|

Toby Moskowitz

Tobias Jacob "Toby" Moskowitz (born February 3, 1971) is an American financial economist and a professor at the Yale School of Management. He was the winner of the 2007 American Finance Association (AFA) Fischer Black Prize, awarded to a leading finance scholar under the age of 40. Background Moskowitz was born in 1971 in West Lafayette, Indiana, where his father was a professor of management at Purdue University. Moskowitz graduated from West Lafayette Junior-Senior High School in 1989, and then attended Purdue where he earned a B.S. in industrial management and industrial engineering (with distinction) in 1993, and a M.S. in management in 1994. He received a Ph.D. in finance from the University of California, Los Angeles Anderson School of Management in 1998. Professional career Moskowitz has been a faculty member at Booth since 1998. Moskowitz has published several award-winning research papers and was promoted to full professor in 2005. He was the Professor of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

West Lafayette, Indiana

West Lafayette ( ) is a city in Wabash and Tippecanoe Townships, Tippecanoe County, Indiana, United States, approximately northwest of the state capital of Indianapolis and southeast of Chicago. West Lafayette is directly across the Wabash River from its sister city, Lafayette. As of the 2020 census, its population was 44,595. It is home to Purdue University and is a college town and the most densely populated city in Indiana. History Augustus Wylie laid out a town in 1836 in the Wabash River floodplain south of the present Levee. Due to regular flooding of the site, Wylie's town was never built. The present city was formed in 1888 by the merger of the adjacent suburban towns of Chauncey, Oakwood, and Kingston, located on a bluff across the Wabash River from Lafayette, Indiana. The three towns had been small suburban villages which were directly adjacent to one another. Kingston was laid out in 1855 by Jesse B. Lutz. Chauncey was platted in 1860 by the Chauncey family of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

West Lafayette Junior-Senior High School

West Lafayette Junior-Senior High School (also informally known as West Side High School or simply West Side) is the only high school within the West Lafayette city limits, and is administered by the West Lafayette Community School Corporation. The school district which this school belongs to covers central portions of West Lafayette municipality. Text list/ref> West Lafayette Junior-Senior High School was constructed in 1939 of cream brick and glass at a cost of $225,000, and was remodeled in the late 1990s. The school is located near Purdue University, and the children of many Purdue faculty and staff attend West Lafayette Junior-Senior High School. In 2012, the school was ranked as the 2nd and 4th best public high school in Indiana by '' U.S. News & World Report'' and ''Newsweek'', respectively. As of 2021, the high school was ranked in U.S. News & World Report as 2nd in Indiana and 239th nationwide. Athletics The school offers athletic programs including football, baseball, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Smith-Breeden Prize

''The Journal of Finance'' is a peer-reviewed academic journal published by Wiley-Blackwell on behalf of the American Finance Association. It was established in 1946. The editor-in-chief is Antoinette Schoar. According to the ''Journal Citation Reports'', the journal has a 2021 impact factor of 7.870, ranking it 6th out of 111 journals in the category "Business, Finance" and 16th out of 381 journals in the category "Economics". Editors The editorial board consists of the editor, co-editors, and associate editors. The current editor is Antoinette Schoar (MIT). The following persons are or have been editor-in-chief of the journal: Awards Each year the associate editors vote for the best papers published in the journal. The Smith Breeden Prize is awarded for the best finance papers and the Brattle Prize for the best corporate finance Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Regulation

Financial regulation is a broad set of policies that apply to the financial sector in most jurisdictions, justified by two main features of finance: systemic risk, which implies that the failure of financial firms involves public interest considerations; and information asymmetry, which justifies curbs on freedom of contract in selected areas of financial services, particularly those that involve retail clients and/or principal–agent problems. An integral part of financial regulation is the supervision of designated financial firms and markets by specialized authorities such as securities commissions and bank supervision, bank supervisors. In some jurisdictions, certain aspects of financial supervision are delegated to self-regulatory organizations. Financial regulation forms one of three legal categories which constitutes the content of financial law, the other two being market practices and case law. History In the early modern period, the Dutch were the pioneers in finan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Political Economy

Political or comparative economy is a branch of political science and economics studying economic systems (e.g. Marketplace, markets and national economies) and their governance by political systems (e.g. law, institutions, and government). Widely-studied phenomena within the discipline are systems such as labour market, labour and international markets, as well as phenomena such as Economic growth, growth, Distribution of wealth, distribution, Economic inequality, inequality, and International trade, trade, and how these are shaped by institutions, laws, and government policy. Originating in the 18th century, it is the precursor to the modern discipline of economics. Political economy in its modern form is considered an interdisciplinary field, drawing on theory from both political science and Neoclassical economics, modern economics. Political economy originated within 16th century western moral philosophy, with theoretical works exploring the administration of states' wealth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Privately Held Company

A privately held company (or simply a private company) is a company whose Stock, shares and related rights or obligations are not offered for public subscription or publicly negotiated in their respective listed markets. Instead, the Private equity, company's stock is offered, owned, traded or exchanged privately, also known as "over-the-counter (finance), over-the-counter". Related terms are unlisted organisation, unquoted company and private equity. Private companies are often less well-known than their public company, publicly traded counterparts but still have major importance in the world's economy. For example, in 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for $1.8 trillion in revenues and employed 6.2 million people, according to ''Forbes''. In general, all companies that are not owned by the government are classified as private enterprises. This definition encompasses both publ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Mergers

This is a partial list of major banking company mergers in the United States. Table Mergers chart This 2012 chart shows some of the mergers noted above. Solid arrows point from the acquiring bank to the acquired one. The lines are labeled with the year of the deal and color-coded from blue (older) to red (newer). Dotted arrows point to the final merged entity. References Citations * Stephen A. Rhoades, "Bank Mergers and Industrywide Structure, 1980–1994," Washington: Board of Governors of the Federal Reanuary 1996.Staff study 169 * Steven J. Pilloff, "Bank Merger Activity in the United States, 1994–2003," Washington: Board of Governors of the Federal Reserve System, May 2004. Staff study 176Institute of Mergers, Acquisitions and Alliances (MANDA) M&AAn academic research institute on mergers & acquisitions, including bank mergers *Mellon Merger, ''The New York Times'', April 7, 1983 {{DEFAULTSORT:Bank Mergers In The United States, List Of Corporation-related li ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset Allocation

Asset allocation is the implementation of an investment strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according to the investor's risk tolerance, goals and investment time frame. The focus is on the characteristics of the overall portfolio. Such a strategy contrasts with an approach that focuses on individual assets. Description Many financial experts argue that asset allocation is an important factor in determining returns for an investment portfolio. Asset allocation is based on the principle that different assets perform differently in different market and economic conditions. A fundamental justification for asset allocation is the notion that different asset classes offer returns that are not perfectly correlated, hence diversification reduces the overall risk in terms of the variability of returns for a given level of expected return. Asset diversification has been described as "the only f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rate Of Return

In finance, return is a profit on an investment. It comprises any change in value of the investment, and/or cash flows (or securities, or other investments) which the investor receives from that investment over a specified time period, such as interest payments, coupons, cash dividends and stock dividends. It may be measured either in absolute terms (e.g., dollars) or as a percentage of the amount invested. The latter is also called the holding period return. A loss instead of a profit is described as a '' negative return'', assuming the amount invested is greater than zero. To compare returns over time periods of different lengths on an equal basis, it is useful to convert each return into a return over a period of time of a standard length. The result of the conversion is called the rate of return. Typically, the period of time is a year, in which case the rate of return is also called the annualized return, and the conversion process, described below, is called ''annualiz ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Momentum (finance)

In finance, momentum is the empirically observed tendency for rising asset prices or securities return to rise further, and falling prices to keep falling. For instance, it was shown that stocks with strong past performance continue to outperform stocks with poor past performance in the next period with an average excess return of about 1% per month. Momentum signals (e.g., 52-week high) have been used by financial analysts in their buy and sell recommendations. The existence of momentum is a market anomaly, which finance theory struggles to explain. The difficulty is that an increase in asset prices, in and of itself, should not warrant further increase. Such increase, according to the efficient-market hypothesis, is warranted only by changes in demand and supply or new information (cf. fundamental analysis). Students of financial economics have largely attributed the appearance of momentum to cognitive biases, which belong in the realm of behavioral economics. The explanation is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistical Hypothesis Testing

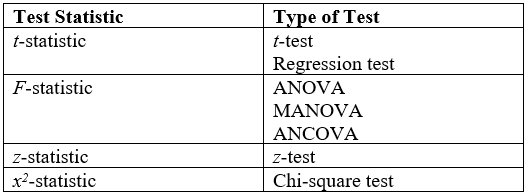

A statistical hypothesis test is a method of statistical inference used to decide whether the data provide sufficient evidence to reject a particular hypothesis. A statistical hypothesis test typically involves a calculation of a test statistic. Then a decision is made, either by comparing the test statistic to a Critical value (statistics), critical value or equivalently by evaluating a p-value, ''p''-value computed from the test statistic. Roughly 100 list of statistical tests, specialized statistical tests are in use and noteworthy. History While hypothesis testing was popularized early in the 20th century, early forms were used in the 1700s. The first use is credited to John Arbuthnot (1710), followed by Pierre-Simon Laplace (1770s), in analyzing the human sex ratio at birth; see . Choice of null hypothesis Paul Meehl has argued that the epistemological importance of the choice of null hypothesis has gone largely unacknowledged. When the null hypothesis is predicted by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |