|

Argentine Currency Board

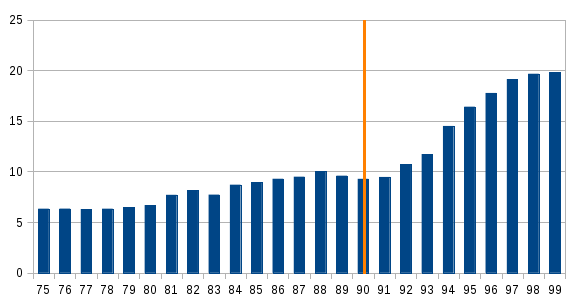

The Convertibility plan was a plan by the Argentine Currency Board that pegged the Argentine peso to the U.S. dollar between 1991 and 2002 in an attempt to eliminate hyperinflation and stimulate economic growth. While it initially met with considerable success, the board's actions ultimately failed. The peso was only pegged to the dollar until 2002. Background For most of the period between 1975 and 1990, Argentina experienced hyperinflation (averaging 325% a year), poor or negative GDP growth, a severe lack of confidence in the national government and the Central Bank, and low levels of capital investment. After eight currency crises since the early 1970s, inflation peaked in 1989, reaching 5,000% that year. GDP was 10% lower than in 1980 and per capita GDP had fallen by over 20%. Fixed investment fell by over half and, by 1989, could not cover yearly depreciation - particularly in the industrial sector. Social indicators deteriorated seriously: real wages collapsed to ab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation Tax

Seigniorage , also spelled seignorage or seigneurage (), is the increase in the value of money due to money creation minus the cost of producing the additional money. Monetary seigniorage is where government bonds are exchanged for newly created money by a central bank, allowing debt monetization ("borrowing" without repaying). The increased purchasing power of the government at the expense of public purchasing power imposes what is known as an inflation tax on the public. Seignorage can also refer to: * Seigniorage derived from specie (metal coins) is a tax added to the total cost of a coin (metal content and production costs) that a customer of the mint had to pay, and which was sent to the sovereign of the political region. * Seigniorage derived from banknotes is the difference between interest earned on securities acquired in exchange for banknotes and the cost of printing and distributing the notes. Seigniorage is the positive return, or carry, on issued notes and coins ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carlos Menem

Carlos Saúl Menem (2 July 1930 – 14 February 2021) served as the 50th president of Argentina for ten years, from 1989 to 1999. He identified as Peronism, Peronist, serving as President of the Justicialist Party for 13 years (from 1990 to 2001 and again from 2001 to 2003), and his political approach became known as Menemism. Born in Anillaco, La Rioja Province, Argentina, La Rioja, to a Syrian Argentines, Syrian family, Menem was raised as a Muslim,"Carlos Menem" ''Encyclopædia Britannica'' but later converted to Catholic Church, Roman Catholicism to pursue a political career. Menem became a Peronist during a visit to Buenos Aires. He was elected governor of La Rioja in 1973, deposed and detained following the 1976 Argentine coup d'état, and re-elected in 1983. He defeated the Buenos Aires governor Antonio Cafiero in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Domingo Cavallo

Domingo Felipe Cavallo (born July 21, 1946) is an Argentine economist and politician. Between 1991 and 1996, he was the Minister of Economy during Carlos Menem's presidency. He is known for implementing the convertibility plan, which established a pseudo-currency board with the United States dollar and allowed the dollar to be used for legal contracts. This brought the inflation rate down from over 1,300% in 1990 to less than 20% in 1992 and nearly to zero during the rest of the 1990s. He implemented pro-market reforms which included privatizations of state enterprises. Productivity per hour worked during his five-years as minister of Menem increased by more than 100%. In 2001, he was the economy minister for nine months during the 1998–2002 Argentine great depression. During a bank run, he implemented a restriction on cash withdrawing, known as '' corralito''. This was followed by the December 2001 riots in Argentina and the fall of Fernando de la Rúa as president. Caval ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Historical Exchange Rates Of Argentine Currency

The following table contains the monthly historical exchange rate of the different currencies of Argentina, expressed in Argentine currency units per United States dollar. The exchange rate at the end of each month is expressed in: * * * * * The value of one current peso is ten trillion (m$n), the currency in use from 1881 to 1969. It is also equal, as of the end of 2024, to 4.5 quadrillion 1914-era pesos with the U.S. dollar as reference – an average annual depreciation relative to the dollar of 28% (i.e. an annual increase of the value of the dollar of 39%). See also * Economic history of Argentina ** 2018–present Argentine monetary crisis * Latin American debt crisis * ("The Lost Decade"; during the 1980s) Sources Información Económica al Día: Dinero y Bancos, Ministerio de Economía de la República Argentinaaverage monthly exchange rates External links BCRA – Banco Central de la República Argentina {{Economy of Argentina Economic history ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Argentine Economy

The economy of Argentina is the second-largest national economy in South America, behind Brazil. Argentina has a human Development Index classified as "very high" by the United Nations, with a highly literate population, an export-oriented Agriculture of Argentina, agricultural sector, and a diversified industrial base. Argentina benefits from rich natural resources. However, its economic performance has historically been very uneven, with high economic growth alternating with severe recessions, particularly since the late twentieth century. Income maldistribution and poverty have increased since this period. Early in the twentieth century, Argentina had one of the ten highest per capita GDP levels globally. It was on par with Canada and Australia and had surpassed both France and Italy. Argentina's currency declined by about 50% in 2018 from 18 to 20 Argentine pesos, to more than 38 Argentine Argentine peso, pesos per United States dollar, U.S. Dollar. As of that year, it is under ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank Of Argentina

The Central Bank of the Argentine Republic (, BCRA) is the central bank of Argentina, being an autarchic entity. Article 3 of the Organic Charter lists the objectives of this Institution: “The bank aims to promote, to the extent of its powers and within the framework of the policies established by the national government, monetary stability, financial stability, employment, and economic development with social equity." Establishment Established by six Acts of Congress enacted on May 28, 1935, the bank replaced Argentina's currency board, which had been in operation since 1899. Its first president was Ernesto Bosch, who served in that capacity from 1935 to 1945. The Central Bank's headquarters on San Martín Street (in the heart of Buenos Aires' financial district, known locally as the ''city''), was originally designed in 1872 by architects Henry Hunt and Hans Schroeder. Completed in 1876, the Italian Renaissance-inspired building initially housed the Mortgage Bank of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Requirement

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the Bank reserves, commercial bank's reserve, is generally determined by the central bank on the basis of a specified proportion of Deposit account, deposit liabilities of the bank. This rate is commonly referred to as the cash reserve ratio or shortened as reserve ratio. Though the definitions vary, the commercial bank's reserves normally consist of currency, cash held by the bank and stored physically in the bank vault (vault cash), plus the amount of the bank's balance in that bank's account with the central bank. A bank is at liberty to hold in reserve sums above this minimum requirement, commonly referred to as ''excess reserves''. In some areas such as the euro area and the UK, tightening of reserve requirements in the home country is found to be associated with higher lending by foreign branches. Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five Territories of the United States, major island territories and United States Minor Outlying Islands, various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's List of countries and dependencies by area, third-largest land area and List of countries and dependencies by population, third-largest population, exceeding 340 million. Its three Metropolitan statistical areas by population, largest metropolitan areas are New York metropolitan area, New York, Greater Los Angeles, Los Angel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income". The borrower wants, or needs, to have money sooner, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * the term to m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Crisis

A currency crisis is a type of financial crisis, and is often associated with a real economic crisis. A currency crisis raises the probability of a banking crisis or a default crisis. During a currency crisis the value of foreign denominated debt will rise drastically relative to the declining value of the home currency. Generally doubt exists as to whether a country's central bank has sufficient foreign exchange reserves to maintain the country's fixed exchange rate, if it has any. The crisis is often accompanied by a speculative attack in the foreign exchange market. A currency crisis results from chronic balance of payments deficits, and thus is also called a balance of payments crisis. Often such a crisis culminates in a devaluation of the currency. Financial institutions and the government will struggle to meet debt obligations and economic crisis may ensue. Causation also runs the other way. The probability of a currency crisis rises when a country is experiencing a banki ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

M2 (economics)

In macroeconomics, money supply (or money stock) refers to the total volume of money held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation (i.e. physical cash) and demand deposits (depositors' easily accessed assets on the books of financial institutions). Money supply data is recorded and published, usually by the national statistical agency or the central bank of the country. Empirical money supply measures are usually named M1, M2, M3, etc., according to how wide a definition of money they embrace. The precise definitions vary from country to country, in part depending on national financial institutional traditions. Even for narrow aggregates like M1, by far the largest part of the money supply consists of deposits in commercial banks, whereas currency (banknotes and coins) issued by central banks only makes up a small part of the total money supply in modern economies. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |