|

Värde Partners

Värde Partners (Värde) is an American alternative investment management firm headquartered in Minneapolis, Minnesota. The firm focuses on investments in credit-related assets and distressed securities although it has also expanded into other areas of alternative investments including real estate. Outside the United States, the firm has offices in Luxembourg, London, Mumbai and Singapore. Background Värde Partners was founded in 1993 by three former Cargill financial executives, George Hicks, Marcia Page and Greg McMillan. Värde gets its name from the Swedish word for value. Värde originally started as a hedge fund that focused on distressed securities and grew slowly in its early years before expanding into other alternative investments. It has been viewed as a much lower profile firm compared to others such as Kohlberg Kravis Roberts, The Carlyle Group and Apollo Global Management, and Hicks has stated the firm's intention is to "do a good job and be a great place to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Privately Held Company

A privately held company (or simply a private company) is a company whose Stock, shares and related rights or obligations are not offered for public subscription or publicly negotiated in their respective listed markets. Instead, the Private equity, company's stock is offered, owned, traded or exchanged privately, also known as "over-the-counter (finance), over-the-counter". Related terms are unlisted organisation, unquoted company and private equity. Private companies are often less well-known than their public company, publicly traded counterparts but still have major importance in the world's economy. For example, in 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for $1.8 trillion in revenues and employed 6.2 million people, according to ''Forbes''. In general, all companies that are not owned by the government are classified as private enterprises. This definition encompasses both publ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge Fund

A hedge fund is a Pooling (resource management), pooled investment fund that holds Market liquidity, liquid assets and that makes use of complex trader (finance), trading and risk management techniques to aim to improve investment performance and insulate returns from beta (finance), market risk. Among these portfolio (finance), portfolio techniques are short (finance), short selling and the use of leverage (finance), leverage and derivative (finance), derivative instruments. In the United States, financial regulations require that hedge funds be marketed only to institutional investors and high-net-worth individuals. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and Exchange-traded fund, ETFs. They are also considered distinct from private-equity fund, private equity funds and other similar cl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Latitude Financial Services

Latitude Financial Services (shortened to Latitude Financial or Latitude) is an Australian financial services company with headquarters in Melbourne, Victoria, also doing business in New Zealand under the name Gem Finance. Latitude’s core business is in consumer finance through a variety of services including secured and unsecured personal loans, credit cards, car loans and interest free retail finance. it had around a 6% share of Australia’s personal lending market, making it the biggest non-bank lender of consumer credit in Australia. History Latitude began as the Australian and New Zealand personal finance and motor dealer finance operations of Australian Guarantee Corporation acquired from Westpac in 2002 by GE Capital. GE Capital sold its Australian and New Zealand business in 2015 to a consortium led by Deutsche Bank, KKR and Värde Partners. The business was renamed Latitude Financial Services. On 20 April 2021, Latitude completed an initial public offering at $2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

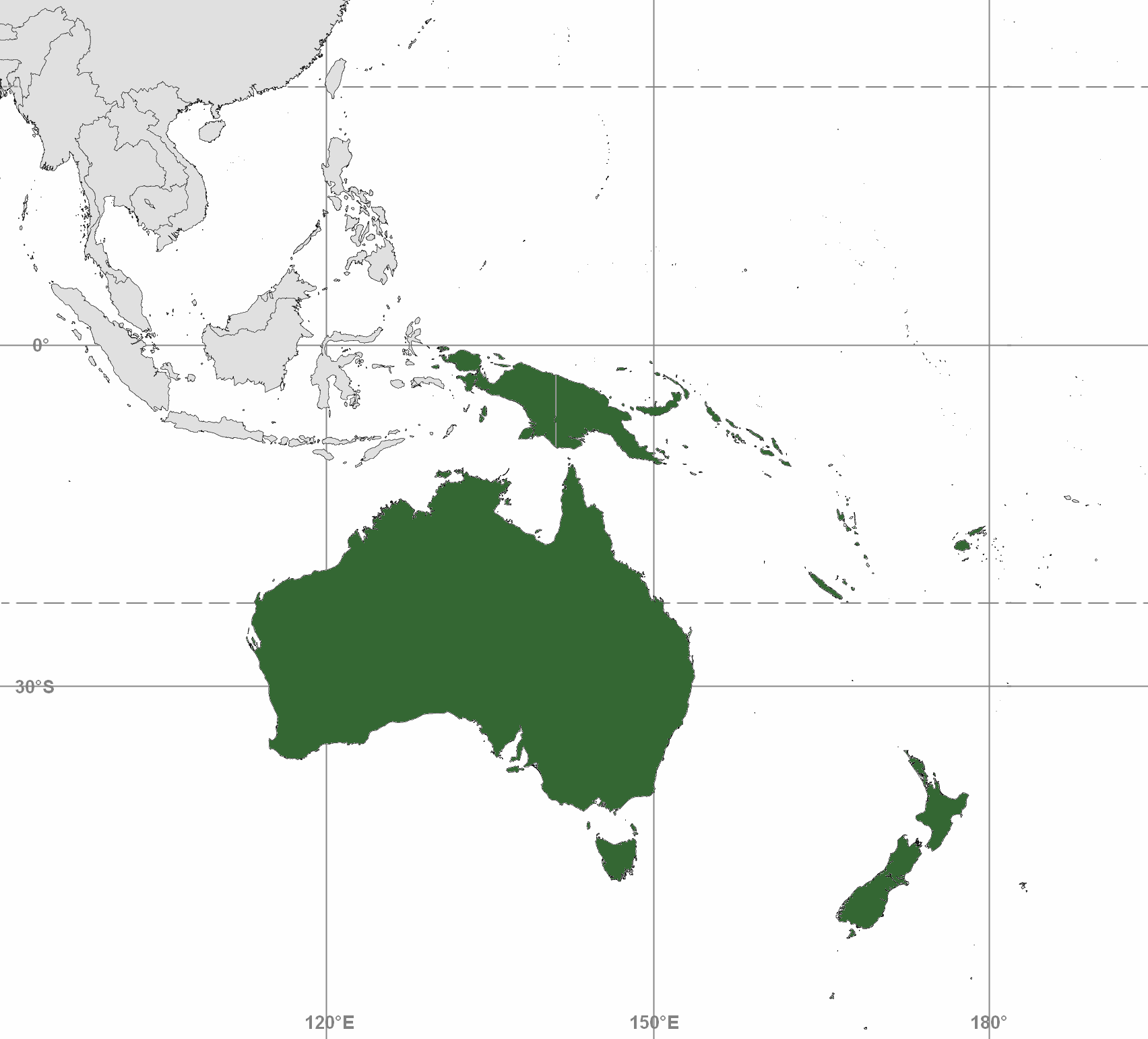

Australia And New Zealand

Australasia is a subregion of Oceania, comprising Australia, New Zealand (overlapping with Polynesia), and sometimes including New Guinea and surrounding islands (overlapping with Melanesia). The term is used in a number of different contexts, including geopolitically, physiogeographically, philologically, and ecologically, where the term covers several slightly different but related regions. Derivation and definitions Charles de Brosses coined the term (as French ''Australasie'') in ''Histoire des navigations aux terres australes'' (1756). He derived it from the Latin for "south of Asia" and differentiated the area from Polynesia (to the east) and the southeast Pacific ( Magellanica). In the late 19th century, the term Australasia was used in reference to the "Australasian colonies". In this sense it related specifically to the British colonies south of Asia: New South Wales, Queensland, South Australia, Tasmania, Western Australia, Victoria (i.e., the Australian colonies) an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

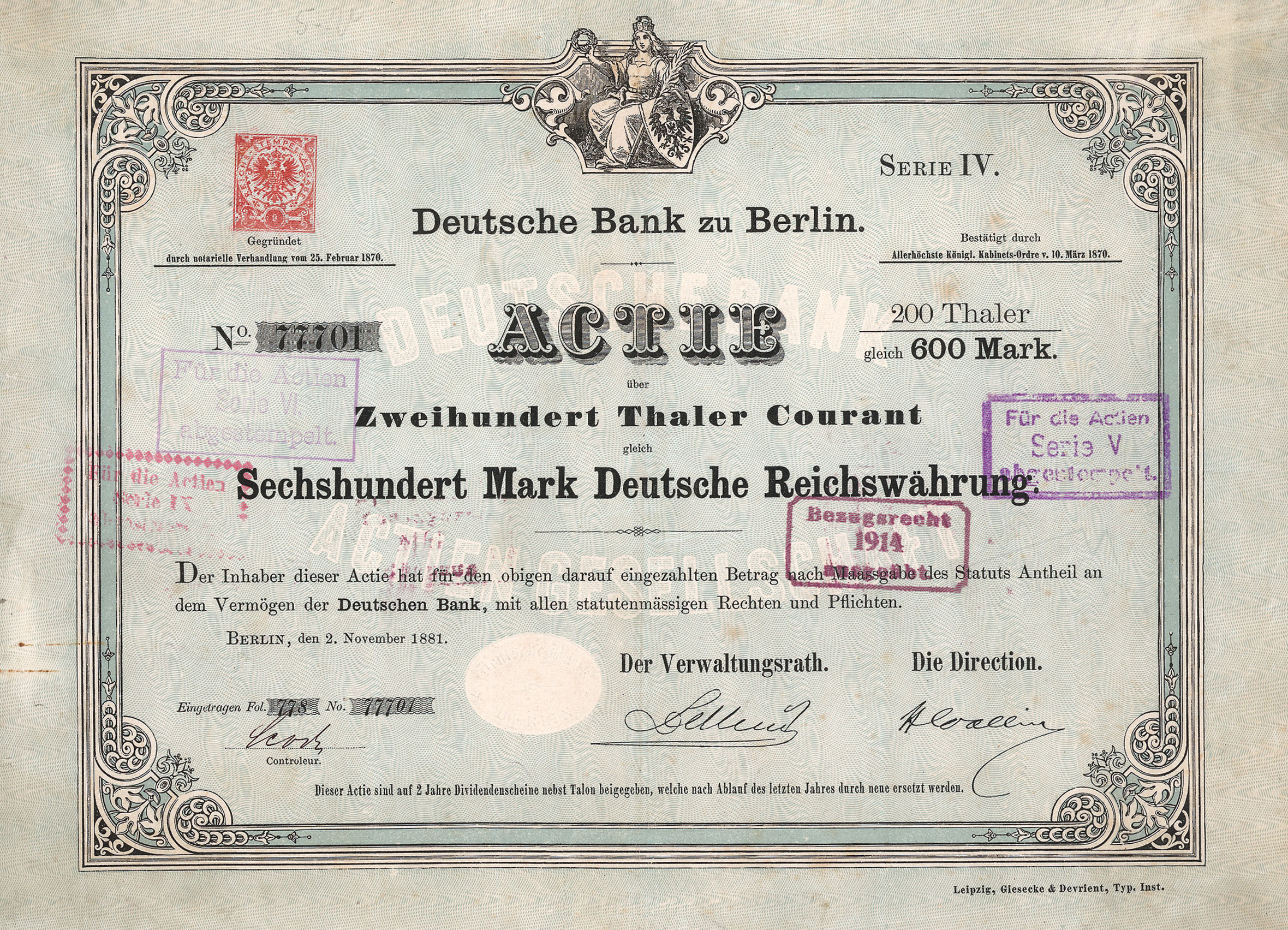

Deutsche Bank

Deutsche Bank AG (, ) is a Germany, German multinational Investment banking, investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. Deutsche Bank was founded in 1870 in Berlin. From 1929 to 1937, following its merger with Disconto-Gesellschaft, it was known as ''Deutsche Bank und Disconto-Gesellschaft'' or DeDi-Bank. Other transformative acquisitions have included those of Mendelssohn & Co. in 1938, Morgan, Grenfell & Company, Morgan Grenfell in 1990, Bankers Trust in 1998, and Deutsche Postbank in 2010. As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. It is a component of the DAX stock market index and is often referred to as the List of banks in Germany, largest German banking institution, with Deutsche Bank holding the majority stake in DWS Group for combined assets of 2.2 trillion euros, rivaling even Spa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crest Nicholson

Crest Nicholson is a British housebuilding company based in Weybridge, Surrey. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. History 1963-2000 The company was founded by Bryan Skinner in 1963 as Crest Homes and floated on the London Stock Exchange in 1968. One of the characteristics that differentiated Crest from most other housebuilders of the time was “not to hold large stocks of land”. During 1969, Crest made its first diversification via the acquisition of En-Tout-Cas, a leading firm in tennis court construction. Two years later, it purchased Tony Pidgley’s earth moving business; Pidgley teamed up with Jim Farrer, a board member and originally the estate agent who had provided Skinner with his first land. These two ran Crest’s housing until 1975, at which point they left to form Berkeley Homes. In 1972, a new holding company, Crest Securities, was formed to facilitate further diversification. At the end of that year, Crest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt-for-equity Swap

