|

Stop Payment

A stop payment is an order by a customer of a financial institution (bank, savings bank, or credit union) or to a money order A money order is a directive to pay a pre-specified amount of money from prepaid funds, making it a more trusted method of payment than a cheque. History Systems similar to modern money orders can be traced back centuries. Paper documents known ... issuer to refuse to pay a check or draft drawn on the customer's account, and to return the draft to the depositor unpaid. Stop payments are used in cases where the depositor does not want the check to be paid. The reasons can include: * The customer has a dispute with the party that the check was given to, and wants to withhold payment. * The check was lost or stolen. * The check was forged or the amount was raised. * The customer does not have enough money to cover the check (typically, a stop payment on a check has less of a dishonorable appearance than a check that bounces). Stop payments are charged a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Savings Bank

A savings bank is a financial institution that is not run on a profit-maximizing basis, and whose original or primary purpose is collecting deposits on savings accounts that are invested on a low-risk basis and receive interest. Savings banks have mostly existed as a separate category in Europe. Savings banks originated in late-18th century Europe as a development of the Enlightenment, and became a Europe-wide phenomenon in the first half of the 19th century. The trajectories of savings bank systems then diverged across European nations, variously leading to the formation of integrated banking groups, cohesive national networks, conversion into cooperative banking or commercial banking entities, and/or piecemeal consolidation with other credit institutions. In most countries, the surviving savings banks have private-sector status and no longer operate under a distinctive legislative framework; significant exceptions include Germany and Luxembourg, where savings banks are public ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Union

A credit union is a member-owned nonprofit organization, nonprofit cooperative financial institution. They may offer financial services equivalent to those of commercial banks, such as share accounts (savings accounts), share draft accounts (checking account, cheque accounts), credit cards, Credit (finance), credit, share term certificates (Certificate of deposit, certificates of deposit), and online banking. Normally, only a member of a credit union may deposit account, deposit or loan, borrow money. In several African countries, credit unions are commonly referred to as ''SACCOs'' (''savings and credit co-operatives''). Worldwide, credit union systems vary significantly in their total assets and average institution asset size, ranging from volunteer operations with a handful of members to institutions with hundreds of thousands of members and assets worth billions of US dollars. In 2018, the number of members in credit unions worldwide was 375 million, with over 100 millio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Order

A money order is a directive to pay a pre-specified amount of money from prepaid funds, making it a more trusted method of payment than a cheque. History Systems similar to modern money orders can be traced back centuries. Paper documents known as "flying cash" were used in China from the 800s, while the Hawala practice of informal financial remittances through a widespread system of brokers can be traced to India in the 1300s and remains common in parts of Asia and Africa. The modern western money order system was established by a private firm in Great Britain in 1762, though due to high costs was not very successful. Around 1836 it was sold to another private firm which lowered the fees, significantly increasing the popularity and usage of the system. The Post Office (United Kingdom), Post Office noted the success and profitability, and it took over the system in 1838. Fees were further reduced and usage increased further, making the money order system reasonably profitable. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-sufficient Funds

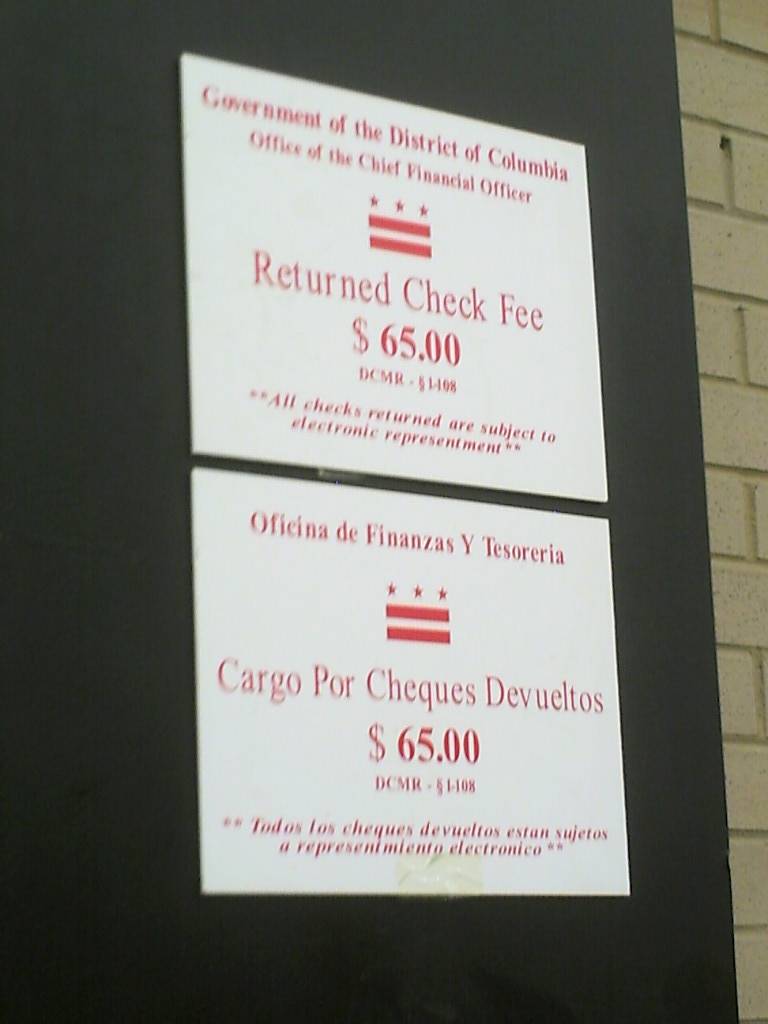

A dishonoured cheque (US spelling: dishonored check) is a cheque that the bank on which it is drawn declines to pay ("honour"). There are a number of reasons why a bank might refuse to honour a cheque, with non-sufficient funds (NSF) being the most common, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF cheque may be referred to as a bad cheque, dishonoured cheque, bounced cheque, cold cheque, rubber cheque, returned item, or hot cheque. Lost or bounced cheques result in late payments and affect the relationship with customers. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed "Present again", by which time the funds should have cleared. When more than one cheque is presented fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |