Canada in 1853. Under this system, the external value of all currencies was denominated in terms of gold with central banks ready to buy and sell unlimited quantities of gold at the fixed price. Each central bank maintained

gold reserves

A gold reserve is the gold held by a national central bank, intended mainly as a guarantee to redeem promises to pay depositors, note holders (e.g. paper money), or trading peers, during the eras of the gold standard, and also as a store ...

as their official reserve asset.

For example, during the "classical" gold standard period (1879–1914), the U.S. dollar was defined as 0.048 troy oz. of pure gold.

Bretton Woods system

Following the Second World War, the

Bretton Woods system (1944–1973) replaced gold with the U.S. dollar as the official reserve asset. The regime intended to combine binding legal obligations with multilateral decision-making through the

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster gl ...

(IMF). The rules of this system were set forth in the articles of agreement of the IMF and the

International Bank for Reconstruction and Development. The system was a monetary order intended to govern currency relations among sovereign states, with the 44 member countries required to establish a parity of their national currencies in terms of the U.S. dollar and to maintain exchange rates within 1% of parity (a "

band") by intervening in their

foreign exchange markets (that is, buying or selling foreign money). The U.S. dollar was the only currency strong enough to meet the rising demands for international currency transactions, and so the United States agreed both to link the dollar to gold at the rate of $35 per ounce of gold and to convert dollars into gold at that price.

Due to concerns about America's rapidly deteriorating

payments situation and massive

flight of liquid capital from the U.S., President

Richard Nixon

Richard Milhous Nixon (January 9, 1913April 22, 1994) was the 37th president of the United States, serving from 1969 to 1974. A member of the Republican Party, he previously served as a representative and senator from California and was t ...

suspended the convertibility of the dollar into gold on

15 August 1971. In December 1971, the

Smithsonian Agreement paved the way for the increase in the value of the dollar price of gold from US$35.50 to US$38 an ounce. Speculation against the dollar in March 1973 led to the birth of the independent float, thus effectively terminating the Bretton Woods system.

Current monetary regimes

Since March 1973, the

floating exchange rate

In macroeconomics and economic policy, a floating exchange rate (also known as a fluctuating or flexible exchange rate) is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange ma ...

has been followed and formally recognized by the Jamaica accord of 1978. Countries use

foreign exchange reserves to intervene in

foreign exchange markets to balance short-run fluctuations in exchange rates.

The prevailing exchange rate regime is often considered a revival of Bretton Woods policies, namely

Bretton Woods II.

Mechanisms

Open market trading

Typically, a government wanting to maintain a fixed exchange rate does so by either buying or selling its own currency on the open market. This is one reason governments maintain reserves of foreign currencies.

If the exchange rate drifts too far above the fixed benchmark rate (it is stronger than required), the government sells its own currency (which increases supply) and buys foreign currency. This causes the price of the currency to decrease in value (Read: Classical Demand-Supply diagrams). Also, if they buy the currency it is pegged to, then the price of that currency will increase, causing the relative value of the currencies to approach what is intended.

If the exchange rate drifts too far below the desired rate, the government buys its own currency in the market by selling its reserves. This places greater demand on the market and causes the local currency to become stronger, hopefully back to its intended value. The reserves they sell may be the currency it is pegged to, in which case the value of that currency will fall.

Fiat

Another, less used means of maintaining a fixed exchange rate is by simply making it illegal to trade currency at any other rate. This is difficult to enforce and often leads to a

black market in foreign currency. Nonetheless, some countries are highly successful at using this method due to government monopolies over all money conversion. This was the method employed by the Chinese government to maintain a currency peg or tightly banded float against the US dollar. China buys an average of one billion US dollars a day to maintain the currency peg. Throughout the 1990s, China was highly successful at maintaining a currency peg using a government monopoly over all currency conversion between the yuan and other currencies.

Open market mechanism example

Under this system, the central bank first announces a fixed exchange-rate for the currency and then agrees to buy and sell the domestic currency at this value. The

market equilibrium exchange rate is the rate at which supply and demand will be equal, i.e., markets will

clear. In a flexible exchange rate system, this is the

spot rate. In a fixed exchange-rate system, the pre-announced rate may not coincide with the market equilibrium exchange rate. The foreign central banks maintain

reserves of foreign currencies and gold which they can sell in order to intervene in the foreign exchange market to make up the excess demand or take up the excess supply

The demand for foreign exchange is derived from the domestic demand for foreign

goods

In economics, goods are items that satisfy human wants

and provide utility, for example, to a consumer making a purchase of a satisfying product. A common distinction is made between goods which are transferable, and services, which are not ...

,

services, and financial

assets. The supply of foreign exchange is similarly derived from the foreign demand for goods, services, and financial assets coming from the home country. Fixed exchange-rates are not permitted to fluctuate freely or respond to daily changes in demand and supply. The government fixes the exchange value of the currency. For example, the

European Central Bank

The European Central Bank (ECB) is the prime component of the monetary Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's most important centra ...

(ECB) may fix its exchange rate at €1 = $1 (assuming that the euro follows the fixed exchange-rate). This is the central value or

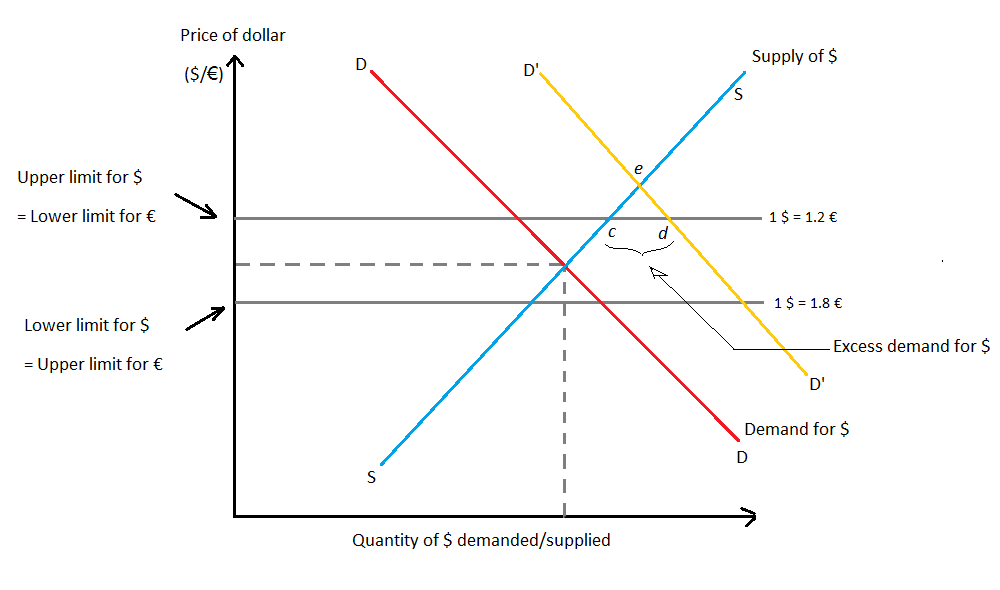

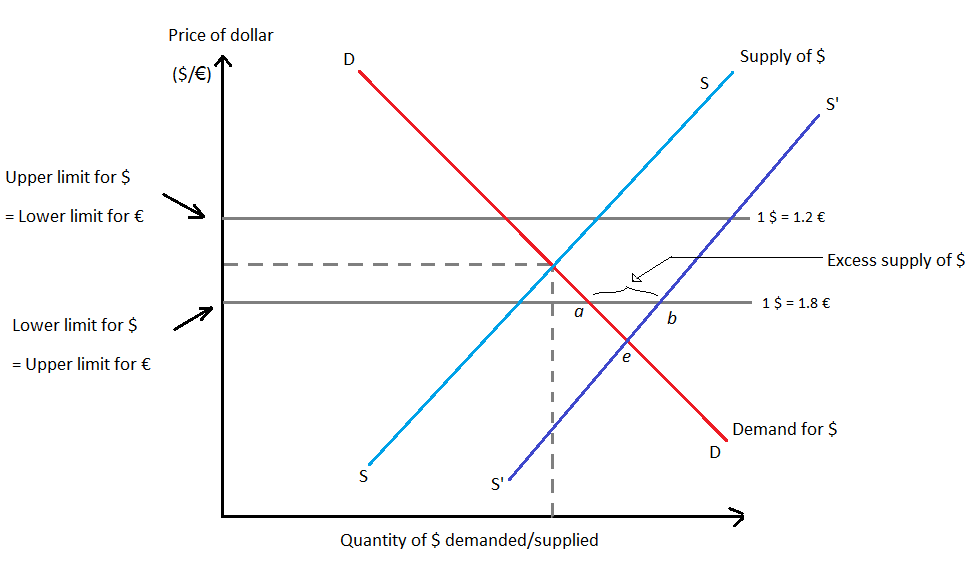

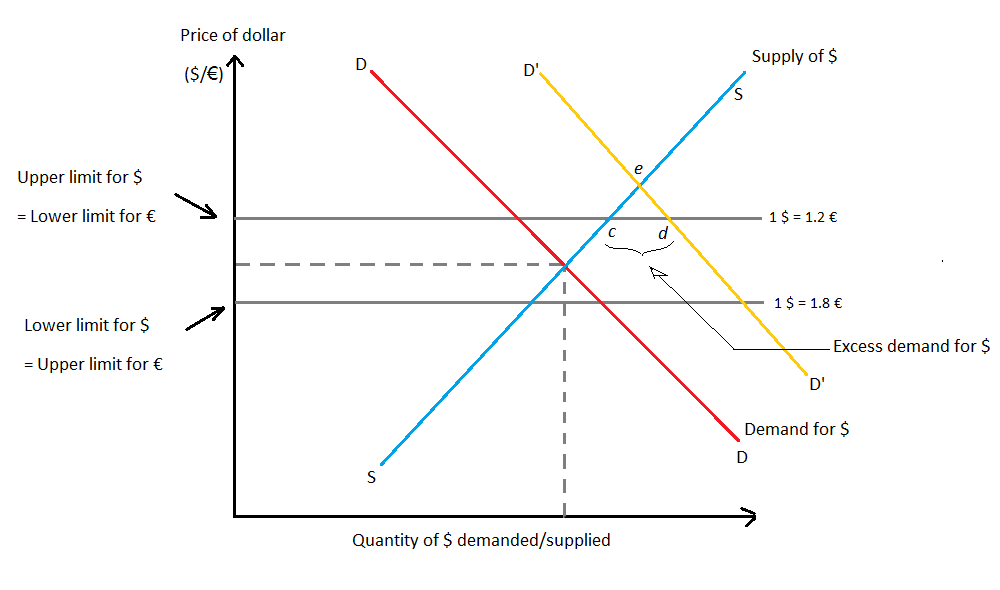

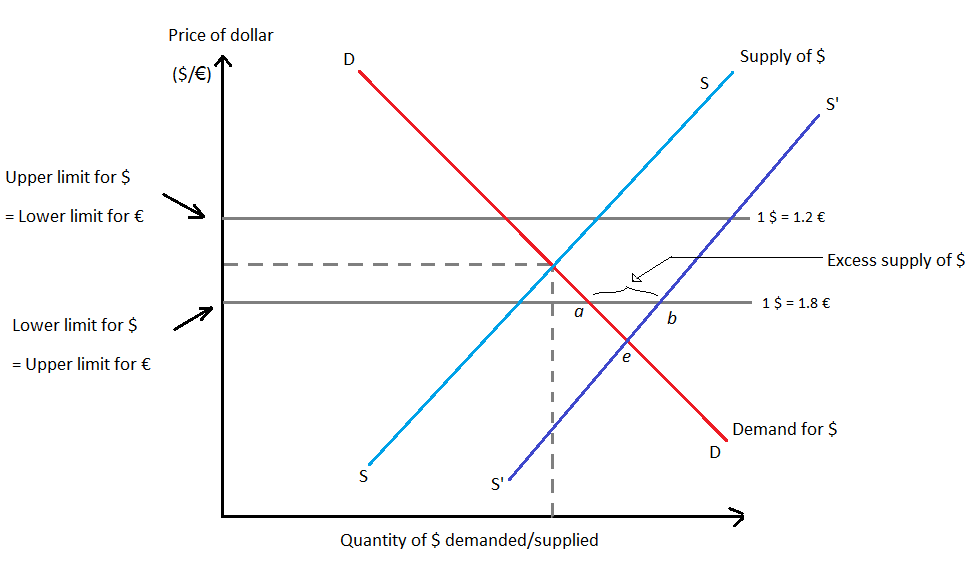

par value of the euro. Upper and lower limits for the movement of the currency are imposed, beyond which variations in the exchange rate are not permitted. The "band" or "spread" in Fig.1 is €0.6 (from €1.2 to €1.8).

Excess demand for dollars

Fig.2 describes the excess demand for dollars. This is a situation where domestic demand for foreign goods, services, and financial assets exceeds the foreign demand for goods, services, and financial assets from the

European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been ...

. If the demand for dollar rises from DD to D'D', excess demand is created to the extent of ''cd''. The ECB will sell ''cd'' dollars in exchange for euros to maintain the limit within the band. Under a floating exchange rate system, equilibrium would have been achieved at ''e''.

When the ECB sells dollars in this manner, its official dollar reserves decline and domestic

money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

shrinks. To prevent this, the ECB may purchase

government bonds and thus meet the shortfall in money supply. This is called

sterilized intervention in the foreign exchange market.

When the ECB starts running out of reserves, it may also devalue the euro in order to reduce the excess demand for dollars, i.e., narrow the gap between the equilibrium and fixed rates.

Excess supply of dollars

Fig.3 describes the excess supply of dollars. This is a situation where the foreign demand for goods, services, and financial assets from the European Union exceeds the European demand for foreign goods, services, and financial assets. If the supply of dollars rises from SS to S'S', excess supply is created to the extent of ''ab''. The ECB will buy ''ab'' dollars in exchange for euros to maintain the limit within the band. Under a floating exchange rate system, equilibrium would again have been achieved at ''e''.

When the ECB buys dollars in this manner, its official dollar reserves increase and domestic

money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

expands, which may lead to inflation. To prevent this, the ECB may sell government bonds and thus counter the rise in money supply.

When the ECB starts accumulating excess reserves, it may also revalue the euro in order to reduce the excess supply of dollars, i.e., narrow the gap between the equilibrium and fixed rates. This is the opposite of

devaluation.

Types of fixed exchange rate systems

The gold standard

Under the gold standard, a country's government declares that it will exchange its currency for a certain weight in gold. In a pure gold standard, a country's government declares that it will freely exchange currency for actual gold at the designated exchange rate. This "rule of exchange” allows anyone to enter the central bank and exchange coins or currency for pure gold or vice versa. The gold standard works on the assumption that there are no restrictions on capital movements or export of gold by private citizens across countries.

Because the central bank must always be prepared to give out gold in exchange for coin and currency upon demand, it must maintain gold reserves. Thus, this system ensures that the exchange rate between currencies remains fixed. For example, under this standard, a £1 gold coin in the United Kingdom contained 113.0016 grains of pure gold, while a gold coin in the United States contained 23.22 grains. The mint parity or the exchange rate was thus:

R = $/£ = 113.0016/23.22 = 4.87.

The main argument in favor of the gold standard is that it ties the world price level to the world supply of gold, thus preventing inflation unless there is a gold discovery (a

gold rush

A gold rush or gold fever is a discovery of gold—sometimes accompanied by other precious metals and rare-earth minerals—that brings an onrush of miners seeking their fortune. Major gold rushes took place in the 19th century in Australia, New Z ...

, for example).

Price specie flow mechanism

The automatic adjustment mechanism under the gold standard is the

price specie flow mechanism

A price is the (usually not negative) quantity of payment or compensation given by one party to another in return for goods or services. In some situations, the price of production has a different name. If the product is a "good" in the c ...

, which operates so as to correct any

balance of payments disequilibrium and adjust to

shocks or changes. This mechanism was originally introduced by

Richard Cantillon and later discussed by

David Hume

David Hume (; born David Home; 7 May 1711 NS (26 April 1711 OS) – 25 August 1776) Cranston, Maurice, and Thomas Edmund Jessop. 2020 999br>David Hume" ''Encyclopædia Britannica''. Retrieved 18 May 2020. was a Scottish Enlightenment phil ...

in 1752 to refute the

mercantilist doctrines and emphasize that nations could not continuously accumulate gold by exporting more than their imports.

The assumptions of this mechanism are:

# Prices are flexible

# All transactions take place in gold

# There is a fixed supply of gold in the world

# Gold coins are minted at a fixed parity in each country

# There are no banks and no capital flows

Adjustment under a gold standard involves the flow of gold between countries resulting in

equalization of prices satisfying

purchasing power parity

Purchasing power parity (PPP) is the measurement of prices in different countries that uses the prices of specific goods to compare the absolute purchasing power of the countries' currencies. PPP is effectively the ratio of the price of a baske ...

, and/or equalization of rates of

return on assets satisfying

interest rate parity at the current fixed exchange rate. Under the gold standard, each country's money supply consisted of either gold or paper currency backed by gold. Money supply would hence fall in the deficit nation and rise in the surplus nation. Consequently, internal prices would fall in the deficit nation and rise in the

surplus

Surplus may refer to:

* Economic surplus, one of various supplementary values

* Excess supply, a situation in which the quantity of a good or service supplied is more than the quantity demanded, and the price is above the equilibrium level determ ...

nation, making the exports of the deficit nation more competitive than those of the surplus nations. The deficit nation's exports would be encouraged and the imports would be discouraged till the deficit in the balance of payments was eliminated.

Reserve currency standard

In a reserve currency system, the currency of another country performs the functions that gold has in a gold standard. A country fixes its own currency value to a unit of another country's currency, generally a currency that is prominently used in international transactions or is the currency of a major trading partner. For example, suppose India decided to fix its currency to the dollar at the exchange rate E₹/$ = 45.0. To maintain this fixed exchange rate, the

Reserve Bank of India would need to hold dollars on reserve and stand ready to exchange rupees for dollars (or dollars for rupees) on demand at the specified exchange rate. In the gold standard the central bank held gold to exchange for ''its own currency'', with a reserve currency standard it must hold a stock of the ''reserve currency''.

Currency board

In public finance, a currency board is a monetary authority which is required to maintain a fixed exchange rate with a foreign currency. This policy objective requires the conventional objectives of a central bank to be subordinated to the exc ...

arrangements are the most widespread means of fixed exchange rates. Under this, a nation rigidly pegs its currency to a foreign currency,

special drawing rights

Special drawing rights (SDRs, code ) are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund (IMF). SDRs are units of account for the IMF, and not a currency ''per se''. They represent a claim ...

(SDR) or a basket of currencies. The central bank's role in the country's monetary policy is therefore minimal as its money supply is equal to its foreign reserves. Currency boards are considered hard pegs as they allow central banks to cope with shocks to money demand without running out of reserves.

CBAs have been operational in many nations including:

*

Hong Kong

Hong Kong ( (US) or (UK); , ), officially the Hong Kong Special Administrative Region of the People's Republic of China (abbr. Hong Kong SAR or HKSAR), is a city and special administrative region of China on the eastern Pearl River Delta i ...

(since 1983);

*

Argentina

Argentina (), officially the Argentine Republic ( es, link=no, República Argentina), is a country in the southern half of South America. Argentina covers an area of , making it the second-largest country in South America after Brazil, t ...

(1991 to 2001);

*

Estonia

Estonia, formally the Republic of Estonia, is a country by the Baltic Sea in Northern Europe. It is bordered to the north by the Gulf of Finland across from Finland, to the west by the sea across from Sweden, to the south by Latvia, and t ...

(1992 to 2010);

*

Lithuania (1994 to 2014);

*

Bosnia and Herzegovina

Bosnia and Herzegovina ( sh, / , ), abbreviated BiH () or B&H, sometimes called Bosnia–Herzegovina and often known informally as Bosnia, is a country at the crossroads of south and southeast Europe, located in the Balkans. Bosnia and ...

(since 1997);

*

Bulgaria

Bulgaria (; bg, България, Bǎlgariya), officially the Republic of Bulgaria,, ) is a country in Southeast Europe. It is situated on the eastern flank of the Balkans, and is bordered by Romania to the north, Serbia and North Mac ...

(since 1997);

*

Bermuda

)

, anthem = " God Save the King"

, song_type = National song

, song = "Hail to Bermuda"

, image_map =

, map_caption =

, image_map2 =

, mapsize2 =

, map_caption2 =

, subdivision_type = Sovereign state

, subdivision_name =

, ...

(since 1972);

*

Denmark

)

, song = ( en, "King Christian stood by the lofty mast")

, song_type = National and royal anthem

, image_map = EU-Denmark.svg

, map_caption =

, subdivision_type = Sovereign state

, subdivision_name = Kingdom of Denmark

, establishe ...

(since 1945);

*

Brunei

Brunei ( , ), formally Brunei Darussalam ( ms, Negara Brunei Darussalam, Jawi alphabet, Jawi: , ), is a country located on the north coast of the island of Borneo in Southeast Asia. Apart from its South China Sea coast, it is completely sur ...

(since 1967)

Gold exchange standard

The fixed exchange rate system set up after World War II was a gold-exchange standard, as was the system that prevailed between 1920 and the early 1930s. A gold exchange standard is a mixture of a reserve currency standard and a gold standard. Its characteristics are as follows:

* All non-reserve countries agree to fix their exchange rates to the chosen reserve at some announced rate and hold a stock of reserve currency assets.

* The reserve currency country fixes its currency value to a fixed weight in gold and agrees to exchange on demand its own currency for gold with other central banks within the system, upon demand.

Unlike the gold standard, the central bank of the reserve country does not exchange gold for currency with the general public, only with other central banks.

Hybrid exchange rate systems

The current state of foreign exchange markets does not allow for the rigid system of fixed exchange rates. At the same time, freely floating exchange rates expose a country to

volatility in exchange rates. Hybrid exchange rate systems have evolved in order to combine the characteristics features of fixed and flexible exchange rate systems. They allow fluctuation of the exchange rates without completely exposing the currency to the flexibility of a free float.

Basket-of-currencies

Countries often have several important trading partners or are apprehensive of a particular currency being too

volatile over an extended period of time. They can thus choose to peg their currency to a weighted average of several currencies (also known as a

currency basket

A currency basket is a portfolio of selected currencies with different weightings. A currency basket is commonly used by investors to minimize the risk of currency fluctuations and also governments when setting the market value of a country� ...

) . For example, a composite currency may be created consisting of 100 Indian rupees, 100 Japanese yen and one Singapore dollar. The country creating this composite would then need to maintain reserves in one or more of these currencies to intervene in the foreign exchange market.

A popular and widely used composite currency is the

SDR, which is a composite currency created by the

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster gl ...

(IMF), consisting of a fixed quantity of U.S. dollars, Chinese yuan, euros, Japanese yen, and British pounds.

Crawling pegs

In a crawling peg system a country fixes its exchange rate to another currency or basket of currencies. This fixed rate is changed from time to time at periodic intervals with a view to eliminating exchange rate volatility to some extent without imposing the constraint of a fixed rate. Crawling pegs are adjusted gradually, thus avoiding the need for

interventions

''Interventions'' is a book by Noam Chomsky, an American academic linguist and political activist. Published in May 2007, ''Interventions'' is a collection of 44 op-ed articles, post-9/11, from September 2002, through March 2007. The book's ...

by the central bank (though it may still choose to do so in order to maintain the fixed rate in the event of excessive fluctuations).

Pegged within a band

A currency is said to be pegged within a band when the

central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a centra ...

specifies a central exchange rate with reference to a single currency, a cooperative arrangement, or a currency composite. It also specifies a percentage allowable deviation on both sides of this central rate. Depending on the band width, the central bank has discretion in carrying out its monetary policy. The band itself may be a crawling one, which implies that the central rate is adjusted periodically. Bands may be symmetrically maintained around a crawling central parity (with the band moving in the same direction as this parity does). Alternatively, the band may be allowed to widen gradually without any pre-announced central rate.

Currency boards

A

currency board

In public finance, a currency board is a monetary authority which is required to maintain a fixed exchange rate with a foreign currency. This policy objective requires the conventional objectives of a central bank to be subordinated to the exc ...

(also known as 'linked exchange rate system") effectively replaces the central bank through a legislation to fix the currency to that of another country. The domestic currency remains perpetually exchangeable for the

reserve currency at the fixed exchange rate. As the anchor currency is now the basis for movements of the domestic currency, the interest rates and inflation in the domestic economy would be greatly influenced by those of the foreign economy to which the domestic currency is tied. The

currency board

In public finance, a currency board is a monetary authority which is required to maintain a fixed exchange rate with a foreign currency. This policy objective requires the conventional objectives of a central bank to be subordinated to the exc ...

needs to ensure the maintenance of adequate reserves of the anchor currency. It is a step away from officially adopting the anchor currency (termed as

currency substitution).

Currency substitution

This is the most extreme and rigid manner of fixing exchange rates as it entails adopting the currency of another country in place of its own. The most prominent example is the

eurozone

The euro area, commonly called eurozone (EZ), is a currency union of 19 member states of the European Union (EU) that have adopted the euro ( €) as their primary currency and sole legal tender, and have thus fully implemented EMU polic ...

, where 19

European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been ...

(EU)

member states have adopted the euro (€) as their common currency (euroization). Their exchange rates are effectively fixed to each other.

There are similar examples of countries adopting the U.S. dollar as their domestic currency (dollarization):

British Virgin Islands

)

, anthem = " God Save the King"

, song_type = Territorial song

, song = "Oh, Beautiful Virgin Islands"

, image_map = File:British Virgin Islands on the globe (Americas centered).svg

, map_caption =

, mapsize = 290px

, image_map2 = Bri ...

,

Caribbean Netherlands

)

, image_map = BES islands location map.svg

, map_caption = Location of the Caribbean Netherlands (green and circled). From left to right: Bonaire, Saba, and Sint Eustatius

, elevation_max_m = 887

, elevation_max_footnotes =

, demographics ...

,

East Timor

East Timor (), also known as Timor-Leste (), officially the Democratic Republic of Timor-Leste, is an island country in Southeast Asia. It comprises the eastern half of the island of Timor, the exclave of Oecusse on the island's north-we ...

,

Ecuador

Ecuador ( ; ; Quechuan languages, Quechua: ''Ikwayur''; Shuar language, Shuar: ''Ecuador'' or ''Ekuatur''), officially the Republic of Ecuador ( es, República del Ecuador, which literally translates as "Republic of the Equator"; Quechuan ...

,

El Salvador

El Salvador (; , meaning " The Saviour"), officially the Republic of El Salvador ( es, República de El Salvador), is a country in Central America. It is bordered on the northeast by Honduras, on the northwest by Guatemala, and on the south by ...

,

Marshall Islands

The Marshall Islands ( mh, Ṃajeḷ), officially the Republic of the Marshall Islands ( mh, Aolepān Aorōkin Ṃajeḷ),'' () is an independent island country and microstate near the Equator in the Pacific Ocean, slightly west of the Internati ...

,

Federated States of Micronesia

The Federated States of Micronesia (; abbreviated FSM) is an island country in Oceania. It consists of four states from west to east, Yap, Chuuk, Pohnpei and Kosraethat are spread across the western Pacific. Together, the states compri ...

,

Palau

Palau,, officially the Republic of Palau and historically ''Belau'', ''Palaos'' or ''Pelew'', is an island country and microstate in the western Pacific. The nation has approximately 340 islands and connects the western chain of the Ca ...

,

Panama

Panama ( , ; es, link=no, Panamá ), officially the Republic of Panama ( es, República de Panamá), is a transcontinental country spanning the southern part of North America and the northern part of South America. It is bordered by Co ...

,

Turks and Caicos Islands

The Turks and Caicos Islands (abbreviated TCI; and ) are a British Overseas Territory consisting of the larger Caicos Islands and smaller Turks Islands, two groups of tropical islands in the Lucayan Archipelago of the Atlantic Ocean and ...

and

Zimbabwe

Zimbabwe (), officially the Republic of Zimbabwe, is a landlocked country located in Southeast Africa, between the Zambezi and Limpopo Rivers, bordered by South Africa to the south, Botswana to the south-west, Zambia to the north, and Mozam ...

.

(See

ISO 4217 for a complete list of territories by currency.)

Monetary co-operation

Monetary co-operation is the mechanism in which two or more

monetary policies

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, ofte ...

or

exchange rates are linked, and can happen at regional or international level. The monetary co-operation does not necessarily need to be a voluntary arrangement between two countries, as it is also possible for a country to link its

currency

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins.

A more general ...

to another countries currency without the

consent of the other country. Various forms of monetary co-operations exist, which range from fixed parity systems to

monetary unions. Also, numerous institutions have been established to enforce monetary co-operation and to stabilise

exchange rates, including the

European Monetary Cooperation Fund (EMCF) in 1973 and the

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster gl ...

(IMF)

Monetary co-operation is closely related to

economic integration, and are often considered to be reinforcing processes.

[Berben, R.-P., Berk, J. M., Nitihanprapas, E., Sangsuphan, K., Puapan, P., & Sodsriwiboon, P. (2003). Requirements for successful currency regimes: The Dutch and Thai experiences: De Nederlandsche Bank] However, economic integration is an economic arrangement between different regions, marked by the reduction or elimination of

trade barriers and the coordination of monetary and

fiscal policies

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables d ...

, whereas monetary co-operation is focussed on currency linkages. A

monetary union is considered to be the crowning step of a process of monetary co-operation and

economic integration.

[ In the form of monetary co-operation where two or more countries engage in a mutually beneficial exchange, capital among the countries involved is free to move, in contrast to capital controls.]economic development

In the economics study of the public sector, economic and social development is the process by which the economic well-being and quality of life of a nation, region, local community, or an individual are improved according to targeted goals a ...

.

Example: The Snake

In 1973, the currencies of the European Economic Community countries, Belgium, France, Germany, Italy, Luxemburg and the Netherlands, participated in an arrangement called ''the Snake''. This arrangement is categorized as exchange rate co-operation. During the next 6 years, this agreement allowed the currencies of the participating countries to fluctuate within a band of plus or minus 2¼% around pre-announced central rates. Later, in 1979, the European Monetary System (EMS) was founded, with the participating countries in ''‘the Snake’'' being founding members. The EMS evolves over the next decade and even results into a truly fixed exchange rate at the start of the 1990s.European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been ...

over three phases [ Economic and Monetary Union of the European Union on Wikipedia]

Example: The baht-U.S. dollar co-operation

In 1963, the Thai government established the Exchange Equalization Fund (EEF) with the purpose of playing a role in stabilizing exchange rate movements. It linked to the U.S. dollar by fixing the amount of gram of gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile ...

per baht as well as the baht per U.S. dollar. Over the course of the next 15 years, the Thai government decided to depreciate the baht in terms of gold three times, yet maintain the parity

Parity may refer to:

* Parity (computing)

** Parity bit in computing, sets the parity of data for the purpose of error detection

** Parity flag in computing, indicates if the number of set bits is odd or even in the binary representation of the r ...

of the baht against the U.S. dollar. Due to the introduction of a new generalized floating exchange rate system by the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster gl ...

(IMF) in 1978 that gave a smaller role to gold in the international monetary system, this fixed parity system as a monetary co-operation policy was terminated. The Thai government amended its monetary policies to be more in line with the new IMF policy.

Advantages

*A fixed exchange rate may minimize instabilities in real economic activityexchange rate risk

Foreign exchange risk (also known as FX risk, exchange rate risk or currency risk) is a financial risk that exists when a financial transaction is denominated in a currency other than the domestic currency of the company. The exchange risk arise ...

by reducing the associated uncertainty

*It imposes discipline on the monetary authority

*International trade and investment flows between countries are facilitated

* Speculation in the currency markets is likely to be less destabilizing under a fixed exchange rate system than it is in a flexible one, since it does not amplify fluctuations resulting from business cycles

*Fixed exchange rates impose a price discipline on nations with higher inflation rates than the rest of the world, as such a nation is likely to face persistent deficits in its balance of payments and loss of reserves

Disadvantages

Lack of automatic rebalancing

One main criticism of a fixed exchange rate is that flexible exchange rates serve to adjust the balance of trade

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balance ...

.

Currency crisis

Another major disadvantage of a fixed exchange-rate regime is the possibility of the central bank running out of foreign exchange reserves when trying to maintain the peg in the face of demand for foreign reserves exceeding their supply. This is called a currency crisis

A currency crisis is a type of financial crisis, and is often associated with a real economic crisis. A currency crisis raises the probability of a banking crisis or a default crisis. During a currency crisis the value of foreign denominated debt ...

or balance of payments crisis, and when it happens the central bank must devalue

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national curr ...

the currency. When there is the prospect of this happening, private-sector agents will try to protect themselves by decreasing their holdings of the domestic currency and increasing their holdings of the foreign currency, which has the effect of increasing the likelihood that the forced devaluation will occur. A forced devaluation will change the exchange rate by more than the day-by-day exchange rate fluctuations under a flexible exchange rate system.

Freedom to conduct monetary and fiscal policy

Moreover, a government, when having a fixed rather than dynamic exchange rate, cannot use monetary or fiscal policies with a free hand. For instance, by using reflationary tools to set the economy growing faster (by decreasing taxes and injecting more money in the market), the government risks running into a trade deficit. This might occur as the purchasing power of a common household increases along with inflation, thus making imports relatively cheaper.

Additionally, the stubbornness of a government in defending a fixed exchange rate when in a trade deficit

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balance ...

will force it to use deflationary measures (increased taxation and reduced availability of money), which can lead to unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the refer ...

. Finally, other countries with a fixed exchange rate can also retaliate in response to a certain country using the currency of theirs in defending their exchange rate.

Other disadvantages

*The need for a fixed exchange rate regime is challenged by the emergence of sophisticated derivatives and financial tools in recent years, which allow firms to hedge

A hedge or hedgerow is a line of closely spaced shrubs and sometimes trees, planted and trained to form a barrier or to mark the boundary of an area, such as between neighbouring properties. Hedges that are used to separate a road from adjoin ...

exchange rate fluctuations

*The announced exchange rate may not coincide with the market equilibrium exchange rate, thus leading to excess demand or excess supply

*The central bank needs to hold stocks of both foreign and domestic currencies at all times in order to adjust and maintain exchange rates and absorb the excess demand or supply

*Fixed exchange rate does not allow for automatic correction of imbalances in the nation's balance of payments since the currency cannot appreciate/depreciate as dictated by the market

*It fails to identify the degree of comparative advantage or disadvantage of the nation and may lead to inefficient allocation of resources throughout the world

*There exists the possibility of policy delays and mistakes in achieving external balance

*The cost of government intervention is imposed upon the foreign exchange market

Fixed exchange rate regime versus capital control

The belief that the fixed exchange rate regime brings with it stability is only partly true, since speculative attacks tend to target currencies with fixed exchange rate regimes, and in fact, the stability of the economic system is maintained mainly through capital control. A fixed exchange rate regime should be viewed as a tool in capital control.

FIX Line: Trade-off between symmetry of shocks and integration

*The trade-off between symmetry of shocks and market integration for countries contemplating a pegged currency is outlined in Feenstra and Taylor's 2015 publication "International Macroeconomics" through a model known as the FIX Line Diagram.

*This symmetry-integration diagram features two regions, divided by a 45-degree line with slope of -1. This line can shift to the left or to the right depending on extra costs or benefits of floating. The line has slope= -1 is because the larger symmetry benefits are, the less pronounced integration benefits have to be and vice versa. The right region contains countries that have positive potential for pegging, while the left region contains countries that face significant risks and deterrents to pegging.

*This diagram underscores the two main factors that drive a country to contemplate pegging a currency to another, shock symmetry and market integration. Shock symmetry can be characterized as two countries having similar demand shocks due to similar industry breakdowns and economies, while market integration is a factor of the volume of trading that occurs between member nations of the peg.

*In extreme cases, it is possible for a country to only exhibit one of these characteristics and still have positive pegging potential. For example, a country that exhibits complete symmetry of shocks but has zero market integration could benefit from fixing a currency. The opposite is true, a country that has zero symmetry of shocks but has maximum trade integration (effectively one market between member countries). *This can be viewed on an international scale as well as a local scale. For example, neighborhoods within a city would experience enormous benefits from a common currency, while poorly integrated and/or dissimilar countries are likely to face large costs.

See also

* List of circulating fixed exchange rate currencies

* Exchange rate regime

*Floating exchange rate

In macroeconomics and economic policy, a floating exchange rate (also known as a fluctuating or flexible exchange rate) is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange ma ...

* Linked exchange rate

* Managed float regime

*Gold standard

A gold standard is a Backed currency, monetary system in which the standard economics, economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the ...

* Bretton Woods system

* Nixon Shock

* Smithsonian Agreement

* Foreign exchange fixing

* Currency union

* Black Wednesday

* Capital control

* Convertibility

*Currency board

In public finance, a currency board is a monetary authority which is required to maintain a fixed exchange rate with a foreign currency. This policy objective requires the conventional objectives of a central bank to be subordinated to the exc ...

*Impossible trinity

The impossible trinity (also known as the impossible trilemma or the Unholy Trinity) is a concept in international economics which states that it is impossible to have all three of the following at the same time:

* a fixed foreign exchange rate

...

* Speculative attack

*Swan diagram

The Swan Diagram, 233x233px

In economics, a Swan Diagram, also known as the Australian model (because it was originally published by Australian economist Trevor Swan in 1956 to model the Australian economy during the Great Depression), represents ...

References

{{Reflist, 30em, refs=

*[{{cite book , last1=Dornbusch , first1=Rüdiger , author-link=Rüdiger Dornbusch , last2=Fisher , first2=Stanley , author2-link=Stanley Fischer , last3=Startz , first3=Richard , title=Macroeconomics , edition=Eleventh , publisher=McGraw-Hill/Irwin , location=New York , year=2011 , isbn=978-0-07-337592-2]

*[{{cite book, last=Kreinin, first=Mordechai, author-link=Mordechai E. Kreinin, title=International Economics: A Policy Approach, publisher=Pearson Learning Solutions, year=2010, isbn=978-0-558-58883-0, pages=438]

* [{{cite book, last1=Bordo, first1=Michael D., last2=Christl, first2=Josef, last3=Just, first3=Christian, last4=James, first4=Harold, title=OENB Working Paper (no. 92), year=2004, url=http://www.oenb.at/dms/oenb/Publikationen/Volkswirtschaft/Working-Papers/2004/Working-Paper-92/fullversion/wp92_tcm16-22389.pdf]

*[{{cite book, last=Bordo, first=Michael, title=Gold Standard and Related Regimes: Collected Essays, year=1999, publisher=Cambridge University Press, isbn=978-0-521-55006-2]

*[{{cite book, last=Salvatore, first=Dominick, title=International Economics, publisher=John Wiley & Sons, year=2004, isbn=978-81-265-1413-7]

*[{{cite book, last=Cooper, first=R.N., title=International Finance, pages=25–37, publisher=Penguin Publishers, year=1969]

**[{{Cite book , last1 = Garber , first1 = Peter M. , last2 = Svensson , first2 = Lars E. O. , year = 1995 , chapter = The Operation and Collapse of Fixed Exchange Rate Regimes , title = Handbook of International Economics , volume = 3 , pages = 1865–1911 , publisher = Elsevier , doi = 10.1016/S1573-4404(05)80016-4 , isbn = 9780444815477 ]

Foreign exchange market

Gold standard

fr:Régime de change#Régime de change fixe

Under this system, the central bank first announces a fixed exchange-rate for the currency and then agrees to buy and sell the domestic currency at this value. The market equilibrium exchange rate is the rate at which supply and demand will be equal, i.e., markets will clear. In a flexible exchange rate system, this is the spot rate. In a fixed exchange-rate system, the pre-announced rate may not coincide with the market equilibrium exchange rate. The foreign central banks maintain reserves of foreign currencies and gold which they can sell in order to intervene in the foreign exchange market to make up the excess demand or take up the excess supply

The demand for foreign exchange is derived from the domestic demand for foreign

Under this system, the central bank first announces a fixed exchange-rate for the currency and then agrees to buy and sell the domestic currency at this value. The market equilibrium exchange rate is the rate at which supply and demand will be equal, i.e., markets will clear. In a flexible exchange rate system, this is the spot rate. In a fixed exchange-rate system, the pre-announced rate may not coincide with the market equilibrium exchange rate. The foreign central banks maintain reserves of foreign currencies and gold which they can sell in order to intervene in the foreign exchange market to make up the excess demand or take up the excess supply

The demand for foreign exchange is derived from the domestic demand for foreign  Fig.2 describes the excess demand for dollars. This is a situation where domestic demand for foreign goods, services, and financial assets exceeds the foreign demand for goods, services, and financial assets from the

Fig.2 describes the excess demand for dollars. This is a situation where domestic demand for foreign goods, services, and financial assets exceeds the foreign demand for goods, services, and financial assets from the  Fig.3 describes the excess supply of dollars. This is a situation where the foreign demand for goods, services, and financial assets from the European Union exceeds the European demand for foreign goods, services, and financial assets. If the supply of dollars rises from SS to S'S', excess supply is created to the extent of ''ab''. The ECB will buy ''ab'' dollars in exchange for euros to maintain the limit within the band. Under a floating exchange rate system, equilibrium would again have been achieved at ''e''.

When the ECB buys dollars in this manner, its official dollar reserves increase and domestic

Fig.3 describes the excess supply of dollars. This is a situation where the foreign demand for goods, services, and financial assets from the European Union exceeds the European demand for foreign goods, services, and financial assets. If the supply of dollars rises from SS to S'S', excess supply is created to the extent of ''ab''. The ECB will buy ''ab'' dollars in exchange for euros to maintain the limit within the band. Under a floating exchange rate system, equilibrium would again have been achieved at ''e''.

When the ECB buys dollars in this manner, its official dollar reserves increase and domestic