Debt restructuring is a process that allows a private or public company or a sovereign entity facing cash flow problems and financial distress to reduce and renegotiate its delinquent debts to improve or restore liquidity so that it can continue its operations. Replacement of old debt by new debt when not under financial distress is called "refinancing". Out-of-court restructurings, also known as s, are increasingly becoming a global reality. Motivation Debt restructuring involves reduction of debt and an extension of payment terms and is usually less expensive than bankruptcy. The main costs associated with debt restructuring are the time and effort spent negotiating with bankers, creditors, vendors, and tax authorities. In the United States, small business bankruptcy filings cost at least $50,000 in legal and court fees, and filing costs in excess of $100,000 are common. By some measures, only 20% of firms survive Chapter 11 bankruptcy filings. Historically, debt restructu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Member Of The Board

A board of directors is a governing body that supervises the activities of a business, a nonprofit organization, or a government agency. The powers, duties, and responsibilities of a board of directors are determined by government regulations (including the jurisdiction's corporate law) and the organization's own constitution and by-laws. These authorities may specify the number of members of the board, how they are to be chosen, and how often they are to meet. In an organization with voting members, the board is accountable to, and may be subordinate to, the organization's full membership, which usually elect the members of the board. In a stock corporation, non-executive directors are elected by the shareholders, and the board has ultimate responsibility for the management of the corporation. In nations with codetermination (such as Germany and Sweden), the workers of a corporation elect a set fraction of the board's members. The board of directors appoints the chief execu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

COVID-19 Pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December 2019. Soon after, it spread to other areas of Asia, and COVID-19 pandemic by country and territory, then worldwide in early 2020. The World Health Organization (WHO) declared the outbreak a public health emergency of international concern (PHEIC) on 30 January 2020, and assessed the outbreak as having become a pandemic on 11 March. COVID-19 symptoms range from asymptomatic to deadly, but most commonly include fever, sore throat, nocturnal cough, and fatigue. Transmission of COVID-19, Transmission of the virus is often airborne transmission, through airborne particles. Mutations have variants of SARS-CoV-2, produced many strains (variants) with varying degrees of infectivity and virulence. COVID-19 vaccines were developed rapidly and deplo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bloomington, Minnesota

Bloomington is a city in Hennepin County, Minnesota, United States. It is located on the north bank of the Minnesota River above its confluence with the Mississippi River, south of downtown Minneapolis and just south of the Interstate 494/Interstate 694, 694 Beltway. The population was 89,987 at the 2020 United States census, 2020 census, making it Minnesota's List of cities in Minnesota, fourth-largest city. Bloomington was established as a Post–World War II economic expansion, post–World War II housing boom suburb connected to Minneapolis's urban street grid, and is serviced by four major freeways: Interstate 35W (Minnesota), Interstate 35W running north-south through the approximate middle of the city, Minnesota State Highway 77, also signed as Cedar Avenue, running north-south near the eastern end of the city, U.S. Highway 169 in Minnesota, U.S. Highway 169, running north-south along the western boundary of the city, and Interstate 494 running east-west at the northern b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institutional Investor

An institutional investor is an entity that pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, real estate investment trusts, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM). Institutional investors appear to be more sophisticated than retail investors, but it remains unclear if professional active investment managers can reliably enhance risk-adjusted returns by an amount that exceeds fees and expenses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Family Office

A family office is a privately held company that handles investment management and wealth management for a wealthy family, generally one with at least $50–100 million in investable assets, with the goal being to effectively grow and transfer wealth across generations. The company's financial capital is the family's own wealth. Family offices also may handle tasks such as managing household staff, making travel arrangements, property management, day-to-day accounting and payroll activities, management of legal affairs, family management services, family governance, financial and investor education, coordination of philanthropy and private foundations, and succession planning. A family office can cost over $1 million a year to operate, so the family's net worth usually exceeds $50–100 million in investable assets. Some family offices accept investments from people who are not members of the owning family. Some firms that cater to multiple clients offer personality psycholog ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |