|

VAT

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax. VAT is an indirect tax, because the consumer who ultimately bears the burden of the tax is not the entity that pays it. Specific goods and services are typically exempted in various jurisdictions. Products exported to other countries are typically exempted from the tax, typically via a rebate to the exporter. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the customer. VAT raises about a fifth of total tax revenues worldwide and among the members of the Organisation for Economic Co-operation and Development (OECD). As of January 2025, 175 of the 193 countries with UN membership employ a VAT, including all OECD members except the United States. History German indust ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indirect Tax

An indirect tax (such as a sales tax, per unit tax, value-added tax (VAT), excise tax, consumption tax, or tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity who pays taxes to the tax collecting authority does not suffer a corresponding reduction in income, i.e., the effect and tax incidence are not on the same entity meaning that tax can be shifted or passed on, then the tax is indirect. An indirect tax is collected by an intermediary (such as a retail store) from the person (such as the consumer) who pays the tax included in the price of a purchased good. The intermediary later files a tax return and forwards the tax proceeds to government with the return. In this sense, the term indirect tax is contrasted with a direct tax, which is collected directly by government from the persons (legal or natural) on whom it is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the Tax exemption, exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Value-added tax#Comparison with sales tax, Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final good, final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the cer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Turnover Tax

A turnover tax is similar to VAT, with the difference that it taxes intermediate and possibly capital goods. It is an indirect tax, typically on an ad valorem basis, applicable to a production process or stage. For example, when manufacturing activity is completed, a tax may be charged on some companies. Sales tax occurs when merchandise has been sold. By country In South Africa, the turnover tax is a simple tax on the gross income of small businesses. Businesses that elect to pay the turnover tax are exempt from VAT. Turnover tax is at a very low rate compared to most taxes but is without any deductions. In Ireland, turnover tax was introduced in 1963 and followed by wholesale tax in 1966. Both were replaced in 1972 by VAT, in preparation for Ireland's accession to the European Communities, which prohibited both taxes. See also * Cascade tax * Goods and Services Tax * Gross receipts tax * Sales tax * Turnover tax in the Soviet Union * Value-added tax A value-added t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zero-rated Supply

In economics, zero-rated supply refers to items subject to a 0% VAT tax on their input supplies. The term is applied to items that would normally be taxed under valued-added systems such as Europe's Value Added Tax (VAT) or Canada Canada is a country in North America. Its Provinces and territories of Canada, ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, making it the world's List of coun ...'s Goods and Services Tax (GST). Examples of these items include most exports, basic groceries, and prescription drugs. Under the Indian 2016 GST Act, any supplies (supply should be defined in accordance with GST India) made by a registered dealer as an export (both goods or services) or supply to an SEZ qualifies for Zero Rated Supplies in GST. This attracts zero rate of taxation and ITC (Input Tax Credit) can also be explained through the e-portal of GST Council. External links Radburn Financial's Defi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institute For Fiscal Studies

The Institute for Fiscal Studies (IFS) is an independent economic research institute based in London, United Kingdom, which specialises in UK taxation and public policy. It produces both academic and policy-related findings. The institute's stated aim is "to provide top quality economic analysis independent of government, political party or any other vested interest. Our goal is to promote effective economic and social policies by understanding better their impact on individuals, families, businesses and the government's finances." Its offices are in the Bloomsbury area of Central London close to the British Museum and University College London. History The institute was founded in response to the passing of the Finance Act 1965, by four financial professionals: a banker and later Conservative Party politician ( Will Hopper), an investment trust manager (Bob Buist), a stockbroker ( Nils Taube), and a tax consultant ( John Chown). In 1964, the then Chancellor of the Excheq ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Proportional Tax

A proportional tax is a tax imposed so that the tax rate is fixed, with no change as the taxable base amount increases or decreases. The amount of the tax is in proportion to the amount subject to taxation. "Proportional" describes a distribution effect on income or expenditure, referring to the way the rate remains consistent (does not progress from "low to high" or "high to low" as income or consumption changes), where the marginal tax rate is equal to the average tax rate.Hyman, David M. (1990) ''Public Finance: A Contemporary Application of Theory to Policy'', 3rd, Dryden Press: Chicago, ILJames, Simon (1998) ''A Dictionary of Taxation'', Edgar Elgar Publishing Limited: Northampton, MA It can be applied to individual taxes or to a tax system as a whole; a year, multi-year, or lifetime. Proportional taxes maintain equal tax incidence regardless of the ability-to-pay and do not shift the incidence disproportionately to those with a higher or lower economic well-being. Althou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fritz Neumark

Fritz Neumark (20 July 1900 in Hanover – 9 March 1991 in Baden-Baden) was a German economist. He made important contributions to the development of education in the preparation of the income tax laws of economics in Turkey. Early life He was born in 1900. As he was Jewish-German, he emigrated to Istanbul (Turkey) in 1933, to avoid the Third Reich. He later moved back to Germany, and served two terms as Rector of the Goethe University Frankfurt (1954–1955 and 1961–1962). Career He was faculty member at Istanbul University, where he taught finance and economics. He published many books in the Turkish language. The Fiscal and Financial Committee set up by the European Commission in 1960 under the chairmanship of Professor Neumark made its priority objective the elimination of distortions to competition caused by disparities in national indirect tax systems: Following publication of the Neumark Committee Report in 1962, it was recommended that a value-added tax, as used in Fra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maurice Lauré

Maurice Lauré (24 November 1917 – 20 April 2001)*Maurice Lauré was a French civil servant. He is primarily known for creating the ''taxe sur la valeur ajoutée'' (TVA in French, otherwise known as value added tax (VAT) in English). Originally an engineer of the École Polytechnique with the French postal and telephone service (PTT), he joined the French tax inspectorate after World War II. In 1952, he became deputy director of the new tax authority, the ''Direction générale des impôts'', which he had helped to create. In 1954, he invented an indirect tax on consumption which became the TVA. His idea was quickly adopted because it forced taxpayers at all levels in the production process to administer and account for the tax themselves, rather than putting the burden only on retailers or requiring assessment by the tax authorities. He later joined the board of several private sector companies, including Société Générale Société Générale S.A. (), colloquia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Propensity To Consume

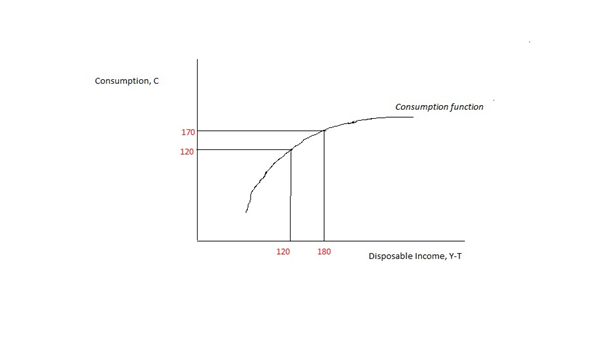

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending ( consumption) occurs with an increase in disposable income (income after taxes and transfers). The proportion of disposable income which individuals spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend ''more'' than the extra dollar (without borrowing or using savings). If the extra money accessed by the individual gives more economic confidence, then the MPC of the individual may well exceed 1, as they may borrow or utilise savings. According to John Maynard Keynes, marginal propensity to consume is less than one. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, world trade. It is a forum (legal), forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are generally regarded as developed country, developed countries, with High-income economy, high-income economies, and a very high Human Development Index. their collective population is 1.38 billion people with an average life expectancy of 80 years and a median age of 40, against a global average of 30. , OECD Member countries collectively comprised 62.2% of list of countries by GDP (nominal), global nom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regressive Tax

A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. "Regressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from high to low, so that the average tax rate exceeds the marginal tax rate.Hyman, David M. (1990) ''Public Finance: A Contemporary Application of Theory to Policy'', 3rd, Dryden Press: Chicago, ILJames, Simon (1998) ''A Dictionary of Taxation'', Edgar Elgar Publishing Limited: Northampton, MA The regressivity of a particular tax can also factor the propensity of the taxpayers to engage in the taxed activity relative to their resources (the demographics of the tax base). In other words, if the activity being taxed is more likely to be carried out by the poor and less likely to be carried out by the rich, the tax may be considered regressive. To measure the effect, the income elasticity of the good being taxed as well as the income effect on cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |